SLIDE PRESENTATION

Published on September 14, 2009

RenaissanceRe Holdings Ltd. Fox-Pitt Kelton Cochran Caronia Waller Bermuda in Boston Investor Conference September 2009 Exhibit 99.2 |

2 Safe Harbor Statement Cautionary Statement under "Safe Harbor Provisions of the Private Securities Litigation Reform

Act of 1995: Statements made in this presentation contain information about the Company's future business prospects. These statements may be considered "forward-looking." These statements

are subject to risks and uncertainties that could cause actual results to differ materially

from those set forth in or implied by such forward-looking statements. Forward-looking

statements are only as of the date they are made and we do not undertake any obligation to

update or revise publicly any forward- looking statements, whether as a result of new

information, future events or otherwise. For further information regarding cautionary

statements and factors affecting future results, please refer to RenaissanceRe Holdings

Ltd.s filings with the Securities and Exchange Commission, including its Annual Report on

Form 10-K for the year ended December 31, 2008, and its quarterly reports on Form 10-Q

for the quarters ended March 31, 2009 and June 30, 2009. This presentation includes certain non-GAAP financial measures within the meaning of Regulation

G including "tangible book value per common share plus accumulated dividends,

operating ROE and managed catastrophe premium. A definition of

such measures and a reconciliation of these measures to the most comparable GAAP figures in

accordance with Regulation G is available in the Company's July 28, 2009 Earnings Release and

Financial Supplement, and in the Companys 2003-2009

Investor Information/Current News or Investor Information/ Financial Reports.

Annual Reports. which are located on the Company's website www.renre.com under |

Table

of Contents The Company: RenaissanceRe at a Glance Holdings Overview: A Consistent Strategy Our Strategy: Focusing on Our Competitive Strengths Ventures: Leveraging and Expanding Our Franchise Summary: Well-Positioned for the Future |

4 RenaissanceRe at a Glance Established in Bermuda in 1993 to write principally property catastrophe reinsurance,

RenaissanceRe is today a leading global provider of reinsurance and insurance coverage and related services Traded on New York Stock Exchange (RNR) Market cap of $3.5 billion as of September 10, 2009 Leading financial strength ratings of AA--from

