DEF 14A: Definitive proxy statements

Published on April 2, 2019

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| ☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

RENAISSANCERE HOLDINGS LTD.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| ☑ | No fee required. | |

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

| (1) Title of each class of securities to which the transaction applies:

|

||

| (2) Aggregate number of securities to which the transaction applies:

|

||

| (3) Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

||

| (4) Proposed maximum aggregate value of the transaction:

|

||

|

(5) Total fee paid:

|

||

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

| (1) Amount Previously Paid:

|

||

| (2) Form, Schedule or Registration Statement No.:

|

||

| (3) Filing Party:

|

||

| (4) Date Filed: |

||

|

|

||

Table of Contents

LETTER TO OUR SHAREHOLDERS

In 2018, we celebrated the 25th anniversary of RenaissanceRe Holdings Ltd.s founding, and continued to work diligently towards developing new ways of creating value for clients, brokers and shareholders, while aligning these efforts with long-term shareholder value and responsible risk management. Our results in 2018 benefited from solid underwriting, smart portfolio construction and decades of experience.

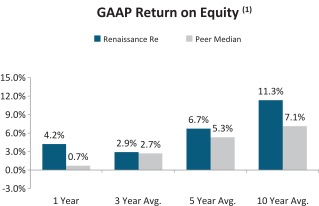

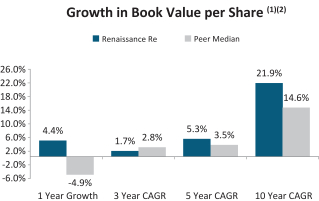

In another active year for natural catastrophes around the world, our strong financial performance was the result of solid execution, continued investment in strategic imperatives and the application of our gross-to-net strategy and integrated system. Despite the severe industrywide catastrophic losses, in 2018 our book value per common share increased by 4.4%, our tangible book value per common share plus change in accumulated dividends increased by 6.4%, our return on average common equity was 4.7% and our operating return on average common equity was 8.8%. In addition, we reported an operating profit for every quarter of 2018. We were gratified to see that the investments we have made over time to deploy new and enhanced risk management tools and execute our gross-to-net strategy bore fruit in 2018, benefiting shareholders and business partners alike.

One of our most significant strategic achievements for 2018 was our agreement to acquire Tokio Marines reinsurance business, Tokio Millennium Re. The transaction accelerates our strategy and enhances our global reinsurance leadership, product offerings and access to attractive risk. Taken together with our organic growth initiatives, we have more resources, broader capabilities and a larger global footprint than ever before. Our entire team, including the colleagues we have just welcomed to the RenaissanceRe organization, is committed to delivering the best underwriting and risk management solutions in the business while delivering superior long-term shareholder returns.

Over the previous five years, we more than doubled our gross premiums written, while growing shareholders equity by approximately 30% and holding the sum of operational and corporate expenses approximately flat. We have achieved this by working diligently on your behalf to increase the operating efficiency of our business to what we believe to be industry leading levels, while executing our strategy across our platforms. We plan to continue to focus on enhancing our operational and capital leverage as we integrate Tokio Millennium Re and pursue our organic growth initiatives.

We believe the compensation realized by our executives with respect to 2018 reflects our pay-for-performance philosophy and our goal of designing competitive and fair compensation packages that align the interests of our executives and employees with those of our shareholders. We are proud of our ability to consistently demonstrate that we are good stewards of our shareholders capital.

Thank you for your continued support.

April 2, 2019

| Sincerely,

James L. Gibbons Non-Executive Chair of the Board of Directors |

Kevin J. ODonnell President and Chief Executive Officer |

Table of Contents

| RenaissanceRe Holdings Ltd. Renaissance House 12 Crow Lane Pembroke HM 19, Bermuda Phone +1 (441) 295-4513 www.renre.com |

|

NOTICE OF ANNUAL GENERAL

MEETING OF SHAREHOLDERS

| Meeting Agenda:

|

||||||||

| Date:

Time:

Place:

Record Date: |

Wednesday, May 15, 2019

8:30 a.m. Atlantic Time

Renaissance House 12 Crow Lane Pembroke HM 19 Bermuda

March 13, 2019 |

◾ Elect four Class III director nominees

◾ Advisory vote on executive compensation

◾ Approve the appointment of our independent registered public accounting firm for fiscal 2019 and the referral of the auditors remuneration to the Board of Directors

◾ Any other business that properly comes before the meeting

|

||||||

|

|

|

|

|

|||||

|

Please Vote Your Shares |

By Telephone |

By Internet |

By Mail |

By Tablet or Smartphone |

||||

| We encourage shareholders to vote promptly, as this will save the expense of additional proxy solicitation. You may vote in the following ways: | In the United States or Canada you can vote your shares by calling 1-800-690-6903. | You can vote your shares online at www.proxyvote.com. You will need the 12-digit control number on the Notice of Internet Availability or proxy card.

|

You can vote by mail by marking, dating and signing your proxy card or voting instruction form and returning it in the postage-paid envelope provided.

|

You can vote your shares online with your tablet or smartphone by scanning the QR code above. | ||||

| Important Notice of Internet Availability of Proxy Materials

This Notice of Annual General Meeting of Shareholders and related proxy materials are being distributed or made available to shareholders beginning on or about April 2, 2019. This includes instructions on how to access these materials (including our proxy statement and 2018 annual report to shareholders) online.

|

By Order of the Board of Directors,

Stephen H. Weinstein Corporate Secretary |

Table of Contents

| TABLE OF CONTENTS |

Table of Contents

| PROXY SUMMARY |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider and you should read the entire proxy statement carefully before voting.

2019 Annual General Meeting of Shareholders

| Date and Time May 15, 2019, 8:30 a.m. Atlantic Time |

Place Renaissance House, 12 Crow Lane, Pembroke HM 19, Bermuda |

|

|

Record Date March 13, 2019 |

Voting Eligibility Owners of our common shares as of the record date are entitled to vote on all matters |

Voting Items and Board Recommendations

| Item | Proposal | Board Vote Recommendation |

Page Reference (for more detail) |

|||

| 1. | Election of four Class III director nominees | FOR each nominee |

7 | |||

| 2. | Advisory vote on the compensation of our named executive officers | FOR | 53 | |||

| 3. | Approval of the appointment of Ernst & Young Ltd. as our independent registered public accounting firm for the 2019 fiscal year and the referral of the auditors remuneration to the Board of Directors | FOR | 58 | |||

Corporate Governance Highlights

The Board is elected by the shareholders to oversee management and to assure that the long-term interests of the shareholders are being served.

|

|

Proxy Statement 1 |

Table of Contents

| PROXY SUMMARYCONTINUED |

Strategic, Financial and Operational Highlights

| 1 | Operating income available to RenaissanceRe common shareholders, operating return on average common equity, and tangible book value per common share plus accumulated dividends are non-GAAP financial measures. A reconciliation of non-GAAP financial measures is included in Appendix A to this proxy statement. |

| 2 |

|

Proxy Statement |

Table of Contents

| PROXY SUMMARYCONTINUED |

Compensation Highlights

Advisory Vote on Compensation; Shareholder Engagement

|

|

Proxy Statement 3 |

Table of Contents

Table of Contents

| GENERAL INFORMATIONCONTINUED |

The following table summarizes the voting options, vote required for approval and effect of abstentions and broker non-votes for each proposal to be considered at the Annual Meeting:

| Proposal | Board Recommendation |

Voting Options |

Voting Approval Standard |

Effect of Abstentions |

Broker Discretionary Voting Allowed? |

Effect of Broker Non-Votes |

||||||

| Election of four Class III director nominees | FOR each nominee | FOR, AGAINST or ABSTAIN for each director nominee | The number of votes cast FOR that directors election exceeds the number of votes cast AGAINST that directors election as a director at the Annual Meeting | No effect | No | No effect | ||||||

| Advisory vote on the compensation of our named executive officers | FOR | FOR, AGAINST or ABSTAIN | Majority of the votes cast at the Annual Meeting | No effect | No | No effect | ||||||

| Approval of the appointment of Ernst & Young Ltd. as our independent registered public accounting firm for the 2019 fiscal year and the referral of the auditors remuneration to the Board | FOR | FOR, AGAINST or ABSTAIN | Majority of the votes cast at the Annual Meeting | No effect | Yes | Not applicable |

|

|

Proxy Statement 5 |

Table of Contents

| GENERAL INFORMATIONCONTINUED |

| 6 |

|

Proxy Statement |

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORS |

PROPOSAL 1: ELECTION OF DIRECTORS

Director Nominees

Class III Director Nominees (whose terms, if elected, expire in 2022)

| Henry Klehm III Age: 60 Director Since: 2006 Chair of the Compensation and Corporate Governance Committee |

