UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

RenaissanceRe Holdings Ltd.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

2021

Notice of Annual General Meeting of

Shareholders and Proxy Statement

RenaissanceRe

Holdings Ltd.

“At RenaissanceRe, we are committed to being a positive force for change. Whether we are promoting climate resilience, closing the protection gap, or creating an environment where our people and communities thrive, we apply our risk acumen to help solve some of the world’s largest challenges.”

— Kevin J. O’Donnell, President and Chief Executive Officer

| 2021 Proxy Statement | 1 |

Dear Fellow Shareholders,

At its core, our strategy is to employ an integrated system to match desirable risk with efficient capital. Over the years, our consistent execution of this strategy regardless of market cycle has been a hallmark of RenaissanceRe’s outperformance. In furtherance of this, the Board of Directors and executive team work closely together to set strategic objectives, and the Board oversees their execution through robust corporate governance, industry-leading enterprise risk management and aligned executive compensation.

Despite the unprecedented disruption of COVID-19 in 2020, our organization remained focused and excelled in meeting our strategic objectives. We undertook a vigorous process to raise over $1 billion in common equity capital, the largest in our history, and deployed it quickly and efficiently through a combination of organic growth and risk retention. While our underwriting results were impacted by the global COVID-19 pandemic and multiple weather-related catastrophic events, we grew book value per common share by 14.9%, increased gross premiums written by 20.8%, and improved our underwriting expense ratio by 1.6 percentage points. Even with restricted travel, the Board increased engagement with management to deliver a robust oversight process and fulfill our fiduciary responsibilities to shareholders.

Our executive compensation program reflects a pay-for-performance philosophy that supports achievement of long-term strategic goals and thorough risk-management practices. We regularly review our compensation program to ensure that the interests of our shareholders and executives are aligned. As a result of a comprehensive shareholder outreach following our 2019 Annual General Meeting of Shareholders, we made several changes to our executive compensation program which were implemented in 2020. This included shifting our performance shares to a three-year performance period with vesting based on absolute and relative metrics. We also increased the performance share component of the long-term incentive awards to 50% for all named executive officers. Our executive compensation programs demonstrated strong alignment with shareholder interests in 2020. Financial results were not as uniformly strong as they were in 2019, and our named executive officers saw corresponding reductions in incentive compensation payouts.

Advancing our ESG Strategy

As Kevin discussed in his Letter to Shareholders in our 2020 Annual Report, we believe that serving all stakeholders and maximizing shareholder value are complementary endeavors. Environmental, social and governance (“ESG”) issues have always been a central part of our culture and strategy, and in 2020 we formalized our efforts through a comprehensive ESG strategy. We have focused on three strategic ESG priorities—promoting climate resilience, closing the protection gap and inducing positive societal change—where we can apply our core business strengths

| 2 |  |

to make a meaningful impact on our community and stakeholders. While we have historically considered our ESG objectives when making compensation decisions, starting in 2021, management’s execution of our ESG strategy will be formally assessed as part of the strategic accomplishments pillar of our annual incentive bonus plan. We believe that this addition, as well as the changes we made to our compensation program in 2020, support our long-term strategy and better align the interests of our executives with those of our shareholders and various stakeholders.

Diversity and Board Composition

Having directors with diverse skills, viewpoints, experience, knowledge, and abilities allows the Board to fulfill its responsibilities as we execute our strategy in an evolving market. We are proud that over a five-year period, we have increased gender diversity from less than 10% to over 36%. As we select new directors, the Board is committed to seeking candidates who embody all aspects of diversity, including racial, ethnic and gender diversity, and expanding the pool from which we source qualified directors.

In closing, despite a challenging year, we executed our strategy strongly and consistently in 2020. We are excited about the many opportunities ahead of us and will continue to work hard on your behalf to maximize shareholder value. Thank you for investing in RenaissanceRe.

March 23, 2021

Sincerely,

|

James L. Gibbons Non-Executive Chair of the Board of Directors

Kevin J. O’Donnell President and Chief Executive Officer |

|

| 2021 Proxy Statement | 3 |

Notice of Annual General Meeting of Shareholders

|

Date and Time Wednesday, May 5, 2021 |

|

Location Renaissance House |

|

Who Can Vote Owners of our common shares as of March 9, 2021 are entitled to vote on all matters |

| How to Vote | ||

|

Telephone In the United States or Canada you can vote your shares by calling 1-800-690-6903 |

|

|

Online You can vote your shares online at www.proxyvote.com |

|

| You will need the 16-digit control number on the Notice of Internet Availability or proxy card | ||

|

You can vote by mail by marking, dating and signing your proxy card or voting instruction form and returning it in the postage-paid envelope provided |

|

|

QR Code You can vote your shares online with your tablet or smartphone by scanning the QR code. |

|

| Voting Items | Board Vote Recommendation |

For Further Details | ||||

| 1. | Election of three Class II director nominees |  |

“FOR” each director nominee | Page 14 | ||

| 2. | Advisory vote on the compensation of our named executive officers |  |

“FOR” | Page 40 | ||

| 3. | Approval of the appointment of Ernst & Young Ltd. as our independent registered public accounting firm for the 2021 fiscal year and the referral of the auditor’s remuneration to the Board of Directors |  |

“FOR” | Page 78 | ||

Shareholders will also act on other business that properly comes before the meeting.

Please Vote Your Shares

We encourage shareholders to vote promptly, as this will save the expense of additional proxy solicitation.

By Order of the Board of Directors,

Shannon L. Bender

Corporate Secretary

|

Important Notice of Internet Availability of Proxy Materials This Notice of Annual General Meeting of Shareholders and related proxy materials are being distributed or made available to shareholders beginning on or about March 23, 2021. This proxy statement includes instructions on how to access these materials (including our proxy statement and 2020 annual report to shareholders) online. |

| 4 |  |

The board of directors (the “Board”) of RenaissanceRe Holdings Ltd. (“RenaissanceRe,” the “Company,” “we,” “us,” or “our”) is making this proxy statement and proxy available to you in connection with the solicitation of proxies for our 2021 Annual General Meeting of Shareholders (the “Annual Meeting”).

This proxy summary highlights information contained elsewhere in this proxy statement. It does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

| PROPOSAL 1 | ||

| Election of Three Class II Director Nominees | ||

|

The Board recommends a vote FOR each director nominee |  See page 14 See page 14 |

| PROPOSAL 2 | ||

| Advisory Vote on the Compensation of Our Named Executive Officers | ||

|

The Board recommends a vote FOR this proposal |  See page 40 See page 40 |

| PROPOSAL 3 | ||

| Approval of the Appointment of Ernst & Young Ltd. as Our Independent Registered Public Accounting Firm for the 2021 Fiscal Year and the Referral of the Auditor’s Remuneration to the Board of Directors | ||

|

The Board recommends a vote FOR this proposal |  See page 78 See page 78 |

| 2021 Proxy Statement | 5 |

Director Nominees and Continuing Directors

| Director | Committee Membership | ||||||||||

| Name and Primary Occupation | Age | Since | AC | CCGC | IRMC | TC | OC | ||||

|

|

|

Brian G. J. Gray IND Former Group Chief Underwriting Officer, Swiss Reinsurance Company Ltd. |