Standard & Poors and A+ from A.M. Best with stable outlooks for

Renaissance Reinsurance Ltd. Operating ROE * has averaged 18%, and tangible book

value per common share plus accumulated dividends* has grown at a compounded

annual rate of 17% since 1999 Underwrote $1.7 billion of GPW in 2008, in

catastrophe reinsurance (57% of GPW), specialty reinsurance (9% of GPW) and

Individual Risk (34% of GPW) * Information concerning the reconciliation of

non-GAAP measures can be found at the beginning of this presentation. |

HOLDINGS OVERVIEW: A CONSISTENT STRATEGY 5 |

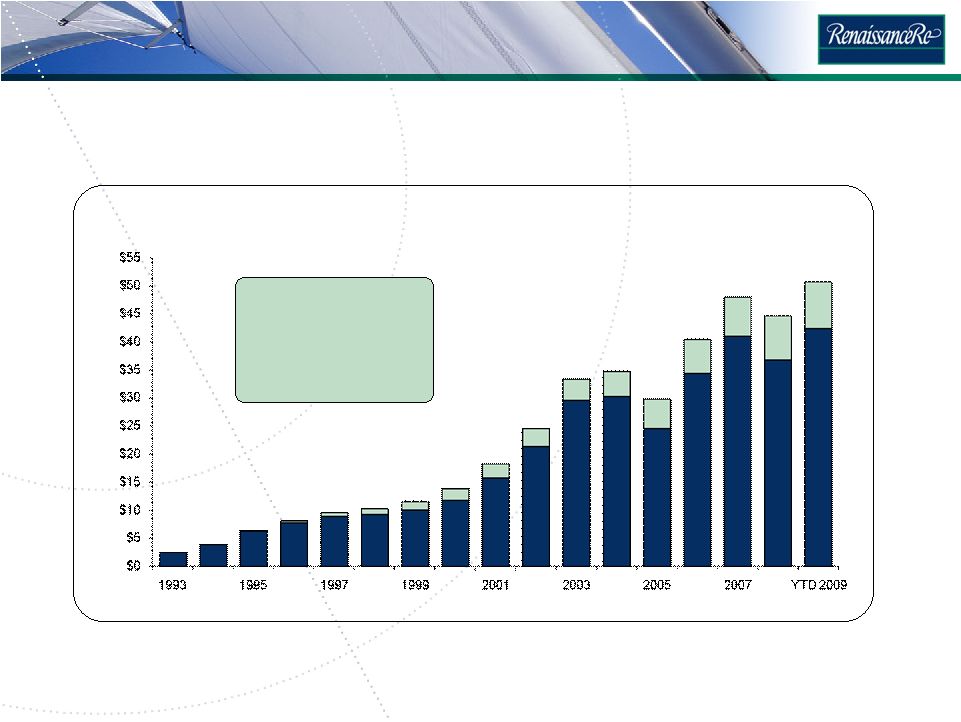

6 We Have Generated Superior Shareholder Value Across Market Cycles Legend: Blue =TBVPS; Green = accumulated dividends *Information concerning the reconciliation of Non-GAAP measures can be found at the

beginning of this presentation. ** Compounded annual growth rate

Goal Remains to Grow Tangible Book Value Per Common Share (TBVPS) Plus Accumulated Dividends* by Over 15% Over the Long-Term 1993-2009: 21% CAGR** 1999-2009: 17% CAGR** |

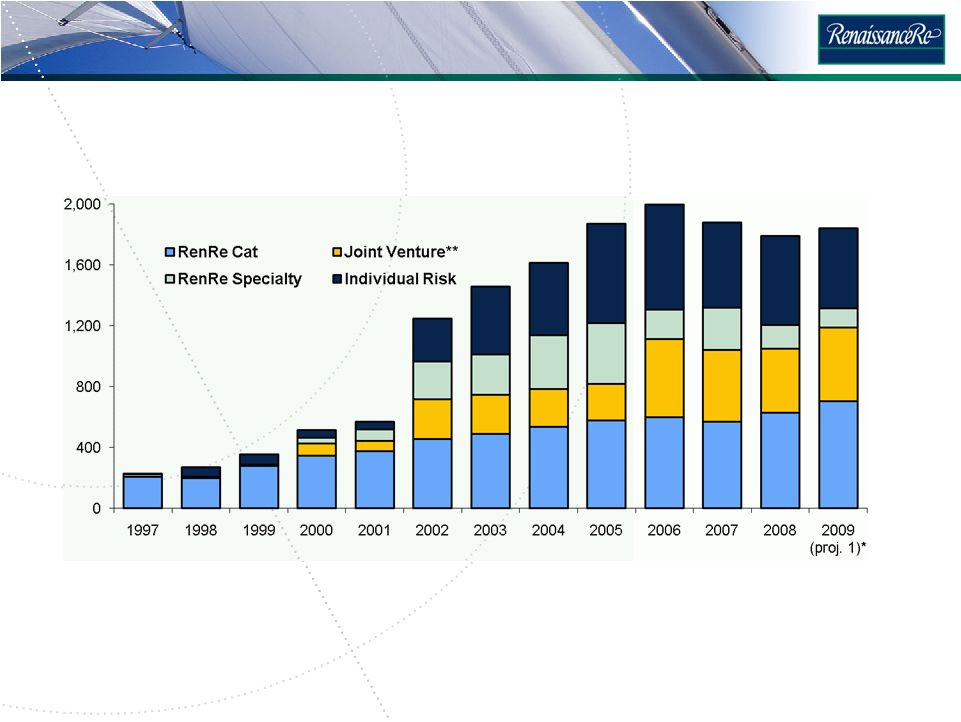

7 Disciplined Diversification Has Been Key to Our Success Note: Information concerning reconciliation of non-GAAP measures and cautionary