Mr. Klehm has been a partner at the law firm Jones Day since 2008 and has been the Practice Leader of the firms Securities Litigation and SEC Enforcement Practice since January 2017. From 2002 to 2007, Mr. Klehm served as Global Head of Compliance for Deutsche Bank, AG. Prior to joining Deutsche Bank, AG, Mr. Klehm served as Chief Regulatory Officer and Deputy General Counsel at Prudential Financial from 1999 to 2002. Prior to joining Prudential, Mr. Klehm served in various positions with the SEC, including as Senior Associate Director of the Northeast Regional Office. |

|

| Valerie Rahmani Age: 61 Director Since: 2017 Member of the Audit Committee |

Dr. Rahmani has served as the part-time head of the Innovation Panel at Standard Life Aberdeen plc, a UK-based Financial Times Stock Exchange (FTSE) 100 global investment company, since 2017. She has more than 30 years of experience in the technology industry, including more than 25 years at IBM serving in roles of increasing seniority across multiple global business segments from 1981 to 2009, most recently as General Manager of Internet Security Systems. Subsequent to her tenure at IBM, Dr. Rahmani was Chief Executive Officer at Damballa, Inc., a privately held Internet security software company, from 2009 to 2012. She has served on the Board of Directors of Computer Task Group, Incorporated, a publicly traded information technology solutions and software company, since 2015, where she currently serves as Chair of the Compensation Committee and as a member of the Audit Committee and the Nominating and Corporate Governance Committee. In 2017, she joined the Board of the London Stock Exchange, where she is a member of the Risk Committee and the Remuneration Committee. Dr. Rahmani also served on the board of Aberdeen Asset Management PLC, a UK-based FTSE 250 global investment management group, from 2015 to 2017. |

|

|

|

Proxy Statement 7 |

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORSCONTINUED |

| Carol P. Sanders Age: 52 Director Since: 2016 Member of the Audit Committee |

Ms. Sanders has served as the President of Carol P. Sanders Consulting, LLC, providing consulting services to the insurance and technology industries, since June 2015. From June 2013 until June 2015, she served as Executive Vice President, Chief Financial Officer and Treasurer of Sentry Insurance a Mutual Company. Previously she served as the Executive Vice President and Chief Operating Officer of Jewelers Mutual Insurance Company from November 2012 until June 2013, where she also served as Senior Vice President, Chief Financial Officer and Treasurer from May 2011 until November 2012 and as Chief Financial Officer and Treasurer from 2004 until May 2011, after holding a series of positions of increasing responsibility in finance, accounting, treasury and tax. Ms. Sanders has served on the Board of Directors of Alliant Energy Corporation, a publicly traded public utility holding company, since 2005, where she currently serves as Chair of the Audit Committee and serves as a member of the Nominating and Governance Committee and the Executive Committee. In 2016, she joined the Board of Directors of First Business Financial Services, Inc., a publicly traded registered bank holding company, where she is Chair of the Audit Committee. |

|

| Cynthia Trudell Age: 65 Director Nominee |

From 2011 until her retirement in September 2017, Ms. Trudell served as Executive Vice President and Chief Human Resources Officer of PepsiCo, Inc. (PepsiCo). From 2007 through 2011, she served as Senior Vice President and Chief Personnel Officer of PepsiCo. Prior to her tenure at PepsiCo, Ms. Trudell held a number of executive operating and general management positions with General Motors Corporation from 1981 to 2001, and Brunswick Corporation from 2001 to 2006, including chairwoman and president of Saturn Corporation, president of IBC Vehicles and president of Sea Ray Group. Since 2015, Ms. Trudell has served on the board of ISS A/S, a global facility services provider based in Denmark and publicly traded on the NASDAQ OMX Copenhagen, where she currently serves as a member of the Remuneration Committee and the Nomination Committee. Since 2013, she has served as a member of the Defense Business Board, which provides business advice to the U.S. Department of Defense. She also served on the boards of PepsiCo from 2000 to 2007, Canadian Imperial Bank of Commerce from 2005 to 2008 and The Pepsi Bottling Group, Inc. from 2008 to 2010. |

|

Recommendation and Vote

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF MR. KLEHM, DR. RAHMANI, MS. SANDERS AND MS. TRUDELL.

Continuing Directors

Class I Directors (whose terms expire in 2020)

| David C. Bushnell Age: 64 Director Since: 2008 Chair of the Audit Committee |

Mr. Bushnell has served as the principal of Bushnell Consulting, a financial services consulting firm, since 2008. Mr. Bushnell retired from Citigroup Inc. (Citigroup) in 2007, after 22 years of service. Mr. Bushnell served as the Senior Risk Officer of Citigroup from 2003 through 2007 and retired as Chief Administrative Officer in 2007. Following his retirement from Citigroup, Mr. Bushnell served as a consultant to Citigroup until December 31, 2008. Previously, Mr. Bushnell worked for Salomon Smith Barney Inc. (later acquired by Citigroup) and its predecessors in a variety of positions, including as a managing director and Chief Risk Officer. Mr. Bushnell served on the Board of Directors and as Chief Risk Officer of Cordia Bancorp Inc. (Cordia), a public bank holding company, and its wholly owned subsidiary, Bank of Virginia, from 2011 until Cordia was acquired in September 2016. |

|

| 8 |

|

Proxy Statement |

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORSCONTINUED |

| James L. Gibbons Age: 55 Director Since: 2008 Non-Executive Chair of the Board Member of the Transaction and Offerings Committees |

Mr. Gibbons, a Bermudian citizen, is Chairman of Harbour International Trust Company Limited and the Treasurer and a Director of Edmund Gibbons Limited (EGL). Mr. Gibbons also serves as a Director of Clarien Group Limited (Clarien), an international financial company. He was also Non-Executive President of Bermuda Air Conditioning Limited (BACL) through March 2019 and currently serves as a Director of BACL. From June 2013 to June 2016, Mr. Gibbons served as a member of the Board of Directors of Nordic American Tankers Limited, a publicly held company. Mr. Gibbons served as Chair of Capital G Bank Limited from 1999 to 2013 and as President and Chief Executive Officer of Capital G Limited from 1999 to 2010, prior to the change of name to Clarien from Capital G in 2014. |

|

| Jean D. Hamilton Age: 72 Director Since: 2005 Member of the Compensation and Corporate Governance Committee |

Ms. Hamilton is an independent consultant and private investor and a Member of Brock Capital Group LLC. Previously, she held various positions with Prudential Financial, Inc., including Executive Vice President, and was Chief Executive Officer of Prudential Institutional from 1998 through 2002. Prior to joining Prudential, she held several positions with The First National Bank of Chicago, including Senior Vice President and Head of the Northeastern Corporate Banking Department. She is currently a Trustee, a member of the Audit Committee and Deferred Compensation Committee, and Chair of the Board Valuation and Liquidity Committee, of First Eagle Funds and First Eagle Variable Funds. |

|

| Anthony M. Santomero Age: 72 Director Since: 2008 Chair of the Investment and Risk Management Committee |

Mr. Santomero served as Senior Advisor at McKinsey & Company from 2006 to 2008. From 2000 to 2006, Mr. Santomero was President and Chief Executive Officer of the Federal Reserve Bank of Philadelphia. Prior to joining the Federal Reserve, Mr. Santomero was the Richard K. Mellon Professor of Finance at the University of Pennsylvanias Wharton School and held various positions there, including Director of the Financial Institutions Center and Deputy Dean. Mr. Santomero serves on the Boards of Directors of Penn Mutual Life Insurance Company, Citigroup, Citibank, N.A. and Columbia Funds. Mr. Santomero currently serves as the Chair of the Risk Management Committee and a member of the Audit Committee and Executive Committee of Citigroup and Chairman of the Board of Directors of Citibank, N.A. In addition, Mr. Santomero served on the Board of Directors of B of A Fund Series Trust from 2008 until 2011. |

|

Class II Directors (whose terms expire in 2021)

| Brian G. J. Gray Age: 56 Director Since: 2013 Member of the Investment and Risk Management, Transaction and Offerings Committees |

