DEF 14A: Definitive proxy statements

Published on March 29, 2018

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| ☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

RENAISSANCERE HOLDINGS LTD.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| ☑ | No fee required. | |

| ☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

| (1) Title of each class of securities to which the transaction applies:

|

||

| (2) Aggregate number of securities to which the transaction applies:

|

||

| (3) Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

||

| (4) Proposed maximum aggregate value of the transaction:

|

||

|

(5) Total fee paid:

|

||

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

| (1) Amount Previously Paid:

|

||

| (2) Form, Schedule or Registration Statement No.:

|

||

| (3) Filing Party:

|

||

| (4) Date Filed: |

||

|

|

||

Table of Contents

LETTER TO OUR SHAREHOLDERS

In 2017, RenaissanceRe executed well against our strategic plan and strengthened our franchise against the backdrop of a difficult market that was impacted by record-breaking natural catastrophe losses. While we cannot control when these losses happen, we can plan for them. We believe we executed well on the things we could control, demonstrating our commitment to disciplined underwriting and protecting our operations and shareholders with our suite of portfolio optimization tools, which we frequently refer to as our gross-to-net strategy. After the catastrophe events, we demonstrated our superior client service by paying our customers claims rapidly and being a first call market for new business. We also continued our commitment to the strategic allocation of capital, extending our franchise reach and further diversifying our revenues and operations with new initiatives, rapidly responding to the U.S. tax law changes and remaining focused on our philosophy of matching well-priced risk with the most efficient capital resources available. In sum, we believe RenaissanceRes long-term franchise value was enhanced by our strong operational performance in 2017.

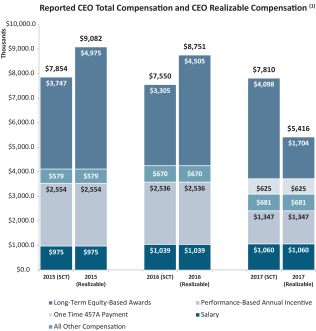

Our goal is to design competitive and fair compensation packages that align the interests of our executives and employees with those of our shareholders, and we believe the compensation realized by our executives with respect to 2017 reflects our pay-for-performance philosophy. As we would expect in a year of record natural catastrophes, the driver of our overall performance was the multiple catastrophic events occurring in the second half of 2017, coupled with the impact of our long-term investment in our gross-to-net strategy. In excess of two-thirds of our gross losses were ceded to retrocessionaires, shared with third-party capital or offset by reinstatement premiums. In addition to preserving our capital, this strategy was highly efficient. The year, although challenging, was not surprising and we believe our experience and results validate both our view of risk and our long-term strategy. We are encouraged by the strong execution of our strategy and the growth we saw in 2017. We believe we reinforced our position as a market leader and innovator by deepening and broadening our relationships with clients and brokers, investing in innovative new partnerships and deploying efficient capital to bridge the global insured risk gap. Today we have more resources, a broader set of underwriting capabilities, better access to multiple forms of capital and a bigger global footprint than ever before, with globally coordinated underwriting capabilities in Bermuda, New York, Chicago, London, Switzerland and Singapore.

As we celebrate the 25th anniversary of our founding in 2018, we will continue to work diligently towards developing new ways of creating value for clients, brokers and shareholders, while aligning these efforts with long-term shareholder value and responsible risk management.

Thank you for your continued support.

March 29, 2018

| Sincerely,

James L. Gibbons Non-Executive Chair of the Board of Directors |

Kevin J. ODonnell President and Chief Executive Officer |

Table of Contents

| RenaissanceRe Holdings Ltd. Renaissance House 12 Crow Lane Pembroke HM 19, Bermuda Phone +1 (441) 295-4513 www.renre.com |

|

NOTICE OF ANNUAL GENERAL

MEETING OF SHAREHOLDERS

| Meeting Agenda:

|

||||||||

| Date:

Time:

Place:

Record Date: |

Monday, May 14, 2018

8:30 a.m. Atlantic Time

Renaissance House 12 Crow Lane Pembroke HM 19 Bermuda

March 14, 2018 |

◾ Elect three Class II director nominees and one Class III director nominee

◾ Advisory vote on executive compensation

◾ Approve the appointment of our independent registered public accounting firm for fiscal 2018 and the referral of the auditors remuneration to the Board of Directors

◾ Any other business that properly comes before the meeting

|

||||||

|

|

|

|

|

|||||

|

Please Vote Your Shares |

By Telephone |

By Internet |

By Mail |

By Tablet or Smartphone |

||||

| We encourage shareholders to vote promptly, as this will save the expense of additional proxy solicitation. You may vote in the following ways: | In the United States or Canada you can vote your shares by calling 1-800-690-6903. | You can vote your shares online at www.proxyvote.com. You will need the 12-digit control number on the Notice of Internet Availability or proxy card.

|

You can vote by mail by marking, dating and signing your proxy card or voting instruction form and returning it in the postage-paid envelope provided.

|

You can vote your shares online with your tablet or smartphone by scanning the QR code above. | ||||

| Important Notice of Internet Availability of Proxy Materials

This Notice of Annual General Meeting of Shareholders and related proxy materials are being distributed or made available to shareholders beginning on or about March 29, 2018. This includes instructions on how to access these materials (including our proxy statement and 2017 annual report to shareholders) online.

|

By Order of the Board of Directors,

Stephen H. Weinstein Corporate Secretary |

Table of Contents

| TABLE OF CONTENTS |

Table of Contents

| PROXY SUMMARY |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider and you should read the entire proxy statement carefully before voting.

2018 Annual General Meeting of Shareholders

| Date and Time May 14, 2018, 8:30 a.m. Atlantic Time |

Place Renaissance House, 12 Crow Lane, Pembroke HM 19, Bermuda |

|

|

Record Date March 14, 2018 |

Voting Eligibility Owners of our common shares as of the record date are entitled to vote on all matters |

Voting Items and Board Recommendations

| Item | Proposal | Board Vote Recommendation |

Page Reference (for more detail) |

|||

| 1. | Election of three Class II director nominees and one Class III director nominee | FOR each nominee |

7 |

|||

| 2. | Advisory vote on the compensation of our named executive officers | FOR | 51 |

|||

| 3. | Approval of the appointment of Ernst & Young Ltd. as our independent registered public accounting firm for the 2018 fiscal year and the referral of the auditors remuneration to the Board of Directors | FOR | 56 |

|||

Corporate Governance Highlights

The Board is elected by the shareholders to oversee management and to assure that the long-term interests of the shareholders are being served.

|

Proxy Statement 1 |

Table of Contents

| PROXY SUMMARYCONTINUED |

2017 Strategic, Financial and Operational Highlights

| 1 | Operating income available to RenaissanceRe common shareholders, operating return on average common equity, and tangible book value per common share plus accumulated dividends are non-GAAP financial measures. A reconciliation of non-GAAP financial measures is included in Appendix A to this proxy statement. |

| 2 |

|

Proxy Statement |

Table of Contents

| PROXY SUMMARYCONTINUED |

Compensation Highlights

Advisory Vote on Compensation; Shareholder Engagement

|

Proxy Statement 3 |

Table of Contents

Table of Contents

| GENERAL INFORMATIONCONTINUED |

| Proposal | Board Recommendation |

Voting Options |

Voting Approval Standard |

Effect of Abstentions |

Broker Discretionary Voting Allowed? |

Effect of Broker Non-Votes |

||||||

| Election of three Class II director nominees and one Class III director nominee | FOR each nominee | FOR, AGAINST or ABSTAIN for each director nominee | The number of votes cast FOR that directors election exceeds the number of votes cast AGAINST that directors election as a director at the Annual Meeting | No effect | No | No effect | ||||||

| Advisory vote on the compensation of our named executive officers | FOR | FOR, AGAINST or ABSTAIN | Majority of the votes cast at the Annual Meeting | No effect | No | No effect | ||||||

| Approval of the appointment of Ernst & Young Ltd. as our independent registered public accounting firm for the 2018 fiscal year and the referral of the auditors remuneration to the Board | FOR | FOR, AGAINST or ABSTAIN | Majority of the votes cast at the Annual Meeting | No effect | Yes | Not applicable |

|

Proxy Statement 5 |

Table of Contents

| GENERAL INFORMATIONCONTINUED |

| 6 |

|

Proxy Statement |

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORS |

PROPOSAL 1: ELECTION OF DIRECTORS

Director Nominees

Class II Director Nominees (whose terms, if elected, expire in 2021)

| Brian G. J. Gray Age: 55 Director Since: 2013 Member of the Investment and Risk Management, Transaction and Offerings Committees |