58 | 2013 | I |  |

|

| ||

|

Duncan P. Hennes IND Co-Founder and Managing Member, |

64 | 2017 |  |

|||||||

|

Kevin J. O’Donnell President and Chief Executive Officer, |

54 | 2013 | C | C | ||||||

|

|

|

Henry Klehm III IND Partner, Jones Day |

62 | 2006 | C | |||||

|

Valerie Rahmani IND Former Chief Executive Officer, Damballa, Inc. |

63 | 2017 |  |

|||||||

|

Carol P. Sanders IND Former Chief Financial Officer, |

54 | 2016 |  |

|||||||

|

Cynthia Trudell IND Former Chief Human Resources Officer, |

67 | 2019 |  |

|||||||

|

|

David C. Bushnell IND Retired Chief Administrative Officer, |

66 | 2008 | C | ||||||

|

James L. Gibbons IND Chairman, Harbour International Trust |

57 | 2008 | I | I |  |

| ||||

|

Jean D. Hamilton IND Retired Chief Executive Officer, |

74 | 2005 |  |

|

| |||||

|

Anthony M. Santomero IND Former President, Federal Reserve Bank of Philadelphia |

74 | 2008 | C | |||||||

| IND | Independent | AC | Audit Committee |

| C | Chair | CCGC | Compensation and Corporate Governance Committee |

|

Member | IRMC | Investment and Risk Management Committee |

| I | Interim Member | TC | Transaction Committee |

| OC | Offerings Committee |

| 6 |  |

Board Snapshot

| Independence | Diversity | |

91% Independent

|

36% Women

| |

|

| |

| Tenure | Age | |

9 years Average

|

63 Average

| |

|

|

| Skills and Experience | ||

|

Executive Management | |

|

Risk/Compliance/Regulation | |

|

Insurance/Reinsurance Operations | |

|

Investments/Asset Management | |

|

Financial & Audit | |

|

International | |

|

Strategic Transactions | |

|

Public Company CEO | |

|

ESG/Sustainability | |

|

Talent/Human Capital | |

|

Data Analytics/Digital | |

|

Technology/Cybersecurity | |

| 2021 Proxy Statement | 7 |

Corporate Governance Highlights

Our Board is comprised almost entirely of independent directors with a wide range of professional experience, and has consistently implemented corporate governance best practices to ensure that we serve the long-term interests of our shareholders.

Board Independence and Composition |

Active Oversight |

Shareholder Alignment | ||||

• Independent Non-Executive Chair of the Board. • Fully independent Audit, Compensation and Corporate Governance, and Investment and Risk Management Committees. • Majority vote standard for uncontested director elections. • Rigorous director evaluation and selection criteria, which encourage diversity and refreshment. |

• Board oversight of strategic planning and enterprise-wide risk management. • Enhanced management interaction and Board participation to ensure effective oversight during COVID-19 pandemic. • Active shareholder engagement. • Robust Code of Ethics and Conduct (“Code of Ethics”) for all directors and employees. • Oversight of key ESG, diversity, equity and inclusion (“DEI”), and corporate social responsibility (“CSR”) initiatives. |

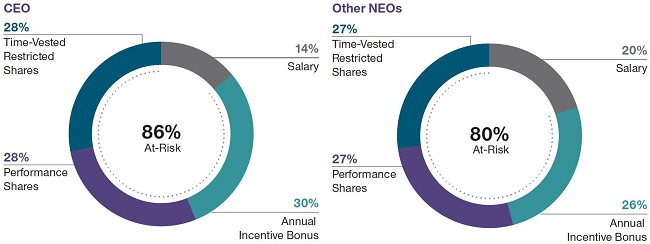

• Meaningful share ownership guidelines for all directors and named executive officers. • Anti-hedging, anti-pledging and insider trading policies. • At-risk pay is 86% of total target compensation for our Chief Executive Officer and 80% on average for our other named executive officers. • Pay-for-performance philosophy guides executive compensation decisions. |

Environmental and Corporate Social Responsibility Highlights

| Our commitment to ESG issues has always been a central part of our corporate strategy at RenaissanceRe. We believe that our dedication to these values benefits our stakeholders, communities and environment. In 2020, our leadership team adopted a formal ESG strategy, which focuses on three core areas where we apply our core business strengths to make a meaningful impact on society—promoting climate resilience, closing the protection gap, and inducing positive societal change. | For additional information on our DEI and other ESG activities, see our new ESG webpage (www.renre.com/about-us/ esg-at-renaissancere) |

Promoting

Climate Resilience |

Closing

the Protection Gap |

Inducing

Positive Societal Change | ||||

• Continued leadership by our dedicated team of scientists in researching and modeling atmospheric hazards and the economic impact of climate-related risks. • Commitment to leadership in environmental sustainability, climate change and risk mitigation. • Active in promotion of risk mitigation and disaster preparedness. • Tracking and offsetting of our estimated operational carbon emissions. |

• Leveraging our partnerships to increase economic resiliency of vulnerable communities. • Formal strategy and dedicated global team for our public sector partnership activities. • Significant commitments to reduce the protection gap and mitigate the impact of natural disasters. |

• Investment in our employees’ professional development and personal growth. • DEI principles embedded throughout the organization. • Encouragement of open dialogue with employees. • Long-standing dedication to community engagement and charitable giving. • Global CSR strategy with a locally-led philosophy.

|

| 8 |  |

Strategic, Operational and Financial Highlights

While RenaissanceRe’s performance in 2020 was impacted by the COVID-19 pandemic as well as the elevated frequency of the year’s natural catastrophic events, we had a strong year strategically, operationally and financially. Some of the highlights included:

| STRONG STRATEGIC AND OPERATIONAL PERFORMANCE | ||

| Strong

Strategic Plan Performance |

Underwriting

Accomplishments |

Capital

Management Accomplishments |

Strong

Operational Performance |

|||||||||||||

|

• Organic

growth and portfolio diversification |

• Grew

gross premiums written by 20.8% to $5.8 billion

• Combined

Ratio of 101.9%, 5th best in peer group |

• Maintained

financial strength ratings

• Raised

and deployed over $1.1 billion in equity capital

• Raised

$1 billion of capital across our third-party vehicles

• Lowered

cost of capital |

• Executed

during global COVID-19 pandemic

• Increased

operational, capital and investment leverage |

|||||||||||||

|

||||||||||||||||

| STRONG FINANCIAL PERFORMANCE | ||

|

• Net

Income Available to Common Shareholders of $731 million |

• Return

on Average Common Equity of 11.7%

• Operating Return

on Average Common Equity of 0.2%(1) |

• Growth in Book Value per Common

Share of 14.9%

• Growth in Tangible

Book Value per Common Share plus Change in Accumulated Dividends of 17.9%(1)

|

• Total Investment

Return of 5.9%

• Increased

dividend |

|||||||||||||

| (1) | Operating return on average common equity and growth in tangible book value per common share plus change in accumulated dividends are non-GAAP financial measures. A reconciliation of non-GAAP financial measures is included in “Appendix A.” |

Executive Compensation Highlights

Our executive compensation program is designed to support our long-term strategy and risk-management practices, align the interests of our shareholders and executives, and encourage operational and financial consistency over the market cycles and earnings volatility that are inherent and unique to our industry. We have a team-based approach to leading, managing and operating the Company. Our executives develop and implement our strategy on a Company-wide basis, and our executive compensation program reflects this approach, rewarding executives based on overall Company performance.

| 2021 Proxy Statement | 9 |

2020 Compensation Snapshot

To achieve the goals of our executive compensation program, the Compensation and Corporate Governance Committee (the “Compensation and Governance Committee”) has developed a target pay mix for our Chief Executive Officer (or, “CEO”) and other named executive officers (or, “NEOs”) that ties a significant portion of their compensation to our short- and long-term performance. We measure success against a mix of key performance metrics, the majority of which are objectively measurable. We believe this mix of metrics aligns the interests of our executives and shareholders and rewards our Chief Executive Officer and other named executive officers for delivering strong performance on our strategic plan without incentivizing excessive risk taking.

