DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on May 12, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| þ Filed by the Registrant |

¨ Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ¨ |

Preliminary Proxy Statement |

|

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| þ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

RENAISSANCERE HOLDINGS LTD.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ |

No fee required. |

|||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which the transaction applies: | |||

| (2) | Aggregate number of securities to which the transaction applies: | |||

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of the transaction: | |||

| (5) | Total fee paid:

|

|||

| ¨ |

Fee paid previously with preliminary materials. |

|||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed:

|

|||

Beginning on May 11, 2015, RenaissanceRe Holdings Ltd. (RenaissanceRe or the Company) made the following letter available to shareholders:

Dear Shareholders:

By now you should have received our Proxy Statement with respect to RenaissanceRes Annual General Meeting of Shareholders to be held on May 20, 2015. You can also view our Proxy Statement on our website at www.renre.com.

We are writing to ask for your support at the Annual General Meeting by voting in accordance with the recommendations of our Board of Directors (our Board) on all proposals. In particular, as you are aware, the Company conducts an annual advisory vote to approve the compensation of our named executive officers (the say-on-pay proposal). This years say-on-pay proposal is described in Proposal 2 on page 65 of our Proxy Statement, and the details of our executive compensation philosophy and programs, including how executive pay is rigorously tied to Company performance, are set forth in the Compensation Discussion and Analysis section of our Proxy Statement beginning on page 27. On behalf of our Board, we are seeking your support in approving our say-on-pay proposal by voting FOR Proposal 2. In prior years, our shareholders have shown strong support for our annual say-on-pay proposals, with approval rates of approximately 91% in 2014, 94% in 2013 and 98% in 2012. Our Board remains committed to an executive compensation program that supports performance, reduces risk and aligns with investors interests.

We were pleased to learn that Glass Lewis & Co. (Glass Lewis), upon its own independent evaluation of our executive compensation program, has recommended that its clients vote in favor of our say-on-pay proposal. It has come to our attention that ISS Proxy Advisory Services (ISS) has issued a voting recommendation that is inconsistent with our Boards recommendation on Proposal 2 based on claims that there is a misalignment between our executive pay and Company performance. Because we are confident that the facts support a vote in favor of our say-on-pay proposal, and because we believe that our financial performance and executive compensation program are strong, we are taking this opportunity to provide our shareholders with additional information and context regarding our executive compensation program.

As discussed in more detail below, in 2014, our operating return on average common equity was third in our peer group; our end-of-year price to book value was second in our peer group; we returned $582.5 million to investors; and we delivered strong operating and financial performance. At the same time, our compensation appropriately reflected performance with a meaningful decrease in our Chief Executive Officers compensation and 100% forfeiture by our named executive officers of a significant component of equity compensation linked to total shareholder return (TSR).

If you review ISSs recommendation in connection with your voting determinations, we request that you also independently consider factors outside its evaluation, including the information in our Proxy Statement and the information presented below, for the reasons why our Board, along with Glass Lewis, is recommending a vote FOR Proposal 2.

Shareholder Engagement

We are committed to a regular and robust program of shareholder engagement and have received shareholder feedback on many aspects of our business, including our corporate strategy, financial results and performance and related matters. Importantly, at no time over the past year has any shareholder expressed a concern with our Chief Executive Officers compensation or our compensation program generally. We welcome an open dialogue with shareholders regarding our executive compensation program and remain interested in receiving your constructive feedback.

An Engaged and Thoughtful Compensation Process

As discussed in detail in our Proxy Statement, we believe that our compensation design framework is well structured and holds our executive officers accountable for annual and long-term performance, manages compensation-related risk-taking in our business within the parameters of our philosophy, and supports the guiding principles that drive our overall pay philosophy.

As detailed in our Proxy Statement, our executive compensation program consists generally of four core components, which we view as related but distinct and each of which simultaneously fulfills one or more of the core objectives of our compensation philosophy. Together, these components provide a mixture of compensation, which we believe is in alignment with our goal of creating long-term shareholder value. Importantly, we believe that reliance on a single outcome, such as short-term TSR, has the potential to create an environment where risk-taking actions could lead to an unacceptable short-term focus. This would be inconsistent with our enterprise risk management culture, which we believe critically supports our long-term results. Accordingly, our executive compensation program is carefully tailored to encourage a balanced approach and to foster long-term strategic decision making. Moreover, although our Compensation and Corporate Governance Committee (our Compensation Committee) does review total compensation, it does not believe that significant compensation derived from one component of compensation should necessarily negate or reduce compensation from other components.