From 2008 until his retirement in 2012, Mr. Gray served as Group Chief Underwriting Officer of Swiss Reinsurance Company Ltd. (Swiss Re) and was a member of Swiss Res Group Executive Committee. From 2005 through 2008, he was a member of the Group Executive Board, responsible for underwriting Property and Specialty Product Lines on a global basis for Swiss Re. Mr. Gray joined Swiss Re in Canada (Swiss Re Canada) in 1985, and served in a variety of roles, including President and Chief Executive Officer of Swiss Re Canada from 2001 to 2005 and Senior Vice President of Swiss Re Canada from 1997 to 2001. | |

| Duncan P. Hennes Age: 61 Director Since: 2017 Member of the Compensation and Corporate Governance Committee |

Mr. Hennes has served as the Co-Founder and Managing Member of Atrevida Partners, LLC (Atrevida) since 2007. Prior to co-founding Atrevida, he served as Co-Founder and Partner of Promontory Financial Group from 1999 to 2006. Prior to that, Mr. Hennes served in a number of senior executive positions at Bankers Trust Corporation, including Executive Vice President in charge of Trading, Sales and Derivatives, and as the Chairman of the Board of Oversight Partners I, the consortium that took control of Long Term Capital Management, from 1987 to 1998. From 1998 to 1999 he was the Chief Executive Officer at Soros Fund Management, LLC. Mr. Hennes has served on the Boards of Directors of Citigroup Inc. (Citigroup) and Citibank, N.A. since 2013, where he currently serves as the Chair of the Personnel and Compensation Committee and Institutional Compliance Committee and a member of the Risk Management Committee. | |

| Kevin J. ODonnell Age: 51 Director Since: 2013 Chair of the Transaction and Offerings Committees |

Mr. ODonnell has served as our Chief Executive Officer since July 2013 and as our President since November 2012. Mr. ODonnell previously served in a number of roles since joining the Company in 1996, including Global Chief Underwriting Officer, Executive Vice President, Senior Vice President, Vice President and Assistant Vice President. Mr. ODonnell also serves as the Chair of the Association of Bermuda Insurers and Reinsurers and the Vice-Chair of the Global Reinsurance Forum. | |

|

Proxy Statement 7 |

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORSCONTINUED |

Class III Director Nominee (whose term, if elected, expires in 2019)

| Valerie Rahmani Age: 60 Director Since: 2017 Member of the Audit Committee |

Dr. Rahmani has served as the part-time head of the Innovation Panel at Standard Life Aberdeen plc, a UK-based Financial Times Stock Exchange (FTSE) 100 global investment company, since 2017. She has more than 30 years of experience in the technology industry, including more than 25 years at IBM serving in roles of increasing seniority across multiple global business segments from 1981 to 2009, most recently as General Manager of Internet Security Systems. Subsequent to her tenure at IBM, Dr. Rahmani was Chief Executive Officer at Damballa, Inc., a privately held Internet security software company, from 2009 to 2012. She has served on the Board of Directors of Computer Task Group, Incorporated (CTG), a publicly traded information technology solutions and software company, since 2015, where she currently serves as Chair of the Compensation Committee and as a member of the Audit Committee and the Nominating and Corporate Governance Committee. In 2017, she joined the Board of the London Stock Exchange, where she is a member of the Risk Committee. Dr. Rahmani also served on the board of Aberdeen Asset Management PLC, a UK-based FTSE 250 global investment management group, from 2015 to 2017. |

Recommendation and Vote

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF MR. GRAY, MR. HENNES, MR. ODONNELL AND DR. RAHMANI.

Continuing Directors

Class III Directors (whose terms expire in 2019)

| Henry Klehm III Age: 59 Director Since: 2006 Chair of the Compensation and Corporate Governance Committee |

Mr. Klehm has been a partner at the law firm Jones Day since 2008 and has been the Practice Leader of the firms Securities Litigation and SEC Enforcement Practice since January 2017. From 2002 to 2007, Mr. Klehm served as Global Head of Compliance for Deutsche Bank, AG. Prior to joining Deutsche Bank, AG, Mr. Klehm served as Chief Regulatory Officer and Deputy General Counsel at Prudential Financial from 1999 to 2002. Prior to joining Prudential, Mr. Klehm served in various positions with the SEC, including as Senior Associate Director of the Northeast Regional Office. | |

| Carol P. Sanders Age: 51 Director Since: 2016 Member of the Audit Committee |

Ms. Sanders has served as the President of Carol P. Sanders Consulting, LLC, providing consulting services to the insurance and technology industries, since June 2015. From June 2013 until June 2015, she served as Executive Vice President, Chief Financial Officer and Treasurer of Sentry Insurance a Mutual Company. Previously she served as the Executive Vice President and Chief Operating Officer of Jewelers Mutual Insurance Company from November 2012 until June 2013, where she also served as Senior Vice President, Chief Financial Officer and Treasurer from May 2011 until November 2012 and as Chief Financial Officer and Treasurer from 2004 until May 2011, after holding a series of positions of increasing responsibility in finance, accounting, treasury and tax. Ms. Sanders has served on the Board of Directors of Alliant Energy Corporation, a publicly traded public utility holding company, since 2005, where she currently chairs the Audit Committee and serves as a member of the Nominating and Governance Committee and the Executive Committee. In 2016, she joined the Board of Directors of First Business Financial Services, Inc., a publicly traded registered bank holding company, where she is a member of the Audit Committee. | |

| 8 |

|

Proxy Statement |

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORSCONTINUED |

| Edward J. Zore Age: 71 Director Since: 2010 Member of the Investment and Risk Management Committee |

Mr. Zore served in a variety of capacities at The Northwestern Mutual Life Insurance Company (Northwestern Mutual), principally as Chairman (2009 to 2010), as Chief Executive Officer (2001 to 2010) and as President (2000 to 2009). He served on the Northwestern Mutual Board of Trustees from 2000 until May 2016. Mr. Zore began his career with Northwestern Mutuals investment department, and also served as the companys Executive Vice President, Chief Financial Officer and Chief Investment Officer, and as a director of Northwestern Mutual Series Fund, Inc. He is the Lead Director of the Board of Directors of ManpowerGroup Inc., a publicly traded multinational human resource consulting firm, and is the Chair of its Executive Compensation and Human Resources Committee. Previously, Mr. Zore served as Chairman of the Board of Mason Street Funds, Inc. from 2000 to 2007. | |

Class I Directors (whose terms expire in 2020)

| David C. Bushnell Age: 63 Director Since: 2008 Chair of the Audit Committee |

Mr. Bushnell has served as the principal of Bushnell Consulting, a financial services consulting firm, since 2008. Mr. Bushnell retired from Citigroup in 2007, after 22 years of service. Mr. Bushnell served as the Senior Risk Officer of Citigroup from 2003 through 2007 and retired as Chief Administrative Officer in 2007. Following his retirement from Citigroup, Mr. Bushnell served as a consultant to Citigroup until December 31, 2008. Previously, Mr. Bushnell worked for Salomon Smith Barney Inc. (later acquired by Citigroup) and its predecessors in a variety of positions, including as a managing director and Chief Risk Officer. Mr. Bushnell served on the Board of Directors and as Chief Risk Officer of Cordia Bancorp Inc. (Cordia), a public bank holding company, and its wholly owned subsidiary, Bank of Virginia, from 2011 until Cordia was acquired in September 2016. | |

| James L. Gibbons Age: 54 Director Since: 2008 Non-Executive Chair of the Board Member of the Transaction and Offerings Committees |

Mr. Gibbons, a Bermudian citizen, is Chairman of Harbour International Trust Company Limited and the Treasurer and a Director of Edmund Gibbons Limited (EGL). Mr. Gibbons also serves as a Director of Clarien Group Limited (Clarien), an international financial company, as well as Non-Executive President of Bermuda Air Conditioning Limited (BACL). From June 2013 to June 2016, Mr. Gibbons served as a member of the Board of Directors of Nordic American Tankers Limited, a publicly held company. Mr. Gibbons served as Chair of Capital G Bank Limited from 1999 to 2013 and as President and Chief Executive Officer of Capital G Limited from 1999 to 2010, prior to the change of name to Clarien from Capital G in 2014. | |

| Jean D. Hamilton Age: 71 Director Since: 2005 Member of the Compensation and Corporate Governance Committee |

