DEF 14A: Definitive proxy statements

Published on April 12, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

RENAISSANCERE HOLDINGS LTD. |

||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which the transaction applies:

|

|||

|

|

||||

| (2) | Aggregate number of securities to which the transaction applies:

|

|||

|

|

||||

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

|

|

||||

| (4) | Proposed maximum aggregate value of the transaction:

|

|||

|

|

||||

| (5) | Total fee paid: | |||

|

|

||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

|

|||

|

|

||||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

|

|

||||

| (3) | Filing Party:

|

|||

|

|

||||

| (4) | Date Filed:

|

|||

|

|

||||

RENAISSANCERE HOLDINGS LTD.

Renaissance House

12 Crow Lane

Pembroke HM 19 Bermuda

April 12, 2012

Dear Shareholder:

You are cordially invited to attend the 2012 Annual General Meeting of Shareholders of RenaissanceRe Holdings Ltd. to be held on May 22, 2012, at 9:00 a.m., Atlantic Daylight Time, at Renaissance House, 12 Crow Lane, Pembroke, Bermuda.

The Proxy Statement provides you with detailed information regarding the business to be considered at the meeting. Please read it carefully.

Pursuant to rules promulgated by the Securities and Exchange Commission, we are providing access to our proxy materials principally by notifying you of the availability and location at which you can access our proxy materials on the Internet. We believe this allows us to efficiently provide our shareholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual General Meeting.

Your vote is important to us regardless of the size of your holding. To ensure your shares are represented at the meeting, whether or not you plan to attend the meeting in person, we urge you to vote your shares as soon as possible. Voting instructions can be found in the Q&A section of the Proxy Statement.

Thank you for your continued support of RenaissanceRe.

Sincerely,

|

|

|

|

| Ralph B. Levy Chairman of the Board of Directors |

Neill A. Currie President and Chief Executive Officer |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be Held on May 22, 2012

Notice is hereby given that our 2012 Annual General Meeting of Shareholders (the Annual Meeting) will be held at Renaissance House, 12 Crow Lane, Pembroke, Bermuda on May 22, 2012, at 9:00 a.m., Atlantic Daylight Time, for the following purposes:

| 1. | To elect three Class II directors to serve until our 2015 Annual Meeting; |

| 2. | To conduct a non-binding advisory vote to approve the compensation of our named executive officers (collectively, the Named Executive Officers); and |

| 3. | To appoint the firm of Ernst & Young Ltd., an independent registered public accounting firm, to serve as our auditors for the 2012 fiscal year until our 2013 Annual Meeting, and to refer the determination of the auditors remuneration to the Board of Directors. |

At the Annual Meeting, shareholders will receive the report of our independent auditors and our financial statements for the year ended December 31, 2011, and may also be asked to consider and take action with respect to such other matters as may properly come before the Annual Meeting.

The Board of Directors has fixed the close of business on March 26, 2012 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting.

By order of the Board of Directors,

Stephen H. Weinstein

Corporate Secretary

RENAISSANCERE HOLDINGS LTD.

Renaissance House

12 Crow Lane

Pembroke HM 19 Bermuda

ANNUAL GENERAL MEETING OF SHAREHOLDERS

May 22, 2012

GENERAL INFORMATION

| Q: | Why am I receiving these materials? |

| A: | You are receiving these materials because you were a shareholder of RenaissanceRe Holdings Ltd. (RenaissanceRe or the Company) as of March 26, 2012 (the Record Date), and are entitled to attend and vote at the Annual Meeting to be held at Renaissance House, 12 Crow Lane, Pembroke, Bermuda on May 22, 2012, at 9:00 a.m., Atlantic Daylight Time, or any postponement or adjournment thereof. |

This proxy statement (the Proxy Statement) summarizes the information you need to know to vote at the Annual Meeting. The Notice Regarding the Availability of Proxy Materials (the Notice), the Proxy Statement, the Notice of Annual Meeting, and the proxy card are first being made available to shareholders on or about April 12, 2012. We have made available with this Proxy Statement our Annual Report to Shareholders, although the Annual Report should not be deemed to be part of the Proxy Statement.

| Q: | Why did I receive a notice in the mail regarding the Internet availability of proxy materials? |

| A: | Pursuant to rules adopted by the Securities and Exchange Commission (the SEC or the Commission) and applicable Bermuda law, we are providing access to our proxy materials over the Internet. Accordingly, we are sending the Notice to holders of our common shares, par value $1.00 per share (the Common Shares). All shareholders will have the ability to access the proxy materials on a website referred to in the Notice or request to receive a printed set of the proxy materials, as described below. |

| Q: | How can I get electronic access to the proxy materials? |

| A: | The Notice provides you with instructions regarding how to: |

| | Access (for viewing and/or printing purposes) our proxy materials for the Annual Meeting on the Internet; and |

| | Instruct us to send our future proxy materials to you electronically by email. |

If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

| Q: | How can I receive a printed copy of the proxy materials? |

| A: | The Notice provides you with instructions regarding how to: |

| | Request a printed copy of our proxy materials for the Annual Meeting; and |

| | Instruct us to send printed copies of our future proxy materials to you by mail. |

If you choose to receive future proxy materials by mail, your election to receive proxy materials by mail will remain in effect until you terminate it.

1

| Q: | What will I be voting on at the Annual Meeting? |

| A: | You will be voting on three items (collectively, the Proposals): |

| 1. | To elect three Class II directors to serve until our 2015 Annual Meeting (the Board Nominees Proposal); |

| 2. | To conduct a non-binding advisory vote to approve the compensation of our Named Executive Officers (the Say on Pay Proposal); and |

| 3. | To appoint the firm of Ernst & Young Ltd., an independent registered public accounting firm, to serve as our auditors for the 2012 fiscal year until our 2013 Annual Meeting, and to refer the determination of the auditors remuneration to the Board of Directors (the Board) (collectively, the Auditors Proposal). |

Shareholders may also be asked to consider and take action with respect to such other matters as may properly come before the Annual Meeting.

| Q: | What are the voting recommendations of the Board? |

| A: | The Board recommends the following votes: |

| 1. | FOR the Board Nominees Proposal |

| 2. | FOR the Say on Pay Proposal |

| 3. | FOR the Auditors Proposal |

| Q: | Who is entitled to vote? |

| A: | The Board has set March 26, 2012 as the record date for the Annual Meeting. If you were the beneficial owner of Common Shares held in street name, or a shareholder of record with respect to our Common Shares at the close of business on the Record Date, you are entitled to notice of, and may vote at, the Annual Meeting. The Common Shares are our only class of equity securities outstanding and entitled to vote at the Annual Meeting. |

| Q: | What is the quorum requirement? |

| A: | As of March 26, 2012, 51,765,197 Common Shares were issued and outstanding. The presence of two persons in person and throughout the meeting representing, in person or by proxy, more than 50% of the Common Shares outstanding and entitled to vote on the matters to be considered at the Annual Meeting is required to constitute a quorum for the transaction of business at the Annual Meeting. |

| Q: | Who is soliciting my proxy? |

| A: | Your proxy is being solicited by the Board. MacKenzie Partners is acting as the solicitation agent on behalf of the Board. See Who pays the costs of soliciting proxies? below. The persons named in the proxy card have been designated as proxies by the Board. Such persons designated as proxies are officers of RenaissanceRe. |

| Q: | Who pays the costs of soliciting proxies? |

| A: | We will bear the cost of solicitation of proxies. We have engaged the firm of MacKenzie Partners to assist in the solicitation of proxies for a fee of $15,000, plus the reimbursement of certain expenses. Further solicitation may be made by our directors, officers, and employees personally, by telephone, Internet, or otherwise, but such persons will not be specifically compensated for such services. We may also solicit, |