For the past three years, ISS and Glass Lewis each have recommended a vote FOR our say-on-pay proposal. During this period and continuing through 2014, the structure and main components of our executive compensation program remained the same; and, as noted above, Glass Lewis has continued to support our program this year. Furthermore, in reaching its recommendation to vote FOR our say-on-pay proposal, Glass Lewis concluded under its pay-for-performance model that the Company has adequately aligned executive pay and corporate performance. ISS, however, has recommended a vote against our say-on-pay proposal notwithstanding that our Board and our Compensation Committee have continued to consistently determine the compensation for our Chief Executive Officer and other named executive officers following the same disciplined approach used in recent years and detailed in our Proxy Statement.

Strong Company Performance

In its evaluation of our performance, ISS relies on TSR and does not take into account the other operational and financial metrics that we use to measure the Companys growth and success. We understand that TSR is one important approach to comparing peer company compensation and

1

performance, and indeed have made an important component of our executives compensation contingent on relative TSR performance. However, our Compensation Committee believes that other metrics such as growth in book value per share and return on equity are also relevant in determining our executives compensation and that operating performance in respect of such metrics is related to long-term growth in shareholder value. In determining our executives compensation, our Compensation Committee also considers the impact of significant events or actions taken which are intended to add shareholder value in the long term but may have an adverse impact on TSR in the short term, such as our 2014 decision to acquire Platinum Underwriters Holdings, Ltd. (Platinum) described further below. As noted on page 28 of our Proxy Statement, we achieved strong operating and financial performance during 2014. Among other things, we achieved, and our Compensation Committee utilized in determining executive compensation:

| | An operating return on average common equity of 13.7%, third in our peer group (a discussion regarding our 2014 peer group can be found in our Proxy Statement beginning on page 34); |

| | An increase in tangible book value per common share plus change in accumulated dividends of 13.9%, which was seventh highest in our peer group; |

| | A share price to book value per common share multiple of 1.08x, using year-end financial information, which was second in our peer group; |

| | Gross premiums written of $1.6 billion, down only 3.4% from 2013 while maintaining sustained efforts to preserve portfolio quality and maintain underwriting discipline; and |

| | Substantial returns of capital to our investors, including $582.5 million of capital to our common and preferred shareholders through share repurchases and dividends. |

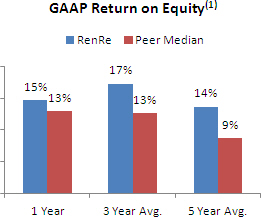

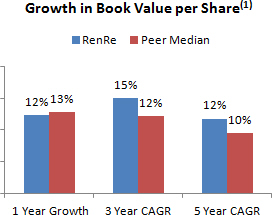

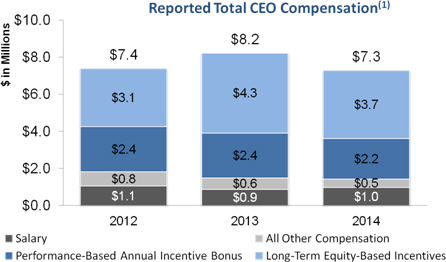

The following graphs illustrate the Companys GAAP return on equity compared to our peer group over one-, three- and five-year periods ending December 31, 2014, growth in book value per common share (compounded annually) over the same periods and the ratio of the Companys closing price to book value per share measured as of December 31 for each of the past six years:

| (1) | Source: Bloomberg. |

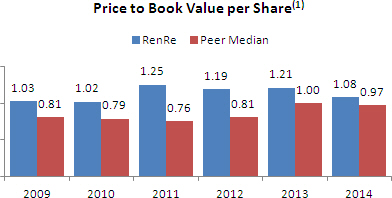

Decrease in CEO Total Reported Compensation

While the structure of our executive compensation program remained the same in 2014 as it was in recent years, reflecting our pay-for-performance philosophy, the total compensation of our Chief Executive Officer (as reported in the Summary Compensation Table in our Proxy Statement) decreased

2

by 11.4% in 2014 as compared to 2013, as a result of reductions in the amount of his cash-based annual incentive performance bonus and in the grant date fair value of his long-term incentive equity grants, among other reductions. We believe that this meaningful decrease in our Chief Executive Officers total compensation illustrates that our executive compensation program is tied to performance.