Ms. Hamilton is an independent consultant and private investor and a Member of Brock Capital Group LLC. Previously, she held various positions with Prudential Financial, Inc., including Executive Vice President, and was Chief Executive Officer of Prudential Institutional from 1998 through 2002. Prior to joining Prudential, she held several positions with The First National Bank of Chicago, including Senior Vice President and Head of the Northeastern Corporate Banking Department. She is currently a Trustee, a member of the Audit Committee and Deferred Compensation Committee, and Chair of the Board Valuation Committee, of First Eagle Funds and First Eagle Variable Funds. | |

| Anthony M. Santomero Age: 71 Director Since: 2008 Chair of the Investment and Risk Management Committee |

Mr. Santomero served as Senior Advisor at McKinsey & Company from 2006 to 2008. From 2000 to 2006, Mr. Santomero was President and Chief Executive Officer of the Federal Reserve Bank of Philadelphia. Prior to joining the Federal Reserve, Mr. Santomero was the Richard K. Mellon Professor of Finance at the University of Pennsylvanias Wharton School and held various positions there, including Director of the Financial Institutions Center and Deputy Dean. Mr. Santomero serves on the Boards of Directors of Penn Mutual Life Insurance Company, Citigroup, Citibank, N.A. and Columbia Funds. Mr. Santomero currently serves as the Chair of the Risk Management Committee and a member of the Audit Committee and Executive Committee of Citigroup and Chairman of the Board of Directors of Citibank, N.A. In addition, Mr. Santomero served on the Board of Directors of B of A Fund Series Trust from 2008 until 2011. | |

|

Proxy Statement 9 |

Table of Contents

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Board Leadership Structure

Role of the Non-Executive Chair of the Board

Board Role in Risk Oversight

|

Proxy Statement 11 |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Committees of the Board

| Audit Committee |

Compensation and Corporate Governance Committee |

Investment and Risk Management Committee |

Transaction Committee |

Offerings Committee |

||||||

| David C. Bushnell |

Chair | |||||||||

| James L. Gibbons |

x | x | ||||||||

| Brian G. J. Gray |

x | x | x | |||||||

| Jean D. Hamilton |

x | x | x | |||||||

| Duncan P. Hennes |

x | |||||||||

| Henry Klehm III |

Chair | |||||||||

| Kevin J. ODonnell |

Chair | Chair | ||||||||

| Valerie Rahmani |

x | |||||||||

| Carol P. Sanders |

x | |||||||||

| Anthony M. Santomero |

Chair | |||||||||

| Edward J. Zore |

x |

Audit Committee

| 12 |

|

Proxy Statement |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

|

Proxy Statement 13 |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

| 14 |

|

Proxy Statement |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

|

Proxy Statement 15 |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Meetings and Attendance

Compensation Committee Interlocks and Insider Participation

| 16 |

|

Proxy Statement |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Sustainability and Corporate Social Responsibility

|

Proxy Statement 17 |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Code of Ethics

Communicating with the Board of Directors

| 18 |

|

Proxy Statement |

Table of Contents

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies and Procedures Dealing with the Review, Approval and Ratification of Transactions with Related Persons

Relationship with BlackRock, Inc.

Relationship with Colonial Group International

Use of Company Aircraft

Housing Arrangements with Executive Officers

|

Proxy Statement 19 |

Table of Contents

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSCONTINUED |

Charitable Donations

| 20 |

|

Proxy Statement |

Table of Contents

| DIRECTOR COMPENSATION |

Director Compensation Table

The following table sets forth information concerning compensation paid to each director who served on the Board during 2017, other than Mr. ODonnell, whose compensation as our President and Chief Executive Officer is set forth under Executive CompensationSummary Compensation Table below:

| Name | Fees Earned or Paid in Cash (1) |

Stock Awards (2) ($) |

Total ($) |

|||||||||

| David C. Bushnell |

120,000 | 139,976 | 259,976 | |||||||||

| James L. Gibbons |

170,000 | 289,875 | 459,875 | |||||||||

| Brian G. J. Gray |

90,000 | 139,976 | 229,976 | |||||||||

| William F. Hagerty IV (3) |

90,000 | 139,976 | 229,976 | |||||||||

| Jean D. Hamilton |

90,000 | 139,976 | 229,976 | |||||||||

| Duncan P. Hennes (3) |

45,000 | 139,979 | 184,979 | |||||||||

| Henry Klehm III |

120,000 | 139,976 | 259,976 | |||||||||

| Ralph B. Levy (3) |

90,000 | 139,976 | 229,976 | |||||||||

| Valerie Rahmani (3) |

45,000 | 139,979 | 184,979 | |||||||||

| Carol P. Sanders |

90,000 | 139,976 | 229,976 | |||||||||

| Anthony M Santomero |

120,000 | 139,976 | 259,976 | |||||||||

| Edward J. Zore |

90,000 | 139,976 | 229,976 | |||||||||

| (1) | Amounts shown reflect annual retainer and annual committee chair retainer, as described below. |

| (2) | The amounts in this column represent the aggregate grant date fair value of time-vested restricted shares granted to our non-employee directors in 2017, computed in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718, excluding the effect of estimated forfeitures. The assumptions made in the valuation of stock awards are discussed in Note 17 (Stock Incentive Compensation and Employee Benefit Plans) of our Annual Report on Form 10-K for the year ended December 31, 2017 (the 2017 Form 10-K). These values do not represent the actual value the recipient will or has received from the award. On March 1, 2017, each of Messrs. Bushnell, Gray, Hagerty, Klehm, Levy, Santomero and Zore and Mses. Hamilton and Sanders were awarded 931 restricted shares and Mr. Gibbons was awarded 1,928 restricted shares. On August 2, 2017, Mr. Hennes and Dr. Rahmani each were awarded 943 restricted shares. All of the restricted shares awarded to our non-employee directors in 2017 will vest in three equal annual installments beginning on March 1, 2018. The aggregate number of stock awards outstanding as of December 31, 2017 for each director who served on the Board during 2017 was as follows: Mr. Gibbons: 3,584 restricted shares; Messrs. Bushnell, Gray, Klehm, Santomero and Zore and Ms. Hamilton: 2,151 restricted shares each; Ms. Sanders: 1,750 restricted shares; Mr. Hennes and Dr. Rahmani: 943 restricted shares each; and Mr. Hagerty and Mr. Levy: 0 restricted shares each. |

| (3) | On July 20, 2017, Mr. Hagerty resigned from the Board following his confirmation by the U.S. Senate to the position of Ambassador to Japan and prior to his commencement of service as Ambassador, and on August 2, 2017, Mr. Levy retired from the Board. On August 2, 2017, Mr. Hennes and Dr. Rahmani were appointed to the Board. The amounts shown for Mr. Hennes and Dr. Rahmani represent their annual retainers, prorated for their service during 2017. |

Director Compensation Program

|

Proxy Statement 21 |

Table of Contents

| DIRECTOR COMPENSATIONCONTINUED |

Director Equity Ownership Policy; No Hedging or Pledging

| 22 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE OFFICERS |

| Kevin J. ODonnell Age: 51 President and Chief Executive Officer |

Mr. ODonnell has served as our Chief Executive Officer since July 2013 and as our President since November 2012. Mr. ODonnell previously served in a number of roles since joining the Company in 1996, including Global Chief Underwriting Officer, Executive Vice President, Senior Vice President, Vice President and Assistant Vice President. Mr. ODonnell also serves as the Chair of the Association of Bermuda Insurers and Reinsurers and the Vice-Chair of the Global Reinsurance Forum. | |

| Robert Qutub Age: 56 Executive Vice President and Chief Financial Officer |

Mr. Qutub has served as our Executive Vice President and Chief Financial Officer since August 2016. Prior to joining RenaissanceRe, Mr. Qutub served as Chief Financial Officer and Treasurer for MSCI Inc., a leading provider of portfolio construction and risk management tools and services for global investors, from July 2012 to May 2016. Prior to MSCI Inc., Mr. Qutub was with Bank of America from November 1994 to June 2012, where he held several segment Chief Financial Officer roles. He has served on the Board of Directors of USAA Federal Savings Bank since June 2014 and also served in the United States Marine Corps. | |

| Ross A. Curtis Age: 45 Senior Vice President and Group Chief Underwriting Officer |

