EX-99.2

Published on October 31, 2018

RenaissanceRe Agreed Acquisition of Tokio Millennium Re Accelerating our Strategy and Enhancing our Global Reinsurance Leadership October 31, 2018 Exhibit 99.2

Disclaimer Any forward-looking statements made in this presentation reflect the current views of RenaissanceRe Holdings Ltd. (“RenaissanceRe” or the “Company”) with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are subject to numerous factors that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements, including the following: the failure to obtain regulatory approvals or satisfy other conditions to completion of the proposed Tokio Millennium Re transaction; risks that the proposed transaction disrupts current plans and operations; the ability to recognize the benefits of the proposed transaction; the amount of the costs, fees, expenses and charges related to the proposed transaction; the frequency and severity of catastrophic and other events that the Company covers; the effectiveness of the Company’s claims and claim expense reserving process; the Company’s ability to maintain its financial strength ratings; the effect of climate change on the Company’s business; collection on claimed retrocessional coverage, and new retrocessional reinsurance being available on acceptable terms and providing the coverage that we intended to obtain; the effects of U.S. tax reform legislation and possible future tax reform legislation and regulations, including changes to the tax treatment of the Company’s shareholders or investors in the Company’s joint ventures or other entities the Company manages; the effect of emerging claims and coverage issues; continued soft reinsurance underwriting market conditions; the Company’s reliance on a small and decreasing number of reinsurance brokers and other distribution services for the preponderance of its revenue; the Company’s exposure to credit loss from counterparties in the normal course of business; the effect of continued challenging economic conditions throughout the world; a contention by the Internal Revenue Service that Renaissance Reinsurance Ltd., or any of the Company’s other Bermuda subsidiaries, is subject to taxation in the U.S.; the success of any of the Company’s strategic investments or acquisitions, including the Company’s ability to manage its operations as its product and geographical diversity increases; the Company’s ability to retain key senior officers and to attract or retain the executives and employees necessary to manage its business; the performance of the Company’s investment portfolio; losses that the Company could face from terrorism, political unrest or war; the effect of cybersecurity risks, including technology breaches or failure on the Company’s business; the Company’s ability to successfully implement its business strategies and initiatives; the Company’s ability to determine the impairments taken on investments; the effect of inflation; the ability of the Company’s ceding companies and delegated authority counterparties to accurately assess the risks they underwrite; the effect of operational risks, including system or human failures; the Company’s ability to effectively manage capital on behalf of investors in joint ventures or other entities it manages; foreign currency exchange rate fluctuations; the Company’s ability to raise capital if necessary; the Company’s ability to comply with covenants in its debt agreements; changes to the regulatory systems under which the Company operates, including as a result of increased global regulation of the insurance and reinsurance industry; changes in Bermuda laws and regulations and the political environment in Bermuda; the Company’s dependence on the ability of its operating subsidiaries to declare and pay dividends; aspects of the Company’s corporate structure that may discourage third-party takeovers or other transactions; the cyclical nature of the reinsurance and insurance industries; adverse legislative developments that reduce the size of the private markets the Company serves or impede their future growth; consolidation of competitors, customers and insurance and reinsurance brokers; the effect on the Company’s business of the highly competitive nature of its industry, including the effect of new entrants to, competing products for and consolidation in the (re)insurance industry; other political, regulatory or industry initiatives adversely impacting the Company; increasing barriers to free trade and the free flow of capital; international restrictions on the writing of reinsurance by foreign companies and government intervention in the natural catastrophe market; the effect of Organization for Economic Cooperation and Development or European Union (“EU”) measures to increase the Company’s taxes and reporting requirements; the effect of the vote by the U.K. to leave the EU; changes in regulatory regimes and accounting rules that may impact financial results irrespective of business operations; the Company’s need to make many estimates and judgments in the preparation of its financial statements; and other factors affecting future results disclosed in RenaissanceRe’s filings with the Securities and Exchange Commission, including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Acquisition of Tokio Millennium Re + investment from State Farm Continued execution of our strategy