2

| through bankers, brokers, or other persons, proxies from beneficial holders of the Common Shares. Upon request, we will reimburse brokers, dealers, banks, or similar entities for reasonable expenses incurred in forwarding copies of the proxy materials relating to the Annual Meeting to the beneficial owners of Common Shares which such persons hold of record. |

| Q: | What is the difference between holding Common Shares as a shareholder of record and as a beneficial owner of Common Shares held in street name? |

| A: | Shareholder of Record. If your Common Shares are registered directly in your name with our transfer agent, BNY Mellon Shareowner Services, you are considered the shareholder of record with respect to those shares, and the Notice was sent directly to you by Broadridge Financial Solutions, Inc., the Companys tabulation agent and Inspector of Election. |

| Beneficial Owner of Common Shares Held in Street Name. If your Common Shares are held in an account at a brokerage firm, bank, broker-dealer, or similar organization, then you are the beneficial owner of Common Shares held in street name, and the Notice should have been forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner of Common Shares held in street name, you have the right to direct that organization on how to vote the Common Shares held in your account. |

| Q: | If I am a shareholder of record of Common Shares, how do I vote? |

| A: | If you are a shareholder of record, you may vote in person at the Annual Meeting, in which case we will give you a ballot when you arrive. |

If you do not wish to vote in person or if you will not be attending the Annual Meeting, you may vote by proxy in accordance with the following instructions:

| | You may vote by proxy over the Internet by following the instructions provided in the Notice; or |

| | If you requested printed copies of the proxy materials by mail, you must either: |

| 1. | fill out the enclosed proxy card, date and sign it, and return it in the enclosed postage paid envelope; or |

| 2. | vote by Internet (instructions are on the proxy card). |

| Q: | If I am a beneficial owner of Common Shares held in street name, how do I vote? |

| A: | If you are a beneficial owner of Common Shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain and produce at the Annual Meeting a valid proxy from the organization that holds your shares along with valid identification. We will give you a ballot when you arrive. |

If you do not wish to vote in person or you will not be attending the Annual Meeting, you have the right to direct your brokerage firm, bank, broker-dealer, or similar organization on how to vote the Common Shares held in your account. Please refer to the voting instructions provided by such organization for directions as to how to vote the Common Shares that you beneficially own.

| Q: | What does it mean if I receive more than one Notice or set of printed proxy materials? |

| A: | Generally, it means that you hold Common Shares registered in more than one account. To ensure that all of your shares are voted, please vote in the manner described above with respect to each Notice or in the proxy card accompanying the proxy materials. |

3

| Q: | What happens if I do not give specific voting instructions? |

| A: | Shareholder of Record. If you are a shareholder of record and you: |

| | Indicate when voting on the Internet that you wish to vote as recommended by our Board; or |

| | If you sign and return a proxy card without giving specific voting instructions, then the proxies will vote your shares in the manner recommended by our Board on all matters presented in the Proxy Statement and as the proxies may determine in their discretion with respect to any other matters properly presented for a vote at the meeting. Abstentions will be counted for purposes of determining whether a quorum is present but will not otherwise be counted. |

Beneficial Owner of Common Shares Held in Street Name. If you are a beneficial owner of Common Shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter at least ten (10) days before the Annual Meeting, the organization that holds your shares will inform our Inspector of Election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a broker non-vote. When our Inspector of Election tabulates the votes for any particular non-routine matter, broker non-votes (like abstentions) will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided by that organization.

| Q: | Which Proposals are considered routine or non-routine? |

| A: | Proposal 1 (Board Nominees Proposal) and Proposal 2 (Say on Pay Proposal) are non-routine matters. Proposal 3 (Auditors Proposal) is a routine matter. |

| Q: | May I change my vote after I have submitted a proxy or otherwise instructed how my shares are to be voted? |

| A: | Yes. You may change your vote or revoke your proxy at any time before your proxy is voted at the Annual Meeting. You may vote again on a later date by following the same procedures by which you submitted your original vote, or by attending the meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the meeting or specifically request in writing that your prior proxy be revoked. Your latest vote or proxy, however submitted, will be counted. If you wish to change your vote or revoke your proxy, you must do so in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the vote is taken. |

| Q: | Am I entitled to appraisal rights? |

| A: | The Board has not proposed for consideration at the Annual Meeting any transaction for which the laws of Bermuda grant appraisal rights to shareholders. |

| Q: | How does the voting take place at the Annual Meeting? |

| A: | The nominees for election as directors at the Annual Meeting who receive the highest number of FOR votes will be elected as directors up to the maximum number of directors (3) to be chosen at the Annual Meeting. This is called plurality voting. The rules of the New York Stock Exchange (NYSE) do not permit your bank, broker or other nominee to vote your shares on proposals that are not considered routine. When a proposal is not a routine matter and your bank, broker or other nominee has not received your |

4

| voting instructions with respect to that proposal, your bank, broker or other nominee cannot vote your shares on that proposal. This is called a broker non-vote. Your bank, broker or other nominee may not vote your shares with respect to (i) the Board Nominees Proposal or (ii) the Say on Pay Proposal in the absence of your specific instructions as to how to vote with respect to each of these matters because, under the rules of the NYSE, these matters are considered to be non-routine matters. For routine matters unless your proxy indicates otherwise, the persons named as your proxies will vote your shares according to the recommendation of the Board. All Proposals require the affirmative FOR vote of a majority of the votes cast at the Annual Meeting. The vote on the Say on Pay Proposal is not binding on the Board or the Company. A hand vote will be taken unless a poll is requested pursuant to the Bye-laws. |

| Q: | How many votes do I have? |

| A: | Each of our Common Shares entitles its holder to one vote on each matter that is voted upon at the Annual Meeting or any adjournments thereof, subject to certain provisions of our Bye-laws that reduce the total voting power of any shareholder owning, directly or indirectly, beneficially or otherwise, as described in our Bye-laws, more than 9.9% of the Common Shares to not more than 9.9% of the total voting power of our capital stock unless otherwise waived at the discretion of the Board. In addition, the Board may limit a shareholders voting rights where the Board deems it necessary to do so to avoid adverse tax, legal, or regulatory consequences. |

The reduction of such voting power may have the effect of increasing another shareholders voting power to more than 9.9%, thereby requiring a corresponding reduction in such other shareholders voting power.

Because the applicability of the voting power reduction provisions to any particular shareholder depends on facts and circumstances that may be known only to the shareholder or related persons, we request that any holder of Common Shares with reason to believe that it is a shareholder whose Common Shares carry more than 9.9% of the voting power of RenaissanceRe contact us promptly so that we may determine whether the voting power of such holders Common Shares should be reduced. The Board is empowered to require any shareholder to provide information as to that shareholders beneficial ownership of Common Shares, the names of persons having beneficial ownership of the shareholders Common Shares, relationships with other shareholders or any other facts the directors may consider relevant to the determination of the number of Common Shares attributable to any person. The Board may disregard the votes attached to Common Shares of any holder who fails to respond to such a request or who, in its judgment, submits incomplete or inaccurate information. The Board retains the discretion to make such final adjustments that it considers fair and reasonable in all circumstances as to the aggregate number of votes attaching to the Common Shares of any shareholder to ensure that no shareholders voting power is more than 9.9% of the total voting power of our capital stock at any time.