| Compensation Component* | Description | Benchmarks/Metrics | ||||||

|

Salary

|

Fixed component of compensation | Reflects expertise and scope of responsibilities in a competitive market for executive talent | |||||

|

Annual Incentive Bonus

|

Annual, at-risk cash incentive program designed to promote achievement of financial metrics and strategic accomplishments against pre-defined targets that support long-term growth and operational efficiencies | • One-year performance period • Metrics: • Combined ratio rank (relative to peers) (16.7%) • Ratio of operating return on average common equity to peer median (33.3%) • Ratio of actual gross premiums written to budget (16.7%) • Board-approved strategic accomplishments (33.3%) | |||||

|

Long-Term Incentive Awards | At-risk, long-term, equity-based compensation to encourage multi-year performance and retention | ||||||

Performance Shares

|

• Subject to both performance-and service-based vesting • Comprise 50%

of long-term incentive awards for all named executive officers |

• Three-year

performance/vesting period • Metrics: • Average growth in book value per common share plus change in accumulated dividends (75%) • Average underwriting

expense ratio rank compared to peers (25%) | ||||||

Time-Vested Restricted Shares

|

• Subject to service-based vesting | • Four-year vesting period (equal annual installments) |

| * | 2020 Target Pay Mix for CEO and Average Target Pay Mix for Other Named Executive Officers. |

| 10 |  |

Pay for Performance

The link between pay and performance and the outcomes of our executive compensation program for 2020 are discussed in detail in the Compensation Discussion and Analysis

► Page 41 |

The Compensation and Governance Committee evaluates and sets rigorous performance goals at the time of grant for all performance-based compensation. In 2020, in a time of unprecedented disruption due to the COVID-19 pandemic and significant weather-related loss events, we benefited from strong execution of our consistent long-term strategy. Reflecting the volatility in the markets and industry, our resulting performance against our 2020 compensation metrics and strategic goals, all of which were determined prior to the onset of the COVID-19 pandemic, led to varied outcomes. We saw substantial growth in gross premiums written and tangible book value per common share plus change in accumulated dividends, a relatively strong combined ratio compared to peers, and total shareholder return in line with our peer group, with operating return on average common equity falling somewhat short of the peer median. As a result, our 2020 annual incentive bonuses paid out at approximately target and our 2020 performance share payouts ranged from below target to maximum, depending on the metric. |

| (1) | Operating return on average common equity and growth in tangible book value per common share plus change in accumulated dividends are non-GAAP financial measures. A reconciliation of non-GAAP financial measures is included in “Appendix A.” |

| (2) | Total shareholder return refers to total shareholder return relative to a pre-approved performance share peer group during each calendar year performance period. For these purposes, total shareholder return is determined as the increase in the 20-day average share price preceding the end of the performance period, plus the dividends paid with respect to such shares during such period, expressed as a percentage of the 20-day average share price preceding the beginning of the performance period. |

| 2021 Proxy Statement | 11 |

Our 2020 performance represented a continuation of our success over time. Since Mr. O’Donnell was named our Chief Executive Officer in 2013, we have performed strongly on key financial metrics. He has led the Company to become a diversified reinsurer with an innovative and flexible operating platform. From 2013 to 2020, our gross premiums written grew at a compound annual growth rate (“CAGR”) of 17.4% and our total shareholder return grew at a CAGR of 10.4%, while our Chief Executive Officer’s total compensation grew at a CAGR of only 1.7%. The graph below illustrates the alignment of Mr. O’Donnell’s pay with our performance during Mr. O’Donnell’s tenure.

| Return on Average Common Equity(1) | Growth in Book Value per Common Share(1) |

|

|

Sources: S&P Research Insight (for 2009-2014 peer company data) and S&P Capital IQ (for 2015-2020 peer company data).

| (1) | Includes our current compensation peer group except that Third Point Reinsurance Ltd. is excluded from 10-year calculations due to lack of data prior to 2012. |

| 12 |  |

Say-on-Pay and Shareholder Engagement

|

We reached out to shareholders totaling almost |

We are committed to ensuring that our shareholders fully understand our executive compensation program, including how the program rewards the achievement of our strategic objectives and aligns the interests of our named executive officers with those of our shareholders.

The results of the annual advisory say-on-pay vote at our 2020 Annual General Meeting of Shareholders (the “2020 Annual General Meeting”), where approximately 94% of the votes cast were in support of the compensation of our named executive officers, indicate strong shareholder support of our programs. This significant increase in support from our 2019 Annual Meeting followed the changes we made to our programs for 2020 taking into account the feedback we received during our extensive shareholder outreach efforts after the 2019 Annual Meeting and into 2020.

To ensure that we continue to enjoy the support of our shareholders, we engaged in an extensive shareholder outreach effort in 2020. We focused our outreach on our top 25 shareholders, who generally represent about two-thirds of our shares outstanding.

In total, we reached out to shareholders representing almost 72% of our shares outstanding and spoke to about two-thirds of those shareholders. When requested, the Chair of the Compensation and Governance Committee participated in the discussions with shareholders.

For additional information see “Executive Compensation–Compensation Discussion and Analysis–Executive Summary–Response to our Say-on-Pay Vote– Shareholder Outreach and Feedback.” | ||

|

We received support for the compensation of our named executive officers of approximately

of shares voted |

2020 Enhancements to Compensation Program

Our shareholders told us that they appreciated the opportunity to engage in discussions and our willingness to consider their input in the design of our executive compensation program. They generally expressed support for our strategy and the structure and design of our executive compensation program. However, we did hear feedback regarding some areas for potential improvement following our 2019 Annual Meeting. To reflect the organic and inorganic growth of our business that has resulted in larger, more diversified and longer duration risk and investment portfolios, the Compensation and Governance Committee made the following changes which took effect in 2020:

| Some shareholders expressed a preference for: | Beginning with awards made in 2020: | |

|

|

|

|

| 2021 Proxy Statement | 13 |

| PROPOSAL 1 | ||

|

Election of Three Class II Director Nominees

The Board unanimously recommends that shareholders vote FOR the election of Mr. Gray, Mr. Hennes and Mr. O’Donnell. |

||

Our Amended and Restated Bye-laws (our “Bye-laws”) provide that the number of directors shall be determined by our Board and shall be between eight and eleven members. Currently, that number has been fixed by the Board at eleven. The Board consists of three classes, with directors of one class elected each year for terms extending to the annual general meeting of shareholders held in the third year following their election.

The terms of our Class II directors will expire at the Annual Meeting. The Board, upon the recommendation of the Compensation and Governance Committee, has nominated Brian G. J. Gray, Duncan P. Hennes and Kevin J. O’Donnell for election as Class II directors. Mr. Gray, Mr. Hennes and Mr. O’Donnell were last elected to the Board at our 2018 Annual General Meeting of Shareholders. If elected at the Annual Meeting, these nominees will serve until the expiration of their terms in 2024, or until their earlier resignation or removal.

We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if a nominee becomes unable or unwilling to accept a nomination or election, the Board may select a substitute nominee and the common shares represented by proxies may be voted for such nominee unless shareholders indicate otherwise.

Majority Vote Requirement

Each nominee for election to serve as a Class II director who receives a majority of the votes cast at the Annual Meeting will be elected as a director. However, if a nominee fails to receive a majority of the votes cast at the Annual Meeting, such nominee will tender an irrevocable resignation that will be effective upon the Board’s acceptance of such resignation. Upon the submission of the resignation, the Compensation and Governance Committee will promptly consider the resignation and make a recommendation to the Board, and the Board will consider any relevant factors in deciding whether to accept or reject the director’s resignation.

