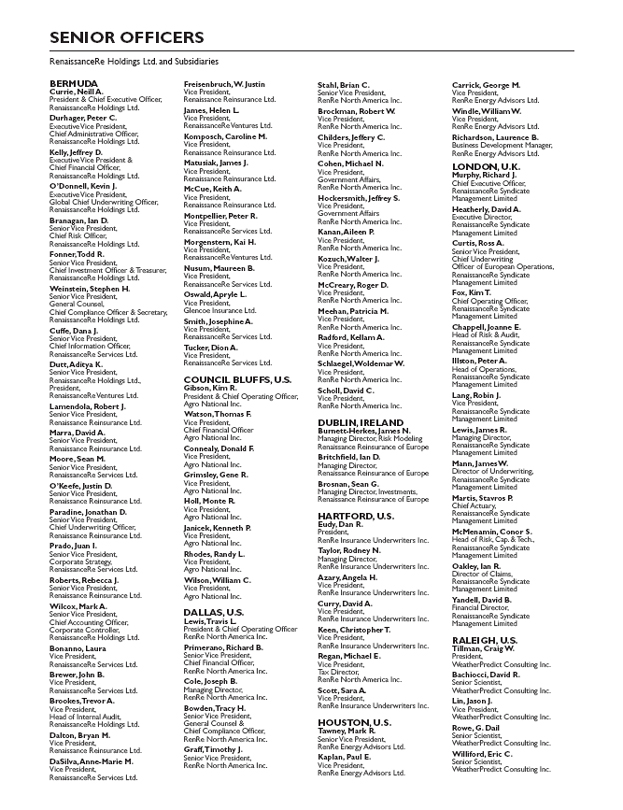

ARS: Annual report to security holders

Published on April 8, 2010

Table of Contents

RenaissanceRe

2009 Annual Report

Table of Contents

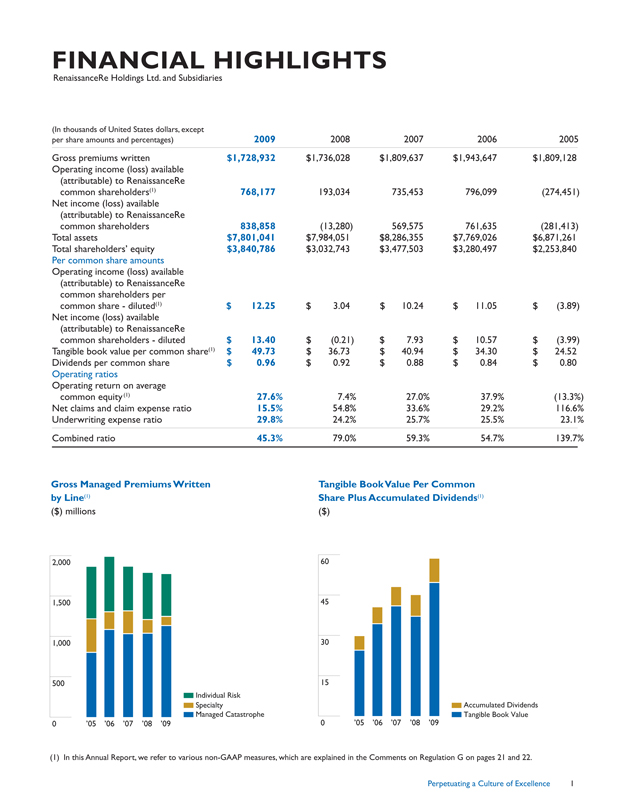

FINANCIAL HIGHLIGHTS

RenaissanceRe Holdings Ltd. and Subsidiaries

(In thousands of United States dollars, except per share amounts and percentages)

2009

2008

2007

2006

2005

Gross premiums written

$1,728,932

$1,736,028

$1,809,637

$1,943,647

$1,809,128

Operating income (loss) available (attributable) to RenaissanceRe common shareholders(1)

768,177

193,034

735,453

796,099

(274,451)

Net income (loss) available (attributable) to RenaissanceRe common shareholders

838,858

(13,280)

569,575

761,635

(281,413)

Total assets

$7,801,041

$7,984,051

$8,286,355

$7,769,026

$6,871,261

Total shareholders equity

$3,840,786

$3,032,743

$3,477,503

$3,280,497

$2,253,840

Per common share amounts

Operating income (loss) available (attributable) to RenaissanceRe common shareholders per common share - diluted(1)

$12.25

$3.04

$10.24

$11.05

$(3.89)

Net income (loss) available (attributable) to RenaissanceRe common shareholders - diluted

$13.40

$(0.21)

$7.93

$10.57

$(3.99)

Tangible book value per common share(1)

$49.73

$36.73

$40.94

$34.30

$24.52

Dividends per common share

$0.96

$0.92

$0.88

$0.84

$0.80

Operating ratios

Operating return on average common equity (1)

27.6%

7.4%

27.0%

37.9%

(13.3%)

Net claims and claim expense ratio

15.5%

54.8%

33.6%

29.2%

116.6%

Underwriting expense ratio

29.8%

24.2%

25.7%

25.5%

23.1%

Combined ratio

45.3%

79.0%

59.3%

54.7%

139.7%

Gross Managed Premiums Written

by Line(1)

($) millions

2,000

1,500

1,000

500

0

05

06

,07

,08

,09

Individual Risk

Specialty

Managed Catastrophe

Tangible Book Value Per Common

Share Plus Accumulated Dividends(1)

60

45

30

15

0

05

06

,07

,08

,09

Accumulated Dividends

Tangible Book Value

(1) In this Annual Report, we refer to various non-GAAP measures, which are explained in the Comments on Regulation G on pages 21 and 22.

Perpetuating a Culture of Excellence 1

Table of Contents

COMPANY OVERVIEW

RenaissanceRe is a leading provider of property catastrophe reinsurance and insurance worldwide. Founded in Bermuda in 1993, the Company has gained recognition for excellence in the industry through disciplined underwriting, capital management expertise, sophisticated risk modeling and responsive client service. RenaissanceRe is traded on the New York Stock Exchange under the ticker symbol RNR.

PROPERTY CATASTROPHE AND SPECIALTY REINSURANCE

We underwrite our Reinsurance business principally through Renaissance Reinsurance Ltd. and DaVinci Reinsurance Ltd., two of the worlds leading reinsurers specializing in property catastrophe and specialty reinsurance products. We have been a pioneer in the use of sophisticated computer modeling for risk analysis and management. Using proprietary technology, our seasoned team of underwriters seeks to construct a superior risk portfolio, while cultivating long-term relationships with clients who appreciate our problem-solving capabilities. In addition to our expertise in property catastrophe reinsurance, our coverages include aviation, casualty clash, medical malpractice, political risk and trade credit, surety, terrorism and catastrophe-exposed workers compensation reinsurance.

2 Perpetuating a Culture of Excellence

Table of Contents

INDIVIDUAL RISK

RenaissanceRes Individual Risk business is written by RenRe Insurance through its operating subsidiaries. Individual Risk products primarily comprise commercial and homeowners property coverages including catastrophe-exposed products, crop, commercial liability coverages including general liability, automobile and various specialty products. Individual Risk business is produced through several distribution channels: wholly-owned program managers, third-party program managers, quota share partners and brokers.

VENTURES

RenaissanceRes Ventures unit structures and manages joint ventures and other strategic relationships that leverage the Companys underwriting expertise and experience. We manage several property catastrophe joint ventures that provide additional high-quality capacity to our clients and generate fee income for RenaissanceRe. Our principal joint ventures include Top Layer Reinsurance Ltd. and DaVinci Reinsurance Ltd., and we structure other joint ventures when market opportunities arise. We make strategic investments to provide capital to existing clients in forms other than reinsurance. We also structure new ventures in partnership with other market participants in non-catastrophe classes of risk.

Perpetuating a Culture of Excellence 3

Table of Contents

TO OUR SHAREHOLDERS

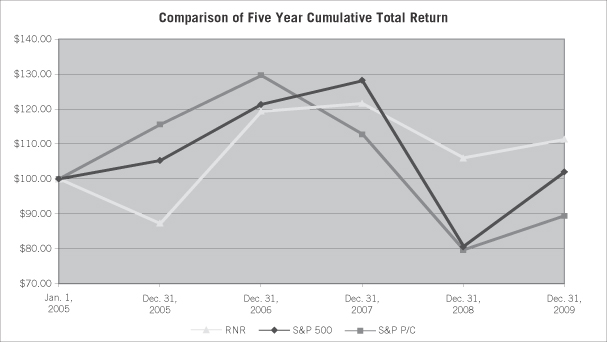

We had an outstanding year in 2009, with the highest net income in our history. We were nimble yet disciplined precisely as we have always sought to be. Aided by light catastrophe losses and a jump in the value of our investment portfolio, the Companys tangible book value per share, plus the change in accumulated dividends the most important metric by which we measure shareholder value grew by 38% for the year.