From 2008 until his retirement in 2012, Mr. Gray served as Group Chief Underwriting Officer of Swiss Reinsurance Company Ltd. (Swiss Re) and was a member of Swiss Res Group Executive Committee. From 2005 through 2008, he was a member of the Group Executive Board, responsible for underwriting Property and Specialty Product Lines on a global basis for Swiss Re. Mr. Gray joined Swiss Re in Canada (Swiss Re Canada) in 1985, and served in a variety of roles, including President and Chief Executive Officer of Swiss Re Canada from 2001 to 2005 and Senior Vice President of Swiss Re Canada from 1997 to 2001. |

|

| Duncan P. Hennes Age: 62 Director Since: 2017 Member of the Compensation and Corporate Governance Committee |

Mr. Hennes has served as the Co-Founder and Managing Member of Atrevida Partners, LLC (Atrevida) since 2007. Prior to co-founding Atrevida, he served as Co-Founder and Partner of Promontory Financial Group from 1999 to 2006. Prior to that, Mr. Hennes served in a number of senior executive positions at Bankers Trust Corporation, including Executive Vice President in charge of Trading, Sales and Derivatives, and as the Chairman of the Board of Oversight Partners I, the consortium that took control of Long Term Capital Management, from 1987 to 1998. From 1998 to 1999 he was the Chief Executive Officer at Soros Fund Management, LLC. Mr. Hennes has served on the Boards of Directors of Citigroup and Citibank, N.A. since 2013, where he currently serves as the Chair of the Personnel and Compensation Committee and as a member of the Risk Management Committee and the Executive Committee. |

|

| Kevin J. ODonnell Age: 52 Director Since: 2013 Chair of the Transaction and Offerings Committees |

Mr. ODonnell has served as our Chief Executive Officer since July 2013 and as our President since November 2012. Mr. ODonnell previously served in a number of roles since joining the Company in 1996, including Global Chief Underwriting Officer, Executive Vice President, Senior Vice President, Vice President and Assistant Vice President. Mr. ODonnell also serves as the Chair of the Global Reinsurance Forum and served as the Chair of the Association of Bermuda Insurers and Reinsurers in 2017 and 2018. |

|

|

|

Proxy Statement 9 |

Table of Contents

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Board Leadership Structure

Role of the Non-Executive Chair of the Board

Board Role in Risk Oversight

|

|

Proxy Statement 11 |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Committees of the Board

| Audit Committee |

Compensation and Corporate Governance Committee |

Investment and Risk Management Committee |

Transaction Committee |

Offerings Committee |

||||||

| David C. Bushnell |

Chair | |||||||||

| James L. Gibbons |

x | x | ||||||||

| Brian G. J. Gray |

x | x | x | |||||||

| Jean D. Hamilton |

x | x | x | |||||||

| Duncan P. Hennes |

x | |||||||||

| Henry Klehm III |

Chair | |||||||||

| Kevin J. ODonnell |

Chair | Chair | ||||||||

| Valerie Rahmani |

x | |||||||||

| Carol P. Sanders |

x | |||||||||

| Anthony M. Santomero |

Chair | |||||||||

| Edward J. Zore |

x |

Audit Committee

| 12 |

|

Proxy Statement |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

|

|

Proxy Statement 13 |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

| 14 |

|

Proxy Statement |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

|

|

Proxy Statement 15 |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Meetings and Attendance

Compensation Committee Interlocks and Insider Participation

| 16 |

|

Proxy Statement |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Sustainability and Corporate Social Responsibility

|

|

Proxy Statement 17 |

Table of Contents

| CORPORATE GOVERNANCECONTINUED |

Code of Ethics

Communicating with the Board of Directors

| 18 |

|

Proxy Statement |

Table of Contents

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies and Procedures Dealing with the Review, Approval and Ratification of Transactions with Related Persons

Relationship with BlackRock, Inc.

Relationship with Colonial Group International

Use of Company Aircraft

Housing Arrangements with Executive Officers

|

|

Proxy Statement 19 |

Table of Contents

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSCONTINUED |

Charitable Donations

| 20 |

|

Proxy Statement |

Table of Contents

| DIRECTOR COMPENSATION |

Director Compensation Table

The following table sets forth information concerning compensation paid to each director who served on the Board during 2018, other than Mr. ODonnell, whose compensation as our President and Chief Executive Officer is set forth under Executive CompensationSummary Compensation Table below:

| Name | Fees Earned or Paid in Cash (1) |

Stock Awards (2) ($) |

Total ($) |

|||||||||

| David C. Bushnell |

120,000 | 139,892 | 259,892 | |||||||||

| James L. Gibbons |

170,000 | 289,967 | 459,967 | |||||||||

| Brian G. J. Gray |

90,000 | 139,892 | 229,892 | |||||||||

| Jean D. Hamilton |

90,000 | 139,892 | 229,892 | |||||||||

| Duncan P. Hennes |

90,000 | 139,892 | 229,892 | |||||||||

| Henry Klehm III |

120,000 | 139,892 | 259,892 | |||||||||

| Valerie Rahmani |

90,000 | 139,892 | 229,892 | |||||||||

| Carol P. Sanders |

90,000 | 139,892 | 229,892 | |||||||||

| Anthony M Santomero |

120,000 | 139,892 | 259,892 | |||||||||

| Edward J. Zore |

90,000 | 139,892 | 229,892 | |||||||||

| (1) | Amounts shown reflect annual retainer and annual committee chair retainer, as described below. |

| (2) | The amounts in this column represent the aggregate grant date fair value of time-vested restricted shares granted to our non-employee directors in 2018, computed in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718, excluding the effect of estimated forfeitures. The assumptions made in the valuation of stock awards are discussed in Note 16 (Stock Incentive Compensation and Employee Benefit Plans) of our Annual Report on Form 10-K for the year ended December 31, 2018 (the 2018 Form 10-K). These values do not represent the actual value the recipient will or has received from the award. On March 1, 2018, each of Messrs. Bushnell, Gray, Hennes, Klehm, Levy, Santomero and Zore, Mses. Hamilton and Sanders and Dr. Rahmani were awarded 1,099 restricted shares and Mr. Gibbons was awarded 2,278 restricted shares. All of the restricted shares awarded to our non-employee directors in 2018 will vest in three equal annual installments beginning on March 1, 2019. The aggregate number of stock awards outstanding as of December 31, 2018 for each director who served on the Board during 2018 was as follows: Mr. Gibbons: 4,189 restricted shares; Messrs. Bushnell, Gray, Klehm, Santomero and Zore and Ms. Hamilton: 2,127 restricted shares each; Ms. Sanders: 2,129 restricted shares; Mr. Hennes and Dr. Rahmani: 1,727 restricted shares each. |

Director Compensation Program

|

|

Proxy Statement 21 |

Table of Contents

| DIRECTOR COMPENSATIONCONTINUED |

Director Equity Ownership Policy; No Hedging or Pledging

| 22 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE OFFICERS |

| Kevin J. ODonnell Age: 52 President and Chief Executive Officer |

Mr. ODonnell has served as our Chief Executive Officer since July 2013 and as our President since November 2012. Mr. ODonnell previously served in a number of roles since joining the Company in 1996, including Global Chief Underwriting Officer, Executive Vice President, Senior Vice President, Vice President and Assistant Vice President. Mr. ODonnell also serves as the Chair of the Global Reinsurance Forum and served as the Chair of the Association of Bermuda Insurers and Reinsurers in 2017 and 2018. |

|

| Robert Qutub Age: 57 Executive Vice President and Chief Financial Officer |

Mr. Qutub has served as our Executive Vice President and Chief Financial Officer since August 2016. Prior to joining RenaissanceRe, Mr. Qutub served as Chief Financial Officer and Treasurer for MSCI Inc., a leading provider of portfolio construction and risk management tools and services for global investors, from July 2012 to May 2016. Prior to MSCI Inc., Mr. Qutub was with Bank of America from November 1994 to June 2012, where he held several segment Chief Financial Officer roles. He has served on the Board of Directors of USAA Federal Savings Bank since June 2014 and also served in the United States Marine Corps. |

|

| Ross A. Curtis Age: 46 Senior Vice President and Group Chief Underwriting Officer |