Skills and Experience of our Nominees and Continuing Directors

Each nominee has extensive business experience, education and personal skills that qualify him or her to serve as an effective Board member. The specific experience and qualifications of the nominees are set forth below. We encourage you to read the biographies of our nominees and continuing directors, as well as the discussion of our Board’s composition, below.

| 14 |  |

Director Nominees

Class II Directors (whose terms, if elected, expire in 2024)

|

Brian G. J. Gray INDEPENDENT

Committees: Investment and Risk Management, Transaction, Offerings, Audit (Interim) Age: 58 Director Since: 2013 |

|

Other Public Company Boards

• None |

Background and Qualifications

From 2008 until his retirement in 2012, Mr. Gray served as Group Chief Underwriting Officer of Swiss Reinsurance Company Ltd. (“Swiss Re”) and was a member of Swiss Re’s Group Executive Committee. From 2005 through 2008, he was a member of the Group Executive Board, responsible for underwriting Property and Specialty Product Lines on a global basis for Swiss Re. Mr. Gray joined Swiss Re in Canada (“Swiss Re Canada”) in 1985, and served in a variety of roles, including President and Chief Executive Officer of Swiss Re Canada from 2001 to 2005 and Senior Vice President of Swiss Re Canada from 1997 to 2001. |

|

Duncan P. Hennes INDEPENDENT Committees: Investment and Risk Management Age: 64 Director Since: 2017 |

|

Other Public Company Boards

• Citigroup Inc. (2013 to present) |

Background and Qualifications

Mr. Hennes has served as the Co-Founder and Managing Member of Atrevida Partners, LLC (“Atrevida”) since 2007. Prior to co-founding Atrevida, he served as Co-Founder and Partner of Promontory Financial Group from 1999 to 2006. Prior to that, Mr. Hennes served in a number of senior executive positions at Bankers Trust Corporation, including Executive Vice President in charge of Trading, Sales and Derivatives, and as the Chairman of the Board of Oversight Partners I, the consortium that took control of Long Term Capital Management, from 1987 to 1998. From 1998 to 1999 he was the Chief Executive Officer at Soros Fund Management, LLC. Mr. Hennes currently serves as the Chair of the Risk Management Committee and as a member of the Audit Committee, Compliance Committee, Executive Committee and Personnel and Compensation Committee of Citigroup Inc. (“Citigroup”) and as a member of the Board of Directors of Citibank, N.A. |

| 2021 Proxy Statement | 15 |

|

Kevin J. O’Donnell CHIEF EXECUTIVE OFFICER

Committees: Transaction (Chair), Offerings (Chair) Age: 54 Director Since: 2013 |

|

Other Public Company Boards

• None |

Background and Qualifications

Mr. O’Donnell has served as our Chief Executive Officer since July 2013 and as our President since November 2012. Mr. O’Donnell previously served in a number of roles since joining the Company in 1996, including Global Chief Underwriting Officer, Executive Vice President, Senior Vice President, Vice President and Assistant Vice President. Mr. O’Donnell served as the Chair of the Global Reinsurance Forum from 2018 to 2020 and as the Chair of the Association of Bermuda Insurers and Reinsurers in 2017 and 2018.

|

| Continuing Directors | |

| The members of the Board whose terms do not expire at the Annual Meeting and who are not standing for election at this year’s Annual Meeting are set forth below. | |

| Class III Directors (whose terms expire in 2022) | |

|

Henry Klehm III INDEPENDENT

Committees: Compensation and Corporate Governance (Chair) Age: 62 Director Since: 2006 |

|

Other Public Company Boards

• None |

Background and Qualifications

Mr. Klehm has been a partner at the law firm Jones Day since 2008 and has been the Practice Leader of the firm’s Securities Litigation and SEC Enforcement Practice since January 2017. From 2002 to 2007, Mr. Klehm served as Global Head of Compliance for Deutsche Bank, AG. Prior to joining Deutsche Bank, AG, Mr. Klehm served as Chief Regulatory Officer and Deputy General Counsel at Prudential Financial from 1999 to 2002. Prior to joining Prudential Financial, Mr. Klehm served in various positions with the U.S. Securities and Exchange Commission (the “Commission” or the “SEC”), including as Senior Associate Director of the Northeast Regional Office. |

| 16 |  |

|

Valerie Rahmani INDEPENDENT

Committees: Audit Age: 63 Director Since: 2017 |

|

Other Public Company Boards • Computer

Task Group, Incorporated • London

Stock Exchange Group, plc • Aberdeen

Asset Management PLC |

Background and Qualifications

Dr. Rahmani has more than 30 years of experience in the technology industry, including more than 25 years at IBM serving in roles of increasing seniority across multiple global business segments from 1981 to 2009, most recently as General Manager of Internet Security Systems. Subsequent to her tenure at IBM, Dr. Rahmani was Chief Executive Officer at Damballa, Inc., a privately held Internet security software company, from 2009 to 2012. From 2017 to 2019, she served as the part-time head of the Innovation Panel at Standard Life Aberdeen plc, a UK-based FTSE 100 global investment company. She currently serves as Chair of the Compensation Committee and as a member of the Audit Committee and the Nominating and Corporate Governance Committee of Computer Task Group, Incorporated, an information technology solutions and software company, and as a member of the Nomination Committee, Risk Committee and the Remuneration Committee of the Board of the London Stock Exchange Group, plc. |

|

Carol P. Sanders INDEPENDENT

Committees: Audit Age: 54 Director Since: 2016 |

|

Other Public Company Boards • Alliant

Energy Corporation • First

Business Financial Services, Inc. |

Background and Qualifications

Ms. Sanders has served as the President of Carol P. Sanders Consulting, LLC, providing consulting services to the insurance and technology industries, since June 2015. From June 2013 until June 2015, she served as Executive Vice President, Chief Financial Officer and Treasurer of Sentry Insurance a Mutual Company. Previously she served as the Executive Vice President and Chief Operating Officer of Jewelers Mutual Insurance Company from November 2012 until June 2013, where she also served as Senior Vice President, Chief Financial Officer and Treasurer from May 2011 until November 2012 and as Chief Financial Officer and Treasurer from 2004 until May 2011, after holding a series of positions of increasing responsibility in finance, accounting, treasury and tax. Ms. Sanders currently serves as Chair of the Nominating and Governance Committee, as a member of the Audit Committee and the Executive Committee and as the Lead Independent Director of Alliant Energy Corporation, a public utility holding company, and as Chair of the Audit Committee of First Business Financial Services, Inc., a registered bank holding company. |

| 2021 Proxy Statement | 17 |

|

Cynthia Trudell INDEPENDENT

Committees: Compensation and Corporate Governance Age: 67 Director Since: 2019 |

|

Other Public Company Boards

• ISS

A/S • Canadian

Tire Corporation • The

Pepsi Bottling Group, Inc. • Canadian

Imperial Bank of Commerce • PepsiCo,

Inc. |

Background and Qualifications

From 2011 until her retirement in September 2017, Ms. Trudell served as Executive Vice President and Chief Human Resources Officer of PepsiCo, Inc. (“PepsiCo”). From 2007 through 2011, she served as Senior Vice President and Chief Personnel Officer of PepsiCo. Prior to her tenure at PepsiCo, Ms. Trudell held a number of executive operating and general management positions with General Motors Corporation from 1981 to 2001, and Brunswick Corporation from 2001 to 2006, including chairwoman and president of Saturn Corporation, president of IBC Vehicles and president of Sea Ray Group. Since 2015, Ms. Trudell has served on the board of ISS A/S, a global facility services provider based in Denmark and publicly traded on the NASDAQ OMX Copenhagen, where she currently serves as a member of the Remuneration Committee and the Nomination Committee. Since 2019, Ms. Trudell has served on the board of Canadian Tire Corporation, a Canadian retail company publicly traded on the Toronto Stock Exchange, where she is Chair of the Management Resources and Compensation Committee and a member of the Audit Committee and Governance Committee. From 2013 to 2019, she served as a member of the Defense Business Board, which provides business advice to the U.S. Department of Defense. |

| Class I Directors (whose terms expire in 2023) | |

|

David C. Bushnell INDEPENDENT

Committees: Audit (Chair)