Of course, one cannot expect such an exceptional performance every year. Ours is a volatile business, but we are willing to accept volatility in order to pursue superior returns over time. Our business model seeks to produce a portfolio of risks that we believe will produce attractive expected returns, with the potential of achieving outsized returns in the good years. At the same time, we seek to manage our exposures so that in the bad years our losses will be manageable and our franchise will endure. Since the formation of our Company, we have been able to grow tangible book value plus the change in accumulated dividends by a compounded annual growth rate of over 21%.

The strategy underlying our strong track record is grounded in perpetuating a culture of excellence, and as I reflect on the events of 2009, the components of our culture clearly served us well.

4 Perpetuating a Culture of Excellence

Table of Contents

Table of Contents

SERVICE AT A TIME OF DISLOCATION

I must admit that 2009 did not unfold as I initially imagined. The year commenced with the financial markets in crisis and a climate of fear. Credit was scarce and financial assets had fallen precipitously in value. This left many of our customers in challenging circumstances.

In contrast, RenaissanceRe emerged from the financial melt-down with a strong balance sheet and ample capital, enabling us to be there for our clients when they needed us. In fact, the ratings of our reinsurance entities were affirmed and those of our insurance segment were upgraded. Standard & Poors reaffirmed its Excellent rating for our Enterprise Risk Management, a tribute received by only a handful of companies, all the more meaningful given the prevailing environment. This was the result of our prudent risk and investment management, our low degree of leverage, and the short-tail nature of our business.

Credit Ratings

At December 31, 2009

A.M. Best

S&P

Moodys

Fitch

Reinsurance Segment1

Renaissance Reinsurance

A+

AA-

A1

A

DaVinci

A

A+

-

-

Top Layer Re

A+

AA

-

-

Renaissance Reinsurance of Europe

A+

AA-

-

-

Individual Risk Segment1

Glencoe

A

A+

-

-

Stonington

A

A+

-

-

Stonington Lloyds

A

A+

-

-

Lantana

A

A+

-

-

RenaissanceRe2

a-

A

A3

BBB+

RenaissanceRe3

-

Excellent

-

-

1 The A.M. Best, S&P, Moodys and Fitch ratings for the companies in the Reinsurance and Individual Risk segments reflect the insurers financial strength rating.

2 The A.M. Best, S&P, Moodys and Fitch ratings for RenaissanceRe represent the credit ratings on its senior unsecured debt.

3 This S&P rating for RenaissanceRe represents the rating on its Enterprise Risk Management practices.

As is often the case, difficult times spell opportunity for us. At a time when many found themselves with less capital, and unable to access additional capital, we brought increased amounts of capacity and solutions to our customers.

During the January 2009 renewal season, we were able to assemble an excellent portfolio in our largest book of business, catastrophe reinsurance. For the year, our managed catastrophe gross premiums written grew 15% after excluding the impact of the 2008 loss-related premiums. We were heavily committed to Atlantic hurricane risk, where demand was high and we believed the risk/reward trade-off was attractive. Unusually low catastrophe activity in 2009 led our portfolio to outperform our already high expectations. For 2009, our catastrophe reinsurance unit achieved a remarkable combined ratio of 8%.

Strong franchises and skillful risk selection separate good performance from average in changing market conditions. We remain particularly focused on aligning our underwriting operations to maintain the risk management excellence that has been at the foundation of our success.

KEVIN J. ODONNELL

Executive Vice President, Global Chief Underwriting Officer, RenaissanceRe Holdings Ltd.

6 Perpetuating a Culture of Excellence

Table of Contents

When we set up Syndicate 1458, an early success from a risk-taking perspective was the seamless cultural alignment of that team with the rest of the organization.

IAN D. BRANAGAN

Senior Vice President, Chief Risk Officer, RenaissanceRe Holdings Ltd..

We launched a new sidecar called Timicuan Re II, similar to our successful sidecars of prior years. Timicuan Re II enabled investors to provide approximately $96 million of additional hurricane reinsurance capacity to the Florida marketplace and attracted both new and former investors.

BALANCING DISCIPLINE WITH NIMBLENESS

By springtime, the financial markets began to stabilize and turn upward, more quickly than most had predicted. Our customers assets began to recover in value, and major but weakened industry players were backstopped by government funding. These conditions made capital more accessible once again, and drove pricing lower. As the year progressed, our markets became increasingly competitive.

Tangible Book Value Per Common

Share Plus Accumulated Dividends(1)

($)

60

45

30

15

0 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09

Accumulated Dividends

Tangible Book Value

(1) In this Annual Report, we refer to various non-GAAP measures, which are explained in the Comments on Regulation G on pages 21 and 22.

Our specialty reinsurance unit succeeded in finding pockets of dislocated market opportunity, but in general, conditions in most of these lines were soft with increasing competition. While our specialty reinsurance gross premiums written contracted by 28%, we saw good deal flow and recruited excellent new talent in anticipation of better opportunities ahead.

On the primary insurance side, the years challenges included a softer market environment for insurance than for reinsurance, and an unusual series of Nebraska hailstorms that took a heavy toll on our crop insurance results. Although it was not a banner year for profitability, we were able to learn from the hailstorm events. In a very short period of time, we were able to convene a meeting of our agribusiness team and our modelers, refine our data and our modeling, and adjust our underwriting strategy for hail going forward.

MEASURED EXPANSION AND DIVERSIFICATION

Our entry into the Lloyds market in London signaled an important expansion effort. The new RenaissanceRe Syndicate 1458 provides property and specialty products in both insurance and reinsurance. We believe that the extensive distribution network and worldwide licenses of the Lloyds marketplace further enhance our global underwriting platform. In tandem,

Perpetuating a Culture of Excellence 7

Table of Contents

we acquired Spectrum Syndicate Management Ltd. (Spectrum) as our managing agent at Lloyds. Although we envision that our Lloyds underwriting activity will build slowly, given the current environment and our disciplined underwriting approach, we believe this expansion presents significant long-term potential.

In Individual Risk, during 2009, we augmented systems and staff to enhance our risk management and further integrate our newer operations. We opened new offices in Hartford and Atlanta, where we created teams in modeling and underwriting.

Our location in these major insurance hubs enabled us to tap into a talented pool of people and provides access to major distribution channels.

In our crop business, we successfully integrated the prior years acquisition of Agro National, our long-term managing general agent, and markedly grew our presence in this market.

We will continue to seek lines of primary insurance business that are diversifying to our catastrophe portfolio and can both reduce volatility in our overall results and increase the efficient use of Company capital.

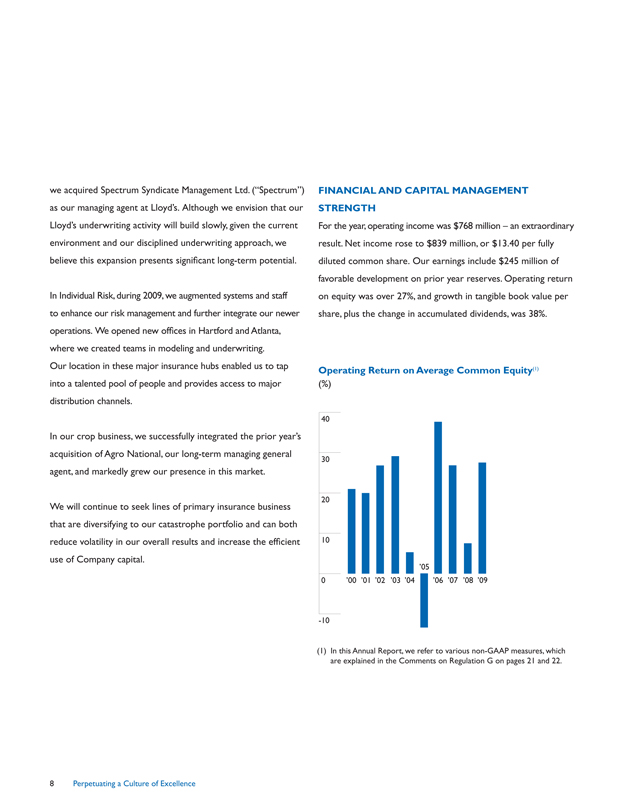

FINANCIAL AND CAPITAL MANAGEMENT STRENGTH

For the year, operating income was $768 million an extraordinary result. Net income rose to $839 million, or $13.40 per fully diluted common share. Our earnings include $245 million of favorable development on prior year reserves. Operating return on equity was over 27%, and growth in tangible book value per share, plus the change in accumulated dividends, was 38%.

Operating Return on Average Common Equity(1)

(%)

40

30

20

10

0

-10

00 01 02 03 04 05 06 07 08 09

(1) In this Annual Report, we refer to various non-GAAP measures, which are explained in the Comments on Regulation G on pages 21 and 22.

8 Perpetuating a Culture of Excellence

Table of Contents

2008 and 2009 were remarkable for what amounted to the consecutive occurrence of two low-probability events in the financial markets one of the largest widenings in spreads in history, followed by one of the biggest rallies. The fourth quarter of 2008 and the second quarter of 2009 were extraordinary for the speed at which people reassessed risk.

TODD R. FONNER

Senior Vice President, Chief Investment Officer & Treasurer, RenaissanceRe Holdings Ltd.

We achieved these results even though gross premiums written were only marginally higher. As I have stated many times, when we write business, we focus on the potential for profitability, not simply on generating revenue or increasing market share.