information with respect to the 2009 projections can be found at the beginning of this presentation. * 2009 projected premiums calculated as managed catastrophe premiums up 20%, individual

risk premiums down 10%, and specialty reinsurance premiums down 20%. These

estimates were disclosed on the Companys July 29, 2009 earnings call for the quarter ended June 30, 2009. Historical Gross Written Premiums ($ in millions) ** Joint venture premiums included in results for catastrophe and specialty reinsurance

units |

OUR

STRATEGY: FOCUSING ON OUR COMPETITIVE STRENGTHS 8 |

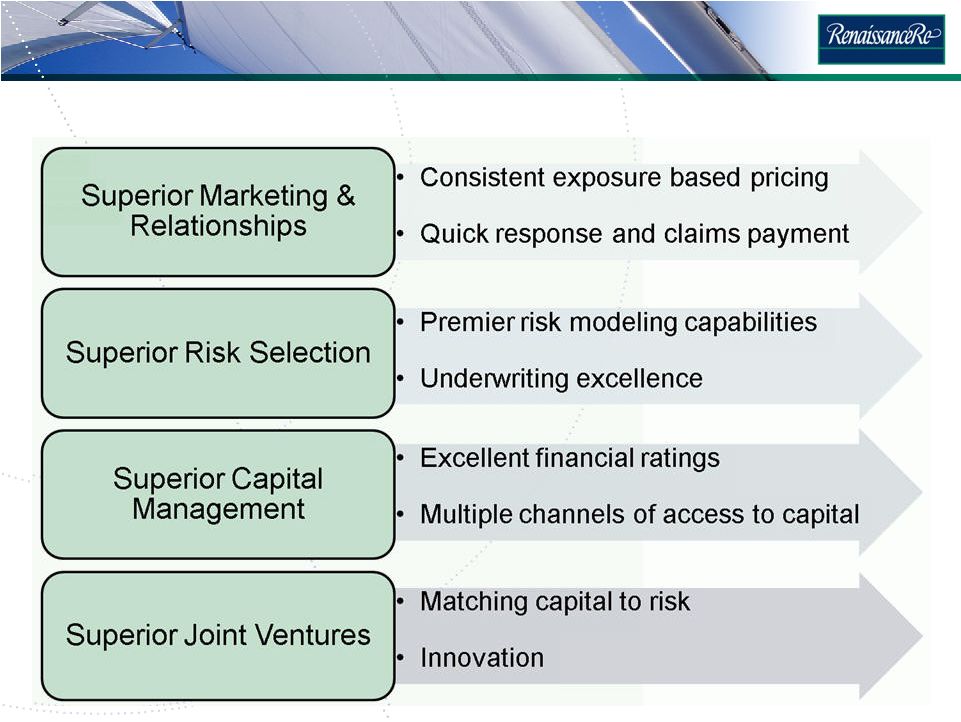

9 We Have Important Competitive Advantages |

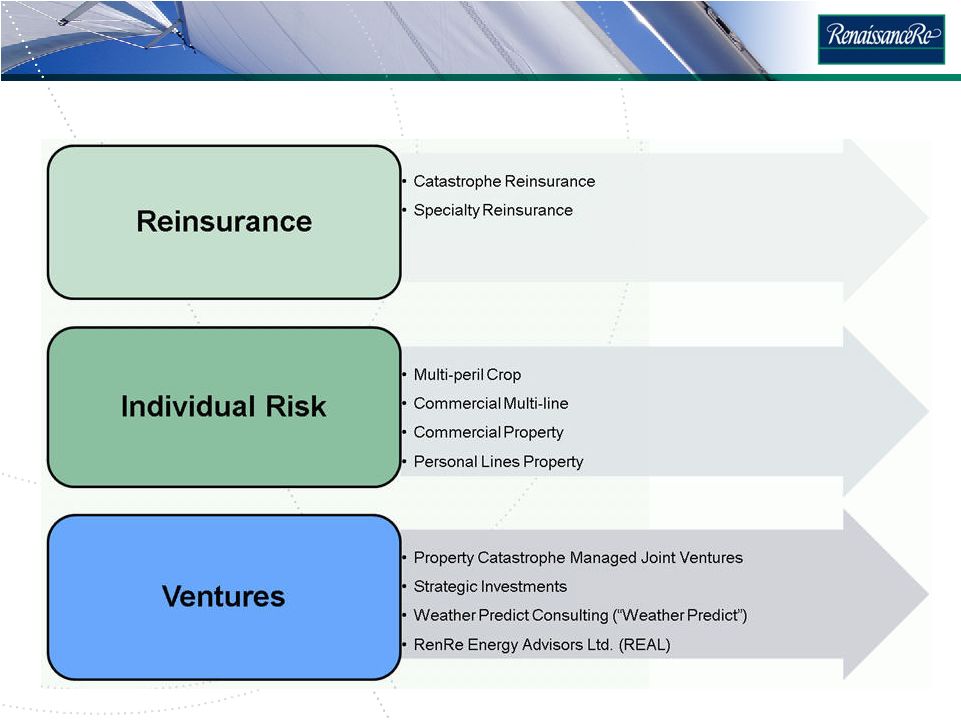

10 Our Focus Remains the Same

|

11 We Screen New Opportunities With a Consistent Framework Seek Opportunities That Meet Our Return Hurdles and Fit Our Business Model Market Opportunity Credible Data/ Decision Support Tools Cultural Fit |

VENTURES: LEVERAGING AND EXPANDING OUR FRANCHISE 12 |

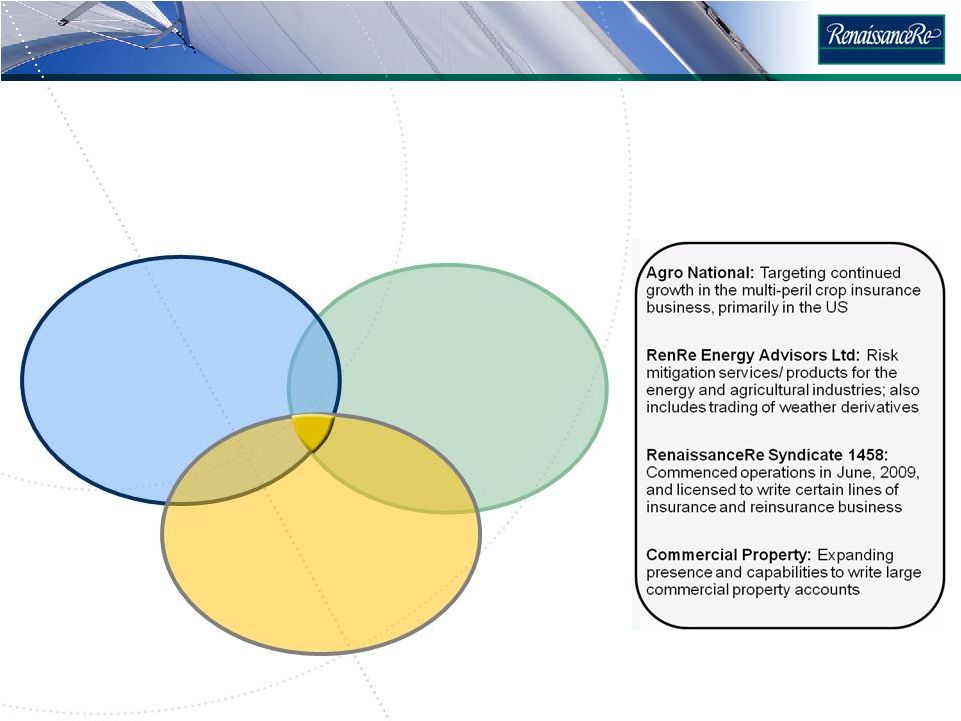

Leveraging and Expanding Our Franchise 13 Managed Risk Capital Venture Capital RenRe Energy Advisors Ltd. (REAL) Weather Predict Consulting |