Age: 66

Director Since: 2008 |

|

Other Public Company Boards

• Cordia

Bancorp Inc. |

Background and Qualifications

Mr. Bushnell has served as the principal of Bushnell Consulting, a financial services consulting firm, since 2008. Mr. Bushnell retired from Citigroup Inc. in 2007, after 22 years of service. Mr. Bushnell served as the Senior Risk Officer of Citigroup from 2003 through 2007 and retired as Chief Administrative Officer in 2007. Following his retirement from Citigroup, Mr. Bushnell served as a consultant to Citigroup until December 31, 2008. Previously, Mr. Bushnell worked for Salomon Smith Barney Inc. (later acquired by Citigroup) and its predecessors in a variety of positions, including as a managing director and Chief Risk Officer. In addition to his board service on Cordia Bancorp Inc. (“Cordia”), a public bank holding company, Mr. Bushnell served as Chief Risk Officer of Cordia and its wholly owned subsidiary, Bank of Virginia, from 2011 until Cordia was acquired in September 2016. |

| 18 |  |

|

James L. Gibbons INDEPENDENT NON-EXECUTIVE CHAIR OF THE BOARD

Committees: Transaction, Offerings, Compensation and Corporate Governance (Interim), Audit (Interim) Age: 57 Director Since: 2008 |

|

Other Public Company Boards • Nordic

American Tankers Limited |

Background

and Qualifications Mr. Gibbons, a Bermudian citizen, is Executive Chairman of Harbour International Trust Company Limited and the Treasurer, a Director and member of the Executive Committee of Edmund Gibbons Limited (“EGL”). Mr. Gibbons also serves as a Director and member of the Risk Committee of Clarien Group Limited (“Clarien”), an international financial company. He was also Non-Executive President of Bermuda Air Conditioning Limited (“BACL”) through March 2019 and currently serves as a Director of BACL. Mr. Gibbons served as Chair of Capital G Bank Limited from 1999 to 2013 and as President and Chief Executive Officer of Capital G Limited from 1999 to 2010, prior to the change of name to Clarien from Capital G in 2014. |

|

Jean D. Hamilton INDEPENDENT

Committees: Compensation and Corporate Governance, Transaction, Offerings Age: 74 Director Since: 2005 |

|

Other Public Company Boards

• None Investment Company Boards • First Eagle Funds (2003 to present) • First Eagle Variable Funds (2003 to present) • First Eagle Credit Opportunities Fund (2020 to present) |

Background and

Qualifications Ms. Hamilton held various positions with Prudential Financial, Inc., including Executive Vice President, and was Chief Executive Officer of Prudential Institutional from 1998 through her retirement in 2002. Currently, she is an independent consultant and private investor as well as a Senior Managing Director and Partner of Brock Capital Group LLC. Prior to joining Prudential, she held several positions with The First National Bank of Chicago, including Senior Vice President and Head of the Northeastern Corporate Banking Department. She is currently a Trustee, a member of the Audit Committee and Deferred Compensation Committee, and Chair of the Board Valuation and Liquidity Committee of First Eagle Funds and First Eagle Variable Funds, and a Trustee, a member of the Audit Committee and Chair of the Credit Valuation and Allocation Committee of First Eagle Credit Opportunities Fund. |

| 2021 Proxy Statement | 19 |

|

Anthony M. Santomero INDEPENDENT

Committees: Investment and Risk Management (Chair) Age: 74 Director Since: 2008 |

|

Other Public Company Boards • Citigroup

Inc. Investment Company Boards • Columbia

Funds Group • Columbia

Seligman Premium Technology Growth

Fund • Tri-Continental

Corporation |

Background

and Qualifications Mr. Santomero served as Senior Advisor at McKinsey & Company from 2006 to 2008. From 2000 to 2006, Mr. Santomero was President and Chief Executive Officer of the Federal Reserve Bank of Philadelphia. Prior to joining the Federal Reserve, Mr. Santomero was the Richard K. Mellon Professor of Finance at the University of Pennsylvania’s Wharton School and held various positions there, including Director of the Financial Institutions Center and Deputy Dean. Mr. Santomero has served as a Trustee of Penn Mutual Life Insurance Company since 2009. He has served on the Board of Directors of Columbia Funds Group since 2009 and as a member of the Governance Committee since 2020, and on the Board of Directors of two of Columbia Funds’ registered investment company funds, Columbia Seligman Premium Technology Growth Fund and Tri-Continental Corporation since 2019. Until April 2019, Mr. Santomero served as the Chair of the Risk Management Committee and as a member of both the Audit Committee and Executive Committee of Citigroup, as well as Chairman of the Board of Directors of Citibank, N.A. In addition, he served on the Board of Directors of B of A Fund Series Trust from 2008 until 2011. |

| 20 |  |

| Board Changes Over the Past Five Years | We believe the Board benefits from a holistic approach to board composition. Our Board values a mix of new directors, who bring fresh perspectives, and longer-serving directors, who bring continuity and breadth of experience with our strategies and risk management processes. Our Board has developed comprehensive and ongoing assessment and succession planning processes and regularly reviews the biographical backgrounds and skills of its current members and potential nominees in connection with its ongoing evaluation of Board composition. | ||

Added four new directors Added four new directors |

|||

Increased gender diversity from less than 10% to over 36% (currently four women on the Board) Increased gender diversity from less than 10% to over 36% (currently four women on the Board) |

|||

Enhanced Board skills relating to ESG, human resources, and cybersecurity Enhanced Board skills relating to ESG, human resources, and cybersecurity |

|||

Selection and Nomination of Directors

Director Nomination Process

The Compensation and Governance Committee is responsible for identifying and recommending qualified candidates for nomination to the Board.

| Assess Board Composition |

• Compensation and Governance Committee regularly assesses appropriate Board size and composition • Determines needs based on current and evolving strategies, potential vacancies and competencies of the Board as a whole |

|

|

| Identify and Source Candidates |

• Board is committed to expanding the pool from which it selects qualified director candidates, and is focused on seeking candidates who embody all aspects of diversity, including racial, ethnic and gender diversity • Candidate recommendations may come from current Board members, management, search firms, shareholders or others |

|

|

| Select Director Nominees |

• Committee reviews candidates to ensure fit with the needs and collegiality of the Board • Seeks a combination of qualities and experience that will complement and contribute to the competencies of the Board as a whole • Interviews by Committee members, Non-Executive Chair and other members of the Board before full Board votes to nominate |

| 2021 Proxy Statement | 21 |

Director Qualifications

As discussed in our Guidelines on Significant Corporate Governance Issues (“Corporate Governance Guidelines”), we do not set specific criteria for directors but believe that candidates should show evidence of leadership in their particular field, and have broad experience and the ability to exercise sound business judgment. The Board considers the diversity, skills and experience of candidates in the context of the needs of the Board as a whole. In selecting directors, the Board generally seeks a combination of qualities and experience that will contribute to the exercise of the duties of the Board, including active or former chief executive or senior officers of major complex businesses, leading academics and entrepreneurs.