Our investments performed unusually well, returning approximately

7%. This was better than we had expected, especially given our decision to reduce risk in the investment portfolio in the fourth quarter of 2008. We did this to preserve capital in response to the uncertainty of the ongoing financial crisis. At that time, we were anticipating an increase in demand for our products given that the capital bases of many in our industry had been reduced by underwriting and investment losses.

When the fixed income markets recovered in 2009, we benefited from the rally in spreads and the recovery in mark-to-market valuations in many of the sectors in which we were deployed. Much of our return in 2009 was driven by a modest allocation to high yield, which rebounded substantially from the losses sustained in 2008, and strong returns in investment grade debt. In 2009 we also saw a return to profitability in our hedge fund and private equity allocations. We do not expect to produce investment returns like those of 2009 in most years, given that our investment strategy is designed to preserve capital and maintain robust levels of liquidity while producing diversifying but relatively conservative returns.

With the stabilization of the economy, we have modestly increased our allocations to high-quality credit, focusing mainly on investment grade corporate debt. We are maintaining a relatively short duration profile for the portfolio as we remain concerned about the potential for an increase in interest rates. Overall, our investment portfolio remains conservatively positioned. We have also begun the process of shifting the accounting for our fixed maturity investment portfolio to a trading basis to increase the transparency of our investment results.

Fundamental to our strategy has always been the return of excess capital to shareholders. In 2008 we suspended our share repurchase program to preserve capital, but beginning late in 2009, we resumed buying back our stock to take advantage of its unusual and historically low price-to-book value.

LEVERAGING OUR EXPERTISE THROUGH VENTURES

2009 was an active and productive year for our Ventures group, which offers alternative ways to provide capital to clients and leverages our core expertise into additional avenues of revenue. We increased our investment in DaVinciRe, formed Timicuan Re II, and further enhanced our understanding of earthquake and storm surge exposure through the work of WeatherPredict Consulting.

Perpetuating a Culture of Excellence 9

Table of Contents

The real competitive advantage of our Company lies not so much in the sophistication of its risk modeling and risk management, but more in the seamless integration of these functions within the firms risk-taking process.

JEFFREY D. KELLY

Executive Vice President, Chief Financial Officer, RenaissanceRe Holdings Ltd.

DaVinciRe, one of our flagship managed joint ventures participating alongside the Company in natural catastrophe risk, had a very strong year. In 2009, our stake in DaVinciRe increased to 38% as certain shareholders elected to reduce or exit their investment, and as we determined to increase our participation in light of client and market needs. These decisions had the effect of increasing our share of DaVinciRes profitable results for 2009. In the future, it is possible DaVinciRe will accept new investors and that our percentage ownership will fluctuate.

Top Layer Re, our 50%-owned joint venture providing remote layers of catastrophe coverage for regions outside the United States, was profitable and loss-free for the eleventh consecutive year.

Our energy advisory group, RenRe Energy Advisors Ltd., (REAL), had an outstanding year. This team provides hedging and risk management solutions to clients in the energy industry (ranging from large utilities to small heating oil distributors) to help them manage risk from fluctuations in temperature and commodity prices. REAL is a recognized leader in the field. Bringing to bear its extensive market knowledge, expertise in both weather-related analysis and risk management, in 2009 REAL was able to expand its product and services suite, enhance its risk management systems and personnel, and produce diversifying, positive returns.

MAINTAINING OUR RISK MANAGEMENT EDGE

We believe that one of RenaissanceRes key differentiators has always been our risk management and modeling capability. This year, we continued to invest heavily in both our risk management models and data analytics as well as in our business processing systems. This has become particularly important as we have evolved, with more people in more locations worldwide.

We undertook a significant upgrade of our proprietary REMS© risk modeling system, which we anticipate will continue to meet our needs well into the future. As an early innovator in risk aggregation and roll-up, through which we generate an accurate snapshot of our reinsurance portfolios and capital management in real time on a daily basis, we focused this year on extending this capability across a more diverse set of risks underwritten in more locations.

We are mindful, however, that technology alone does not translate into underwriting success. It is the thorough understanding of the strengths and weaknesses of models, of their varying assumptions and biases, that enables us to sharpen the underwriting decisions we base upon them.

10 Perpetuating a Culture of Excellence

Table of Contents

PEOPLE, CULTURE AND COMMUNICATION

Over the years, the Company has grown deliberately and carefully, but steadily. Today we have almost twice as many employees than just three years ago. A large part of this increase is due to the acquisition last year of Agro National and Claims Management Services, as well as the growth of our commercial property risk operations, the start-up of our Lloyds syndicate and purchase of its managing agent, Spectrum. With culture so essential to our success, this presents a challenge. As we add people, and spread ourselves across more locations worldwide, we need to work hard at maintaining those precious qualities that generate our competitive advantages.

This year, we expended significant energy thinking about the perpetuation of our core culture and its consistency throughout the organization. We refreshed our mission and vision statements, making them meaningful and understandable to all employees. We expanded centers of excellence, like our Dublin office, whose expertise in modeling and deal analytics can be leveraged across the business units. We increased the practice of moving people from one office into another to help carry our culture around the Company.

We made tremendous progress in company-wide communication. An example of this was setting up a new project management office to allow anyone within the organization to see the different activities we are working on, so they can offer advice, share best ideas and profit from experience already gained elsewhere in the Company. I continue to be convinced that a significant contributor to our success to date has been the openness with which our people share ideas with one another. We must never lose this trait.

Above all, our focus is always on developing our people: training them to grow, challenging them to assume new responsibilities, and nurturing their leadership skills. At RenaissanceRe, we have a rigorous hiring process to ensure that those who come aboard possess not only the technical skills and work ethic we expect, but also personalities that will mesh with their colleagues. We seek to maintain a unified environment that is demanding, open-minded, innovative, collaborative, profit-driven and, at the same time, where our people have fun.

As we expand, we are concentrating more skills and capacity in regional centers. This is maximizing efficiency, accelerating learning and promoting cultural integration.

PETER C. DURHAGER

Executive Vice President, Chief Administrative Officer, RenaissanceRe Holdings Ltd.

11 Perpetuating a Culture of Excellence

Table of Contents

We will address any changes in the regulatory and legislative environment in which we operate with the same commitment, discipline and rigor with which we have responded to the evolution of the markets we serve.

STEPHEN H. WEINSTEIN

Senior Vice President, General Counsel, Chief Compliance Officer & Secretary, RenaissanceRe Holdings Ltd.

THANKS AND APPRECIATION

I want to thank our employees for their hard work during this eventful year. I also want to welcome the newcomers and express my appreciation of, and gratitude to, those leaving us.

Specifically, Id like to welcome Jeff Kelly, our new Chief Financial Officer. We have already seen the benefits of his significant executive experience, and I look forward to working closely with him over the coming years.

At the same time, we will miss two individuals who recently announced their intention to retire and who have played important roles in our history Jay Nichols and Bill Ashley. Jay has been a valued member of our team almost since our inception and we celebrate his creativity and accomplishments as an innovative pioneer in our industry. Bill has played a critical role in establishing and building our Individual Risk segment, recently driving the acquisition and integration of Agro National, our integrated crop insurance platform. I wish them both all the very best in the future.

OUTLOOK AND FUTURE DIRECTION

Looking ahead, we enter 2010 optimistic about our new initiatives and the portfolio of business we have assembled. We are conscious, however, of the challenges that lie ahead. As is usual following a low-catastrophe year, eager capital providers are crowding into the market, while some customers

are willing to retain more risk in order to retain more profits if loss activity is low. On the insurance side, the markets continue to exhibit competitive pressure on pricing.

In addition, we are carefully monitoring governmental, regulatory and legislative developments and the range of outcomes we may see there. We remain engaged in sharing our scientific and risk mitigation research not only with policy-makers and legislators but also with the general public, and in doing our part in promoting knowledge that can ultimately save lives and reduce the economic losses of the inevitable natural catastrophes of the future.

Our long term strategy will be to lead in whatever business sectors we choose to engage in ideas and skill, not necessarily in size. At the same time, we will stay lean and flexible. We will refuse to write business that does not meet our hurdles for profitability. And, as we have done since the formation of our Company, we will manage our business to the market cycles.

Thank you for your continuing support.

Sincerely,

Neill A. Currie

President and Chief Executive Officer

12 Perpetuating a Culture of Excellence

Table of Contents

MESSAGE FROM THE CHAIRMAN

On behalf of the Board of Directors, I would like to thank the global team at RenaissanceRe for an outstanding year. The Board is proud of the Companys achievements in 2009, accomplished against a backdrop of economic upheaval, financial uncertainty, and other severe challenges. RenaissanceRes performance under these circumstances has reinforced our conviction that diligent, continuously evolving risk management is essential to the welfare of any enterprise, and especially to one with our strategy and vision. In particular, we are pleased by the degree to which high risk management standards, and the related cultural attributes described by Neill in his letter, have been transmitted to and embraced throughout the organization.