Mr. Curtis has served as our Senior Vice President and Group Chief Underwriting Officer since July 2014. Mr. Curtis has served in a number of roles since joining the Company in 1999 as a Catastrophe Reinsurance Analyst, including Chief Underwriting Officer of European Operations based in London, England from 2010 to 2014 and Senior Vice President of Renaissance Reinsurance Ltd. in Bermuda, primarily responsible for underwriting the international and retrocessional property catastrophe portfolios and assisting in the development of our specialty reinsurance lines, from 2006 to 2010. | |

| Ian D. Branagan Age: 50 Senior Vice President and Group Chief Risk Officer |

Mr. Branagan has served as our Senior Vice President and Group Chief Risk Officer since 2009 and as the Head of Group Risk Modeling since 2005. Mr. Branagan joined the Company in 1998 to open our Dublin office, later relocating to Bermuda with additional responsibilities for underwriting risk and modeling across our (re)insurance operations. Mr. Branagan subsequently assumed the responsibility of managing risk globally and, in 2013, relocated to our London office. Prior to joining the Company, Mr. Branagan led the international activities of Applied Insurance Research Inc. (AIR), which included the development and marketing of AIRs catastrophe models and tools. | |

| Stephen H. Weinstein Age: 49 Senior Vice President, Group General Counsel, Corporate Secretary and Chief Compliance Officer |

Mr. Weinstein has served as our Group General Counsel and Corporate Secretary since joining the Company in 2002, as Chief Compliance Officer since 2004 and Senior Vice President since 2005. From 2002, Mr. Weinstein also served as a Vice President. Prior to joining RenaissanceRe, Mr. Weinstein specialized in corporate law as an attorney at Willkie Farr & Gallagher LLP. | |

| James C. Fraser Age: 42 Senior Vice President and Chief Accounting Officer |

Mr. Fraser has served as our Senior Vice President and Chief Accounting Officer since December 2016. He joined RenaissanceRe in 2009, and served as our Vice President and Head of Internal Audit from 2011 through 2016. Prior to joining the Company, Mr. Fraser worked in finance and risk management positions at XL Capital and Deloitte. Mr. Fraser is a Chartered Professional Accountant and a Certified Internal Auditor. | |

|

Proxy Statement 23 |

Table of Contents

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 2 | Operating income available to RenaissanceRe common shareholders, operating return on average common equity, and tangible book value per common share plus accumulated dividends are non-GAAP financial measures. A reconciliation of non-GAAP financial measures is included in Appendix A to this proxy statement. |

|

Proxy Statement 25 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Highlights of Our Compensation Program

| 26 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

Proxy Statement 27 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

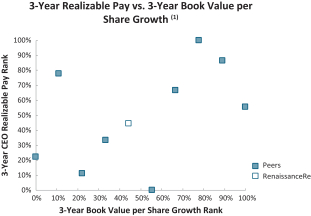

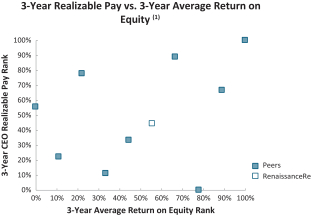

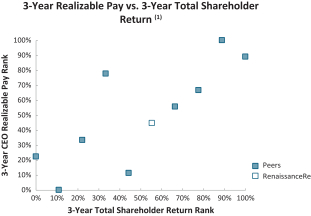

| Source: | S&Ps Research Insight for 2014 and S&P Capital IQ for 2015-2017. |

| (1) | 3-Year Realizable Pay is defined as the sum of: (i) base salary earned in each fiscal year, (ii) actual bonus payout for each fiscal year (including discretionary, sign-on and special bonuses), (iii) in-the-money value, at December 31, 2017, of all options granted during the three-year period, (iv) full value, at December 31, 2017, of all restricted shares/units granted during the three-year period and (v) full value, at December 31, 2017, of all performance shares/units granted during the three-year period (using the actual shares earned for completed performance cycles and the target number of shares for cycles that are ongoing). Time periods for pay are based on most recent available information (2014-2016 for peers and 2015-2017 for RenaissanceRe). Time periods for performance are based on most recent available information (2015-2017 for peers and RenaissanceRe, unless otherwise noted). For purposes of illustration, our current compensation peer group was used. |

The Market for Talent and Our Peer Group

| 28 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

Proxy Statement 29 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

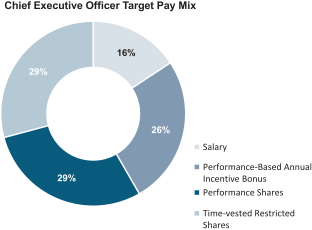

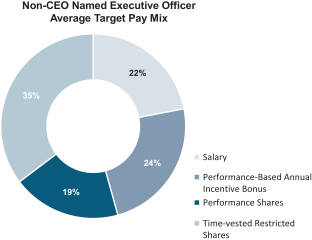

Principal Components of Our Executive

Compensation Program

| Compensation Component | Primary Purpose of Compensation Component |

Philosophy Behind Providing Compensation Component |

||

| Salary |

Provides a fixed component of compensation that reflects expertise and scope of responsibilities | Provides a base component of total compensation

Provides objective, market-driven and competitive pay

Represents a relatively lower contribution to total compensation as responsibilities increase |

||

| Performance-Based Annual Incentive Bonus |

Provides at-risk pay that reflects annual corporate performance and performance against strategic accomplishments | Promotes the achievement of financial and performance metrics important to shareholders

Reinforces the importance of pre-established strategic accomplishments and goals

Rewards team success |

||

| Long-Term Equity-Based Incentives (Performance Shares and Time-Vested Restricted Shares) | Provides at-risk pay with a long-term focus, subject to both performance- and service-based vesting mechanics | Aligns named executive officers and long-term shareholders interests

Reflects long-term performance

Retains talent through long-term wealth-creation opportunities

Holds executives to significant equity ownership requirements |

||

| Other Benefits and Perquisites |

Reflects the Bermuda location of our corporate headquarters and expatriate relocation needs as well as specific local market and competitive practices | Encourages relocation of talented executives to our strategic Bermuda headquarters location

Provides a strong retention element |

||

| 30 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

Proxy Statement 31 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 32 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

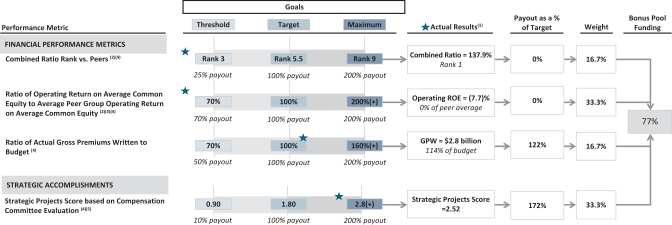

| (1) | For the year ended December 31, 2017, our actual combined ratio was 137.9%, our actual operating return on average common equity was negative 7.7% and our actual gross premiums written were $2.8 billion. |

| (2) | To calculate, we compared our performance to our compensation peer group for 2017, which is described above. In accordance with the terms of the performance-based annual incentive bonus program approved by the Compensation Committee in February 2017, in November 2017 the Compensation Committee determined to remove White Mountains Insurance Group, Ltd. from the peer group for purposes of the final calculation of the business performance factor because it was no longer an appropriate peer following its sale of its interest in OneBeacon Insurance Group, Ltd. on September 28, 2017, and sufficient comparable financial metrics would not be available at year end. |

| (3) | Operating return on average common equity is a non-GAAP financial measure. A reconciliation of non-GAAP financial measures is included in Appendix A to this proxy statement. |

| (4) | Actual payout between levels between threshold and target and target and maximum is determined by straight-line interpolation. |

| (5) | With input from management and in conjunction with the Boards annual review of our strategic plan, the Compensation Committee evaluates performance on the pre-established strategic accomplishments, resulting in a score between 0 and 3.0, which translates to a specific payout on the pre-established payout schedule. |

| Name | Bonus Basis |

Target 2017 Bonus as a Percent of Bonus Basis |

Target 2017 Bonus |

Actual 2017 Bonus |

||||||||||||

| Kevin J. ODonnell |

$ | 1,060,000 | 165% | $ | 1,749,000 | $ | 1,346,730 | |||||||||

| Robert Qutub |

$ | 575,000 | 110% | $ | 632,500 | $ | 487,025 | |||||||||

| Ross A. Curtis |

$ | 625,000 | 110% | $ | 687,500 | $ | 529,375 | |||||||||

| Ian D. Branagan (1) |

$ | 540,840 | 110% | $ | 594,924 | $ | 458,091 | |||||||||

| Stephen H. Weinstein |

$ | 501,000 | 110% | $ | 551,100 | $ | 424,347 | |||||||||

| (1) | Mr. Branagans bonus basis is his salary of £400,000 converted into U.S. dollars at the exchange rate of 1.35 on December 31, 2017. |

|

Proxy Statement 33 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 34 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