Mr. Curtis has served as our Senior Vice President and Group Chief Underwriting Officer since July 2014. Mr. Curtis has served in a number of roles since joining the Company in 1999 as a Catastrophe Reinsurance Analyst, including Chief Underwriting Officer of European Operations based in London, England from 2010 to 2014 and Senior Vice President of Renaissance Reinsurance Ltd. in Bermuda, primarily responsible for underwriting the international and retrocessional property catastrophe portfolios and assisting in the development of our specialty reinsurance lines, from 2006 to 2010. |

|

| Ian D. Branagan Age: 51 Senior Vice President and Group Chief Risk Officer |

Mr. Branagan has served as our Senior Vice President and Group Chief Risk Officer since 2009 and as the Head of Group Risk Modeling since 2005. Mr. Branagan joined the Company in 1998 to open our Dublin office, later relocating to Bermuda with additional responsibilities for underwriting risk and modeling across our (re)insurance operations. Mr. Branagan subsequently assumed the responsibility of managing risk globally and, in 2013, relocated to our London office. Prior to joining the Company, Mr. Branagan led the international activities of Applied Insurance Research Inc. (AIR), which included the development and marketing of AIRs catastrophe models and tools. |

|

| Stephen H. Weinstein Age: 50 Senior Vice President, Group General Counsel, Corporate Secretary and Chief Compliance Officer |

Mr. Weinstein has served as our Group General Counsel and Corporate Secretary since joining the Company in 2002, as Chief Compliance Officer since 2004 and Senior Vice President since 2005. From 2002, Mr. Weinstein also served as a Vice President. Prior to joining RenaissanceRe, Mr. Weinstein specialized in corporate law as an attorney at Willkie Farr & Gallagher LLP. |

|

| James C. Fraser Age: 43 Senior Vice President and Chief Accounting Officer |

Mr. Fraser has served as our Senior Vice President and Chief Accounting Officer since December 2016. He joined RenaissanceRe in 2009, and served as our Vice President and Head of Internal Audit from 2011 through 2016. Prior to joining the Company, Mr. Fraser worked in finance and risk management positions at XL Capital and Deloitte. Mr. Fraser is a Chartered Professional Accountant and a Certified Internal Auditor. |

|

|

|

Proxy Statement 23 |

Table of Contents

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 2 | Operating income available to RenaissanceRe common shareholders, operating return on average common equity, and tangible book value per common share plus accumulated dividends are non-GAAP financial measures. A reconciliation of non-GAAP financial measures is included in Appendix A to this proxy statement. |

|

|

Proxy Statement 25 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Highlights of Our Compensation Program

| 26 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

|

Proxy Statement 27 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| Source: | S&P Capital IQ. |

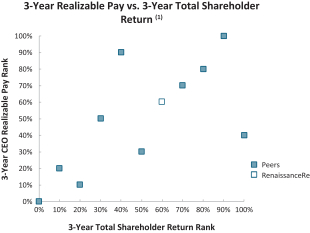

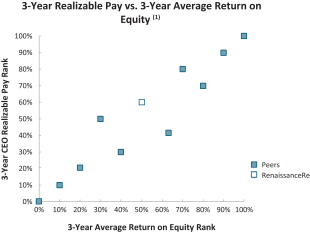

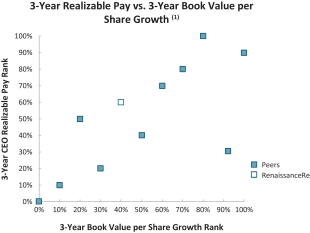

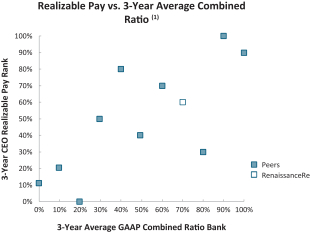

| (1) | The financial ratios used above are calculated using the closest GAAP financial measures to the financial metrics used in various components of our executive compensation program. 3-Year Realizable Pay is defined as the sum of: (i) base salary earned in each fiscal year, (ii) actual bonus payout for each fiscal year (including discretionary, sign-on and special bonuses), (iii) in-the-money value, at December 31, 2018, of all options granted during the three-year period, (iv) full value, at December 31, 2018, of all restricted shares/units granted during the three-year period and (v) full value, at December 31, 2018, of all performance shares/units granted during the three-year period (using the actual shares earned for completed performance cycles and the target number of shares for cycles that are ongoing). Time periods for pay are based on most recent available information (2015-2017 for peers and 2016-2018 for RenaissanceRe). Time periods for performance are based on most recent available information (2016-2018 for peers and RenaissanceRe, unless otherwise noted). For purposes of illustration, our current compensation peer group was used. |

| 28 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

|

Proxy Statement 29 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 30 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

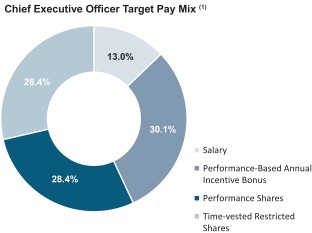

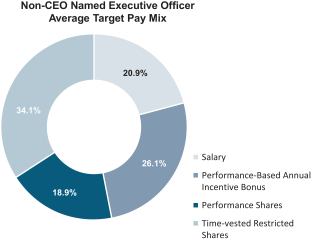

Principal Components of Our Executive

Compensation Program

| Compensation Component | Primary Purpose of Compensation Component |

Philosophy Behind Providing Compensation Component |

||

| Salary |

Provides a fixed component of compensation that reflects expertise and scope of responsibilities |

Provides a base component of total compensation

Provides objective, market-driven and competitive pay

Represents a relatively lower contribution to total compensation as responsibilities increase |

||

| Performance-Based Annual Incentive Bonus |

Provides at-risk pay that reflects annual corporate performance and performance against strategic accomplishments |

Promotes the achievement of financial and performance metrics important to shareholders

Reinforces the importance of pre-established strategic accomplishments and goals

Rewards team success |

||

| Long-Term Equity-Based Incentives (Performance Shares and Time-Vested Restricted Shares) |

Provides at-risk pay with a long-term focus, subject to both performance- and service-based vesting mechanics |

Aligns named executive officers and long-term shareholders interests

Reflects long-term performance

Retains talent through long-term wealth-creation opportunities

Holds executives to significant equity ownership requirements |

||

| Other Benefits and Perquisites |

Reflects the Bermuda location of our corporate headquarters and expatriate relocation needs as well as specific local market and competitive practices |

Encourages relocation of talented executives to our strategic Bermuda headquarters location

Provides a strong retention element |

||

|

|

Proxy Statement 31 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 32 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

|

Proxy Statement 33 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

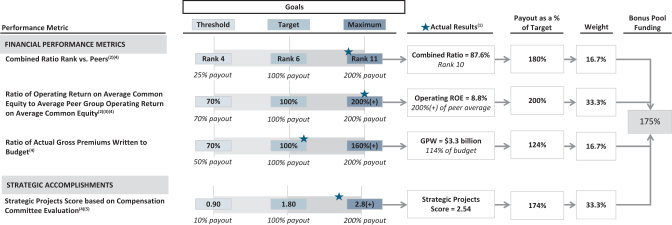

| (1) | For the year ended December 31, 2018, our actual combined ratio was 87.6%, our actual operating return on average common equity was 8.8% and our actual gross premiums written were $3.3 billion. |

| (2) | To calculate, we compared our performance to our compensation peer group for 2018, which is described above. |

| (3) | Operating return on average common equity is a non-GAAP financial measure. A reconciliation of non-GAAP financial measures is included in Appendix A to this proxy statement. |

| (4) | Actual payout between levels between threshold and target and target and maximum is determined by straight-line interpolation. |

| (5) | With input from management and in conjunction with the Boards annual review of our strategic plan, the Compensation Committee evaluates performance on the pre-established strategic accomplishments, resulting in a score between 0 and 3.0, which translates to a specific payout on the pre-established payout schedule. |

| 34 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| Name | Bonus Basis / Base Salary |