When identifying and considering potential director nominees and evaluating the current composition of our Board, the Compensation and Governance Committee focuses on the composition and competencies of our Board as a whole, how the traits possessed by individual directors and director nominees complement one another, the ability of the current and proposed members to operate collegially and effectively, and the intersection of these factors with our current strategy, operational plans and oversight requirements. The factors considered by the Compensation and Governance Committee when evaluating individual director nominees include:

| • | personal and professional ethics, integrity and values; |

| • | independence, including the ability to represent all of our shareholders and other key stakeholders without any conflicting relationship with any particular constituency; |

| • | business acumen, leadership qualities and record of accomplishment; |

| • | professional experience and industry expertise in light of our evolving strategic and operational plans over time; |

| • | compatibility with the existing Board composition; |

| • | ability and willingness to devote sufficient time to carrying out Board duties and responsibilities fully and effectively, particularly in light of our Bermuda headquarters location; |

| • | commitment to serve on our Board for a potentially extended period of time, with a view toward effective oversight of management’s efforts to ensure the safety and soundness of our Company in light of the market cycles and earnings volatility that characterize our industry; |

| • | maintaining a diverse set of skills, experience and viewpoints on the Board as a whole, including with respect to racial, ethnic and gender diversity; and |

| • | other attributes of the candidate, our business and strategic conditions and external factors that the Compensation and Governance Committee deems appropriate. |

The Compensation and Governance Committee has the discretion to weigh these factors as it deems appropriate. The relative importance of these factors may vary from candidate to candidate, depending on our evolving circumstances, and no particular criterion is necessarily applicable to all prospective nominees.

Board Diversity

Our Board believes that the backgrounds and qualifications of the directors, considered as a group, should provide a diverse mix of skills, viewpoints, experience, knowledge, and abilities that will allow the Board to fulfill its responsibilities, taking into account our evolving strategic direction and needs. The Compensation and Governance Committee evaluates and discusses diversity at both the Board and committee levels when carrying out its director selection, recruitment and nomination obligations and also when assessing the performance of current directors. This assessment is undertaken at least annually.

Our Board is committed to expanding the pool from which it selects qualified director candidates, and is focused on seeking candidates who embody all aspects of diversity, including racial, ethnic and gender diversity, while considering the skills and experience of the Board as a whole.

| 22 |  |

| Alignment of Director Skills and Strategy | ||||

|

RenaissanceRe is a global provider of reinsurance and insurance. We aspire to be the world’s best underwriter by matching well-structured risks with efficient sources of capital, and our mission is to produce superior returns for our shareholders over the long term. Our strategy focuses on superior risk selection, superior customer relationships and superior capital management.

Our Compensation and Governance Committee has determined that each of our directors possesses the appropriate skills and experience to effectively oversee our business strategy. As detailed in each director’s biography above, our Board collectively leverages its strength in the following areas: |

|

Executive Management |

|

Risk/Compliance/ Regulation |

|

Insurance/ Reinsurance Operations |

|

Investments/ Asset Management | |

|

Financial & Audit |

|

International | |

|

Strategic Transactions |

|

Public Company CEO | |

|

ESG/ Sustainability |

|

Talent/Human Capital | |

|

Data Analytics/ Digital |

|

Technology/ Cybersecurity | |

Director Independence

The Compensation and Governance Committee has reviewed the independence of each of our current directors and affirmatively determined that each of Mses. Hamilton, Sanders and Trudell, Dr. Rahmani and Messrs. Bushnell, Gibbons, Gray, Hennes, Klehm and Santomero are independent. Mr. O’Donnell is not independent because of his employment as our President and Chief Executive Officer.

The New York Stock Exchange (the “NYSE”) listing standards require that a majority of our directors be independent. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with us either directly or as a partner, shareholder or officer of an organization that has a relationship with us. Our Corporate Governance Guidelines provide that a majority of our directors will meet the NYSE’s independence criteria and set forth additional parameters that the Board uses to determine director independence, which we believe are more stringent than the independence requirements in the NYSE listing standards. In addition, the Board considers all relevant facts and circumstances known or reported to it in making independence determinations.

In particular, when making its independence determinations, the Compensation and Governance Committee considered the following relationships and determined that none of the directors involved had a material relationship with us as a result of these relationships. Mr. Hennes serves (and until April 2019, Mr. Santomero served) as a director of Citigroup. We have current and historical financial relationships with Citigroup and its subsidiaries and affiliates, including Citigroup acting in manager roles in several of our securities offerings over the last few years and being a party to letter of credit facilities with us. Mr. Gibbons is the Treasurer and a director of EGL, the parent company of a number of varied businesses in Bermuda, including Coralisle Group Ltd., formerly Colonial Group International (“Coralisle”), and a director of BACL. We have entered into reinsurance contracts with Coralisle which are described under “Board Structure and Processes—Certain Relationships and Related Transactions” below. In addition, we have other immaterial business relationships with a variety of the other businesses owned by EGL and BACL relating primarily to local services and procurement in Bermuda, for which we paid these entities a total of approximately $12,500 in 2020. Mr. Gibbons is not directly involved in the management of Coralisle or any of the other businesses owned by EGL or BACL with which we do business, and all of the transactions were entered into in the ordinary course of business on terms available to similarly situated parties. Furthermore, EGL and BACL entities did not make payments to, or receive payments from, us in an amount which, in any of the last three fiscal years, exceeded the greater of $1 million or 2% of EGL’s or BACL’s consolidated gross revenues.

| 2021 Proxy Statement | 23 |

Shareholder Nomination Process

Candidates recommended by shareholders for nomination to the Board will be considered and evaluated by the Compensation and Governance Committee using the same process and criteria that we use to evaluate other candidates, assuming the proper procedures for shareholder nominations are followed. The Compensation and Governance Committee will consider nominees to the Board recommended by no fewer than 20 shareholders holding in the aggregate not less than 10% of the outstanding paid-up share capital of RenaissanceRe. Any shareholder recommendation must be sent to our Corporate Secretary not less than 60 days prior to the scheduled date of the annual general meeting of shareholders and must set forth for each nominee: (i) the name, age, business address and residence address of the nominee; (ii) the principal occupation or employment of the nominee; (iii) the class or series and number of shares of capital stock of RenaissanceRe that are owned beneficially or of record by the nominee; and (iv) any other information relating to the nominee that would be required to be disclosed in a proxy statement or other filing required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations promulgated thereunder. The written notice must also include the following information with regard to the shareholders giving the notice:

| • | the name and record address of such shareholders; |

| • | the class or series and number of shares of capital stock of RenaissanceRe that are owned beneficially or of record by such shareholders; |

| • | a description of all arrangements or understandings between such shareholders and each proposed nominee and any other person (including his or her name and address) pursuant to which the nomination(s) are to be made by such shareholders; |

| • | a representation that such shareholder intends to appear in person or by proxy at the annual general meeting of shareholders to nominate the persons named in its notice; and |

| • | any other information relating to such shareholder that would be required to be disclosed in a proxy statement or other filing. |

Such notice must be accompanied by a written consent of each proposed nominee to be named as a nominee and to serve as a director if elected. The Compensation and Governance Committee may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

Board Assessment and Evaluation

The Board recognizes that a robust and constructive evaluation process is an essential part of good corporate governance and Board effectiveness. Pursuant to its charter, the Compensation and Governance Committee has responsibility for oversight of the Board’s annual overall effectiveness reviews, review of individual director performance and similar matters.

At the direction of the Compensation and Governance Committee, our Non-Executive Chair of the Board facilitates the annual assessment of the Board’s effectiveness. He conducts individual interviews with Board members and management, facilitating reviews of individual director effectiveness, as well as of the Board as a whole. In turn, the Chair of the Compensation and Governance Committee, along with the Board members, reviews the performance of the Non-Executive Chair of the Board. From time to time, the Board engages independent third parties to review the Board’s practices and procedures and assess its effectiveness. Each standing committee of the Board performs a comprehensive annual self-assessment as part of the Board’s overall governance effectiveness review and assessment. Results are compiled and discussed by the Board and each committee, and changes in practices, Board composition and procedures are recommended by the Compensation and Governance Committee as necessary.

| 24 |  |

Our Commitment to Corporate Governance

Our Board and management have a strong commitment to effective corporate governance. We believe we have a comprehensive corporate governance framework which takes into account applicable regulatory requirements and best practices. The key components of this framework are set forth in the following documents:

| • | our Bye-laws; |

| • | our Corporate Governance Guidelines; |

| • | our Code of Ethics; |

| • | our Audit Committee Charter; and |

| • | our Compensation and Governance Committee Charter. |

The Board regularly reviews corporate governance developments and modifies our Corporate Governance Guidelines, Code of Ethics, committee charters and key Board practices when it believes modifications are warranted. A copy of each of these documents is published on our website at www.renre.com under “Investors—Corporate Governance,” except our Bye-laws, which are filed with the SEC and can be found on the SEC website at www.sec.gov. Each of these documents is available in print to any shareholder upon request.