Proxy Statement 35 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 36 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

Proxy Statement 37 |

Table of Contents

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

The following table sets forth compensation for our named executive officers in fiscal years 2017, 2016 and 2015:

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Stock Awards (1) ($) |

Non-Equity ($) |

All Other Compensation (3) ($) |

Total ($) |

|||||||||||||||||||||

| Kevin J. ODonnell President and Chief Executive Officer |

|

2017 2016 2015 |

|

|

1,060,000 1,038,750 975,000 |

|

|

|

|

|

4,097,516 3,305,017 3,746,594 |

|

|

1,346,730 2,536,050 2,553,540 |

|

|

1,305,806 670,391 578,701 |

|

|

7,810,052 (4) 7,550,208 7,853,835 |

|

|||||||

|

Robert Qutub (5) Executive Vice President and Chief Financial Officer |

|

2017 2016 |

|

|

575,000 229,167 |

|

|

|

|

|

1,290,914 |

|

|

487,025 515,424 |

|

|

338,630 159,373 |

|

|

2,691,569 903,964 |

|

|||||||

|

Ross A. Curtis Senior Vice President and Group Chief Underwriting Officer |

|

2017 2016 2015 |

|

|

625,000 606,250 550,000 |

|

|

|

|

|

1,660,492 1,398,805 1,535,720 |

|

|

529,375 996,875 1,003,750 |

|

|

173,571 112,492 167,290 |

|

|

2,988,438 3,114,422 3,256,760 |

|

|||||||

|

Ian D. Branagan (6) Senior Vice President and Group Chief Risk Officer |

|

2017 2016 2015 |

|

|

496,839 451,733 464,160 |

|

|

|

|

|

1,377,311 1,127,110 1,326,330 |

|

|

458,091 865,019 839,530 |

|

|

350,985 124,576 121,805 |

|

|

2,683,226 (4) 2,568,438 2,751,825 |

|

|||||||

|

Stephen H. Weinstein Senior Vice President, Group General Counsel, Corporate Secretary and Chief Compliance Officer |

|

2017 2016 2015 |

|

|

501,000 491,625 463,500 |

|

|

|

|

|

1,382,131 1,374,686 1,294,187 |

|

|

424,347 799,095 804,610 |

|

|

745,997 411,913 431,519 |

|

|

3,053,475 (4) 3,077,319 2,993,816 |

|

|||||||

| (1) | The amounts shown in this column represent the aggregate grant date fair value of time-vested restricted shares and performance shares granted to our named executive officers in the applicable fiscal year, computed in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures. The assumptions made in the valuation of stock awards are discussed in Note 17 (Stock Incentive Compensation and Employee Benefit Plans) of our 2017 Form 10-K. These values do not represent the actual value the recipient will or has received from the award. The terms of our time-vested restricted shares and performance shares are discussed above under Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramLong-Term Equity-Based Incentives and the maximum value as of the grant date of performance share awards made in 2017 is included in the Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table below. |

| (2) | The amounts shown in this column represent the actual amounts of the performance-based annual incentive bonuses paid to each named executive officer for the applicable fiscal year. The details of the payment of the performance-based annual incentive bonuses are discussed above under Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramPerformance-Based Annual Incentive Bonus. |

| (3) | See the All Other Compensation Table below for information on the amounts included in the All Other Compensation column for 2017. |

| (4) | The total compensation reported for Messrs. ODonnell, Branagan and Weinstein for 2017 would be less than the totals for 2016 and 2015 if the amount in the All Other Compensation column representing prepayment of the severance benefit, further described in footnote 5 to the All Other Compensation Table below, were excluded. For additional information, please see the discussion below under Compensation Discussion and AnalysisSection 457APayment of Vested Non-Compete Consideration. |

| (5) | Mr. Qutub has served as our Executive Vice President and Chief Financial Officer since August 8, 2016. |

| (6) | Payments made to Mr. Branagan in pounds sterling have been converted into U.S. dollars at the average daily exchange rate of 1.29, 1.36 and 1.53 for the years ended December 31, 2017, 2016 and 2015, respectively. |

|

Proxy Statement 39 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

The following table sets forth information regarding the amounts included in the All Other Compensation column of the Summary Compensation Table for 2017:

| Name | Company 401(k)/Pension Matching ($) |

Value of Life ($) |

Personal ($) |

Housing Benefits (4) ($) |

Pre-paid Non-Compete |

Other ($) |

Total Other ($) |

|||||||||||||||||||||

| Kevin J. ODonnell |

16,200 | 5,808 | 94,943 | 474,325 | 625,000 | 89,530 | 1,305,806 | |||||||||||||||||||||

| Robert Qutub |

16,200 | 2,062 | 65,082 | 192,292 | | 62,994 | 338,630 | |||||||||||||||||||||

| Ross A. Curtis |

16,200 | 5,808 | 130,588 | | | 20,975 | 173,571 | |||||||||||||||||||||

| Ian D. Branagan |

34,678 | 6,553 | | | 303,740 | 6,014 | 350,985 | |||||||||||||||||||||

| Stephen H. Weinstein |

16,200 | 4,763 | 127,463 | 213,325 | 362,000 | 22,246 | 745,997 | |||||||||||||||||||||

| (1) | This column reports Company matching contributions to our named executive officers under our 401(k) plan for Messrs. ODonnell, Qutub and Weinstein, the National Pension Scheme and International Savings Plan for Mr. Curtis and the Renaissance Syndicate Management Plan for Mr. Branagan. |

| (2) | This column reports the value of premiums paid on behalf of our named executive officers with respect to life insurance coverage. The death benefit under the life insurance coverage is equal to four times the named executive officers annual salary up to a maximum of $2.0 million for Bermuda-based employees and ten times the named executive officers annual salary for U.K.-based employees. |

| (3) | Personal travel includes costs for commercial travel for the named executive officer and his immediate family members during 2017 as well as personal use of the corporate aircraft. For more information on travel benefits provided to our named executive officers, please see Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramOther Benefits and Perquisites above. |

| (4) | This column reports the value of housing benefits for Messrs. ODonnell, Qutub and Weinstein. |

| (5) | The amounts in this column represent prepayments of the severance benefits to which Messrs. ODonnell, Branagan and Weinstein are entitled pursuant to their employment agreements as a result of an amendment made to each of their employment agreements in 2008, following the enactment of Section 457A of the Code, to comply with Section 457A while preserving the economics agreed to in their original employment agreements. The amounts do not represent extra-contractual or additional payments not otherwise due. Each amount is equal to a portion of the non-compete consideration to which the executive would become entitled upon a future termination of employment in respect of his salary as of December 31, 2008, and the amount of non-compete consideration to which the executive would become entitled upon a future termination would be reduced by this amount. In addition, each amount is subject to clawback in the event of a future termination for cause or a violation of the restrictive covenants contained in the executives employment agreement. For Mr. Branagan, the amount is converted into U.S. dollars at the average exchange rate of 1.29 for the year ended December 31, 2017. For additional information on the amounts disclosed in this column and Section 457A of the Code, please see the discussion below under Compensation Discussion and AnalysisSection 457APayment of Vested Non-Compete Consideration. |

| (6) | Other benefits include tax planning expenses for Messrs. ODonnell, Qutub, Curtis, Branagan and Weinstein, Company automobile expenses for Messrs. ODonnell, Qutub, Curtis and Weinstein; club dues for Messrs. ODonnell, Qutub, Curtis and Branagan, and Company matching on charitable donations for Messrs. ODonnell, Qutub, Curtis and Weinstein. Automobile expenses for Mr. Qutub were $39,773. |

| 40 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Grants of Plan-Based Awards Table

The following table sets forth information concerning grants of plan-based awards to the named executive officers during the calendar year ended December 31, 2017.