I would also like to acknowledge the key role played by my fellow Directors in providing careful, collaborative oversight to the Companys risk-related policies and practices. As regulators, rating agencies and other stakeholders continue to expand the scope of a boards risk oversight obligations, I am confident our Directors will continue to meet these demands.

We were pleased to announce in 2009 that our CEO renewed his contract for an additional four years. It is noteworthy that the contract incorporates new performance-based

compensation elements. In particular, a meaningful amount of target compensation will be at risk if our total shareholder return substantially lags the peer group determined by the Board. The entire Executive Committee has also agreed to similar arrangements. While these specific features are new, they perpetuate a consistent commitment at RenaissanceRe to align executive compensation with robust risk management and long-term shareholder results.

Finally, together with Neill and our fellow Directors, we are grateful to our customers, partners, shareholders and employees for their continuing support. We look forward to serving you in the future.

Sincerely,

W. James MacGinnitie Chairman of the Board

13 Perpetuating a Culture of Excellence

Table of Contents

EXECUTIVE COMMITTEE

I continue to be pleased with the depth and breadth of our senior management team and our culture of open discourse, data-grounded discussion and rational decision making.

NEILL A. CURRIE

President & Chief Executive Officer, RenaissanceRe Holdings Ltd.

NEILL A. CURRIE

President & Chief Executive Officer,

RenaissanceRe Holdings Ltd.

PETER C. DURHAGER

Executive Vice President,

Chief Administrative Officer,

RenaissanceRe Holdings Ltd.

JEFFREY D. KELLY

Executive Vice President,

Chief Financial Officer,

RenaissanceRe Holdings Ltd.

KEVIN J. ODONNELL

Executive Vice President,

Global Chief Underwriting Officer,

RenaissanceRe Holdings Ltd.

IAN D. BRANAGAN

Senior Vice President,

Chief Risk Officer,

RenaissanceRe Holdings Ltd.

TODD R. FONNER

Senior Vice President,

Chief Investment Officer & Treasurer,

RenaissanceRe Holdings Ltd.

STEPHEN H. WEINSTEIN

Senior Vice President,

General Counsel,

Chief Compliance Officer & Secretary,

RenaissanceRe Holdings Ltd.

Opposite Page

Seated front: Neill Currie

Clockwise from left:

Ian Branagan, Jeff Kelly,

Todd Fonner, Stephen Weinstein

Kevin ODonnell (seated)

and Peter Durhager

14 Perpetuating a Culture of Excellence

Table of Contents

Table of Contents

Table of Contents

16 YEARS OF ENTERPRISE RISK

MANAGEMENT (ERM)

We are in the business of assuming risk, and there is a strong and direct relationship between the amount of well-priced risk we take and our long term profitability. Consequently, since our founding 16 years ago, we have focused relentlessly on developing and consistently applying as rigorous a risk management process as possible.

Formed in the wake of Hurricane Andrew, we started with the idea that rigorous, state of the art analytics could be incorporated into the broader underwriting process to both assess risk at the individual deal level and to achieve capital-efficient portfolio optimization across the entire organization. As we have grown over the years, we have stayed true to this risk and capital management framework, striving to consistently integrate new lines of business and new operations as they have been added. As a result, we are now a multi-line, multi-location organization focused on maintaining the same rigorous and holistic approach to risk analysis, aggregation and management we had when we wrote one line of business from a single location.

PERPETUATING EXCELLENCE IN ERM

It is one thing to know the strategic importance of ERM and to understand what it entails; to execute it well is another. We are pleased to be one of the few companies in our industry to have

17 Perpetuating a Culture of Excellence

Table of Contents

received an ERM classification of Excellent from Standard & Poors. We believe this achievement is due to our focus on the four Cs of risk management culture, capability, consistency and coordination.

We have always had a strong culture of risk management, which starts with tone at the top. But tone is not enough. At RenaissanceRe, risk management has always been the responsibility of every person. This culture is transmitted through training and reinforced through incentives, which reward our people for assuming well-priced risks and not growth for growths sake.

We are pleased to be one of the few companies in our industry to have received an ERM classification of Excellent from Standard & Poors.

Excellent risk management demands the capability to price and track risks appropriately, which requires experienced people using good systems expertly, with well-understood data. We have just completed a substantial enhancement of our industry-leading pricing and exposure management system (REMS©) to incorporate the last 16 years worth of development and extension in a new technology platform, which will accommodate potential tools of the future and enable us to maintain our leading edge. But the real value of tools comes from having people trained to understand both their uses and

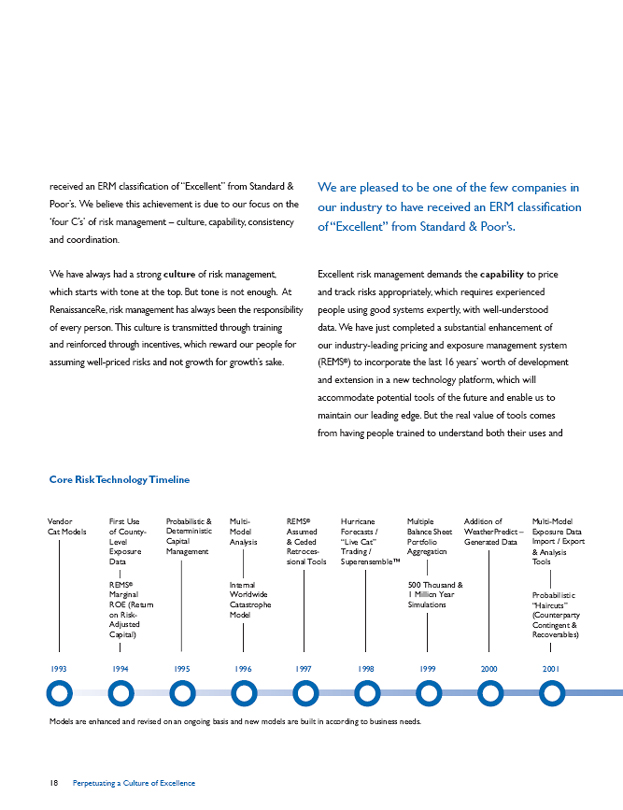

Core Risk Technology Timeline

Vendor Cat Models

First Use of County-Level Exposure Data REMS© Marginal ROE (Return on Risk-Adjusted Capital)

Probabilistic & Deterministic Capital Management

Multi-Model Analysis Internal Worldwide Catastrophe Model

REMS© Assumed & Ceded Retrocessional Tools

Hurricane Forecasts / Live Cat Trading / Superensemble

Multiple Balance Sheet Portfolio Aggregation 500 Thousand & 1 Million Year Simulations

Addition of Weather Predict-Generated Data

Multi-Model Exposure Data Import / Export & Analysis Tools

Probabilistic Haircuts (Counterparty Contingent & Recoverables)

1993 1994 1995 1996 1997 1998 1999 2000 2001

Models are enhanced and revised on an ongoing basis and new models are built in according to business needs.

18 Perpetuating a Culture of Excellence

Table of Contents

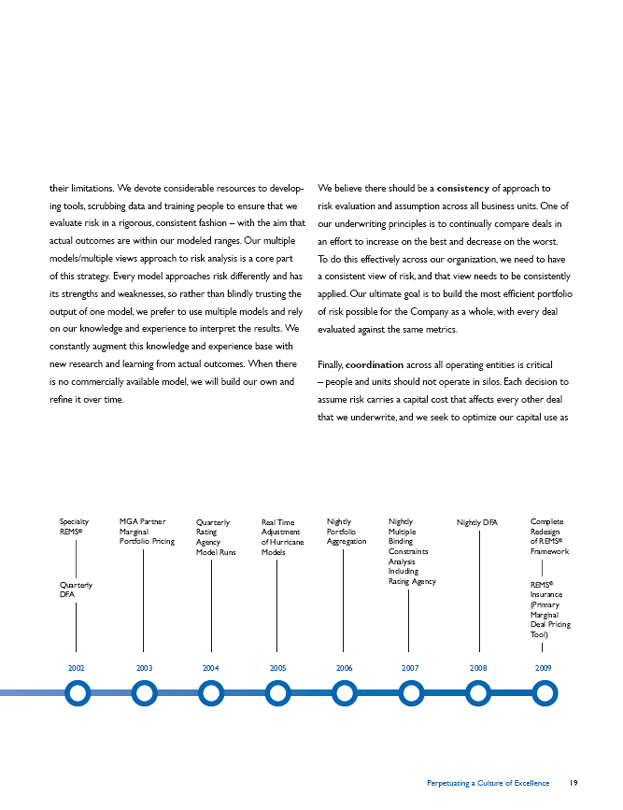

their limitations. We devote considerable resources to developing tools, scrubbing data and training people to ensure that we evaluate risk in a rigorous, consistent fashion with the aim that actual outcomes are within our modeled ranges. Our multiple models/multiple views approach to risk analysis is a core part of this strategy. Every model approaches risk differently and has its strengths and weaknesses, so rather than blindly trusting the output of one model, we prefer to use multiple models and rely on our knowledge and experience to interpret the results. We constantly augment this knowledge and experience base with new research and learning from actual outcomes. When there is no commercially available model, we will build our own and refine it over time.