Governance Highlights | ||

| • | Over 90% of our directors are independent, with an Independent Non-Executive Chair of the Board and fully independent Audit, Compensation and Governance, and Investment and Risk Management Committees. | |

| • | Rigorous director evaluation and selection criteria, which encourage diversity and refreshment. | |

| • | Board oversight of strategic planning and enterprise-wide risk management, including environmental sustainability and climate change matters. | |

| • | Active shareholder engagement. | |

| • | Meaningful share ownership guidelines for directors and named executive officers; anti-hedging, anti-pledging and insider trading policies. | |

Code of Ethics

Our Code of Ethics applies to all of our directors and employees, including our principal executive officer, principal financial officer, and principal accounting officer, and all of our employees performing financial or accounting functions. Our Code of Ethics is available free of charge on our website, www.renre.com, under “Investors—Corporate Governance.” We will also provide a printed copy of our Code of Ethics to any shareholder upon request. We intend to disclose any amendments to our Code of Ethics by posting them on our website. Any waivers of our Code of Ethics applicable to our directors, principal executive officer, principal financial officer, principal accounting officer, controller and other executive officers who perform similar functions will be disclosed by filing a current report on Form 8-K with the SEC.

Board Leadership Structure and Engagement

Role of the Non-Executive Chair of the Board

Pursuant to our Corporate Governance Guidelines, the Chair of the Board may be an officer/director or an outside director and may or may not be the Chief Executive Officer, at the option of the Board. The Board believes it should be free to make these determinations depending on what it believes is best for the Company and our shareholders in light of all the circumstances. At this time, the Board has determined that it is appropriate to separate the roles of Chair and Chief Executive Officer. The Board believes that having an independent director serve as Non-Executive

| 2021 Proxy Statement | 25 |

Chair of the Board is in the best interests of the Company and our shareholders at this time and that this structure currently assists the independent directors in the oversight of the Company and facilitates participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board.

Currently, Mr. Gibbons serves as the Non-Executive Chair of the Board. In addition to chairing each meeting of the Board, the Non-Executive Chair of the Board has significant responsibilities, including: (i) having the authority to call meetings of the Board; (ii) setting the agendas for Board meetings and executive sessions to ensure that Board members receive the information necessary to fulfill the Board’s primary responsibilities; (iii) chairing executive sessions of the independent directors; (iv) briefing the Chief Executive Officer on issues that arise in the executive sessions, as appropriate; (v) facilitating discussion among the independent directors on key issues and concerns that arise outside of Board meetings and serving as a non-exclusive conduit to communicate views, concerns and issues of the independent directors to the Chief Executive Officer; (vi) interviewing candidates for directorship; (vii) facilitating the assessment of the Board’s effectiveness, at the direction of the Compensation and Governance Committee; and (viii) together or in coordination with the Chief Executive Officer, representing the organization in external interactions with shareholders, employees and other stakeholders.

The Non-Executive Chair of the Board typically does not serve as a member of the Board’s three principal standing committees (the Audit Committee, the Compensation and Governance Committee, and the Investment and Risk Management Committee), but rather attends such meetings and other functions of the committees on an ex officio basis as warranted by the facts and circumstances. Given the challenges presented by the COVID-19 pandemic, Mr. Gibbons has been serving as an interim member of the Audit Committee and the Compensation and Governance Committee, as further discussed in “—Meetings and Attendance” below. The Non-Executive Chair of the Board serves as a member of the Transaction Committee and the Offerings Committee, which meet on an as-needed basis.

Meetings and Attendance

Our Bye-laws and operating guidelines prohibit directors from participating in meetings of the Board or its committees while present in the United States or its territories, whether in person, via teleconference or otherwise. Due to these prohibitions, as well as travel restrictions and safety concerns related to the COVID-19 pandemic, our eight directors who are based in the United States were unable to attend certain Board and committee meetings held in Bermuda in 2020. Three of our directors (two of whom are independent) are based outside of the United States: Mr. Gibbons, our Non-Executive Chair of the Board, Mr. O’Donnell, our Chief Executive Officer, and Mr. Gray.

Despite these unique circumstances, our independent directors continued to discharge their oversight and fiduciary duties in the ordinary course, including by holding regular, robust virtual informational sessions designed to cover the same information normally covered at Board and committee meetings, supplemented by additional informational calls and reports. When action requiring a formal Board or committee meeting with a vote of directors was necessary, we convened formal meetings of the Board or the applicable committee (or subcommittee thereof) with only those directors not based in the United States participating in order to comply with our Bye-laws and operating guidelines. Despite these unprecedented challenges, we believe we maintained good governance practices while complying with Bermuda law and SEC and NYSE regulations, as well as with our Bye-laws, corporate governance documents and operating guidelines.

Our Board held the following informational sessions and formal meetings of the Board and committees during 2020:

| Compensation and | Investment and Risk | |||||

| Audit Committee or | Governance Committee | Management | Transaction | Offerings | ||

| Board | Subcommittee | or Subcommittee | Committee | Committee | Committee | |

| Meetings | 4 | 3 | 5 | 1 | 1 | 1 |

| Virtual Informational Sessions | 5 | 7 | 3 | 3 | — | — |

| 26 |  |

Messrs. Gibbons, Gray and O’Donnell – our three directors who are based outside of the United States – each attended 100% of the meetings of the Board and committees of the Board on which he served during 2020 (during the periods that he served). Due to the restrictions noted above, our eight U.S.-based directors – Messrs. Bushnell, Santomero, Hennes and Klehm, Mses. Hamilton, Sanders and Trudell, and Dr. Rahmani – were not able to attend certain Board and committee meetings, and, as a result, did not attend 75% or more of the formal meetings of the Board and committees of the Board on which he or she served during 2020 (during the periods that he or she served). However, each U.S.-based director attended all of the informational sessions of the Board and respective committees, and attended all of the formal meetings of the Board and committees of the Board on which he or she served during 2020 (during the periods that he or she served) that he or she was able to safely attend. For more information on our committees, please see below.

Generally, it is the practice of our Board to attend our annual general meetings of shareholders. However, due to the safety concerns and travel restrictions discussed above, none of our non-executive directors were able to attend our 2020 Annual General Meeting, which was held on May 18, 2020 in Bermuda.

As travel bans and restrictions enacted in response to the COVID-19 pandemic are eased or lifted, we expect that our directors will attend meetings of the Board and of the committees of the Board on which he or she serves, and the annual general meeting of shareholders, in line with historical practices.

Executive Sessions

Separate executive sessions of our non-management directors are held in conjunction with each regular quarterly Board meeting. The Non-Executive Chair of the Board presides at these executive sessions of the Board. The standing committees of the Board also conduct regular executive sessions, which are chaired by the respective chairs of the committees. In 2020, executive sessions of our non-management directors were also held in connection with the virtual informational sessions of the Board and standing committees.

Director Orientation and Continuing Education

Our Compensation and Governance Committee oversees the orientation process for new directors. Each new director and new member of a Board committee participates in a comprehensive orientation program run by management. The orientation includes presentations by senior management to familiarize the new director with our strategic plan, significant accounting and risk management issues, compliance programs, Code of Ethics, and other relevant topics.