These restrictions may be waived by the Board in its sole discretion. To date, the Board has never granted such a waiver.

| Q: | What else will happen at the Annual Meeting? |

| A: | At the Annual Meeting, the only other item currently on the agenda is for the shareholders to receive the report of our independent auditors and our financial statements for the year ended December 31, 2011. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by our Inspector of Election and published on a Form 8-K filed within four business days following the Annual Meeting. |

5

| Q: | How can I communicate with RenaissanceRes Board? |

| A: | Our Board encourages any shareholder or other interested party who is interested in communicating directly with the Board, any committee of the Board, or our non-management directors as a group to do so by addressing the communication in care of our Corporate Secretary with a request to forward the communication to the intended recipient. Any such communications properly addressed to the Corporate Secretary will be forwarded to the intended recipient unopened. Shareholders can send communications electronically by clicking on secretary@renre.com under Contact UsLegal or Corporate Information at our website located at www.renre.com or by mail to: RenaissanceRe Holdings Ltd., P.O. Box HM 2527, Hamilton HM GX, Bermuda, Attn: Secretary. |

6

DIRECTORS AND EXECUTIVE OFFICERS OF RENAISSANCERE

The table below sets forth the names, ages, and titles of the directors, nominees for director, and executive officers of RenaissanceRe as of March 26, 2012. The executive officers provide functional oversight of the Companys business units and has primary responsibility for setting Company policy and decision-making authority. The executive officers consist of the Chief Executive Officer, the Chief Financial Officer, the Chief Administrative Officer, the Global Chief Underwriting Officer, the General Counsel, the Chief Risk Officer, and the Chief Accounting Officer.

| Name |

Age | Position |

||

| Ralph B. Levy |

66 | Non-Executive Chairman of the Board of Directors |

||

| Neill A. Currie |

59 | President, Chief Executive Officer and Director |

||

| Peter C. Durhager |

41 | Executive Vice President and Chief Administrative Officer of RenaissanceRe and President of RenaissanceRe Services Ltd. |

||

| Jeffrey D. Kelly |

58 | Executive Vice President and Chief Financial Officer |

||

| Kevin J. ODonnell |

45 | Executive Vice President and Global Chief Underwriting Officer |

||

| Ian D. Branagan |

44 | Senior Vice President and Chief Risk Officer |

||

| Stephen H. Weinstein |

43 | Senior Vice President, General Counsel, Chief Compliance Officer, and Secretary |

||

| Mark A. Wilcox |

44 | Senior Vice President, Chief Accounting Officer and Corporate Controller |

||

| David C. Bushnell |

57 | Director |

||

| Thomas A. Cooper |

75 | Director |

||

| James L. Gibbons |

48 | Director |

||

| Jean D. Hamilton |

65 | Director |

||

| Henry Klehm III |

53 | Director |

||

| W. James MacGinnitie |

73 | Director |

||

| Anthony M. Santomero |

65 | Director |

||

| Nicholas L. Trivisonno |

64 | Director |

||

| Edward J. Zore |

66 | Director |

Ralph B. Levy has served as one of our directors since August 2007 and as Non-Executive Chairman of the Board since May 2011. Mr. Levy is a Class III director. In January 2012, Mr. Levy joined JAMS as an Atlanta office arbitration and mediation neutral panel member. In 2011, Mr. Levy retired from his position as a Senior Partner in the Atlanta headquarters office of the law firm King & Spalding LLP, which he joined in 1974 and where he served as Managing Partner from 1993 to 1999. Mr. Levy is a former chairman (2004 to 2006) and continues to serve as a member of the Board of Directors of the Attorneys Liability Assurance Society (Bermuda) Ltd., a Bermuda-based mutual insurance company which reinsures professional liability and management liability coverages written by its U.S. subsidiary, Attorneys Liability Assurance Society, Inc., on whose Board of Directors Mr. Levy also serves. Mr. Levy served as a military trial lawyer and judge in the U.S. Navy Judge Advocates Generals Corp from 1971 to 1974.

Neill A. Currie has served as our Chief Executive Officer and as a director since November 2005. Mr. Currie has served as President since January 1, 2008. Mr. Currie is a Class II director. Mr. Currie was a co-founder of RenaissanceRe in 1993 and served as a Senior Vice President until he retired from the Company in 1997. He re-joined RenaissanceRe in July 2005 as an Executive Vice President, and was responsible for our specialty reinsurance business prior to assuming the role of Chief Executive Officer. Mr. Currie served as a director of Platinum Underwriters Holdings, Ltd. from May 2003 until July 2005. Prior to co-founding RenaissanceRe in 1993, Mr. Currie was Chief Executive Officer of G.J. Sullivan Co.Atlanta, a private domestic reinsurance broker. From 1982 through 1992, Mr. Currie served as Senior Vice President at R/I and G.L. Hodson, predecessors to Willis Group Holdings Ltd.

7

Peter C. Durhager, Executive Vice President and Chief Administrative Officer, has served with us since June 2003 and as President of RenaissanceRe Services Ltd. since March 2004. Mr. Durhager is responsible for RenaissanceRes Global Shared Services division, including Human Resources & Organizational Development, Marketing, Operations, Information Technology, and Administration. Prior to his employment at RenaissanceRe, Mr. Durhager was a co-founder and Vice Chairman, President and Chief Operating Officer of Promisant Holdings Ltd. from January 2000 to February 2003. Prior to that, Mr. Durhager was Chairman and CEO of Logic Communications Ltd. from January 1996 until December 1999. From 1997 to 1999, he served as President and CEO of Millennium International Limited, a Bermuda-based internet and advanced data communications services company.

Jeffrey D. Kelly has served as our Executive Vice President and Chief Financial Officer since July 2009. Prior to joining RenaissanceRe, Mr. Kelly served as Chief Financial Officer of National City Corporation from 2000 until his retirement from National City Corporation in 2008. Mr. Kelly had also served in the additional post of Vice Chairman of National City Corporation from 2004. Mr. Kelly also served as a member of the Board of Directors of The Progressive Corporation, where he served as Chairman of the Investment and Capital Committee, from 2000 until his resignation in August 2009.

Kevin J. ODonnell has served as our Executive Vice President and Global Chief Underwriting Officer since January 2010, prior to which he had served as our Senior Vice PresidentReinsurance since November 1999 and as the President of Renaissance Reinsurance Ltd. since November 2005. Previously, Mr. ODonnell served as a Vice President of RenaissanceRe from February 1998 and as Assistant Vice PresidentUnderwriting from 1996. From 1995 to 1996, Mr. ODonnell was Vice President of Centre Financial Products Ltd. From 1993 to 1995, Mr. ODonnell was an underwriter in SCOR USs Alternative Markets operations.

Ian D. Branagan, Senior Vice President, has served as our Chief Risk Officer since February 2009 and as the Head of Group Risk Modeling since 2005. Mr. Branagan joined the Company in 1998 to open the Companys Dublin office, later relocating to Bermuda with additional responsibilities for underwriting risk and modeling across the Companys (re)insurance operations. From August 1996 to December 1998, Mr. Branagan led the international activities of Applied Insurance Research Inc. (AIR), which included the development and marketing of AIRs catastrophe models and tools. Prior to joining AIR, Mr. Branagan worked in the London market at DP Mann Limited, developing pricing and risk analytics from November 1992 to August 1996.

Stephen H. Weinstein, Senior Vice President since August 2005, has served with us as General Counsel and Secretary since joining RenaissanceRe in January 2002 and as Chief Compliance Officer since January 2004. From January 2002 to August 2005, Mr. Weinstein also served as a Vice President of RenaissanceRe. Prior to joining RenaissanceRe, Mr. Weinstein specialized in corporate law as an attorney at Willkie Farr & Gallagher LLP.

Mark A. Wilcox has served as our Senior Vice President and Chief Accounting Officer since March 2006 and as our Corporate Controller since April 2005. Prior to this, Mr. Wilcox served as our Vice President and Internal Auditor from August 2003. Prior to joining RenaissanceRe, Mr. Wilcox worked for PricewaterhouseCoopers LLP from 1997 until 2003, where he was Senior Manager of Audit and Business Advisory Services within the firms Insurance Practice. From 1991 through 1995, Mr. Wilcox worked in commercial banking for Bank of America Corporation (formerly NCNB). Mr. Wilcox is a Certified Public Accountant and a Chartered Financial Analyst.