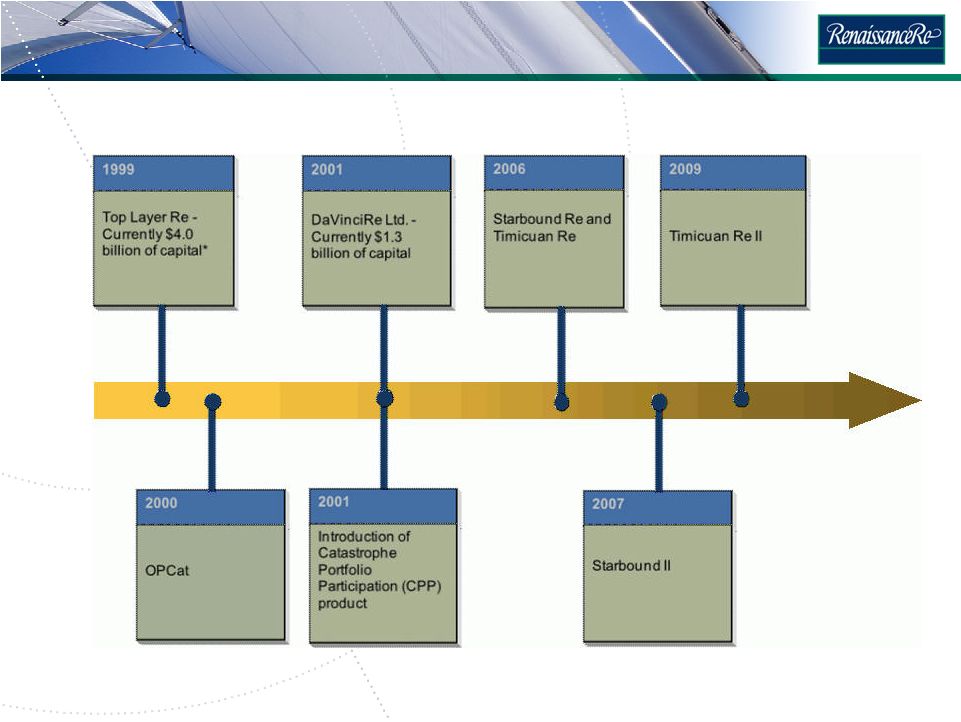

Why the Ventures Strategy Works 14 A superior reinsurance product offering with a track record of strong underwriting results Transaction specific coordination between Ventures, Reinsurance and Individual Risk Record of providing timely solutions to client needs Underwriting management group with over ten years of experience in managing third party capital A track record of delivering strong returns to investors |

Timeline of Joint Venture Innovation 15 * Top Layer Res capital includes a $3.9 billion stop loss reinsurance cover provided by State

Farm |

16 The Way We See the World Investment Banks Investment Banks Private Equity Private Equity Ceding Partners Ceding Partners Public Equity Public Equity Reinsurance Reinsurance Insurance Insurance Joint Ventures Joint Ventures Retrocession Retrocession Reinsurance Reinsurance Admitted Insurance Admitted Insurance Excess & Surplus Lines Excess & Surplus Lines Swaps/ Index/ ILW Swaps/ Index/ ILW State/National/Other State/National/Other Pools Pools Pensions/Endowments Pensions/Endowments Insurance Companies Insurance Companies Capital Channels/ Partner Types Risk Channels/ Sources Hedge Funds Hedge Funds Managed Risk Capital Managed Risk Capital Cat Bonds Cat Bonds Managed Accounts/ Managed Accounts/ Funds Funds Platforms Debt Banks & Others Side Cars |