Target 2018 Bonus as a Percent of Bonus Basis |

Target 2018 Bonus |

Paid 2018 Bonus (1) |

Deferred Bonus (1) |

Total Actual 2018 Bonus (1) |

||||||||||||||||||

| Kevin J. ODonnell |

$ | 1,100,000 | 225% | $ | 2,475,000 | $ | 3,712,500 | $ | 618,750 | $ | 4,331,250 | |||||||||||||

| Robert Qutub |

$ | 635,000 | 125% | $ | 793,750 | $ | 1,190,625 | $ | 198,438 | $ | 1,389,063 | |||||||||||||

| Ross A. Curtis |

$ | 675,000 | 125% | $ | 843,750 | $ | 1,265,625 | $ | 210,938 | $ | 1,476,563 | |||||||||||||

| Ian D. Branagan (2) |

$ | 574,200 | 125% | $ | 717,750 | $ | 1,076,625 | $ | 179,438 | $ | 1,256,063 | |||||||||||||

| Stephen H. Weinstein |

$ | 525,000 | 125% | $ | 656,250 | $ | 984,375 | $ | 164,063 | $ | 1,148,438 | |||||||||||||

| (1) | Paid 2018 bonus represents the portion of the performance-based annual incentive bonus paid for 2018, equal to 150% of the target bonus. Deferred 2018 bonus represents the deferred portion of the performance-based annual incentive bonus for 2018, 0% to 150% of which may be earned based on achievement of goals related to the TMR acquisition. Total actual 2018 bonus represents the sum of paid 2018 bonus and deferred 2018 bonus, equal to 175% of the target 2018 bonus. |

| (2) | Mr. Branagans bonus basis is his salary of £450,000 converted into U.S. dollars at the exchange rate of 1.28 on December 31, 2018. |

|

|

Proxy Statement 35 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 36 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

|

Proxy Statement 37 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| 38 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

|

|

Proxy Statement 39 |

Table of Contents

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

The following table sets forth compensation for our named executive officers in fiscal years 2018, 2017 and 2016:

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Stock Awards (1) ($) |

Non-Equity ($) |

All Other Compensation (3) ($) |

Total ($) |

|||||||||||||||||||||

| Kevin J. ODonnell President and Chief Executive Officer |

|

2018 2017 2016 |

|

|

1,070,000 1,060,000 1,038,750 |

|

|

|

|

|

4,643,024 4,097,516 3,305,017 |

|

|

4,331,250 1,346,730 2,536,050 |

|

|

775,089 1,305,806 670,391 |

|

|

10,819,363 7,810,052 7,550,208 |

|

|||||||

|

Robert Qutub (4) Executive Vice President and Chief Financial Officer |

|

2018 2017 2016 |

|

|

610,000 575,000 229,167 |

|

|

|

|

|

1,491,254 1,290,914 |

|

|

1,389,063 487,025 515,424 |

|

|

472,633 338,630 159,373 |

|

|

3,962,950 2,691,569 903,964 |

|

|||||||

|

Ross A. Curtis Senior Vice President and Group Chief Underwriting Officer |

|

2018 2017 2016 |

|

|

654,167 625,000 606,250 |

|

|

|

|

|

1,599,335 1,660,492 1,398,805 |

|

|

1,476,563 529,375 996,875 |

|

|

162,728 173,571 112,492 |

|

|

3,892,793 2,988,438 3,114,422 |

|

|||||||

|

Ian D. Branagan (5) Senior Vice President and Group Chief Risk Officer |

|

2018 2017 2016 |

|

|

572,923 496,839 451,733 |

|

|

|

|

|

1,417,394 1,377,311 1,127,110 |

|

|

1,256,063 458,091 865,019 |

|

|

129,693 350,985 124,576 |

|

|

3,376,073 2,683,226 2,568,438 |

|

|||||||

|

Stephen H. Weinstein Senior Vice President, Group General Counsel, Corporate Secretary and Chief Compliance Officer |

|

2018 2017 2016 |

|

|

515,000 501,000 491,625 |

|

|

|

|

|

1,331,158 1,382,131 1,374,686 |

|

|

1,148,438 424,347 799,095 |

|

|

389,813 745,997 411,913 |

|

|

3,384,409 3,053,475 3,077,319 |

|

|||||||

| (1) | The amounts shown in this column represent the aggregate grant date fair value of time-vested restricted shares and performance shares granted to our named executive officers in the applicable fiscal year, computed in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures. The assumptions made in the valuation of stock awards are discussed in Note 16 (Stock Incentive Compensation and Employee Benefit Plans) of our 2018 Form 10-K. These values do not represent the actual value the recipient will or has received from the award. The terms of our time-vested restricted shares and performance shares are discussed above under Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramLong-Term Equity-Based Incentives and the maximum value as of the grant date of performance share awards made in 2018 is included in the Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table below. |

| (2) | The amounts shown in this column represent the actual amounts of the performance-based annual incentive bonuses paid to or deferred for each named executive officer for the applicable fiscal year. Payment of a portion of the performance-based annual incentive bonus for 2018 has been deferred subject to successful achievement of certain performance metrics tied to the TMR acquisition. The details of the payment of the performance-based annual incentive bonuses are discussed above under Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramPerformance-Based Annual Incentive Bonus. |

| (3) | See the All Other Compensation Table below for information on the amounts included in the All Other Compensation column for 2018. |

| (4) | Mr. Qutub has served as our Executive Vice President and Chief Financial Officer since August 8, 2016. |

| (5) | Salary and All Other Compensation payments made to Mr. Branagan in pounds sterling have been converted into U.S. dollars at the average daily exchange rate of 1.33, 1.29 and 1.36 for the years ended December 31, 2018, 2017 and 2016, respectively. Non-Equity Incentive Plan Compensation for Mr. Branagan has been converted into U.S. dollars at the exchange rate of 1.28, 1.35 and 1.36 on December 31, 2018, 2017 and 2016, respectively. |

|

|

Proxy Statement 41 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

The following table sets forth information regarding the amounts included in the All Other Compensation column of the Summary Compensation Table for 2018:

| Name | Company 401(k)/Pension Matching ($) |

Value of Life ($) |

Personal ($) |

Housing Benefits (4) ($) |

Other ($) |

Total Other ($) |

||||||||||||||||||

| Kevin J. ODonnell |

16,500 | 5,904 | 232,546 | 474,504 | 45,635 | 775,089 | ||||||||||||||||||

| Robert Qutub |

16,500 | 2,096 | 209,433 | 213,504 | 31,100 | 472,633 | ||||||||||||||||||

| Ross A. Curtis |

16,500 | 5,904 | 132,824 | | 7,500 | 162,728 | ||||||||||||||||||

| Ian D. Branagan |

40,995 | 8,325 | 74,151 | | 6,222 | 129,693 | ||||||||||||||||||

| Stephen H. Weinstein |

16,500 | 4,841 | 134,373 | 213,504 | 20,595 | 389,813 | ||||||||||||||||||

| (1) | This column reports Company matching contributions to our named executive officers under our 401(k) plan for Messrs. ODonnell, Qutub and Weinstein, the National Pension Scheme and International Savings Plan for Mr. Curtis and the Renaissance Syndicate Management Plan for Mr. Branagan. |

| (2) | This column reports the value of premiums paid on behalf of our named executive officers with respect to life insurance coverage. The death benefit under the life insurance coverage is equal to four times the named executive officers annual salary up to a maximum of $2.0 million for Bermuda-based employees and ten times the named executive officers annual salary for U.K.-based employees. |

| (3) | Personal travel includes costs for personal commercial travel for Mr. ODonnell and Mr. Weinstein and their immediate family members during 2018 as well as personal use of the corporate aircraft by the named executive officers. The named executive officers may also invite family members or other guests from time to time to fly on already scheduled corporate aircraft trips. There is no incremental cost to us and, therefore, there is no value included in this column for such use of the corporate aircraft by family or other guests. For more information on travel benefits provided to our named executive officers, please see Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramOther Benefits and Perquisites above. |

| (4) | This column reports the value of housing benefits for Messrs. ODonnell, Qutub and Weinstein. |

| (5) | Other benefits include tax planning expenses for Messrs. ODonnell, Qutub, Curtis, Branagan and Weinstein, Company automobile expenses for Messrs. Qutub and Weinstein; club dues for Messrs. ODonnell, Qutub and Branagan, and Company matching on charitable donations for Messrs. ODonnell, Qutub, Branagan, Curtis and Weinstein. |

| 42 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Grants of Plan-Based Awards Table

The following table sets forth information concerning grants of plan-based awards to the named executive officers during the calendar year ended December 31, 2018.

| Name |

Grant Date (1) |

Approval Date (1) |

Award Type | Estimated Possible Payouts Under Non- Equity Incentive Plan Awards (2) |