| Name |

Grant Date (1) |

Approval Date (1) |

Plan/ Award Type |

Estimated Possible Payouts Under Non- Equity Incentive Plan Awards (2) |

Estimated Future Payouts Under Equity Incentive Plan Awards (3)(4) |

All Other Stock Awards: Number of Shares of Stock or Units (4)(5) (#) |

Grant Date Fair Value of Stock and Option Awards (6) ($) |

|||||||||||||||||||||||||||||||||

| Threshold ($) |

Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) |

|||||||||||||||||||||||||||||||||||

| Kevin J. ODonnell |

3/1/2017 | 2/21/2017 | Performance Shares |

3,267 | 13,069 | 32,673 | 2,132,592 | |||||||||||||||||||||||||||||||||

| 3/1/2017 | 2/21/2017 | Time-Vested Restricted Shares |

13,069 | 1,964,924 | ||||||||||||||||||||||||||||||||||||

| 2/21/2017 | 2/21/2017 | Annual Cash Bonus |

685,025 | 1,749,000 | 3,498,000 | |||||||||||||||||||||||||||||||||||

| Robert Qutub |

3/1/2017 | 2/21/2017 | Time-Vested Restricted Shares |

729 | 2,918 | 7,295 | 476,167 | |||||||||||||||||||||||||||||||||

| 3/1/2017 | 2/21/2017 | Annual Cash Bonus |

5,419 | 814,747 | ||||||||||||||||||||||||||||||||||||

| 2/18/2016 | 2/21/2017 | Annual Cash Bonus |

247,729 | 632,500 | 1,265,000 | |||||||||||||||||||||||||||||||||||

| Ross A. Curtis |

3/1/2017 | 2/21/2017 | Performance Shares |

938 | 3,753 | 9,384 | 612,402 | |||||||||||||||||||||||||||||||||

| 3/1/2017 | 2/21/2017 | Time-Vested Restricted Shares |

6,971 | 1,048,090 | ||||||||||||||||||||||||||||||||||||

| 2/21/2017 | 2/21/2017 | Annual Cash Bonus |

269,271 | 687,500 | 1,375,000 | |||||||||||||||||||||||||||||||||||

| Ian D. Branagan |

3/1/2017 | 2/21/2017 | Performance Shares |

778 | 3,113 | 7,784 | 507,987 | |||||||||||||||||||||||||||||||||

| 3/1/2017 | 2/21/2017 | Time-Vested Restricted Shares |

5,782 | 869,324 | ||||||||||||||||||||||||||||||||||||

| 2/21/2017 | 2/21/2017 | Annual Cash Bonus |

233,012(7) | 594,924 | (7) | 1,189,848 | (7) | |||||||||||||||||||||||||||||||||

| Stephen H. Weinstein |

3/1/2017 | 2/21/2017 | Performance Shares |

781 | 3,124 | 7,811 | 509,800 | |||||||||||||||||||||||||||||||||

| 3/1/2017 | 2/21/2017 | Time-Vested Restricted Shares |

5,802 | 872,331 | ||||||||||||||||||||||||||||||||||||

| 2/21/2017 | 2/21/2017 | Annual Cash Bonus |

215,848 | 551,100 | 1,102,200 | |||||||||||||||||||||||||||||||||||

| (1) | On February 21, 2017, the Compensation Committee approved annual long-term equity-based incentive awards for our named executive officers pursuant to the 2016 LTI Plan. In accordance with our practice, these equity-based awards were granted on March 1, 2017. On February 21, 2017, the Compensation Committee set the terms of the performance-based annual incentive bonuses in respect of 2017 for each of our named executive officers. |

| (2) | The amounts reported in these columns represent estimated possible payouts of performance-based annual incentive bonuses in respect of 2017, assuming threshold achievement, target achievement and maximum achievement of the applicable performance metrics. These performance-based annual incentive bonuses were paid in March 2018 and the actual amounts paid to our named executive officers are included in the Summary Compensation Table in the Non-Equity Incentive Plan Compensation column. See Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramPerformance-Based Annual Incentive Bonus above for a detailed description of our performance-based annual incentive bonus program. |

|

Proxy Statement 41 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| (3) | The amounts reported in these columns represent awards of performance shares made pursuant to the 2016 LTI Plan that are scheduled to vest following the expiration of the service period on December 31, 2019 and the Compensation Committees determination of total shareholder return for a performance period. These columns represent the number of performance shares that vest at threshold achievement, target achievement and maximum achievement of the performance metrics applicable to such awards. At or below the threshold performance level, no shares will be paid out and there will be no payout greater than target if our absolute total shareholder return is negative. See Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramLong-Term Equity-Based Incentives above for a detailed description of the performance share program. |

| (4) | The number of time-vested restricted shares and target number of performance shares awarded were computed by dividing the approved grant value by the closing market price of our common shares on the date of grant of $150.35 per common share. See Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramLong-Term Equity-Based Incentives above for a detailed description of our equity grant practices. |

| (5) | The amounts reported in these columns represent awards of time-vested restricted shares made pursuant to the 2016 LTI Plan that are scheduled to vest in four equal annual installments beginning on March 1, 2018. Dividends are paid currently on time-vested restricted shares. |

| (6) | The amounts shown in this column represent the grant date fair value of time-vested restricted shares and performance shares granted to our named executive officers in the applicable fiscal year, computed in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures. The assumptions made in the valuation of stock awards are discussed in Note 17 (Stock Incentive Compensation and Employee Benefit Plans) of our 2017 Form 10-K. These values do not represent the actual value the recipient will or has received from the award. The terms of our time-vested restricted shares and performance shares are discussed above under Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramLong-Term Equity-Based Incentives and the maximum value as of the grant date of performance share awards made in 2017 is included in the Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table below. |

| (7) | Based on Mr. Branagans salary of £400,000, converted into U.S. dollars at the exchange rate of 1.35 as at December 31, 2017. |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table

| 42 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Option Exercises and Stock Vested Table

The following table sets forth information concerning option exercises by and the vesting of restricted shares and performance shares held by our named executive officers during 2017.

| Name | Number of Shares Acquired on Exercise (#) |

Value

Realized on Exercise (1) ($) |

Number of Shares Acquired on Vesting (#) |

Value

Realized on Vesting (2) ($) |

||||||||||||

| Kevin J. ODonnell |

49,559 | 4,677,874 | 43,620 | 6,239,920 | ||||||||||||

| Robert Qutub |

| | | | ||||||||||||

| Ross A. Curtis |

| | 20,725 | 2,899,205 | ||||||||||||

| Ian D. Branagan |

| | 14,465 | 2,089,388 | ||||||||||||

| Stephen H. Weinstein |

| | 13,152 | 1,894,171 | ||||||||||||

| (1) | The value realized on exercise is calculated by multiplying the number of common shares acquired on exercise by the difference between the closing price of our common shares on the date of exercise and the exercise price of the option. |

| (2) | The value realized on vesting is calculated by multiplying the number of common shares acquired on vesting by the closing price of our common shares on the vesting date. |

Outstanding Equity Awards at Fiscal Year-End Table

The following table sets forth the outstanding equity awards held by our named executive officers as of December 31, 2017:

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||||||||

| Name | Grant Date |

Number of Securities Underlying Unexercised Options Exercisable (#) |

Number of Securities Underlying Unexercised Options Unexercisable (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Stock That |

Market Value of Shares or Units of Stock That Have Not Vested (1) ($) |

Equity Incentive Plan Awards: Number of Unearned Shares That Have Not Vested (#) |

Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested (1) ($) |

|||||||||||||||||||||||||||||||||||

| Kevin J. ODonnell |

03/03/2014 (2) | 7,308 | 917,812 | |||||||||||||||||||||||||||||||||||||||||

| 02/27/2015 (3) | 13,373 | 1,679,515 | ||||||||||||||||||||||||||||||||||||||||||

| 01/12/2016 (4) | 9,799 | 1,230,656 | ||||||||||||||||||||||||||||||||||||||||||

| 05/16/2016 (5) | 840 | 105,496 | ||||||||||||||||||||||||||||||||||||||||||

| 03/01/2017 (6) | 13,069 | 1,641,336 | ||||||||||||||||||||||||||||||||||||||||||

| 02/27/2015 (7) | 497 | 62,418 | ||||||||||||||||||||||||||||||||||||||||||

| 01/12/2016 (8) | 7,001 | 879,256 | 1,089 | 136,768 | ||||||||||||||||||||||||||||||||||||||||

| 05/16/2016 (8) | 601 | 75,480 | 93 | 11,680 | ||||||||||||||||||||||||||||||||||||||||

| 03/01/2017 (9) | | | 2,178 | 273,535 | ||||||||||||||||||||||||||||||||||||||||

|

Robert Qutub |

|

03/01/2017 (6) |

|

|

5,419 |

|

|

680,572 |

|

|||||||||||||||||||||||||||||||||||

| 03/01/2017 (9) | | | 486 | 61,037 | ||||||||||||||||||||||||||||||||||||||||

|

Proxy Statement 43 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||||||||

| Name | Grant Date |

Number of Securities Underlying Unexercised Options Exercisable (#) |

Number of Securities Underlying Unexercised Options Unexercisable (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Stock That |