We encourage our directors to participate in continuing education programs and reimburse them for reasonable expenses associated with third-party training programs relating to our business, industry or the discharge of Board duties. We also provide ongoing education programs on topics relevant to RenaissanceRe and our industry as part of regular Board and committee meetings, and directors are invited and encouraged to visit our offices to meet with management.

Communicating with the Board

Any shareholder or other party may communicate directly with the Board, any committee of the Board or our non-management directors as a group by writing to the intended recipient in the care of the Corporate Secretary. Shareholders can send communications electronically through our website at www.renre.com by clicking on “email” under “About Us—Contacts—Legal or Corporate Information” or by mail to: RenaissanceRe Holdings Ltd., P.O. Box HM 2527, Hamilton HMGX, Bermuda, Attn: Corporate Secretary. If properly addressed, communications will be forwarded to the intended recipient unopened.

| 2021 Proxy Statement | 27 |

The Audit Committee, on behalf of itself and our other non-management directors, has established procedures to enable employees or other parties who may have a concern about our conduct or policies to communicate that concern. Our employees are encouraged and expected to report any conduct which they believe in good faith to be an actual or apparent violation of our Code of Ethics. In addition, as required by the Sarbanes-Oxley Act of 2002, the Audit Committee has established procedures for receiving, retaining and treating complaints regarding accounting, internal accounting controls or auditing matters, as well as for confidential submission by Company employees of concerns regarding questionable accounting or auditing matters, among other things. These communications may be anonymous, and may be submitted in writing, e-mailed or reported by phone through various internal and external mechanisms as provided on the Company’s internal website. Additional procedures by which internal communications may be made are provided to each employee. Our Code of Ethics prohibits any employee or director from retaliating or taking any adverse action against anyone for raising or helping to resolve an integrity concern.

Committees of the Board

The Board maintains three principal standing committees: the Audit Committee, the Compensation and Governance Committee, and the Investment and Risk Management Committee. The primary responsibilities of these committees are summarized below and more fully described in their charters. These committees may delegate any of their responsibilities to a subcommittee composed of one or more members of the committee. In addition, the Board maintains two standing, special purpose committees: the Transaction Committee and the Offerings Committee. The responsibilities of these committees are summarized below.

The Board has determined that each member of the Audit Committee and the Compensation and Governance Committee meets the applicable independence standards of the Commission and the NYSE. The Board has also determined that each member of the Audit Committee is financially literate and has accounting or related financial management expertise as required by NYSE rules and is an “audit committee financial expert” under the Commission’s rules in each case given his or her experience as set forth in his or her biography above.

| Audit Committee | |

|

Members

David C. Bushnell (Chair) Valerie Rahmani Carol P. Sanders James L. Gibbons (interim) Brian G. J. Gray (interim) |

The Audit Committee’s key responsibilities include oversight of: • Our accounting and financial reporting process, as well as the integrity, quality and accuracy of our financial statements, including internal controls; • Our operational risk assessment and risk management process; • Our compliance with legal and regulatory requirements, including review of our Code of Ethics and internal compliance program; • Our information and cybersecurity programs; • Our independent auditor’s appointment, compensation, qualifications, independence and performance; and • The performance of our internal audit function. |

| 28 |  |

| Compensation and Corporate Governance Committee | |

|

Members

Henry Klehm III (Chair) Jean D. Hamilton Cynthia Trudell James L. Gibbons (interim) |

The Compensation and Corporate Governance Committee’s key responsibilities include:

Compensation-Related

• Determining compensation of our Chief Executive Officer and directors, and reviewing and approving our Chief Executive Officer’s recommendations of other key executives’ compensation; • Overseeing incentive and stock-based compensation plans, including granting and setting the terms of awards; • Evaluating performance of executive officers; • Reviewing and recommending policies, practices and procedures concerning compensation strategy and other human resources-related matters, including DEI and employee development; • Reviewing and advising on executive succession planning; and • Reviewing, analyzing and overseeing the mitigation of risks associated with our compensation programs.

Corporate Governance-Related

• Overseeing and supervising the director nomination process, including identifying and evaluating prospective Board candidates; • Reviewing and monitoring the performance and composition of the Board and its committees; • Overseeing the new director orientation process and director continuing education policies; • Developing and evaluating our corporate governance practices and procedures, including compliance with legal and regulatory requirements; • Assisting our Board in overseeing sustainability and corporate responsibility policies and programs and similar ESG, DEI and CSR initiatives; and • Reviewing any properly submitted shareholder proposals. |

Compensation and Corporate Governance Committee Advisors

The Compensation and Governance Committee has the authority to select, retain and dismiss compensation consultants, financial and other advisors and independent legal counsel as it deems necessary in accordance with the procedures set forth in the charter and considering independence and potential conflicts of interest. For a discussion regarding our independent compensation consultant, please see “Executive Compensation—Compensation Discussion and Analysis—Compensation Determination Process—Role of Compensation Consultants” below.

In addition, our Compensation and Governance Committee reviews our compensation programs for consistency with our risk management practices and to assist us in ensuring that our programs align our executives and employees with the long-term interests of shareholders in light of the market cycles and earnings volatility that characterize our industry. For a discussion regarding our compensation policies and practices as they relate to our risk management see “Executive Compensation—Compensation Discussion and Analysis—Compensation Governance—Compensation and Risk Management” below.

| 2021 Proxy Statement | 29 |

Compensation Committee Interlocks and Insider Participation

Mr. Gibbons, Mr. Gray, Ms. Hamilton, Mr. Klehm and Ms. Trudell served on the Compensation and Governance Committee during the 2020 fiscal year. No member of the Compensation and Governance Committee during the 2020 fiscal year was an officer or employee of the Company during the 2020 fiscal year or was formerly an officer of the Company, or had any relationship requiring disclosure by the Company as a transaction with a related person under Item 404 of Regulation S-K (“Regulation S-K”) of the U.S. Securities Act of 1933, as amended (the “Securities Act”). No executive officer of the Company served on any board of directors or compensation committee of any other company for which any of our directors served as an executive officer at any time during the 2020 fiscal year.

| Investment and Risk Management Committee | |

|

Members

Anthony M. Santomero (Chair) Brian G. J. Gray Duncan P. Hennes |

The Investment and Risk Management Committee’s key responsibilities include:

• Overseeing our investment strategies, performance and risk management; • Reviewing management procedures to develop investment strategies and risk limits and monitoring adherence to those guidelines; • Reviewing and monitoring investment manager and investment portfolio performance; • Assisting the Board with assessing our financial, non-operational risk management, in coordination with the Audit Committee; and • Overseeing the processes used to manage key financial risks, including risks related to liquidity, solvency margins, reinsurance program limits, third-party credit risk and foreign exchange exposure. |

Special Purpose Committees

Transaction Committee

The Transaction Committee presently consists of Messrs. Gibbons, Gray and O’Donnell (Chair) and Ms. Hamilton. The Transaction Committee has the authority of the Board to consider and approve, on behalf of the full Board, certain strategic investments and other possible transactions.

Offerings Committee

The Offerings Committee presently consists of Messrs. Gibbons, Gray and O’Donnell (Chair) and Ms. Hamilton. The Offerings Committee has the authority to consider and approve, on behalf of the full Board, transactions pursuant to our shelf registration program, including setting the terms, amount and price of any such offering.

Certain Relationships and Related Transactions

We have adopted a written policy with respect to the review, approval and ratification of transactions with related persons. The policy covers, among other things, transactions between us and any of our executive officers, directors, nominees for director, any of their immediate family members or any other related persons as defined in Item 404 of Regulation S-K. Each transaction covered by this policy is reviewed to determine whether the transaction is in the best interests of the Company and our shareholders. The transactions described below include certain transactions we have entered into with parties that are, or could be deemed to be, related to us.

| 30 |  |

Relationship with BlackRock, Inc.