Estimated Future Payouts Under Equity Incentive Plan Awards (3)(4) |

All Other Stock Awards: Number of Shares of Stock or Units (4)(5) (#) |

Grant Date Fair Value of Stock and Option Awards (6) ($) |

|||||||||||||||||||||||||||||||||

| Threshold ($) |

Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) |

|||||||||||||||||||||||||||||||||||

| Kevin J. ODonnell |

3/1/2018 | 2/7/2018 | Performance Shares |

3,122 | 12,491 | 31,227 | 1,553,215 | |||||||||||||||||||||||||||||||||

| 5/14/2018 | 5/14/2018 | Performance Shares |

2,061 | 5,890 | 11,780 | 749,915 | ||||||||||||||||||||||||||||||||||

| 3/1/2018 | 2/7/2018 | Time-Vested Restricted Shares |

12,491 | 1,589,979 | ||||||||||||||||||||||||||||||||||||

| 5/14/2018 | 5/14/2018 | Time-Vested Restricted Shares |

5,890 | 749,915 | ||||||||||||||||||||||||||||||||||||

| 2/7/2018 | 2/7/2018 | Annual Cash Bonus |

969,375 | 2,475,000 | 4,950,000 | |||||||||||||||||||||||||||||||||||

| Robert Qutub |

3/1/2018 | 2/7/2018 | Performance Shares |

1,033 | 4,134 | 10,335 | 514,049 | |||||||||||||||||||||||||||||||||

| 3/1/2018 | 2/7/2018 | Time-Vested Restricted Shares |

7,677 | 977,205 | ||||||||||||||||||||||||||||||||||||

| 2/7/2018 | 2/7/2018 | Annual Cash Bonus |

310,885 | 793,750 | 1,587,500 | |||||||||||||||||||||||||||||||||||

| Ross A. Curtis |

3/1/2018 | 2/7/2018 | Performance Shares |

1,108 | 4,433 | 11,084 | 551,229 | |||||||||||||||||||||||||||||||||

| 3/1/2018 | 2/7/2018 | Time-Vested Restricted Shares |

8,234 | 1,048,106 | ||||||||||||||||||||||||||||||||||||

| 2/7/2018 | 2/7/2018 | Annual Cash Bonus |

330,469 | 843,750 | 1,687,500 | |||||||||||||||||||||||||||||||||||

| Ian D. Branagan |

3/1/2018 | 2/7/2018 | Performance Shares |

982 | 3,929 | 9,823 | 488,558 | |||||||||||||||||||||||||||||||||

| 3/1/2018 | 2/7/2018 | Time-Vested Restricted Shares |

7,297 | 928,835 | ||||||||||||||||||||||||||||||||||||

| 2/7/2018 | 2/7/2018 | Annual Cash Bonus (7) |

281,119 | 717,750 | 1,435,500 | |||||||||||||||||||||||||||||||||||

| Stephen H. Weinstein |

3/1/2018 | 2/7/2018 | Performance Shares |

922 | 3,690 | 9,226 | 458,839 | |||||||||||||||||||||||||||||||||

| 3/1/2018 | 2/7/2018 | Time-Vested Restricted Shares |

6,853 | 872,318 | ||||||||||||||||||||||||||||||||||||

| 2/7/2018 | 2/7/2018 | Annual Cash Bonus |

257,031 | 656,250 | 1,312,500 | |||||||||||||||||||||||||||||||||||

| (1) | On February 7, 2018, the Compensation Committee approved annual long-term equity-based incentive awards for our named executive officers pursuant to the 2016 LTI Plan. In accordance with our practice, these equity-based awards were granted on March 1, 2018. On May 14, 2018, the Compensation Committee approved the remainder of Mr. ODonnells annual long-term equity-based incentive award pursuant to the 2016 LTI Plan. On February 7, 2018 and May 14, 2018, the Compensation Committee set the terms of the performance-based annual incentive bonuses in respect of 2018 for each of our named executive officers. |

|

|

Proxy Statement 43 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| (2) | The amounts reported in these columns represent estimated possible payouts of performance-based annual incentive bonuses in respect of 2018, assuming threshold achievement, target achievement and maximum achievement of the applicable performance metrics. These performance-based annual incentive bonuses were paid in March 2019 and the actual amounts paid to or deferred for our named executive officers are included in the Summary Compensation Table in the Non-Equity Incentive Plan Compensation column. See Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramPerformance-Based Annual Incentive Bonus above for a detailed description of our performance-based annual incentive bonus program. |

| (3) | The amounts reported in these columns represent awards of performance shares made pursuant to the 2016 LTI Plan that are scheduled to vest following the expiration of the service period on December 31, 2020 and the Compensation Committees determination of (i) total shareholder return for a performance period for awards granted on March 1, 2018 or (ii) growth in tangible book value per common share plus the change in accumulated dividends for awards granted on May 14, 2018. These columns represent the number of performance shares that vest at threshold achievement, target achievement and maximum achievement of the performance metrics applicable to such awards. At or below the threshold performance level, no shares will be paid out. For awards which vest based on total shareholder return, there will be no payout greater than target if our absolute total shareholder return is negative. See Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramLong-Term Equity-Based Incentives above for a detailed description of the performance share program. |

| (4) | The number of time-vested restricted shares and target number of performance shares awarded were computed by dividing the approved grant value by the closing market price of our common shares on the date of grant, which was $127.29 per common share on March 1, 2018 and $127.32 per common share on May 14, 2018. See Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramLong-Term Equity-Based Incentives above for a detailed description of our equity grant practices. |

| (5) | The amounts reported in these columns represent awards of time-vested restricted shares made pursuant to the 2016 LTI Plan that are scheduled to vest in four equal annual installments beginning on March 1, 2019. Dividends are paid currently on time-vested restricted shares. |

| (6) | The amounts shown in this column represent the grant date fair value of time-vested restricted shares and performance shares granted to our named executive officers in the applicable fiscal year, computed in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures. The assumptions made in the valuation of stock awards are discussed in Note 16 (Stock Incentive Compensation and Employee Benefit Plans) of our 2018 Form 10-K. These values do not represent the actual value the recipient will or has received from the award. The terms of our time-vested restricted shares and performance shares are discussed above under Compensation Discussion and AnalysisPrincipal Components of Our Executive Compensation ProgramLong-Term Equity-Based Incentives and the maximum value as of the grant date of performance share awards made in 2018 is included in the Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table below. |

| (7) | Based on Mr. Branagans salary of £450,000, converted into U.S. dollars at the exchange rate of 1.28 as at December 31, 2018. |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table

| 44 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Option Exercises and Stock Vested Table

The following table sets forth information concerning option exercises by and the vesting of restricted shares and performance shares held by our named executive officers during 2018.

| Name | Number of Shares Acquired on Exercise (#) |

Value Realized on Exercise (1) ($) |

Number of Shares Acquired on Vesting (#) |

Value Realized on Vesting (2) ($) |

||||||||||||

| Kevin J. ODonnell |

| | 37,769 | 4,836,273 | ||||||||||||

| Robert Qutub |

| | 1,354 | 172,351 | ||||||||||||

| Ross A. Curtis |

| | 21,492 | 2,730,977 | ||||||||||||

| Ian D. Branagan |

| | 13,189 | 1,683,435 | ||||||||||||

| Stephen H. Weinstein |

31,165 | 2,257,281 | 13,698 | 1,751,040 | ||||||||||||

| (1) | The value realized on exercise is calculated by multiplying the number of common shares acquired on exercise by the difference between the closing price of our common shares on the date of exercise and the exercise price of the option. |

| (2) | The value realized on vesting is calculated by multiplying the number of common shares acquired on vesting by the closing price of our common shares on the vesting date. |

Outstanding Equity Awards at Fiscal Year-End Table

The following table sets forth the outstanding equity awards held by our named executive officers as of December 31, 2018:

| Stock Awards | ||||||||||||||||||||

| Name | Grant Date |

Number of Stock That |

Market Value of Shares or Units of Stock That Have Not Vested (1) ($) |

Equity Incentive Plan Awards: Number of Unearned Shares That Have Not Vested (#) |

Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested (1) ($) |

|||||||||||||||

| Kevin J. ODonnell |

02/27/2015 (2) | 6,687 | 894,052 | |||||||||||||||||

| 01/12/2016 (3) | 6,532 | 873,328 | ||||||||||||||||||

| 05/16/2016 (4) | 560 | 74,872 | ||||||||||||||||||

| 03/01/2017 (5) | 9,802 | 1,310,527 | ||||||||||||||||||

| 03/01/2018 (6) | 12,491 | 1,670,047 | ||||||||||||||||||

| 05/14/2018 (6) | 5,890 | 787,493 | ||||||||||||||||||

| 01/12/2016 (7) | 5,542 | 740,965 | ||||||||||||||||||

| 05/16/2016 (7) | 475 | 63,508 | ||||||||||||||||||

| 03/01/2017 (8) | 4,356 | 582,397 | 10,891 | 1,456,127 | ||||||||||||||||

| 03/01/2018 (9) | 3,383 | 452,307 | 8,328 | 1,113,454 | ||||||||||||||||

| 05/14/2018 (10) | 1,645 | 219,937 | 3,928 | 525,174 | ||||||||||||||||

|

Robert Qutub |

|

03/01/2017 (5) |

|

|

4,065 |

|

|

543,491 |

|

|||||||||||

| 03/01/2018 (6) | 7,677 | 1,026,415 | ||||||||||||||||||

| 03/01/2017 (8) | 973 | 130,090 | 2,431 | 325,025 | ||||||||||||||||

| 03/01/2018 (9) | 1,120 | 149,744 | 2,756 | 368,477 | ||||||||||||||||

|

|

Proxy Statement 45 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| Stock Awards | ||||||||||||||||||||

| Name | Grant Date |

Number of Stock That |

Market Value of Shares or Units of Stock That Have Not Vested (1) ($) |

Equity Incentive Plan Awards: Number of Unearned Shares That Have Not Vested (#) |

Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested (1) ($) |

|||||||||||||||

|

Ross D. Curtis |

|

02/27/2015 (2) |

|

|

2,741 |

|

|

366,472 |

|

|||||||||||

| 01/12/2016 (3) | 3,480 | 465,276 | ||||||||||||||||||

| 05/16/2016 (4) | 467 | 62,438 | ||||||||||||||||||

| 03/01/2017 (5) | 5,229 | 699,117 | ||||||||||||||||||

| 03/01/2018 (6) | 8,234 | 1,100,886 | ||||||||||||||||||

| 01/12/2016 (7) | 1,590 | 212,583 | ||||||||||||||||||

| 05/16/2016 (7) | 213 | 28,478 | ||||||||||||||||||

| 03/01/2017 (8) | 1,251 | 167,259 | 3,128 | 418,214 | ||||||||||||||||

| 03/01/2018 (9) | 1,201 | 160,574 | 2,956 | 395,217 | ||||||||||||||||

|

Ian D. Branagan |

|

02/27/2015 (2) |

|

|

2,367 |

|

|

316,468 |

|

|||||||||||

| 01/12/2016 (3) | 2,854 | 381,580 | ||||||||||||||||||

| 05/16/2016 (4) | 326 | 43,586 | ||||||||||||||||||

| 03/01/2017 (5) | 4,337 | 579,857 | ||||||||||||||||||

| 03/01/2018 (6) | 7,297 | 975,609 | ||||||||||||||||||

| 01/12/2016 (7) | 1,304 | 174,345 | ||||||||||||||||||

| 05/16/2016 (7) | 149 | 19,921 | ||||||||||||||||||

| 03/01/2017 (8) | 1,038 | 138,781 | 2,594 | 346,818 | ||||||||||||||||

| 03/01/2018 (9) | 1,064 | 142,257 | 2,620 | 350,294 | ||||||||||||||||

|

Stephen H. Weinstein |

|

02/27/2015 (2) |

|

|

2,310 |

|

|

308,847 |

|

|||||||||||

| 01/12/2016 (3) | 2,933 | 392,142 | ||||||||||||||||||

| 05/16/2016 (4) | 948 | 126,748 | ||||||||||||||||||

| 03/01/2017 (5) | 4,352 | 581,862 | ||||||||||||||||||

| 03/01/2018 (6) | 6,853 | 916,246 | ||||||||||||||||||

| 01/12/2016 (7) | 1,340 | 179,158 | ||||||||||||||||||

| 05/16/2016 (7) | 433 | 57,892 | ||||||||||||||||||

| 03/01/2017 (8) | 1,042 | 139,315 | 2,603 | 348,021 | ||||||||||||||||

| 03/01/2018 (9) | 1,000 | 133,700 | 2,460 | 328,902 | ||||||||||||||||

| (1) | These amounts were determined based on the closing price of our common shares of $133.70 on December 31, 2018. |

| (2) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2001 Plan that vests in four substantially equal installments on March 1, 2016, 2017, 2018 and 2019. |

| (3) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2001 Plan that vests in four substantially equal installments on March 1, 2017, 2018, 2019 and 2020. |

| (4) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2016 LTI Plan that vests in four substantially equal installments on March 1, 2017, 2018, 2019 and 2020. |

| (5) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2016 LTI Plan that vests in four substantially equal installments on March 1, 2018, 2019, 2020 and 2021. |

| (6) | Unvested portion remaining from an award of time-vested restricted shares granted under the 2016 LTI Plan that vests in four substantially equal installments on March 1, 2019, 2020, 2021 and 2022. |

| (7) | Performance shares granted under the 2001 Plan or 2016 LTI Plan and earned in three substantially equal annual installments based upon total shareholder return relative to our performance share peer group during each calendar year performance period (2016, 2017 and 2018). The performance shares vested following the completion of the service period on December 31, 2018 and the Compensation Committees determination of total shareholder return for the applicable performance period (resulting in vesting dates of December 31, 2018 with respect to the 2016 |

| 46 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| and 2017 performance periods and February 6, 2019 with respect to the 2018 performance period). Because all performance periods are complete, the number of shares earned are reported in the Number of Shares or Units of Stock That Have Not Vested column based on the actual total shareholder return for purposes of performance share awards during the performance periods as follows: for 2016, total shareholder return of 19.8% resulted in the executive earning 160.6% of the target performance shares for 2016; for 2017, total shareholder return of negative 3.7% resulted in the executive earning 0.0% of the target performance shares for 2017; and for 2018, total shareholder return of 5.9% resulted in the executive earning 127.1% of the target performance shares for 2018. |

| (8) | Performance shares granted under the 2016 LTI Plan which vest at the end of the service period on December 31, 2019 and following the Compensation Committees determination of total shareholder return for each calendar year performance period. Performance shares are earned in three substantially equal annual installments based upon total shareholder return relative to our performance share peer group during each calendar year performance period (2017, 2018 and 2019). Because the 2017 and 2018 performance periods are complete, the number of shares earned are reported in the Number of Shares or Units of Stock That Have Not Vested column based on the actual total shareholder return for purposes of performance share awards during the performance period as follows: for 2017, total shareholder return of negative 3.7% resulted in the executive earning 0.0% of the target performance shares with respect to 2017; and for 2018, total shareholder return of 5.9% resulted in the executive earning 100% of the target performance shares for 2018. As a result of our target performance for the 2018 performance period, in accordance with SEC rules, the number of unearned performance shares related to the 2019 and 2020 performance periods are reported in the Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested column based on achieving the maximum number of performance shares (250% of target) that may be earned for the performance period. |

| (9) | Performance shares granted under the 2016 LTI Plan which vest at the end of the service period on December 31, 2020 and following the Compensation Committees determination of total shareholder return for each calendar year performance period. Performance shares are earned in three substantially equal annual installments based upon total shareholder return relative to our performance share peer group during each calendar year performance period (2018, 2019 and 2020). Because the 2018 performance period is complete, the number of shares earned is reported in the Number of Shares or Units of Stock That Have Not Vested column based on the actual total shareholder return for purposes of performance share awards during the performance period as follows: for 2018, total shareholder return of 5.9% resulted in the executive earning 81.3% of the target performance shares with respect to 2018. As a result of our below-target performance for the 2018 performance period, in accordance with SEC rules, the number of unearned performance shares related to the 2019 and 2020 performance periods are reported in the Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested column based on achieving the target number of performance shares (100% of target) that may be earned for the performance period. |

| (10) | Performance shares granted under the 2016 LTI Plan which vest at the end of the service period on December 31, 2020 and following the Compensation Committees determination of growth in tangible book value per common share plus the change in accumulated dividends for each calendar year performance period. Performance shares are earned in three substantially equal annual installments based upon growth in tangible book value per common share plus the change in accumulated dividends during each calendar year performance period (2018, 2019 and 2020). Because the 2018 performance period is complete, the number of shares earned is reported in the Number of Shares or Units of Stock That Have Not Vested column based on the actual growth in tangible book value per common share plus the change in accumulated dividends for purposes of performance share awards during the performance period as follows: for 2018, growth in tangible book value per common share plus the change in accumulated dividends of 6.4% resulted in the executive earning 83.8% of the target performance shares with respect to 2018. As a result of our below-target performance for the 2018 performance period, in accordance with SEC rules, the number of unearned performance shares related to the 2019 and 2020 performance periods are reported in the Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested column based on achieving the target number of performance shares (100% of target) that may be earned for the performance period. |

|

|

Proxy Statement 47 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Equity Compensation Plan Information