The following table sets forth our Chief Executive Officers total compensation, as reported in the Summary Compensation Table for each of 2012, 2013 and 2014:

| (1) | Amounts represent Mr. ODonnells total compensation during 2013 and 2014 and |

| Neill A. Curries (our Chief Executive Officer during 2012) total compensation during 2012. |

TSR Impacted by Timing of the Platinum Acquisition

In its report, ISS noted that its pay-for-performance evaluation of our executive compensation program resulted in a high concern characterization. ISS reached this result almost entirely because of one of its quantitative tests, which measures, over a fixed three-year period, the relative alignment of our Chief Executive Officers pay to the TSR of an ISS-selected peer group (the RDA Test). The RDA Test may be distorted due to, among other things, the arbitrary time period selected for the calculation as there can be short-term share price volatility on the particular dates selected. As a result, we do not believe the TSR used in the RDA Test was reflective of our overall performance in light of various factors, including the temporary drop in our share price following the announcement in late 2014 of our intent to acquire Platinum and to issue shares as a component of the consideration. Instead, we believe that ISSs application of the RDA Test in its report illustrates the impact that a sound long-term business decision can have on TSR in the short term.

In that light, we believe a performance review based solely on any one metric, including TSR, does not provide a sufficiently comprehensive assessment to our shareholders. We believe our sound operating metrics, longer-term value creation, and the future benefits of the Platinum acquisition should also be considered in evaluating our performance. Our views are supported by the low concern result that ISS reached on its absolute alignment quantitative test, which measures the five-year alignment of our Chief Executive Officers pay and our TSR, and ISSs consistent support of our compensation program over the past three years.

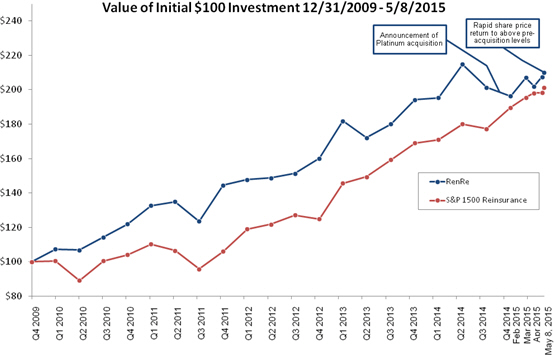

While this dynamic could emerge as a result of a range of events or outcomes, it is clearly illustrated by the short-term impact of having announced a major acquisition in the fourth quarter of a fiscal year. We believe our acquisition of Platinum, which closed on March 2, 2015, will provide meaningful long-term strategic benefits and will increase the likelihood that we will produce superior financial long-term returns for our shareholders. However, our 2014 TSR, as measured on December 31, 2014, was impacted by the announcement in late 2014 of our intent to acquire Platinum, including that we planned to issue approximately 7.5 million shares (or approximately 19% of our then-outstanding shares) in connection with the acquisition. The recent performance of the Company is not taken into account by ISS as the RDA Test measures TSR solely based on our share price as of December 31 of each year, the end of our fiscal year. The chart below illustrates the cumulative return on our common shares, including reinvestment of dividends, since December 31, 2009, including during the period of the announcement of the Platinum acquisition and the recovery of our share price:

3

Challenging Performance Objectives

As part of our compensation program, 25% of long-term equity-based awards have historically been granted in the form of restricted shares subject to both performance vesting and continued service requirements. Grants of these performance shares are earned based on the Companys TSR relative to our established peer group over a three-year period. The performance-based vesting level of one-third of each award is determined at the end of each year of the performance period based on that years performance, and all earned shares remain subject to a service-based vesting requirement through the end of the full three-year period. Performance targets relating to the performance shares are designed by our Compensation Committee, after receiving input from its independent compensation consultant, to be sufficiently rigorous and not easily attained. As currently structured, the performance shares become eligible for vesting at their target level upon achievement of TSR relative to our peers at the 50th percentile. Thus, the target payout is attained if we match the TSR performance of our peers, and payout above target is attained only if we outperform our peers. We believe that this level of achievement appropriately incentivizes our executives, and note that payouts under our performance share program during the last three fiscal years have been far below target. In fact, as reflected in the table below, the tranches of performance shares granted which relate to our 2012, 2013 and 2014 fiscal year performance were completely forfeited:

| Performance Cycle(1) | 2012 | 2013 | 2014 | 2015 (Assumed Target)(2) |

2016 (Assumed Target)(2) |

Total Payout as a Percent of Target |

||||||||||||||||||

| 2012 2014 |

0.0% | 0.0% | 0.0% | 0.0% | ||||||||||||||||||||

| 2013 2015 |

0.0% | 0.0% | 100.0% | 33.3% | ||||||||||||||||||||

| 2014 2016 |

0.0% | 100.0% | 100.0% | 66.7% | ||||||||||||||||||||

| (1) | For purposes of the Companys 2010 Performance-Based Equity Incentive Plan, TSR is determined as the increase in the 20-day average share price preceding the end of the performance period plus the dividends paid with respect to such shares during such period, expressed as a percentage of the 20-day average share price preceding the beginning of the performance period. |

| (2) | The table assumes that outstanding performance shares will be earned based on target performance during 2015 and 2016. |

4

The compensation of our named executive officers has been directly impacted by the Companys below-median TSR performance, both in the short term and over the past three years. The values shown below represent the value of the performance shares (together with any accrued but unpaid dividends) that were forfeited by named executive officers as a result of 2014 relative TSR performance, as well as the total value of the performance shares forfeited by our named executive officers over the past three years:

| Name | Value of Performance Shares Forfeited in 2014(1) |

Total Value of Performance Shares Forfeited in 2012-2014(2) |

||

| Kevin J. ODonnell |

$980,682 | $2,275,174 | ||

| Jeffrey D. Kelly |

$383,925 | $1,058,568 | ||

| Ross A. Curtis |

$262,851 | $700,186 | ||

| Ian D. Branagan |

$294,369 | $785,402 | ||

| Stephen H. Weinstein |

$300,965 | $808,700 |

| (1) | Represents the target value of the forfeited shares (together with any accrued but unpaid dividends) which relate to our 2014 fiscal year performance for each of our 2012-2014, 2013-2015 and 2014-2016 performance share cycles and Mr. ODonnells 2012 and 2013 special performance share awards, based on the closing price of the common shares of $97.22 on December 31, 2014. |

| (2) | Represents the total target value of the performance shares (together with any accrued but unpaid dividends) which relate to our 2012, 2013 and 2014 fiscal year performance that were forfeited by each named executive officer, based on the closing price of the common shares of $81.26, $97.34 and $97.22 on December 31, 2012, 2013 and 2014, respectively. |

We believe these outcomes reflect an appropriate alignment with TSR, without distorting the balanced mix of incentives that we believe encourage our executives to pursue long-term strategic objectives, strong operating performance and consistent risk management. Our named executive officers experienced meaningful economic impacts for the below-median TSR results (compared to our peer group) over the past three years, while our operating return on average common equity and increase in tangible book value per common share (plus change in accumulated dividends) have been at or above median.

FOR THE FOREGOING REASONS AND THE REASONS SET FORTH IN OUR PROXY STATEMENT, WE URGE YOU TO VOTE FOR THE APPROVAL OF OUR SAY-ON-PAY PROPOSAL.

We urge you to review our Proxy Statement, including the Compensation Discussion and Analysis section, along with the supplemental information contained in this letter, and conduct your own independent evaluation of our executive compensation program, including the alignment of executive pay with Company performance. Even if you have already voted, you can change your vote at any time before our Annual General Meeting of Shareholders to be held on May 20, 2015, as described in more detail in our Proxy Statement.

As noted above, we are committed to an active and open conversation with our shareholders and have received shareholder feedback on many aspects of our business, including our corporate strategy, financial results and performance and related matters. We welcome having an open dialogue with you and receiving your constructive feedback regarding our executive compensation program.

Thank you for your consideration. If you have any questions, comments or would like additional information, please contact Stephen Weinstein, our Group General Counsel and Corporate Secretary, at +1 (441) 239-4812, Rohan Pai, our Director of Investor Relations, at +1 (441) 295-4513, or our proxy solicitation agent, MacKenzie Partners, toll-free at +1 (800) 322-2885.

May 11, 2015

Sincerely,

Ralph B. Levy

Non-Executive Chair of the Board of Directors

Kevin J. ODonnell

President and Chief Executive Officer

This letter includes certain non-GAAP financial measures, including operating return on average common equity and tangible book value per common share plus accumulated dividends. A reconciliation of such measures to the most comparable GAAP figures in accordance with Regulation G is presented in Annex A to the Companys Definitive Proxy Statement on Schedule 14A filed with the U.S. Securities and Exchange Commission on April 8, 2015, which is hereby incorporated by reference.

5