Market Value of Shares or Units of Stock That Have Not Vested (1) ($) |

Equity Incentive Plan Awards: Number of Unearned Shares That Have Not Vested (#) |

Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested (1) ($) |

|||||||||||||||||||||||||||||||||||

|

Ross D. Curtis |

|

03/03/2014 (2) |

|

|

2,287 |

|

|

287,224 |

|

|||||||||||||||||||||||||||||||||||

| 11/10/2014 (2) | 2,765 | 347,256 | ||||||||||||||||||||||||||||||||||||||||||

| 02/27/2015 (3) | 5,482 | 688,484 | ||||||||||||||||||||||||||||||||||||||||||

| 01/12/2016 (4) | 5,221 | 655,705 | ||||||||||||||||||||||||||||||||||||||||||

| 05/16/2016 (5) | 700 | 87,913 | ||||||||||||||||||||||||||||||||||||||||||

| 03/01/2017 (6) | 6,971 | 875,488 | ||||||||||||||||||||||||||||||||||||||||||

| 11/10/2014 (7) | 205 | 25,746 | ||||||||||||||||||||||||||||||||||||||||||

| 02/27/2015 (7) | 204 | 25,620 | ||||||||||||||||||||||||||||||||||||||||||

| 01/12/2016 (8) | 2,009 | 252,310 | 312 | 39,184 | ||||||||||||||||||||||||||||||||||||||||

| 05/16/2016 (8) | 270 | 33,909 | 42 | 5,275 | ||||||||||||||||||||||||||||||||||||||||

| 03/01/2017 (9) | | | 626 | 78,619 | ||||||||||||||||||||||||||||||||||||||||

|

Ian D. Branagan |

|

03/03/2014 (2) |

|

|

2,639 |

|

|

331,432 |

|

|||||||||||||||||||||||||||||||||||

| 02/27/2015 (3) | 4,734 | 594,543 | ||||||||||||||||||||||||||||||||||||||||||

| 01/12/2016 (4) | 4,282 | 537,776 | ||||||||||||||||||||||||||||||||||||||||||

| 05/16/2016 (5) | 489 | 61,414 | ||||||||||||||||||||||||||||||||||||||||||

| 03/01/2017 (6) | 5,782 | 726,161 | ||||||||||||||||||||||||||||||||||||||||||

| 02/27/2015 (7) | 176 | 22,104 | ||||||||||||||||||||||||||||||||||||||||||

| 01/12/2016 (8) | 1,647 | 206,847 | 256 | 32,151 | ||||||||||||||||||||||||||||||||||||||||

| 05/16/2016 (8) | 188 | 23,611 | 29 | 3,642 | ||||||||||||||||||||||||||||||||||||||||

| 03/01/2017 (9) | | | 519 | 65,181 | ||||||||||||||||||||||||||||||||||||||||

|

Stephen H. Weinstein |

|

03/03/2008 (10) |

|

|

31,165 |

|

|

|

|

|

53.86 |

|

|

03/03/2018 |

|

|||||||||||||||||||||||||||||

| 03/03/2014 (2) | 2,525 | 317,115 | ||||||||||||||||||||||||||||||||||||||||||

| 02/27/2015 (3) | 4,620 | 580,226 | ||||||||||||||||||||||||||||||||||||||||||

| 01/12/2016 (4) | 4,400 | 552,596 | ||||||||||||||||||||||||||||||||||||||||||

| 05/16/2016 (5) | 1,422 | 178,589 | ||||||||||||||||||||||||||||||||||||||||||

| 03/01/2017 (6) | 5,802 | 728,673 | ||||||||||||||||||||||||||||||||||||||||||

| 02/27/2015 (7) | 171 | 21,476 | ||||||||||||||||||||||||||||||||||||||||||

| 01/12/2016 (8) | 1,693 | 212,624 | 263 | 33,030 | ||||||||||||||||||||||||||||||||||||||||

| 05/16/2016 (8) | 547 | 68,698 | 85 | 10,675 | ||||||||||||||||||||||||||||||||||||||||

| 03/01/2017 (9) | | | 521 | 65,432 | ||||||||||||||||||||||||||||||||||||||||

| (1) | These amounts were determined based on the closing price of our common shares of $125.59 on December 29, 2017. |

| (2) | Unvested portion remaining from an award of time-vested restricted shares granted under the RenaissanceRe Holdings Ltd. 2001 Stock Incentive Plan (the 2001 Plan) that vests in four substantially equal annual installments beginning on the anniversary of the date of grant. |

| (3) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2001 Plan that vests in four substantially equal installments on March 1, 2016, 2017, 2018 and 2019. |

| (4) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2001 Plan that vests in four substantially equal installments on March 1, 2017, 2018, 2019 and 2020. |

| (5) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2016 LTI Plan that vests in four substantially equal installments on March 1, 2017, 2018, 2019 and 2020. |

| (6) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2016 LTI Plan that vests in four substantially equal installments on March 1, 2018, 2019, 2020 and 2021. |

| 44 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| (7) | Performance shares granted under the RenaissanceRe Holdings Ltd. 2010 Performance Share Plan (the Performance Share Plan) and earned in three substantially equal annual installments based upon total shareholder return relative to our performance share peer group during each calendar year performance period (2015, 2016 and 2017). The performance shares vested following the completion of the service period on December 31, 2017 and the Compensation Committees determination of total shareholder return for the applicable performance period (resulting in vesting dates of December 31, 2017 with respect to the 2015 and 2016 performance periods and February 7, 2018 with respect to the 2017 performance period). Because all performance periods are complete, the number of shares earned are reported in the Number of Shares or Units of Stock That Have Not Vested column based on the actual total shareholder return for purposes of performance share awards during the performance periods as follows: for 2015, total shareholder return of 16.7% resulted in the executive earning 168.2% of the target performance shares for 2015; for 2016, total shareholder return of 19.8% resulted in the executive earning 130.0% of the target performance shares for 2016; and for 2017, total shareholder return of negative 3.7% resulted in the executive earning 16.7% of the target performance shares for 2017. |

| (8) | Performance shares granted under the 2001 Plan or 2016 LTI Plan which vest at the end of the service period on December 31, 2018 and following the Compensation Committees determination of total shareholder return for each calendar year performance period. Performance shares are earned in three substantially equal annual installments based upon total shareholder return relative to our performance share peer group during each calendar year performance period (2016, 2017 and 2018). Because the 2016 and 2017 performance periods are complete, the number of shares earned are reported in the Number of Shares or Units of Stock That Have Not Vested column based on the actual total shareholder return for purposes of performance share awards during the performance periods as follows: for 2016, total shareholder return of 19.8% resulted in the executive earning 160.6% of the target performance shares for 2016; and for 2017, total shareholder return of negative 3.7% resulted in the executive earning 0.0% of the target performance shares for 2017. As a result of our below-target performance for the 2017 performance period, in accordance with SEC rules, the number of unearned performance shares related to the 2018 performance period are reported in the Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested column based on achieving the threshold number of performance shares (25% of target) that may be earned for the performance period. |

| (9) | Performance shares granted under the 2016 LTI Plan which vest at the end of the service period on December 31, 2019 and following the Compensation Committees determination of total shareholder return for each calendar year performance period. Performance shares are earned in three substantially equal annual installments based upon total shareholder return relative to our performance share peer group during each calendar year performance period (2017, 2018 and 2019). Because the 2017 performance period is complete, the number of shares earned is reported in the Number of Shares or Units of Stock That Have Not Vested column based on the actual total shareholder return for purposes of performance share awards during the performance period as follows: for 2017, total shareholder return of negative 3.7% resulted in the executive earning 0.0% of the target performance shares with respect to 2017. As a result of our below-target performance for the 2017 performance period, in accordance with SEC rules, the number of unearned performance shares related to the 2018 and 2019 performance periods are reported in the Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested column based on achieving the threshold number of performance shares (25% of target) that may be earned for the performance period. |

| (10) | All options were granted under our 2001 Plan. Each option award had a 10-year term and vested in four substantially equal annual installments beginning on the anniversary of the date of grant. |

|

Proxy Statement 45 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Equity Compensation Plan Information