We believe there should be a consistency of approach to risk evaluation and assumption across all business units. One of our underwriting principles is to continually compare deals in an effort to increase on the best and decrease on the worst. To do this effectively across our organization, we need to have a consistent view of risk, and that view needs to be consistently applied. Our ultimate goal is to build the most efficient portfolio of risk possible for the Company as a whole, with every deal evaluated against the same metrics.

Finally, coordination across all operating entities is critical people and units should not operate in silos. Each decision to assume risk carries a capital cost that affects every other deal that we underwrite, and we seek to optimize our capital use as

Specialty REMS© Quarterly DFA

MGA Partner Marginal Portfolio Pricing

Quarterly Rating Agency Model Runs

Real Time Adjustment of Hurricane Models

Nightly Portfolio Aggregation

Nightly Multiple Binding Constraints Analysis Including Rating Agency

Nightly DFA

Complete Redesign of REMS© Framework

REMS© Insurance (Primary Marginal Deal Pricing Tool)

2002 2003 2004 2005 2006 2007 2008 2009

Perpetuating a Culture of Excellence 19

Table of Contents

an organization. Therefore, each underwriting decision must be validated at the group level. To achieve this, we seek to subject every deal of import to multiple layers of review, including a review of its impact at the operating company level and on RenaissanceRe as a whole. For significant decisions, we frequently deploy a peer review prior to binding, which we refer to as the second set of eyes. Each day, or when required, we aggregate our underwriting risks across the Company from all sources into our consolidated portfolio, allowing us to monitor the underwriting process in real time. And on a quarterly basis, we bring together our business units to discuss our underwriting position, our capital allocation, and quality of our individual and consolidated portfolios. We focus relentlessly on identifying underperforming deals, managing risk across our business units and obtaining the best possible overall portfolio for the Company.

THE PROPER ROLE FOR ERM

In our industry, risk management should not be confused with risk avoidance. We are risk-takers, and it is our job to pick the best risks. The proper role of enterprise risk management is to allow us, when picking risks, to make deliberate decisions rather than having to react to accidental outcomes. Our goal is to avoid being surprised by an outcome; we aim to capture and quantify all the risks to which we are exposed. We accept that exact estimation of the probability of a particular risk may not always be feasible, but nonetheless strive to include all risks in our modeled distributions of potential outcomes.

BUSINESS AND OPERATIONAL RISKS

While the risks we knowingly assume as part of our reinsurance, insurance and other businesses constitute a significant portion of the risks we face as an organization, we are also subject to other risks related to our business and operating environments. These are risks that we are not paid to assume, and therefore we attempt to mitigate them as much as possible. We have worked hard to bring our management of these important risks up to the high standards we have set for ourselves generally. In doing so, we believe we have built world-class legal, accounting and internal audit functions. We continually assess these business and operational risks and try to ensure that appropriate mitigation strategies are in place.

We are risk-takers, and it is our job to pick the best risks.

SUMMARY

A history of strong risk management does not automatically propagate into the future. Retaining our excellence in risk management as we evolve will require the ongoing implementation of the four Cs. Our culture of risk management excellence constitutes a key competitive advantage and is the result of 16 years of committed effort and resources. We will do everything within our capabilities to safeguard and enhance it. This is our commitment to you.

20 Perpetuating a Culture of Excellence

Table of Contents

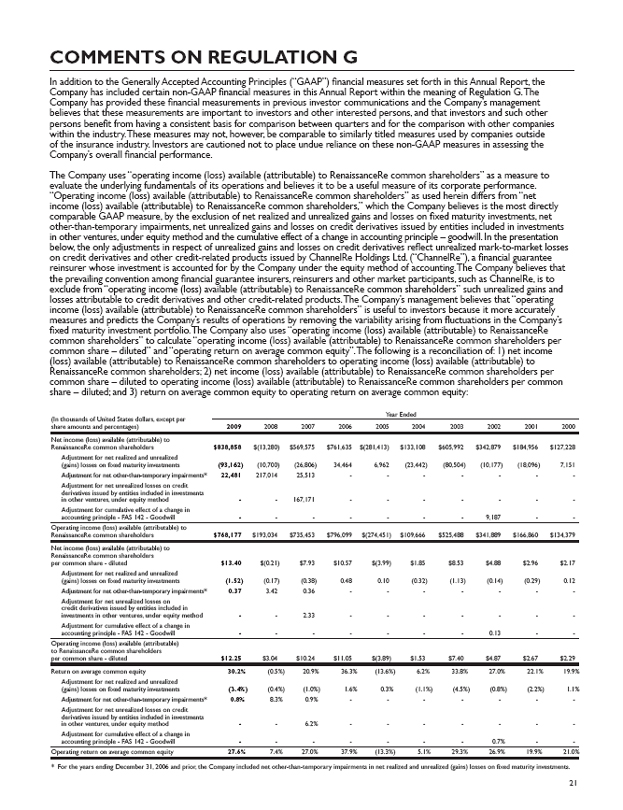

COMMENTS ON REGULATION G

In addition to the Generally Accepted Accounting Principles (GAAP) financial measures set forth in this Annual Report, the Company has included certain non-GAAP financial measures in this Annual Report within the meaning of Regulation G. The Company has provided these financial measurements in previous investor communications and the Companys management believes that these measurements are important to investors and other interested persons, and that investors and such other persons benefit from having a consistent basis for comparison between quarters and for the comparison with other companies within the industry. These measures may not, however, be comparable to similarly titled measures used by companies outside of the insurance industry. Investors are cautioned not to place undue reliance on these non-GAAP measures in assessing the Companys overall financial performance.

The Company uses operating income (loss) available (attributable) to RenaissanceRe common shareholders as a measure to evaluate the underlying fundamentals of its operations and believes it to be a useful measure of its corporate performance. Operating income (loss) available (attributable) to RenaissanceRe common shareholders as used herein differs from net income (loss) available (attributable) to RenaissanceRe common shareholders, which the Company believes is the most directly comparable GAAP measure, by the exclusion of net realized and unrealized gains and losses on fixed maturity investments, net other-than-temporary impairments, net unrealized gains and losses on credit derivatives issued by entities included in investments in other ventures, under equity method and the cumulative effect of a change in accounting principle goodwill. In the presentation below, the only adjustments in respect of unrealized gains and losses on credit derivatives reflect unrealized mark-to-market losses on credit derivatives and other credit-related products issued by ChannelRe Holdings Ltd. (ChannelRe), a financial guarantee reinsurer whose investment is accounted for by the Company under the equity method of accounting. The Company believes that the prevailing convention among financial guarantee insurers, reinsurers and other market participants, such as ChannelRe, is to exclude from operating income (loss) available (attributable) to RenaissanceRe common shareholders such unrealized gains and losses attributable to credit derivatives and other credit-related products. The Companys management believes that operating income (loss) available (attributable) to RenaissanceRe common shareholders is useful to investors because it more accurately measures and predicts the Companys results of operations by removing the variability arising from fluctuations in the Companys fixed maturity investment portfolio. The Company also uses operating income (loss) available (attributable) to RenaissanceRe common shareholders to calculate operating income (loss) available (attributable) to RenaissanceRe common shareholders per common share diluted and operating return on average common equity. The following is a reconciliation of: 1) net income (loss) available (attributable) to RenaissanceRe common shareholders to operating income (loss) available (attributable) to RenaissanceRe common shareholders; 2) net income (loss) available (attributable) to RenaissanceRe common shareholders per common share diluted to operating income (loss) available (attributable) to RenaissanceRe common shareholders per common share diluted; and 3) return on average common equity to operating return on average common equity:

Year Ended

(In thousands of United States dollars, except per share amounts and percentages)

2009 2008 2007 2006 2005 2004 2003 2002 2001 2000

Net income (loss) available (attributable) to RenaissanceRe common shareholders

$838,858 $(13,280) $569,575 $761,635 $(281,413) $133,108 $605,992 $342,879 $184,956 $127,228

Adjustment for net realized and unrealized (gains) losses on fixed maturity investments

(93,162) (10,700) (26,806) 34,464 6,962 (23,442) (80,504) (10,177) (18,096) 7,151

Adjustment for net other-than-temporary impairments*

22,481 217,014 25,513 - - - - - - -

Adjustment for net unrealized losses on credit derivatives issued by entities included in investments in other ventures, under equity method

- - 167,171 - - - - - - -

Adjustment for cumulative effect of a change in accounting principle - FAS 142 - Goodwill

- - - - - - - 9,187 - -

Operating income (loss) available (attributable) to RenaissanceRe common shareholders

$768,177 $193,034 $735,453 $796,099 $(274,451) $109,666 $525,488 $341,889 $166,860 $134,379

Net income (loss) available (attributable) to RenaissanceRe common shareholders per common share - diluted

$13.40 $(0.21) $7.93 $10.57 $(3.99) $1.85 $8.53 $4.88 $2.96 $2.17

Adjustment for net realized and unrealized (gains) losses on fixed maturity investments

(1.52) (0.17) (0.38) 0.48 0.10 (0.32) (1.13) (0.14) (0.29) 0.12

Adjustment for net other-than-temporary impairments*

0.37 3.42 0.36 - - - - - - -

Adjustment for net unrealized losses on credit derivatives issued by entities included in investments in other ventures, under equity method