David C. Bushnell has served as one of our directors since May 2008. Mr. Bushnell is a Class I director. Mr. Bushnell has served as the principal of Bushnell Consulting, a financial services consulting firm, since January 2008. Mr. Bushnell retired from Citigroup Inc. (Citigroup) in December 2007, after 22 years of service. Mr. Bushnell served as the Senior Risk Officer of Citigroup from 2003 through December 2007 and as Chief Administrative Officer from September 2007 through December 2007. Following his retirement from Citigroup, Mr. Bushnell served as a consultant to Citigroup until December 31, 2008. Previously, Mr. Bushnell

8

worked for Salomon Smith Barney Inc. (later acquired by Citigroup) and its predecessors in a variety of positions, including as a managing director and Chief Risk Officer. In September 2011, Mr. Bushnell was appointed Chief Risk Officer of Cordia Bancorp, a privately held bank holding company. In May 2011, Mr. Bushnell was appointed to the Board of Directors of Bank of Virginia, a publicly held company which is majority owned by Cordia Bancorp.

Thomas A. Cooper has served as one of our directors since August 1996. Mr. Cooper is a Class II director. Mr. Cooper has served as Chairman and Chief Executive Officer of TAC Associates, a privately held investment company, since August 1996. From August 1993 until August 1996, Mr. Cooper served as Chairman and Chief Executive Officer of Chase Federal Bank FSB. From June 1992 until July 1993, Mr. Cooper served as principal of TAC Associates. From April 1990 until May 1992, Mr. Cooper served as Chairman and Chief Executive Officer of Goldome FSB. Mr. Cooper previously served on the Board of Directors of The BISYS Group, Inc. from 1997 to 2007 and on the Board of Directors of Wheeling Island Gaming from 2003 to 2007.

James L. Gibbons has served as one of our directors since May 2008. Mr. Gibbons is a Class I director. Mr. Gibbons is a Bermudian citizen who is Chairman of CAPITAL G Bank Limited, a Bermuda-based financial services organization, as well as President of Bermuda Air Conditioning Limited. Mr. Gibbons also serves as a director of Harbour Trust Limited and is the Treasurer of Edmund Gibbons Limited. Formerly, Mr. Gibbons served as President and Chief Executive Officer of CAPITAL G Limited, a Bermuda-based financial services organization, from 1999 to 2010. In addition, Mr. Gibbons served as a Director of Gibbons Management Services Limited from 1986 to 1989, and as Managing Director of Gibbons Deposit Company Limited from 1989 to 1999. Mr. Gibbons worked as a registered representative at Prudential Bache Securities from 1985 to 1986.

Jean D. Hamilton has served as one of our directors since June 2005. Ms. Hamilton is a Class I director. Ms. Hamilton is an independent consultant/private investor and a Member of the Brock Capital Group LLC. Previously, she was Executive Vice President of Prudential Financial, Inc., serving as Chief Executive Officer of Prudential Institutional from November 1998 through November 2002. From 1988 through 1998, she held various positions with Prudential Financial, Inc., including President of the Prudential Diversified Group and President of the Prudential Capital Group. From 1971 to 1988, she held several positions with The First National Bank of Chicago, including Senior Vice President and Head of the Northeastern Corporate Banking Department. She is currently a Trustee of First Eagle Funds and First Eagle Variable Funds.

Henry Klehm III has served as one of our directors since May 2006. Mr. Klehm is a Class III director. In February 2008, Mr. Klehm joined the law firm Jones Day as a partner in the firms Securities Litigation & SEC Enforcement Practice. From July 2002 to October 2007, Mr. Klehm served as Global Head of Compliance for Deutsche Bank, AG. Prior to joining Deutsche Bank, AG, Mr. Klehm served as Chief Regulatory Officer and Deputy General Counsel at Prudential Financial from July 1999 through July 2002. Mr. Klehm joined the SEC in 1989, serving in various positions, including as Senior Associate Director of the Northeast Regional Office from 1996 until June 1999.

W. James MacGinnitie has served as one of our directors since February 2000 and was the Non-Executive Chairman of the Board from November 2005 to May 2011. Mr. MacGinnitie is a Class II director. Mr. MacGinnitie is an independent actuary and consultant. He served as Senior Vice President and Chief Financial Officer of CNA Financial from September 1997 to September 1999. From May 1994 until September 1997, Mr. MacGinnitie was a partner of Ernst & Young and National Director of its actuarial services. From 1975 until 1994, he was a principal in Tillinghast, primarily responsible for its property-casualty actuarial consulting services. Mr. MacGinnitie is a Fellow of both the Casualty Actuarial Society and the Society of Actuaries, and has served as President of both organizations as well as of the American Academy of Actuaries and the International Actuarial Association. Mr. MacGinnitie served on the board of directors of Trustmark Mutual Holding Company (Trustmark) from 2000 until his retirement from the Trustmark board in June 2010.

9

Anthony M. Santomero has served as one of our directors since May 2008. Mr. Santomero is a Class I director. Mr. Santomero served as Senior Advisor at McKinsey & Company from July 2006 to January 2008. From July 2000 to April 2006, Mr. Santomero was President and Chief Executive Officer of the Federal Reserve Bank of Philadelphia. From 1972 to 2000, Mr. Santomero was the Richard K. Mellon Professor of Finance at the University of Pennsylvanias Wharton School and held various positions there, including Director of the Financial Institutions Center and Deputy Dean. Mr. Santomero serves on the boards of Penn Mutual Life Insurance Company, Citigroup and Citibank, N.A and Columbia Funds. In addition, Mr. Santomero formerly served on the board of B of A Fund Series Trust, part of the Bank of America Funds platform until 2011.

Nicholas L. Trivisonno has served as one of our directors since May 2004. Mr. Trivisonno is a Class III director. Mr. Trivisonno was Chairman and Chief Executive Officer of ACNielsen Corporation from January 1996 through March 2001. From September 1995 through November 1996, he was Executive Vice President and Chief Financial Officer of Dun & Bradstreet Corporation. Previously, he had held several positions at GTE Corporation from November 1988 until July 1995, including Group President, Executive Vice President, Strategic Planning, Senior Vice President Finance, and Vice President and Controller. Mr. Trivisonno began his career as a certified public accountant with Arthur Andersen & Co. in 1968, became a partner in 1979 and was appointed a managing partner in 1986.

Edward J. Zore has served as one of our directors since August 2010. Mr. Zore is a Class III director. Mr. Zore served in a variety of capacities at The Northwestern Mutual Life Insurance Company, principally as Chairman (2009 to 2010), as Chief Executive Officer (2001 to 2010), and as President (2000 to 2009). He currently serves on the Northwestern Mutual Board of Trustees. Mr. Zore joined the Northwestern Mutual investment department in 1969, and also served as the companys Executive Vice President, Chief Financial Officer, Chief Investment Officer, and as a director of Northwestern Mutual Series Fund, Inc. He is a member of the Board of Directors of Manpower, Inc., and chairs its Audit Committee. Previously, Mr. Zore served as a director of Mason Street Funds from 2000 to 2007.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS, MANAGEMENT AND DIRECTORS

The following table sets forth information as of March 26, 2012 (unless otherwise noted) with respect to the beneficial ownership of Common Shares and the applicable voting rights attached to such share ownership in accordance with the Bye-laws by (i) each person known by us to own beneficially 5% or more of the outstanding Common Shares; (ii) our Chief Executive Officer, our Chief Financial Officer, and each of the three remaining most highly compensated executive officers during the 2011 fiscal year (collectively, the Named Executive Officers); (iii) each of our directors; and (iv) all of our executive officers and directors as a group. The total number of Common Shares outstanding as of March 26, 2012, was 51,765,197.