The information set forth in the table below is as of December 31, 2017:

| Plan Category |

Number of securities to (a) |

Weighted-average (b) |

Number of securities (c) |

|||||||||

| Equity compensation plans approved by shareholders (2) |

32,001 | $ | 53.86 | 1,762,125 | ||||||||

| Equity compensation plans not approved by shareholders |

| | | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

32,001 | $ | 53.86 | 1,762,125 | ||||||||

| (1) | As of December 31, 2017, there were options outstanding to purchase a total of 32,001 common shares, which represent 0.1% of the number of common shares outstanding. A total of 520,836 unvested restricted shares (including both time-vested restricted shares and performance shares) were excluded from column (a) as those shares are considered issued at the time of grant. Unvested restricted shares were also excluded from column (c) as they are no longer available for future issuance. |

| (2) | Plans previously approved by the shareholders include the 2001 Plan, the Performance Share Plan and the 2016 LTI Plan. The 2001 Plan expired in February 2016 and no further awards will be made under the 2001 Plan. The Performance Share Plan was terminated as of May 16, 2016 and no further awards will be made under the Performance Share Plan. |

Potential Payments Upon Termination or Change in Control

| 46 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Components of Severance Benefits

| By Us Without Cause |

By Executive for Good Reason |

Death (1) | Disability | By Executive Without Good Reason (2) |

Our Non- Extension of Agreement |

Executives Non- Extension of Agreement (2) |

||||||||

| (i) Percent of Salary |

x | x | x | x | x | x | ||||||||

| (ii) Percent of Bonus |

x | x | x | |||||||||||

| (iii) Lump Sum Percent of Salary |

x | x | x | x | x | x | ||||||||

| (iv) Lump Sum Percent of Bonus |

x | x | x | |||||||||||

| (v) Pro rata Bonus |

x | x | x | x | x | |||||||||

| (vi) Continuation of Benefits |

x | x | x | x | x | x | ||||||||

| (vii) Vesting of Awards |

x (3) | x (3) | x | x | x (3) |

| (1) | In addition to the benefits above and as noted in the Summary Compensation Table above, we pay premiums on behalf of our named executive officers with respect to life insurance coverage under our health and benefits plans. The death benefit equals four times the named executive officers annual salary up to a maximum of $2.0 million for Bermuda-based employees and ten times the named executive officers annual salary for U.K.-based employees. |

| (2) | With respect to Messrs. Qutub and Curtis, these benefits will be provided only to the extent we elect to extend the non-competition covenant for up to 12 months beyond the termination date. |

| (3) | Accelerated vesting applies to all time-vested awards. See Treatment of Equity Awards Upon a Termination of Employment or Change in Control below for a discussion relating to the accelerated vesting of performance-based awards. |

|

Proxy Statement 47 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| Death; Disability; By Us Without Cause; By Executive for Good Reason; Retirement (1) |

Change in Control | |||

| Shares as to which the Performance Period Has Ended | ||||

| Performance Shares under Performance Share Plan and 2001 Plan |

Full vesting and waiver of remaining service condition | Full vesting and waiver of remaining service condition | ||

| Performance Shares under 2016 LTI Plan |

Full vesting and waiver of remaining service condition | Remain outstanding until the completion of the remaining service period, subject to acceleration upon a qualifying termination within two years following the change in control | ||

| Shares Remaining Subject to Performance Vesting | ||||

| Performance Shares under Performance Share Plan and 2001 Plan |

Remain outstanding until the completion of the performance period and vest based on the actual level of the attainment of the applicable performance goals | Immediate full vesting assuming target performance or, if greater, based on pro forma performance over the entire performance period extrapolated from the performance run rate through the end of the fiscal year preceding the change in control | ||

| Performance Shares under 2016 LTI Plan |

Remain outstanding until the completion of the performance period, and vest based on the actual level of the attainment of the applicable performance goals | Remain outstanding until the completion of the performance and service periods, subject to acceleration upon a qualifying termination within two years following the change in control, and vest based on the actual level of the attainment of the applicable performance goals |

| (1) | A termination by the executive without good reason will qualify as a retirement if the executives employment is terminated by the executive following the later of the date on which (i) the sum of the executives age and years of service with the Company equals 65 and (ii) the executive has first completed five years of service with the Company. |

| 48 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| Name | Benefit | Before Change in Control Termination without Cause or for Good Reason or Non-Extension by the Company ($) |

After Change in Control Termination without Cause or for Good Reason or Non- Extension by the Company ($) |

Non- Extension |

Executive without |

Death ($) |

Disability ($) |

Change

in Control without Termination (1) ($) |

||||||||||||||||||||||

| Kevin J. ODonnell |

||||||||||||||||||||||||||||||

| Salary (2) | 1,120,000 | 1,120,000 | | | | 1,120,000 | | |||||||||||||||||||||||

| Bonus | 5,247,000 | 5,247,000 | 1,749,000 | | 1,749,000 | 1,749,000 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 8,279,086 | 8,279,086 | | | 8,279,086 | 8,279,086 | 5,315,834 | |||||||||||||||||||||||

| Life Insurance | | | | | 2,000,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 37,174 | 37,174 | 24,783 | 24,783 | | 24,783 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 14,683,260 | 14,683,260 | 1,773,783 | 24,783 | 12,028,086 | 11,172,869 | 5,315,834 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Robert Qutub |

||||||||||||||||||||||||||||||

| Salary (2) | 575,000 | 1,150,000 | 575,000 | 575,000 | | 575,000 | | |||||||||||||||||||||||

| Bonus | 1,265,000 | 1,897,500 | 632,500 | | 632,500 | 632,500 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 924,845 | 924,845 | | | 924,845 | 924,845 | | |||||||||||||||||||||||

| Life Insurance | | | | | 710,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 24,783 | 24,783 | 24,783 | 24,783 | 24,783 | | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 2,789,628 | 3,997,128 | 1,232,283 | 599,783 | 2,267,345 | 2,157,128 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Ross A. Curtis |

||||||||||||||||||||||||||||||

| Salary (2) | 625,000 | 1,250,000 | 625,000 | 625,000 | | 625,000 | | |||||||||||||||||||||||

| Bonus | 1,375,000 | 2,062,500 | 687,500 | | 687,500 | 687,500 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 3,771,441 | 3,771,441 | | | 3,771,441 | 3,771,441 | 2,438,956 | |||||||||||||||||||||||

| Life Insurance | | | | | 2,000,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 24,783 | 24,783 | 24,783 | 24,783 | | 24,783 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 5,796,224 | 7,108,724 | 1,337,283 | 649,783 | 6,458,941 | 5,108,724 | 2,438,956 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Ian D. Branagan |

||||||||||||||||||||||||||||||

| Salary (2) | 78,880 | 619,720 | 78,880 | 78,880 | | 78,880 | | |||||||||||||||||||||||

| Bonus | 1,189,848 | 1,784,772 | 594,924 | | 594,924 | 594,924 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 2,907,627 | 2,907,627 | | | 2,907,627 | 2,907,627 | 1,821,160 | |||||||||||||||||||||||

| Life Insurance | | | | | 5,408,400 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 7,318 | 7,318 | 7,318 | 7,318 | | 7,318 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 4,183,673 | 5,319,437 | 681,122 | 86,198 | 8,910,951 | 3,588,749 | 1,821,160 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Stephen H. Weinstein |

||||||||||||||||||||||||||||||

| Salary (2) | | 501,000 | | | | | | |||||||||||||||||||||||

| Bonus | 1,102,200 | 1,653,300 | 551,100 | | 551,100 | 551,100 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 3,096,309 | 3,096,309 | | | 3,096,309 | 3,096,309 | 1,816,089 | |||||||||||||||||||||||

| Life Insurance | | | | | 2,000,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 24,783 | 24,783 | 24,783 | 24,783 | | 24,783 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 4,223,292 | 5,275,392 | 575,883 | 24,783 | 5,647,409 | 3,672,192 | 1,816,089 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||