- - 2.33 - - - - - - -

Adjustment for cumulative effect of a change in accounting principle - FAS 142 - Goodwill

- - - - - - - 0.13 - -

Operating income (loss) available (attributable) to RenaissanceRe common shareholders per common share - diluted

$12.25 $3.04 $10.24 $11.05 $(3.89) $1.53 $7.40 $4.87 $2.67 $2.29

Return on average common equity

30.2% (0.5%) 20.9% 36.3% (13.6%) 6.2% 33.8% 27.0% 22.1% 19.9%

Adjustment for net realized and unrealized (gains) losses on fixed maturity investments

(3.4%) (0.4%) (1.0%) 1.6% 0.3% (1.1%) (4.5%) (0.8%) (2.2%) 1.1%

Adjustment for net other-than-temporary impairments*

0.8% 8.3% 0.9% - - - - - - -

Adjustment for net unrealized losses on credit derivatives issued by entities included in investments in other ventures, under equity method

- - 6.2% - - - - - - -

Adjustment for cumulative effect of a change in accounting principle - FAS 142 - Goodwill

- - - - - - - 0.7% - -

Operating return on average common equity

27.6% 7.4% 27.0% 37.9% (13.3%) 5.1% 29.3% 26.9% 19.9% 21.0%

* For the years ending December 31, 2006 and prior, the Company included net other-than-temporary impairments in net realized and unrealized (gains) losses on fixed maturity investments.

21

Table of Contents

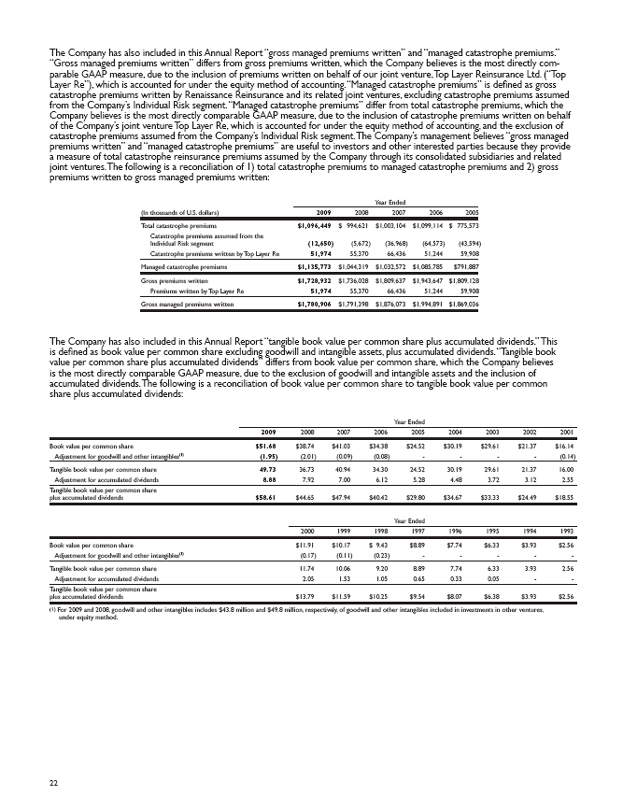

The Company has also included in this Annual Report gross managed premiums written and managed catastrophe premiums. Gross managed premiums written differs from gross premiums written, which the Company believes is the most directly comparable GAAP measure, due to the inclusion of premiums written on behalf of our joint venture, Top Layer Reinsurance Ltd. (Top Layer Re), which is accounted for under the equity method of accounting. Managed catastrophe premiums is defined as gross catastrophe premiums written by Renaissance Reinsurance and its related joint ventures, excluding catastrophe premiums assumed from the Companys Individual Risk segment. Managed catastrophe premiums differ from total catastrophe premiums, which the Company believes is the most directly comparable GAAP measure, due to the inclusion of catastrophe premiums written on behalf of the Companys joint venture Top Layer Re, which is accounted for under the equity method of accounting, and the exclusion of catastrophe premiums assumed from the Companys Individual Risk segment. The Companys management believes gross managed premiums written and managed catastrophe premiums are useful to investors and other interested parties because they provide a measure of total catastrophe reinsurance premiums assumed by the Company through its consolidated subsidiaries and related joint ventures. The following is a reconciliation of 1) total catastrophe premiums to managed catastrophe premiums and 2) gross premiums written to gross managed premiums written:

Year Ended

(In thousands of U.S. dollars)

2009 2008 2007 2006 2005

Total catastrophe premiums

$1,096,449 $994,621 $1,003,104 $1,099,114 $775,573

Catastrophe premiums assumed from the Individual Risk segment

(12,650) (5,672) (36,968) (64,573) (43,594)

Catastrophe premiums written by Top Layer Re

51,974 55,370 66,436 51,244 59,908

Managed catastrophe premiums

$1,135,773 $1,044,319 $1,032,572 $1,085,785 $791,887

Gross premiums written

$1,728,932 $1,736,028 $1,809,637 $1,943,647 $1,809,128

Premiums written by Top Layer Re

51,974 55,370 66,436 51,244 59,908

Gross managed premiums written

$1,780,906 $1,791,398 $1,876,073 $1,994,891 $1,869,036

The Company has also included in this Annual Report tangible book value per common share plus accumulated dividends. This is defined as book value per common share excluding goodwill and intangible assets, plus accumulated dividends. Tangible book value per common share plus accumulated dividends differs from book value per common share, which the Company believes is the most directly comparable GAAP measure, due to the exclusion of goodwill and intangible assets and the inclusion of accumulated dividends. The following is a reconciliation of book value per common share to tangible book value per common share plus accumulated dividends:

Year Ended 2009 2008 2007 2006 2005 2004 2003 2002 2001

Book value per common share

$51.68 $38.74 $41.03 $34.38 $24.52 $30.19 $29.61 $21.37 $16.14

Adjustment for goodwill and other intangibles(1)

(1.95) (2.01) (0.09) (0.08) - - - - (0.14)

Tangible book value per common share

49.73 36.73 40.94 34.30 24.52 30.19 29.61 21.37 16.00

Adjustment for accumulated dividends

8.88 7.92 7.00 6.12 5.28 4.48 3.72 3.12 2.55

Tangible book value per common share plus accumulated dividends

$58.61 $44.65 $47.94 $40.42 $29.80 $34.67 $33.33 $24.49 $18.55

Year Ended

2000 1999 1998 1997 1996 1995 1994 1993

Book value per common share

$11.91 $10.17 $9.43 $8.89 $7.74 $6.33 $3.93 $2.56

Adjustment for goodwill and other intangibles(1)

(0.17) (0.11) (0.23) - - - - -

Tangible book value per common share

11.74 10.06 9.20 8.89 7.74 6.33 3.93 2.56

Adjustment for accumulated dividends

2.05 1.53 1.05 0.65 0.33 0.05 - -

Tangible book value per common share plus accumulated dividends

$13.79 $11.59 $10.25 $9.54 $8.07 $6.38 $3.93 $2.56

(1) For 2009 and 2008, goodwill and other intangibles includes $43.8 million and $49.8 million, respectively, of goodwill and other intangibles included in investments in other ventures, under equity method.

22

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2009

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 001-14428

RENAISSANCERE HOLDINGS LTD.

(Exact Name Of Registrant As Specified In Its Charter)

| Bermuda | 98-014-1974 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

Renaissance House, 8-20 East Broadway, Pembroke HM 19 Bermuda

(Address of Principal Executive Offices)

(441) 295-4513

(Registrants telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Shares, Par Value $1.00 per share |

New York Stock Exchange, Inc. | |

| Series B 7.30% Preference Shares, Par Value $1.00 per share |

New York Stock Exchange, Inc. | |

| Series C 6.08% Preference Shares, Par Value $1.00 per share |

New York Stock Exchange, Inc. | |

| Series D 6.60% Preference Shares, Par Value $1.00 per share |

New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, as defined in Rule 12b-2 of the Act. Large accelerated filer x, Accelerated filer ¨, Non-accelerated filer ¨, Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of Common Shares held by nonaffiliates of the registrant at June 30, 2009 was $2,758.1 million based on the closing sale price of the Common Shares on the New York Stock Exchange on that date.

The number of Common Shares outstanding at February 10, 2010 was 60,058,112.

The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference to the registrants Definitive Proxy Statement to be filed in respect of our 2010 Annual General Meeting of Shareholders.

Table of Contents

RENAISSANCERE HOLDINGS LTD.

| Page | ||||

| 4 | ||||

| ITEM 1. |

4 | |||

| ITEM 1A. |

36 | |||

| ITEM 1B. |

53 | |||

| ITEM 2. |

60 | |||

| ITEM 3. |

60 | |||

| ITEM 4. |

60 | |||

| 60 | ||||

| ITEM 5. |

60 | |||

| ITEM 6. |

63 | |||

| ITEM 7. |

MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

65 | ||

| ITEM 7A. |

129 | |||

| ITEM 8. |

132 | |||

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

132 | ||

| ITEM 9A. |

132 | |||

| ITEM 9B. |

133 | |||

| 134 | ||||

| ITEM 10. |

134 | |||

| ITEM 11. |

134 | |||

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS |

134 | ||

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

134 | ||

| ITEM 14. |

134 | |||

| 135 | ||||

| ITEM 15. |

135 | |||

| 139 | ||||

Table of Contents

NOTE ON FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, us.