| Name and Address of Beneficial Owner(1) |

Number of Common Shares |

Percentage of Class(2) |

||||||

| BlackRock, Inc.(3) |

3,725,940 | 7.2 | % | |||||

| 40 East 52nd Street |

||||||||

| New York, NY 10022 |

||||||||

| FMR LLC(4) |

3,457,942 | 6.7 | % | |||||

| 82 Devonshire Street |

||||||||

| Boston, Massachusetts 02109 |

||||||||

| Orbis Investment Management Limited(5) |

3,344,231 | 6.5 | % | |||||

| Orbis House |

||||||||

| 25 Front Street |

||||||||

| Hamilton, Bermuda HM11 |

||||||||

| TimesSquare Capital Management, LLC(6) |

3,331,700 | 6.4 | % | |||||

| 1177 Avenue of the Americas, 39th Floor |

||||||||

| New York, NY 10036 |

||||||||

| Franklin Resources, Inc.(7) |

2,822,325 | 5.5 | % | |||||

| One Franklin Parkway |

||||||||

| San Mateo, CA 94403-1906 |

||||||||

| Neill A. Currie(8) |

1,308,586 | 2.5 | % | |||||

| Peter C. Durhager(9) |

280,651 | * | ||||||

| Jeffrey D. Kelly(10) |

88,343 | * | ||||||

| Kevin J. ODonnell(11) |

617,985 | 1.2 | % | |||||

| Stephen H. Weinstein(12) |

296,182 | * | ||||||

| David C. Bushnell(13) |

9,419 | * | ||||||

| Thomas A. Cooper(14) |

91,575 | * | ||||||

| James L. Gibbons(15) |

9,419 | * | ||||||

| Jean D. Hamilton(16) |

15,595 | * | ||||||

| Henry Klehm III(17) |

12,454 | * | ||||||

| Ralph B. Levy(18) |

13,335 | * | ||||||

| W. James MacGinnitie(19) |

24,645 | * | ||||||

| Anthony M. Santomero(20) |

9,419 | * | ||||||

| Nicholas L. Trivisonno(21) |

27,160 | * | ||||||

| Edward J. Zore(22) |

4,100 | * | ||||||

| All of our executive officers and directors (17 persons) |

3,088,521 | 6.0 | % | |||||

| * | Less than 1% |

11

| (1) | Pursuant to the regulations promulgated by the SEC, shares are deemed to be beneficially owned by a person if such person directly or indirectly has or shares the power to vote or dispose of such shares whether or not such person has any pecuniary interest in such shares or the right to acquire the power to vote or dispose of such shares within 60 days, including any right to acquire through the exercise of any option, warrant or right. |

| (2) | The percent of class shown was based on the shares of Common Stock reported on the Schedule 13G or Schedule13G/A and the total number of shares outstanding as of December 31, 2011. The difference in the total number of shares outstanding on December 31, 2011 and March 26, 2012 does not materially affect the percentage of ownership of the class. |

| (3) | According to a Statement on Schedule 13G filed with the Commission on February 9, 2012 by BlackRock, Inc. (BlackRock), BlackRock is the beneficial owner of 3,725,940 Common Shares. BlackRock has the sole power to vote or to direct the voting of 3,725,940 Common Shares and sole power to dispose of or to direct the disposition of 3,725,940 Common Shares. |

| (4) | According to a Statement on Schedule 13G/A filed with the Commission on February 14, 2012 by FMR LLC, Fidelity Management & Research Company (Fidelity), a wholly owned subsidiary of FMR LLC, is the beneficial owner of 3,457,942 Common Shares as a result of acting as investment adviser to various investment companies. Edward C. Johnson 3d (Chairman of FMR LLC) and FMR LLC, through its control of Fidelity, and the Fidelity funds each has the sole power to dispose of the 3,457,942 Common Shares owned by the Fidelity funds. Neither FMR LLC nor Edward C. Johnson 3d has the sole power to vote or direct the voting of the shares owned directly by the Fidelity funds, which power resides with the funds Board of Trustees. Fidelity carries out the voting of the shares under written guidelines established by its funds Boards of Trustees. According to this Schedule 13G/A, members of the family of Edward C. Johnson 3d, Chairman of FMR LLC, are the predominant owners, directly or through trusts, of Series B shares of common stock of FMR LLC, representing 49% of the voting power of FMR LLC. Members of the Johnson family and all other Series B shareholders have entered into a shareholders voting agreement under which all Series B shares will be voted in accordance with the majority vote of Series B shares. Accordingly, through their ownership of voting common stock and the execution of the shareholders voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. |

| (5) | This information is based on a Schedule 13G/A filed with the Commission on April 4, 2012 by Orbis Investment Management Limited (OIML), Orbis Asset Management Limited (OAML) and Orbis Investment Management (U.S.), LLC, whose principal address is 600 Montgomery Street, Suite 3800, San Francisco, CA 94111 (OIMUS). According to the Schedule 13G/A, OIML is the beneficial owner of 3,306,713 Common Shares, OAML is the beneficial owner of 7,017 Common Shares and OIMUS is the beneficial owner of 30,491 Common Shares. The Schedule 13G/A reported that OIML, OAML and OIMUS may be deemed to constitute a group for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the Exchange Act). OIML, OAML and OIMUS, collectively, have the sole power to vote or to direct the voting of 3,344,221 Common Shares and sole power to dispose of or to direct the disposition of 3,344,221 Common Shares. However, other people have the right to receive and the power to direct the receipt of dividends from, or the proceeds from the sale of the (i) 3,306,713 Common Shares beneficially owned by OIML, (ii) 7,107 Common Shares owned by OAML and (iii) 30,491 Common Shares owned by OIMUS. |

| (6) | According to a Statement on Schedule 13G/A filed with the Commission on February 8, 2012 by TimesSquare Capital Management, LLC (TimesSquare), TimesSquare is the beneficial owner of 3,331,700 Common Shares. TimesSquare has the sole power to vote or to direct the voting of 2,412,600 Common Shares and sole power to dispose of or to direct the disposition of 3,331,700 Common Shares. |

| (7) | This information is based on a Schedule 13G/A filed by Franklin Resources, Inc. (FRI) with the Commission on February 9, 2012. In the Schedule 13G/A, FRI reported that, with respect to the Common Shares, the shares shown in the table above were beneficially owned by one or more open or closed-end investment companies or other managed accounts that are investment management clients of investment managers that are direct and indirect subsidiaries of FRI. The Schedule 13G/A reported that the investment management subsidiaries of FRI have investment and/or voting power over the securities owned by their investment management clients. Accordingly, such subsidiaries may be deemed to be the beneficial owner of the shares shown in the table. The Schedule 13G/A reported that Charles B. Johnson and Rupert H. Johnson, Jr. (the FRI Principal Stockholders) (each of whom has the same business address as FRI) each own in excess of 10% of the outstanding common stock of FRI and are the principal stockholders of FRI and may be deemed to be the beneficial owners of securities held by persons and entities for whom or for which the investment management subsidiaries of FRI provide investment management services. Templeton Global Advisors Limited, a subsidiary of FRI, has the sole power to vote or to direct the voting of 2,640,310 Common Shares and the sole power to dispose of or to direct the disposition of 2,695,770 Common Shares. The FRI Principal Stockholders and the investment management subsidiaries of FRI disclaim any pecuniary interest or beneficial ownership in the shares shown in the table above and indicate that they are of the view that they are not acting as a group for purposes of the Exchange Act. |

| (8) | Includes 637,892 Common Shares issuable upon the exercise of options under the 2001 Stock Incentive Plan (the 2001 Plan) that are vested and presently exercisable and no Common Shares issuable upon the exercise of options that vest within 60 days. Mr. Currie also holds options to acquire 300,000 Common Shares granted under the RenaissanceRe Holdings Ltd. 2004 Stock Option Incentive Plan (the 2004 Plan), that are currently vested and presently exercisable, and no options to acquire Common Shares granted under the 2001 Plan that are currently unvested. Also includes 113,735 restricted Common Shares that have not vested (Restricted Shares) and 129,366 Performance Shares (as described below) under the 2010 Performance-Based Equity Incentive Plan (the Performance Share Plan) that have not yet vested. |