The information set forth in the table below is as of December 31, 2018:

| Plan Category |

Number of securities to (a) |

Weighted-average (b) |

Number of securities (c) |

|||||||||

| Equity compensation plans approved by shareholders (2) |

| | 1,553,000 | |||||||||

| Equity compensation plans not approved by shareholders |

| | | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

| | 1,553,000 | |||||||||

| (1) | As of December 31, 2018, there were no outstanding options to purchase common shares. A total of 578,713 unvested restricted shares (including both time-vested restricted shares and performance shares) were excluded from column (a) as those shares are considered issued at the time of grant. Unvested restricted shares were also excluded from column (c) as they are no longer available for future issuance. |

| (2) | Plans previously approved by the shareholders include the 2001 Plan and the 2016 LTI Plan. The 2001 Plan expired in February 2016 and no further awards will be made under the 2001 Plan. |

Potential Payments Upon Termination or Change in Control

| 48 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

Components of Severance Benefits

| By Us Without Cause |

By Executive for Good Reason |

Death (1) | Disability | By Executive Without Good Reason (2) |

Our Non- Extension of Agreement |

Executives Non- Extension of Agreement (2) |

||||||||

| (i) Percent of Salary |

x | x | x | x | x | x | ||||||||

| (ii) Percent of Bonus |

x | x | x | |||||||||||

| (iii) Lump Sum Percent of Salary |

x | x | x | x | x | x | ||||||||

| (iv) Lump Sum Percent of Bonus |

x | x | x | |||||||||||

| (v) Pro rata Bonus |

x | x | x | x | x | |||||||||

| (vi) Continuation of Benefits |

x | x | x | x | x | x | ||||||||

| (vii) Vesting of Awards |

x (3) | x (3) | x | x | x (3) |

| (1) | In addition to the benefits above and as noted in the Summary Compensation Table above, we pay premiums on behalf of our named executive officers with respect to life insurance coverage under our health and benefits plans. The death benefit equals four times the named executive officers annual salary up to a maximum of $2.0 million for Bermuda-based employees and ten times the named executive officers annual salary for U.K.-based employees. |

| (2) | With respect to Messrs. Qutub and Curtis, these benefits will be provided only to the extent we elect to extend the non-competition covenant for up to 12 months beyond the termination date. |

| (3) | Accelerated vesting applies to all time-vested awards. See Treatment of Equity Awards Upon a Termination of Employment or Change in Control below for a discussion relating to the accelerated vesting of performance-based awards. |

|

|

Proxy Statement 49 |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| Death; Disability; By Us Without Cause; By Executive for Good Reason; Retirement (1) |

Change in Control | |||

| Shares as to which the Performance Period Has Ended | ||||

| Performance Shares under 2001 Plan |

Full vesting and waiver of remaining service condition |

Full vesting and waiver of remaining service condition |

||

| Performance Shares under 2016 LTI Plan |

Full vesting and waiver of remaining service condition |

Remain outstanding until the completion of the remaining service period, subject to acceleration upon a qualifying termination within two years following the change in control |

||

| Shares Remaining Subject to Performance Vesting | ||||

| Performance Shares under 2001 Plan |

Remain outstanding until the completion of the performance period and vest based on the actual level of the attainment of the applicable performance goals |

Immediate full vesting assuming target performance or, if greater, based on pro forma performance over the entire performance period extrapolated from the performance run rate through the end of the fiscal year preceding the change in control |

||

| Performance Shares under 2016 LTI Plan granted prior to May 14, 2018 |

Remain outstanding until the completion of the performance period, and vest based on the actual level of the attainment of the applicable performance goals |

Remain outstanding until the completion of the performance and service periods, subject to acceleration upon a qualifying termination within two years following the change in control, and vest based on the actual level of the attainment of the applicable performance goals |

||

| Performance Shares under 2016 LTI Plan granted on May 14, 2018 |

Remain outstanding until the completion of the performance period, and vest based on the actual level of the attainment of the applicable performance goals |

Performance shares that are assumed or substituted in connection with the change in control remain outstanding until the completion of the performance and service periods, subject to acceleration upon a qualifying termination within two years following the change in control, and vest based on the actual level of the attainment of the applicable performance goals. For performance shares that are not assumed or substituted in connection with the change in control: (i) shares for which the performance period has not yet commenced are subject to acceleration assuming achievement of the target level of the applicable performance goals, and (ii) shares with a performance period that includes the date of the change in control are subject to acceleration based on the total shareholder return achieved as of the date of the change in control. |

| (1) | A termination by the executive without good reason will qualify as a retirement if the executives employment is terminated by the executive following the later of the date on which (i) the sum of the executives age and years of service with the Company equals 65 and (ii) the executive has first completed five years of service with the Company. |

| 50 |

|

Proxy Statement |

Table of Contents

| EXECUTIVE COMPENSATIONCONTINUED |

| Name | Benefit | Before Change in Control Termination without Cause or for Good Reason or Non-Extension by the Company ($) |

After Change in Control Termination without Cause or for Good Reason or Non- Extension by the Company ($) |

Non- Extension by Executive ($) |

Executive without |

Death ($) |

Disability ($) |

Change

in Control without Termination (1) ($) |

||||||||||||||||||||||

| Kevin J. ODonnell |

||||||||||||||||||||||||||||||

| Salary (2) | 1,200,000 | 1,200,000 | | | | 1,200,000 | | |||||||||||||||||||||||

| Bonus | 11,137,500 | 11,137,500 | 2,475,000 | | 2,475,000 | 2,475,000 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 9,890,367 | 9,890,367 | | | 9,890,367 | 9,890,367 | 2,508,346 | |||||||||||||||||||||||

| Life Insurance | | | | | 2,000,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 38,444 | 38,444 | 25,629 | 25,629 | | 25,629 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 22,266,311 | 22,266,311 | 2,500,629 | 25,629 | 14,365,367 | 13,590,996 | 2,508,346 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Robert Qutub |

||||||||||||||||||||||||||||||

| Salary (2) | 635,000 | 1,270,000 | 635,000 | 635,000 | | 635,000 | | |||||||||||||||||||||||

| Bonus | 2,182,813 | 3,571,875 | 793,750 | | 793,750 | 793,750 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 2,348,215 | 2,348,215 | | | 2,348,215 | 2,348,215 | | |||||||||||||||||||||||

| Life Insurance | | | | | 710,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 25,629 | 25,629 | 25,629 | 25,629 | | 25,629 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 5,191,657 | 7,215,719 | 1,454,379 | 660,629 | 3,851,965 | 3,802,594 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Ross A. Curtis |

||||||||||||||||||||||||||||||

| Salary (2) | 675,000 | 1,350,000 | 675,000 | 675,000 | | 675,000 | | |||||||||||||||||||||||

| Bonus | 2,320,313 | 3,796,875 | 843,750 | | 843,750 | 843,750 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 3,825,373 | 3,825,373 | | | 3,825,373 | 3,825,373 | 1,044,331 | |||||||||||||||||||||||

| Life Insurance | | | | | 2,000,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 25,629 | 25,629 | 25,629 | 25,629 | | 25,629 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 6,846,315 | 8,997,877 | 1,544,379 | 700,629 | 6,669,123 | 5,369,752 | 1,044,331 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Ian D. Branagan |

||||||||||||||||||||||||||||||

| Salary (2) | 63,800 | 638,000 | 63,800 | 63,800 | | 63,800 | | |||||||||||||||||||||||

| Bonus | 1,973,813 | 3,229,875 | 717,750 | | 717,750 | 717,750 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 3,261,348 | 3,261,348 | | | 3,261,348 | 3,261,348 | 872,393 | |||||||||||||||||||||||

| Life Insurance | | | | | 5,742,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 6,906 | 6,906 | 6,906 | 6,906 | | 6,906 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total: | 5,305,867 | 7,136,129 | 788,456 | 70,706 | 9,721,098 | 4,049,805 | 872,393 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Stephen H. Weinstein |

||||||||||||||||||||||||||||||

| Salary (2) | 24,000 | 549,000 | 24,000 | 24,000 | | 24,000 | | |||||||||||||||||||||||

| Bonus | 1,804,688 | 2,953,125 | 656,250 | | 656,250 | 656,250 | | |||||||||||||||||||||||

| Accelerated Vesting of Awards (3) | 3,303,968 | 3,303,968 | | | 3,303,968 | 3,303,968 | 880,147 | |||||||||||||||||||||||

| Life Insurance | | | | | 1,640,000 | | | |||||||||||||||||||||||

| Continuation of Health Benefits | 25,629 | 25,629 | 25,629 | 25,629 | | 25,629 | | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|