In particular, statements using words such as may, should, estimate, expect, anticipate, intends, believe, predict, potential, or words of similar import generally involve forward-looking statements. For example, we may include certain forward-looking statements in Managements Discussion and Analysis of Financial Condition and Results of Operations with regard to trends in results, prices, volumes, operations, investment results, margins, combined ratios, reserves, overall market trends, risk management and exchange rates. This Form 10-K also contains forward-looking statements with respect to our business and industry, such as those relating to our strategy and management objectives, trends in market conditions, market standing and product volumes, investment results, government initiatives and regulatory matters, and pricing conditions in the reinsurance and insurance industries.

In light of the risks and uncertainties inherent in all future projections, the inclusion of forward-looking statements in this report should not be considered as a representation by us or any other person that our objectives or plans will be achieved. Numerous factors could cause our actual results to differ materially from those addressed by the forward-looking statements, including the following:

| | we are exposed to significant losses from catastrophic events and other exposures that we cover, which we expect to cause significant volatility in our financial results from time to time; |

| | the frequency and severity of catastrophic events or other events which we cover could exceed our estimates and cause losses greater than we expect; |

| | risks associated with implementing our business strategies and initiatives, including risks related to developing or enhancing the operations, controls and other infrastructure necessary in respect of our more recent, new or proposed initiatives; |

| | risks relating to adverse legislative developments including, the risk of new legislation in Florida continuing to expand the reinsurance coverages offered by the Florida Hurricane Catastrophe Fund (FHCF) and the insurance policies written by the state-sponsored Citizens Property Insurance Corporation (Citizens); failing to reduce such coverages or implementing new programs which reduce the size of the private market; and the risk that new, state based or federal legislation will be enacted and adversely impact us; |

| | the risk that the Risk Management Agency of the U.S. Department of Agriculture (the RMA) adversely changes the financial terms of the Standard Reinsurance Agreement (the SRA) which we are currently party to and under which our Individual Risk segment participates in the federal multi-peril crop insurance program; |

| | the risk of the lowering or loss of any of the ratings of RenaissanceRe Holdings Ltd. or of one or more of our subsidiaries or changes in the policies or practices of the rating agencies; |

| | risks relating to our strategy of relying on third party program managers, third party administrators, and other vendors to support our Individual Risk operations; |

| | risks due to our dependence on a few insurance and reinsurance brokers for the preponderance of our revenue, a risk we believe is increasing as a larger portion of our business is provided by a small number of these brokers, including as a result of the merger of AON Corporation (AON) and Benfield Group Limited (Benfield); |

| | the risk we might be bound to policyholder obligations beyond our underwriting intent, and the risk that our third party program managers or agents may elect not to continue or renew their programs with us; |

| | the inherent uncertainties in our reserving process, including those related to the 2005 and 2008 catastrophes, which uncertainties we believe are increasing as we diversify into new product classes; |

1

Table of Contents

| | we are exposed to the risk that our customers may fail to make premium payments due to us (a risk that may be increasing in certain of our key markets), as well as the risk of failures of our reinsurers, brokers, third party program managers or other counterparties to honor their obligations to us, including their obligations to make third party payments for which we might be liable, which risks we believe continue to be heightened during the ongoing period of financial market dislocation; |

| | risks associated with appropriately modeling, pricing for, and contractually addressing new or potential factors in loss emergence, such as the trend toward potentially significant global warming and other aspects of climate change which have the potential to adversely affect our business, or the ongoing financial crisis, which could cause us to underestimate our exposures and potentially adversely impact our financial results; |

| | risks associated with a sustained weakness or weakening in business and economic conditions, specifically in the principal markets in which we do business, which may adversely affect the demand for our products and ultimately our business and operating results; |

| | risks relating to a deterioration in the investment markets and current economic conditions which could adversely affect our net investment income and lead to investment losses, particularly with respect to our illiquid investments in asset classes experiencing significant volatility; |

| | risks associated with highly subjective judgments, such as valuing our more illiquid assets, and determining the impairments taken on our investments, which could impact our financial position or operating results; |

| | risks associated with our investment portfolio, including the risk that investment managers may breach our investment guidelines, or the inability of such guidelines to mitigate risks arising out of the ongoing financial crisis; |

| | changes in economic conditions, including interest rate, currency, equity and credit conditions which could affect our investment portfolio or declines in our investment returns for other reasons which could reduce our profitability and hinder our ability to pay claims promptly in accordance with our strategy, which risks we believe are currently enhanced in light of the ongoing financial crisis, both globally and in the U.S.; |

| | we are exposed to counterparty credit risk, including with respect to reinsurance brokers, customers, agents, retrocessionaires, capital providers and parties associated with our investment portfolio, energy trading business, and premiums and other receivables owed to us, which risks we believe continue to be heightened as a result of the ongoing global economic downturn; |

| | emerging claims and coverage issues, which could expand our obligations beyond the amount we intend to underwrite; |

| | loss of services of any one of our key senior officers, or difficulties associated with the transition of new members of our senior management team; |

| | a contention by the U.S. Internal Revenue Service (the IRS) that Renaissance Reinsurance Ltd. (Renaissance Reinsurance), or any of our other Bermuda subsidiaries, is subject to U.S. taxation; |

| | the passage of federal or state legislation subjecting Renaissance Reinsurance or our other Bermuda subsidiaries to supervision, regulation or taxation in the U.S. or other jurisdictions in which we operate, or increasing the taxation of business ceded to us; |

| | changes in insurance regulations in the U.S. or other jurisdictions in which we operate, including the risks that U.S. federal or state governments will take actions to diminish the size of the private markets in respect of the coverages we offer, the risk of potential challenges to the Companys claim of exemption from insurance regulation under current laws and the risk of increased global regulation of the insurance and reinsurance industry; |

| | operational risks, including system or human failures; |

| | risks in connection with our management of third party capital; |

2

Table of Contents

| | risks that we may require additional capital in the future, particularly after a catastrophic event or to support potential growth opportunities in our business, which may not be available or may be available only on unfavorable terms, risks which we believe to be heightened during the ongoing financial market crisis; |

| | risks relating to failure to comply with covenants in our debt agreements; |

| | risks relating to the inability of our operating subsidiaries to declare and pay dividends to the Company; |

| | risks that acquisitions or strategic investments that we have made or may make could turn out to be unsuccessful; |

| | risks that certain of our new or potentially expanding business lines could have a significant negative impact on our financial results or cause significant volatility in our results for any particular period; |

| | the risk that ongoing or future industry regulatory developments will disrupt our business, or that of our business partners, or mandate changes in industry practices in ways that increase our costs, decrease our revenues or require us to alter aspects of the way we do business; |

| | we operate in a highly competitive environment, which we expect to increase over time from new competition from non-traditional participants as capital markets products provide alternatives and replacements for our more traditional reinsurance and insurance products and as a result of consolidation in the (re)insurance industry; |

| | risks arising out of possible changes in the distribution or placement of risks due to increased consolidation of customers or insurance and reinsurance brokers, or third party program managers, or from potential changes in their business practices which may be required by future regulatory changes; |

| | the risk that there could be regulatory or legislative changes adversely impacting us, as a Bermuda-based company, relative to our competitors, or actions taken by multinational organizations having such an impact; |

| | acts of terrorism, war or political unrest; and |

| | risks relating to changes in regulatory regimes and/or accounting rules, such as the roadmap to International Financial Reporting Standards (IFRS), which could result in significant changes to our financial results. |

The factors listed above should not be construed as exhaustive. Certain of these risk factors and others are described in more detail in Item 1A. Risk Factors below. We undertake no obligation to release publicly the results of any future revisions we may make to forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

3

Table of Contents

Unless the context otherwise requires, references in this Form 10-K to RenaissanceRe or the Company mean RenaissanceRe Holdings Ltd. and its subsidiaries, which principally include, but are not limited to, Renaissance Reinsurance, RenRe Insurance Holdings Ltd. and its subsidiaries (RenRe Insurance), Renaissance Trading Ltd. (Renaissance Trading), RenRe Energy Advisors Ltd. (REAL) and the Companys Lloyds syndicate, RenaissanceRe Syndicate 1458 (Syndicate 1458).

We also underwrite reinsurance on behalf of joint ventures, principally including Top Layer Reinsurance Ltd. (Top Layer Re), recorded under the equity method of accounting, and DaVinci Reinsurance Ltd. (DaVinci). The financial results of DaVinci and DaVincis parent company, DaVinciRe Holdings Ltd. (DaVinciRe), are consolidated in our financial statements. For your convenience, we have included a glossary beginning on page 53 of selected insurance and reinsurance terms. All dollar amounts referred to in this Form 10-K are in U.S. dollars unless otherwise indicated. Any discrepancies in the tables included herein between the amounts listed and the totals thereof are due to rounding.