12

| (9) | Includes 141,075 Common Shares issuable upon the exercise of options under the 2001 Plan that are vested and presently exercisable and no Common Shares issuable upon the exercise of options that vest within 60 days. Mr. Durhager also holds options to acquire 42,500 Common Shares granted under the 2004 Plan, that are currently vested and presently exercisable, and no options to acquire Common Shares granted under the 2001 Plan that are currently unvested. Also includes 39,098 Restricted Shares and 26,127 Performance Shares that have not yet vested. |

| (10) | Includes 48,973 Restricted Shares and 26,827 Performance Shares that have not vested. Mr. Kelly holds no options to purchase Common Shares. |

| (11) | Includes 203,767 Common Shares issuable upon the exercise of options under the 2001 Plan that are vested and presently exercisable and no Common Shares issuable upon the exercise of options that vest within 60 days. Mr. ODonnell also holds options to acquire 250,000 Common Shares granted under the 2004 Plan, that are currently vested and presently exercisable, and no options to acquire Common Shares under the 2001 Plan, that are currently unvested. Also includes 59,342 Restricted Shares, and 37,928 Performance Shares that have not yet vested. Also includes 1,079 shares held by a limited partnership for the benefit of Mr. ODonnells family. |

| (12) | Includes 183,586 Common Shares issuable upon the exercise of options under the 2001 Plan that are vested and presently exercisable. Also includes 33,502 Restricted Shares and 19,856 Performance Shares that have not yet vested. Mr. Weinstein has no options to acquire Common Shares granted under the 2001 Plan that are currently unvested. Also includes 5,946 Common Shares held by trusts for the benefit of Mr. Weinsteins minor children. |

| (13) | Includes 3,298 Restricted Shares granted in payment of directors fees under the RenaissanceRe Holdings Ltd. Amended and Restated Non-Employee Director Stock Plan, as amended (the Director Stock Plan), that have not vested. |

| (14) | Includes 3,298 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested. |

| (15) | Includes 3,298 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested. |

| (16) | Includes 3,298 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested. |

| (17) | Includes 3,298 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested. |

| (18) | Includes 5,386 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested. |

| (19) | Includes 4,509 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested. |

| (20) | Includes 3,298 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested. |

| (21) | Includes 3,298 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested, 6,566 Common Shares issuable upon the exercise of options under the Director Stock Plan that are vested and presently exercisable and no Common Shares issuable upon the exercise of options that vest within 60 days. |

| (22) | Includes 3,244 Restricted Shares granted in payment of directors fees under the Director Stock Plan that have not vested. |

13

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies and Procedures Dealing with the Review, Approval and Ratification of Related Party Transactions

We have adopted a written policy with respect to the review, approval, and ratification of transactions with related persons. The policy covers, among other things, related party transactions between us and any of our executive officers, directors, nominees for director, any of their immediate family members or any other related persons as defined in Item 404 of Regulation S-K. Related party transactions covered by this policy are reviewed to determine whether the transaction is in the best interests of the Company and our shareholders. The transactions described below include transactions we have entered into with parties that are, or could be deemed to be, related to us.

Housing and Lease Arrangements

RenaissanceRe provides housing reimbursement with respect to the Bermuda residence of each Named Executive Officer and certain other officers, a practice that is consistent with Bermuda market practice, which housing expense is included in the compensation paid to each such Named Executive Officer. See Compensation Discussion and AnalysisPrincipal Components of CompensationOther Benefits and Perquisites; Limitations and Changes. From time to time, RenaissanceRe entered into long-term leases for properties in Bermuda, which we subleased to certain officers (or due in part to the inefficiency of the Bermuda real estate market we have held a property in connection with, or in anticipation of, recruiting efforts), including certain of our executive officers. During 2011, RenaissanceRe was the lessee on the lease for the Bermuda residence of Mr. ODonnell. RenaissanceRe is no longer the lessee on the lease of the Bermuda residence of any of its officers.

Charitable Donations

We provide support to various charitable organizations in the Bermuda community that meet certain guidelines, including organizations that support insurance industry education and training, crime prevention, substance abuse prevention, affordable housing, and educational assistance. As part of our efforts, we match donations made by our officers and other employees to enumerated Bermuda charities at a ratio of up to 4:1 generally up to a maximum matching contribution for each employee of $10,000 per year. We make direct charitable contributions, in addition to the employee matching program, as well. Certain of our executive officers and directors, and spouses of certain of these persons, serve and have served as officers or trustees of some of these organizations; however, we did not contribute more than $120,000 to any one charity in the 2011 fiscal year for which any of these individuals served as an officer or trustee.

In 2011, RenaissanceRe also made a commitment to contribute $1.0 million to the Bermuda Hospitals Charitable Trust (the BHCT) in connection with the King Edward VII Memorial Hospital (KEMH) redevelopment project. KEMH is the only hospital, and substantially the principal health care facility, in Bermuda, and accordingly is used by all residents of Bermuda, including every Bermuda-based employee of RenaissanceRe. The BHCT is an independent body which accepts and manages donor contributions on behalf of KEMH. Mr. Gibbons serves on the Campaign Steering Committee of the BHCT, an ad hoc, informal committee of local businessmen and women, which works to raise public awareness of the KEMH redevelopment project and provides support for fundraising activities. Neither Mr. Gibbons nor any employee of RenaissanceRe currently serves as a director, officer or trustee of the BHCT, KEMH or the Bermuda Hospitals Board, which oversees the operations of KEMH. The $1.0 million commitment is due and payable upon the completion of the KEMH redevelopment project, which is scheduled for completion in 2014.

Relationship with BlackRock

BlackRock reported beneficial ownership interest of more than 5% of our Common Shares as of December 31, 2011. Affiliates of BlackRock currently provide investment management, risk analytics and investment accounting services to RenaissanceRe and its subsidiaries. During 2011, we incurred $2.4 million in fees relating to these services.

14

Co-investments

From time to time, certain officers of RenaissanceRe have made investments in investment funds in which RenaissanceRe has also invested. None of these officers receives any compensation in connection with such investments or exercises any management discretion over any such investment fund.

Currie Agreement Relating to Use of Company Aircraft

The Company and Mr. Currie are parties to an agreement regarding the use of aircraft interest (the Aircraft Agreement), dated as of November 17, 2009. The aircraft is operated on behalf of the Company under a NetJets Aviation Inc. fractional interest program (the RenRe Aircraft Interest). During 2011, Mr. Currie was permitted to use the RenRe Aircraft Interest for his personal use under his employment agreement with the Company subject to an agreed-upon cap (the Cap) allowing 24 round trips per year for Mr. Curries business commute and 25 hours per year for other personal travel. The Aircraft Agreement contemplated that Mr. Currie would fund and maintain a Company account with certain cash amounts to cover costs incurred by the Company for instances in which Mr. Currie uses the RenRe Aircraft Interest for personal use in excess of the Cap. In respect of such arrangement, Mr. Currie paid amounts equal to an aggregate of $181,760 in respect of such use of the RenRe Aircraft Interest during 2011 in accordance with the terms of the Aircraft Agreement.

On February 21, 2012, the Company entered into a memorandum of agreement (the Memorandum) with Mr. Currie, amending the Aircraft Agreement. The Memorandum provides, among other things, that (i) Mr. Currie will no longer be entitled to the 25 hours of Company-funded personal use of the Companys aircraft that were provided to him previously in accordance with the Companys policies in addition to his contractually contemplated business commute, as specified in the Aircraft Agreement and (ii) to the extent that Mr. Currie wishes to use the Companys aircraft in addition to such business commute, Mr. Currie agrees to pay for such use in advance of any such trip at the fully loaded variable rate (which rate represents the Companys aggregate incremental cost of such use within the meaning of Regulation S-K and the rules and other guidance of the Commission).