17 Note: Areas shaded blue represent entities that are 100% owned by RenaissanceRe; orange

represents CPP arrangements, and green represents joint venture entities that

are managed by RenaissanceRe Renaissance Reinsurance Ltd. Capital - $1.6 billion 2008 GPW - $789 million RNR share 100% Catastrophe Portfolio Participation (CPPs) DaVinci Reinsurance Ltd. Capital - $1.3 billion 2008 GPW - $367 million RNR share - 38% (Fees + comm. + equity participation) Side-cars (Expense override + comm. + equity participation)** Top Layer Reinsurance Ltd. Capital - $4.0 billion* 2008 GPW - $55 million RNR share 50% (Expense override + equity participation) * Includes a $3.9 billion stop loss reinsurance cover provided by State Farm Managed Cat Risk Capital---Overview ** All side-car vehicles other than

Timicuan-Re-II-receive-an-expense-override

|

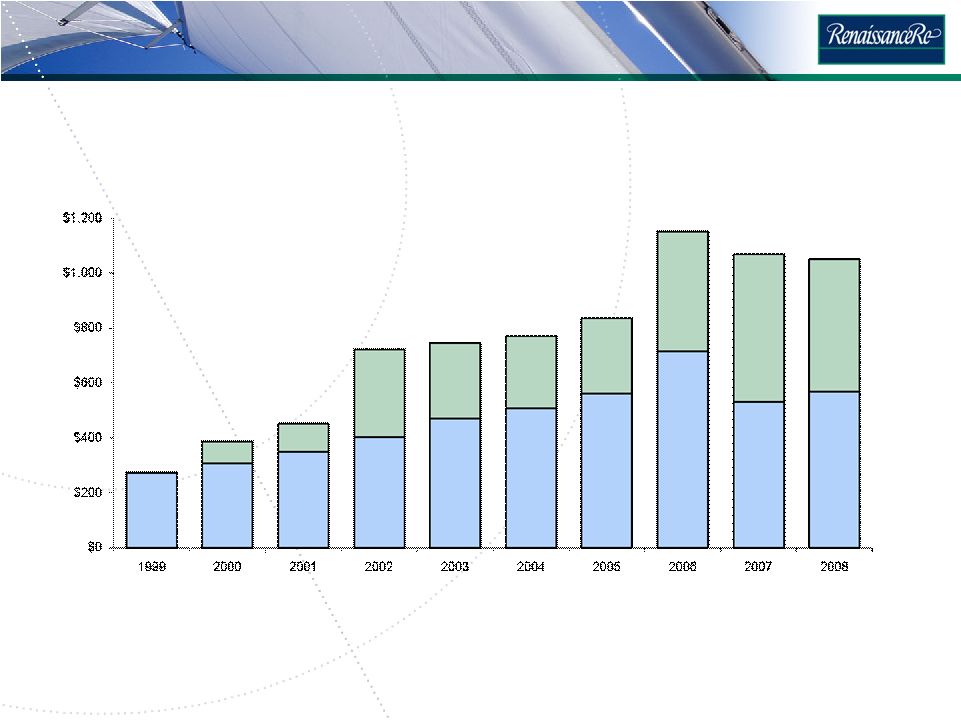

18 Comparison of Retained and Managed Cat* Premiums Legend: Blue = Catastrophe premiums retained by RenaissanceRe; Green = Premiums written

on third party capital, including-the-CPP-product *Information concerning the reconciliation of non-GAAP measures can be found at the

beginning of this presentation. Historical Gross Written Premiums ($ in

millions) |

SUMMARY: WELL POSITIONED FOR THE FUTURE 19 |

20 RenaissanceRe is Well Positioned for the Future Our leadership position in the property catastrophe reinsurance business allows us to match the right capital with the right risk at the right time We continually strive to strengthen our position as a leader in property cat

reinsurance with superior risk analytics We are focused on managing our assets efficiently, and maintaining a strong balance sheet and capitalization Our organization is strengthened by new talent, widening our breadth of expertise We believe our distinctive corporate culture remains a key competitive advantage We believe we are well positioned to continue to deliver responsive solutions,

to seize attractive opportunities when they arise, and to generate superior

shareholder value in the years ahead |

RenaissanceRe Holdings Ltd. Renaissance House 820 East Broadway Pembroke, HM 19 Bermuda Tel: (441) 295-4513 www.renre.com |