GENERAL

RenaissanceRe, established in Bermuda in 1993 to write principally property catastrophe reinsurance, is today a leading global provider of reinsurance and insurance coverages and related services. Through our operating subsidiaries, we seek to produce superior returns for our shareholders by being a trusted, long-term partner to our customers for assessing and managing risk, delivering responsive solutions, and keeping our promises. We accomplish this by leveraging our core capabilities of risk assessment and information management, and by investing in our capabilities to serve our customers across the cycles that have historically characterized our markets. Overall, our strategy focuses on superior risk selection, marketing, capital management and joint ventures. We provide value to our customers and joint venture partners in the form of financial security, innovative products, and responsive service. We are known as a leader in paying valid reinsurance claims promptly. We principally measure our financial success through long-term growth in tangible book value per common share plus the change in accumulated dividends, which we believe is the most appropriate measure of our Companys performance, and believe we have delivered superior performance in respect of this measure over time.

Our core products include property catastrophe reinsurance, which we write through our principal operating subsidiary Renaissance Reinsurance and joint ventures, principally DaVinci and Top Layer Re; specialty reinsurance risks written through Renaissance Reinsurance and DaVinci; and primary insurance and quota share reinsurance, which we write through the operating subsidiaries of RenRe Insurance. We believe that we are one of the worlds leading providers of property catastrophe reinsurance. We also believe we have a strong position in certain specialty reinsurance lines of business and are building a franchise in the U.S. insurance and crop insurance business. Our reinsurance and insurance products are principally distributed through intermediaries, with whom we seek to cultivate strong relationships.

We currently conduct our business through two reportable segments, Reinsurance and Individual Risk. For the year ended December 31, 2009, our Reinsurance and Individual Risk segments accounted for 69.3% and 30.7%, respectively, of our total consolidated gross premiums written. Our segments are more fully described in Business Segments below.

CORPORATE STRATEGY

Our mission is to produce superior returns for our shareholders by being a trusted, long-term partner to our customers for assessing and managing risk, delivering responsive solutions, and keeping our promises. Our vision is to seek to generate long-term growth in tangible book value per common share plus the change in accumulated dividends for our shareholders by being a leader in select financial services through our people and culture, executing our expertise in risk, and having a passion for exceeding our customers expectations.

Since our inception, we have cultivated and endeavor to preserve certain competitive advantages that position us to fulfill our strategic objectives. We believe these competitive advantages are:

| | Superior Risk Selection. We seek to underwrite our reinsurance, insurance and financial risks through the use of sophisticated risk selection techniques, including computer models and databases, such as |

4

Table of Contents

| the Renaissance Exposure Management System (REMS©) and the Program Analysis Central Repository (PACeR). We pursue a disciplined approach to underwriting and only select those risks that we believe will produce an attractive return on equity, subject to prudent risk constraints. |

| | Superior Marketing. We believe our modeling and technical expertise, and the risk management advice that we provide to our customers, has enabled us to become a provider of first choice in many lines of business to our customers worldwide. We seek to offer stable, predictable and consistent risk-based pricing and a prompt turnaround on our claims. |

| | Superior Capital Management. We generally seek to write as much attractively priced business as is available to us and then manage our capital accordingly. Accordingly, we generally seek to raise capital when we forecast an increased demand in the market, at times by accessing capital through joint ventures or other structures and seek to return capital to our shareholders or joint venture investors when the demand for our coverages appears to decline, and we believe a return of capital would be beneficial to our shareholders or joint venture investors. |

| | Superior Joint Ventures. Building upon our relationships and expertise in risk selection, marketing and capital management, we seek to pursue and execute on joint venture and investment opportunities, which include new partners and diversifying classes of business. We believe our focus on our joint ventures allows us to leverage our access to business and our underwriting capabilities on an efficient capital base, develop fee income, and diversify our portfolio. We routinely evaluate and expect that we may in the future pursue additional joint venture opportunities and strategic investments. |

We believe we are well positioned to fulfill these objectives by virtue of the experience and skill of our management team, our significant financial strength, and our strong relationships with brokers and customers. In addition, we believe our superior service, our proprietary modeling technology, and our extensive business relationships, which have enabled us to become a leader in the property catastrophe reinsurance market, will be instrumental in allowing us to achieve our strategic objectives. In particular, we believe our strategy, high performance culture, and commitment to our customers and joint venture partners permit us to differentiate ourselves by offering specialized services and products at times and in markets where capacity and alternatives may be limited.

BUSINESS SEGMENTS

We currently conduct our business through two reportable segments, Reinsurance and Individual Risk. Financial data relating to our two segments is included in Item 7. Managements Discussion and Analysis of Financial Condition and Results of Operations.

Reinsurance Segment

Our Reinsurance operations are comprised of three units: 1) property catastrophe reinsurance, primarily written through Renaissance Reinsurance and DaVinci; 2) specialty reinsurance, primarily written through Renaissance Reinsurance and DaVinci; and 3) certain other activities of ventures as described herein. Our Reinsurance operations are managed by the Global Chief Underwriting Officer, who leads a team of underwriters, risk modelers and other industry professionals, who have access to our proprietary risk management, underwriting and modeling resources and tools. We believe the expertise of our underwriting and modeling team and our proprietary analytic tools, together with superior customer service, provide us with a significant competitive advantage.

Our portfolio of business has continued to be increasingly characterized by relatively large transactions with ceding companies with whom we do business, although no current relationship exceeds 15% of our gross premiums written. Accordingly, our gross premiums written are subject to significant fluctuations depending on our success in maintaining or expanding our relationships with these large customers. We market our reinsurance products worldwide exclusively through brokers, whose market has become extremely consolidated in recent years. In 2009, three brokerage firms accounted for 90.1% of our Reinsurance segment gross premiums written. We believe that recent market dynamics, and trends in our industry in respect of potential future consolidation, have increased our exposure to the risks of broker, client and counterparty concentration.

5

Table of Contents

The following table shows our total catastrophe and specialty reinsurance gross premiums written:

| Year ended December 31, |

2009 | 2008 | 2007 | ||||||

| (in thousands) | |||||||||

| Renaissance catastrophe premiums |

$ | 706,947 | $ | 633,611 | $ | 662,987 | |||

| Renaissance specialty premiums |

111,889 | 153,701 | 277,882 | ||||||

| Total Renaissance premiums |

818,836 | 787,312 | 940,869 | ||||||

| DaVinci catastrophe premiums |

389,502 | 361,010 | 340,117 | ||||||

| DaVinci specialty premiums |

2,457 | 6,069 | 9,434 | ||||||

| Total DaVinci premiums |

391,959 | 367,079 | 349,551 | ||||||

| Total Reinsurance premiums |

$ | 1,210,795 | $ | 1,154,391 | $ | 1,290,420 | |||

| Total specialty premiums (1) |

$ | 114,346 | $ | 159,770 | $ | 287,316 | |||

| Total catastrophe premiums (2) |

$ | 1,096,449 | $ | 994,621 | $ | 1,003,104 | |||

| (1) | Total specialty premiums written includes $nil, $nil and $0.4 million premiums assumed from our Individual Risk segment for the years ended December 31, 2009, 2008 and 2007, respectively. |

| (2) | Total catastrophe premiums written includes $12.7 million, $5.7 million and $37.0 million of premiums assumed from our Individual Risk segment for the years ended December 31, 2009, 2008 and 2007, respectively. |

Property Catastrophe Reinsurance

We believe we are one of the largest providers of property catastrophe reinsurance in the world, based on our total catastrophe premium. Our principal property catastrophe reinsurance products include catastrophe excess of loss reinsurance and excess of loss retrocessional reinsurance as described below:

Catastrophe Excess of Loss Reinsurance. We principally write catastrophe reinsurance on an excess of loss basis, which means we provide coverage to our insureds when aggregate claims and claim expenses from a single occurrence of a covered peril exceed the attachment point specified in a particular contract. Under these contracts, we indemnify an insurer for a portion of the losses on insurance policies in excess of a specified loss amount, and up to an amount per loss specified in the contract. The coverage provided under excess of loss reinsurance contracts may be on a worldwide basis or limited in scope to selected geographic areas. Coverage can also vary from all property perils to limited coverage on selected perils, such as earthquake only coverage.

Excess of Loss Retrocessional Reinsurance. We also write retrocessional reinsurance contracts that provide property catastrophe coverage to other reinsurers or retrocedants. In providing retrocessional reinsurance, we focus on property catastrophe retrocessional reinsurance, which covers the retrocedant on an excess of loss basis when aggregate claims and claim expenses from a single occurrence of a covered peril and from a multiple number of reinsureds exceed a specified attachment point. The coverage provided under excess of loss retrocessional contracts may be on a worldwide basis or limited in scope to selected geographic areas. Coverage can also vary from all property perils to limited coverage on selected perils, such as earthquake only coverage. The information available to retrocessional underwriters concerning the original primary risk can be less precise than the information received from primary companies directly. Moreover, exposures from retrocessional business can change within a contract term as the underwriters of a retrocedant alter their book of business after retrocessional coverage has been bound.