15

CORPORATE GOVERNANCE

Our Commitment to Corporate Governance

Our Board and management have a strong commitment to effective corporate governance. We believe we have in place a comprehensive corporate governance framework for our operations which, among other things, takes into account the requirements of the Sarbanes-Oxley Act of 2002, the SEC, the New York Stock Exchange (NYSE) and the recently enacted Dodd-Frank Act. The key components of this framework are set forth in the following documents:

| | our Bye-laws; |

| | our Guidelines on Significant Corporate Governance Issues (Corporate Governance Guidelines); |

| | our Code of Ethics and Conduct; |

| | our Audit Committee Charter; and |

| | our Compensation/Governance Committee Charter. |

A copy of each of these documents is published on our website under Investor InformationCorporate Governance at www.renre.com, except our Bye-Laws, which are filed with the SEC and can be found on the SEC website at www.sec.gov. Each of these documents is available in print to any shareholder upon request. The Board regularly reviews corporate governance developments and modifies its Corporate Governance Guidelines, committee charters, and key practices as the Board believes to be warranted and, based on the foregoing, in 2011 the Company amended its Audit Committee Charter and Compensation/Governance Committee Charter, and reviewed and updated its Code of Ethics and Conduct.

Director Independence

Our Board is composed of eleven directors, ten of whom are independent. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with RenaissanceRe. The Board has established guidelines to assist it in determining director independence, which conform to, and which we believe are more exacting than, the independence requirements in the NYSE listing standards. In addition to applying these guidelines, which are set forth in our Corporate Governance Guidelines, the Board will consider all relevant facts and circumstances known or reported to it in making an independence determination.

In February 2012, the Compensation/Governance Committee (the Compensation Committee) conducted a review of the independence of each of our current directors. During this review, the Board considered, among other things, transactions and relationships between each director or any member of their immediate family and RenaissanceRe or its subsidiaries and affiliates and relationships between directors (or nominees) or their affiliates and members of RenaissanceRes senior management or their affiliates. As a result of this review, the Board affirmatively determined that Ms. Hamilton and each of Messrs. Bushnell, Cooper, Gibbons, Klehm, Levy, MacGinnitie, Santomero, Trivisonno and Zore are independent directors for purposes of compliance with the NYSE listing standards and SEC rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002 (Independent Directors). Mr. Currie is not considered an Independent Director because of his employment as an executive officer of RenaissanceRe.

In particular, in the course of the Boards determination regarding the independence of each non-management director, the Board considered in respect of Mr. Bushnell, the fact of Mr. Bushnells prior employment with Citigroup (see Mr. Bushnells biography under Directors and Executive Officers of RenaissanceRe); and in respect of Mr. Santomero, the fact of Mr. Santomeros service as a director of Citigroup and Citigroups current and prior financial relationships with RenaissanceRe, including as underwriter for certain

16

offerings of RenaissanceRe. In addition to the foregoing, Jones Day, the law firm at which Mr. Klehm is currently a partner, has provided legal services to Mr. Bushnell relating to his former employment at Citigroup Inc. The Company is not a party to these legal proceedings.

Director Qualifications and Director Nominee Considerations

Our Corporate Governance Guidelines contain Board membership criteria that apply to nominees for a position on our Board. Pursuant to these criteria, our Compensation Committee takes a holistic approach in identifying and considering potential director nominees and in evaluating the current composition of our Board. In general, the Compensation Committee focuses primarily on the composition and competencies of our Board as a whole, how the traits possessed by individual director nominees complement one another, the ability of the current and proposed members to operate collegially and effectively, and the intersection of these factors with the Companys current strategy, operational plans and oversight requirements. Accordingly, when evaluating individual director nominees within this framework, the factors that our Compensation Committee considers include:

| | the personal and professional ethics, integrity and values of the candidate; |

| | the independence of the candidate under legal, regulatory and other applicable standards, including the ability of the candidate to represent all of our shareholders without any conflicting relationship with any particular constituency; |

| | the professional experience and industry expertise of the candidate and whether it will add to or complement that of the existing Board, in light of the Companys evolving strategic and operational plans over time; |

| | the compatibility of the candidate with the existing Board; |

| | the ability and willingness of the candidate to devote sufficient time to carrying out his or her Board duties and responsibilities in respect of RenaissanceRe fully and effectively; |

| | the commitment of the candidate to serve on our Board for a potentially extended period of time, given the benefits our Board ascribes to continuity and a breadth of experience with our strategies and risk management processes, and with a view toward effective oversight of managements efforts to ensure the safety and soundness of our Company in light of the market cycles and earnings volatility that characterize our industry, as well as other matters; |

| | as summarized in more detail below, consideration is given to maintaining a diversity of skills, experience, and viewpoints represented on the Board as a whole; and |

| | such other attributes of the candidate, our business and strategic conditions and external factors as our Compensation Committee deems appropriate at such time and from time to time. |

Our Compensation Committee has the discretion to weight these factors as it deems appropriate. The importance of these factors may vary from candidate to candidate, and in respect of our evolving circumstances.

Board Diversity

As described above, the Companys Corporate Governance Guidelines provide that the Company has not established specific criteria for directors but believes that candidates should show evidence of leadership in their particular field, have broad experience and the ability to exercise sound business judgment. The Compensation Committee, which carries out the Boards director selection, recruitment and nomination obligations, evaluates and discusses diversity at the committee and at the Board level, considering, as contemplated by the Corporate Governance Guidelines, the diversity, skills, and experience of candidates in the context of the needs of the Board as a whole. In assessing the performance of current directors, and in selecting directors, the Board generally seeks a combination of qualities and experience that will contribute to the exercise of the duties of the

17

Board, in light of the evolving strategic direction and needs of the Company. This consideration includes a broad evaluation of diversity of skills, experience, and viewpoints represented on the Board as a whole, and is undertaken by the Compensation Committee no less frequently than annually and at appropriate intervals.

Board Leadership Structure

The Board has currently implemented a leadership structure that separates the role of the Chief Executive Officer and the Chairman of the Board. The Board has determined that having an independent director serve as Non-Executive Chairman of the Board is in the best interest of shareholders at this time. The Company believes that this structure currently assists the Independent Directors in the oversight of the Company and facilitates participation of the Independent Directors in setting agendas and establishing priorities and procedures for the work of the Board.

Risk Oversight

The Company considers enterprise-wide risk management (ERM) to be a key strategic objective, managed by the senior executive team under the oversight of the Board, and implemented by personnel from across the organization. The Company believes that its ERM processes and practices help to identify potential events that may affect the Company; to quantify, evaluate and manage the risks to which it is exposed; and to provide reasonable assurance regarding the achievement of corporate objectives. We believe that the Companys commitment to and investment in effective ERM can represent a significant competitive advantage, and is essential to the Companys corporate strategy and goal of achieving long-term growth in tangible book value per share plus the change in accumulated dividends for shareholders. The Companys efforts to identify and monitor business environment risk and operational risk is coordinated by senior personnel including the Chief Financial Officer, the General Counsel and Chief Compliance Officer, and the Chief Administrative Officer, each of whom reports directly to the Chief Executive Officer, the Chief Risk Officer who reports directly to the Chief Financial Officer, as well as other senior personnel such as the Corporate Controller and Chief Accounting Officer and the Head of Internal Audit.

The Board is actively involved in the oversight of risks that could affect the Company. Among other things, the members of the Board have regular, direct access to the senior executives named above, as well as other officers responsible for the operational and control functions of the Company. While the Board primarily delegates its risk management to its committees, as disclosed in the descriptions of each of the committees below and as contemplated in the charters of each of the committees, the Board regularly reviews the coordination of its oversight of Company risk.

Under the oversight of our Board and its committees, our risk management practices help us to identify potential events that may affect us, to quantify, evaluate and manage the risks to which we are exposed, and to provide reasonable assurance regarding the achievement of our objectives. As a result, we believe our ERM assists our efforts to minimize the likelihood of suffering financial outcomes in excess of the ranges which we have estimated in respect of specific investments, underwriting decisions, or other operating or business activities. We also seek, as a component of our ERM, to minimize the likelihood of the occurrence, or to reduce the severity, of a range of operational risks to which we are exposed, including operational risks that may not give rise to an immediate financial loss but would potential impair our strategy, tactical plans, operating platform, or reputation. We believe that ERM is essential to our corporate strategy and our goal of achieving long-term growth in tangible book value per share plus the change in accumulated dividends for shareholders, and that effective board oversight enhances the quality of our risk management as well as facilitating sound corporate governance.

Our committees regularly receive and discuss materials from each of the other committees, including, but not limited to, the Audit and the Investment and Risk Management Committees, which the Company believes enables the directors to be cognizant of the various risks across the Company. Each committee performs a

18

comprehensive annual self-assessment as part of the Boards overall governance effectiveness review and assessment, which accordingly reflects the committees evaluation of our corporate risk management practices and, if applicable, the identification of potential new oversight needs in light of changes in our strategy, operations or business environment. Each committee has broad powers to ensure that it has the resources to satisfy its duties under its charter. Periodically, in an effort to enhance the flow of information and exchange of ideas across the committees, a committee will open its normal course proceedings to an audit by members of each other committee. Each committee also has access to outside advisors as well as management.

In conjunction with ERM, as well as our strategic and operational planning, we regularly review senior executive compensation and our firm-wide compensation programs and policies, in an ongoing effort to seek to eliminate or mitigate potential risks arising from such programs and policies, and to ensure that our compensation structure, elements and incentives are not reasonably likely to have a material adverse effect on the Company. We seek to design our compensation plans, including our incentive compensation programs, to incorporate a range of components that we believe help to mitigate potential risks while rewarding employees for pursuing our strategic and financial objectives through appropriate risk taking, risk management, and prudent tactical and strategic decision making. Senior executives from our risk, compliance, administrative, and finance functions, as well as the Boards outside compensation consultant, are involved in this review process, which is conducted under the oversight of our Compensation Committee. In respect of 2011 and the compensation programs in place for 2012, based in part on the information and analyses provided by management and its own advisors, the Compensation Committee concluded that the Companys compensation programs are not reasonably likely to have a material adverse effect on the Company. Among the features of our compensation programs considered in this review were the following:

| | Company-wide Basis for Incentive Compensation Determinations. The annual and long-term incentive compensation of our Named Executive Officers and our executive officers more broadly are principally determined based on our overall corporate performance and the attainment of individual performance goals, rather than on the short-term financial performance of a particular business unit, legal entity, segment, or other division of the Company. |

| | Alignment of Shareholder and Executive Interests. The majority of our long-term incentive awards to our executive officers are delivered in the form of Restricted Shares, vesting over a four-year period, including Performance Shares, as described immediately below. Moreover, as described in more detail below, we have adopted share ownership guidelines which apply to each executive officer and director. |

| | Tangible Performance Metrics Based Upon Corporate Performance. As described in more detail below, a meaningful component of the compensation of each Named Executive Officer and each other executive officer (described below under Compensation Committee) consists of restricted Common Shares granted under our Performance Share Plan, as to which vesting is contingent upon the attainment of specific Company-wide performance measures as well as the completion of service periods (Performance Shares), as established by our Compensation Committee in its sole discretion. |

| | Balanced Compensation Elements. Our compensation program for executive officers is designed to provide a balanced mix of salary, annual incentive compensation, and long-term incentive compensation, the realization of which depends in turn upon the attainment of a range of performance. The Compensation Committee believes that the mix of types of compensation delivered by the Company is not overly weighted toward a single form of compensation, or inappropriately designed to overly encourage short-term financial results or unbalanced operational execution, and instead promotes both the pursuit of long-term financial performance, prudent risk management and stewardship of our capital. |

| | Long-Term Focus. We aspire to be the best underwriter in the world of high-severity, low-frequency risks. We seek to produce long-term growth in tangible book value per Common Share plus accumulated dividends for our shareholders, and we anticipate that individual periods may be marked by substantial volatility. Accordingly, we believe that our senior-most executives should have an |

19

| increasing proportion of their compensation in the form of long-term equity incentives that vest over a period of years to reflect the contributions of these executive officers to our longer-term results and to foster their alignment with long-term shareholders. |

Our Compensation Committee, which consists exclusively of Independent Directors, reviews our compensation programs for consistency with our risk management practices and helps to ensure that our programs align our executives and employees with the long-term interests of shareholders and seeks to ensure the safety and soundness of our Company over the market cycles and earnings volatility that characterizes our industry. For more detailed information regarding the composition of our compensation programs, see Compensation Discussion and AnalysisPrincipal Components of Compensation below.

Code of Ethics and Conduct

All directors, officers, and employees of RenaissanceRe are expected to act at all times in accordance with the policies comprising RenaissanceRes Code of Ethics and Conduct. In 2011, as in prior years, each director affirmed his or her current and continuing compliance with our Code. In addition to the web address below, our code is also available in print to any shareholder upon request. Amendments to the code related to certain matters will be published on the RenaissanceRe website as required under SEC rules, at www.renre.com under Investor InformationCorporate Governance.

Communicating Concerns to Directors

The Audit Committee, on behalf of itself and our other non-management directors, has established procedures to enable employees or other parties who may have a concern about RenaissanceRes conduct or policies, to communicate that concern.

Our employees are encouraged and expected to report any conduct they believe in good faith to be an actual or apparent violation of our Code of Ethics and Conduct. In addition, as required under the Sarbanes-Oxley Act of 2002, the Audit Committee has established procedures pertaining to receiving, retaining, and treating complaints received regarding accounting, internal accounting controls, or auditing matters, and with respect to the confidential, anonymous submission by Company employees of concerns regarding, among other things, questionable accounting or auditing matters.

Such communications may be confidential or anonymous, and may be e-mailed, submitted in writing, or reported by phone through various internal and external mechanisms as provided on the Companys internal website. Additional procedures by which internal communications may be made are provided to each employee. Our Code of Ethics and Conduct prohibits any employee or director from retaliating or taking any adverse action against anyone for raising or helping to resolve an integrity concern.

Meetings of Directors

During 2011, the Board conducted four regularly scheduled meetings, each of which was attended by all of the members of the Board. The Audit Committee, the Compensation Committee and the Investment and Risk Management Committee each met four times in 2011. The Transaction Committee and the Offerings Committee, which meet on an as-needed basis, did not meet in 2011. The Audit Committee conducted four informational calls in connection with the review of our quarterly earnings releases and periodic filings. All incumbent directors attended 100% of the aggregate of all Board meetings and meetings of the committees on which they served during 2011. In addition, the Board or its committees conducted certain informational calls relating to various matters. The Company does not pay directors fees in respect of informational calls.

Our non-management directors meet separately from Mr. Currie, our sole management director, in executive sessions each quarter. In 2011, Mr. MacGinnitie, who served as the Non-Executive Chairman of the Board for

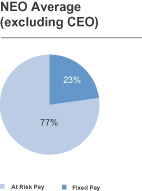

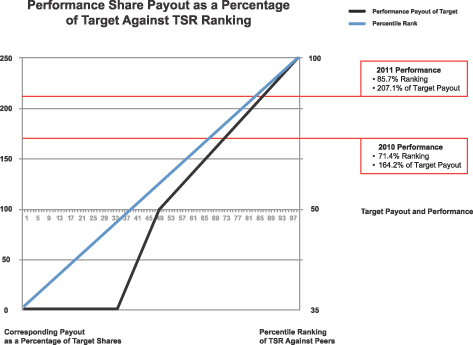

20