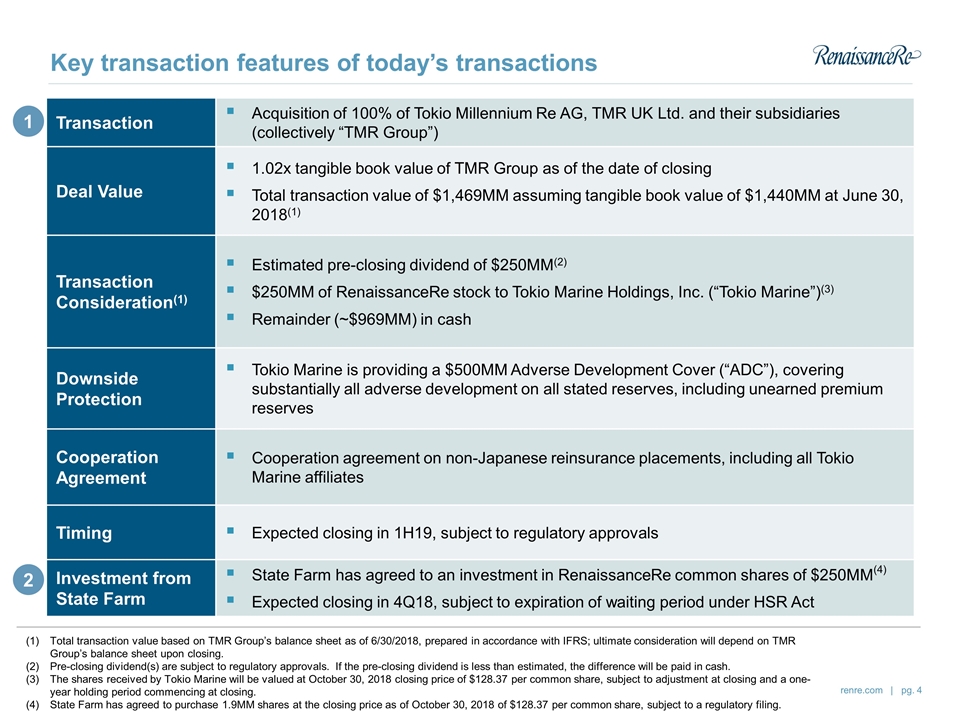

Key transaction features of today’s transactions Transaction Acquisition of 100% of Tokio Millennium Re AG, TMR UK Ltd. and their subsidiaries (collectively “TMR Group”) Deal Value 1.02x tangible book value of TMR Group as of the date of closing Total transaction value of $1,469MM assuming tangible book value of $1,440MM at June 30, 2018(1) Transaction Consideration(1) Estimated pre-closing dividend of $250MM(2) $250MM of RenaissanceRe stock to Tokio Marine Holdings, Inc. (“Tokio Marine”)(3) Remainder (~$969MM) in cash Downside Protection Tokio Marine is providing a $500MM Adverse Development Cover (“ADC”), covering substantially all adverse development on all stated reserves, including unearned premium reserves Cooperation Agreement Cooperation agreement on non-Japanese reinsurance placements, including all Tokio Marine affiliates Timing Expected closing in 1H19, subject to regulatory approvals Investment from State Farm State Farm has agreed to an investment in RenaissanceRe common shares of $250MM(4) Expected closing in 4Q18, subject to expiration of waiting period under HSR Act Total transaction value based on TMR Group’s balance sheet as of 6/30/2018, prepared in accordance with IFRS; ultimate consideration will depend on TMR Group’s balance sheet upon closing. Pre-closing dividend(s) are subject to regulatory approvals. If the pre-closing dividend is less than estimated, the difference will be paid in cash. The shares received by Tokio Marine will be valued at October 30, 2018 closing price of $128.37 per common share, subject to adjustment at closing and a one-year holding period commencing at closing. State Farm has agreed to purchase 1.9MM shares at the closing price as of October 30, 2018 of $128.37 per common share, subject to a regulatory filing. 1 2

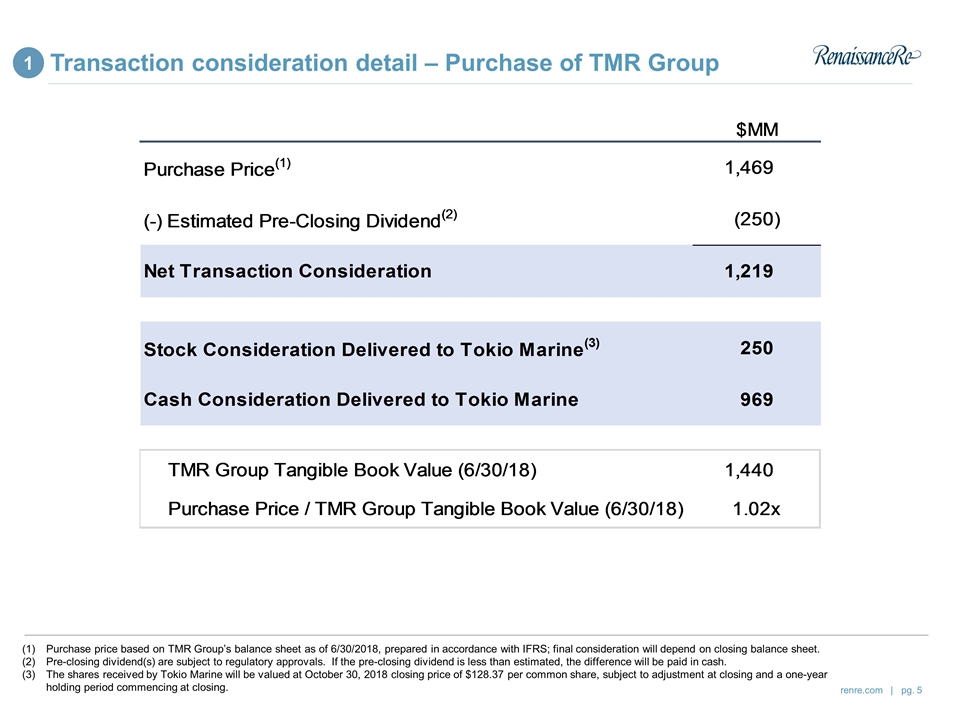

Purchase price based on TMR Group’s balance sheet as of 6/30/2018, prepared in accordance with IFRS; final consideration will depend on closing balance sheet. Pre-closing dividend(s) are subject to regulatory approvals. If the pre-closing dividend is less than estimated, the difference will be paid in cash. The shares received by Tokio Marine will be valued at October 30, 2018 closing price of $128.37 per common share, subject to adjustment at closing and a one-year holding period commencing at closing. Transaction consideration detail – Purchase of TMR Group 1

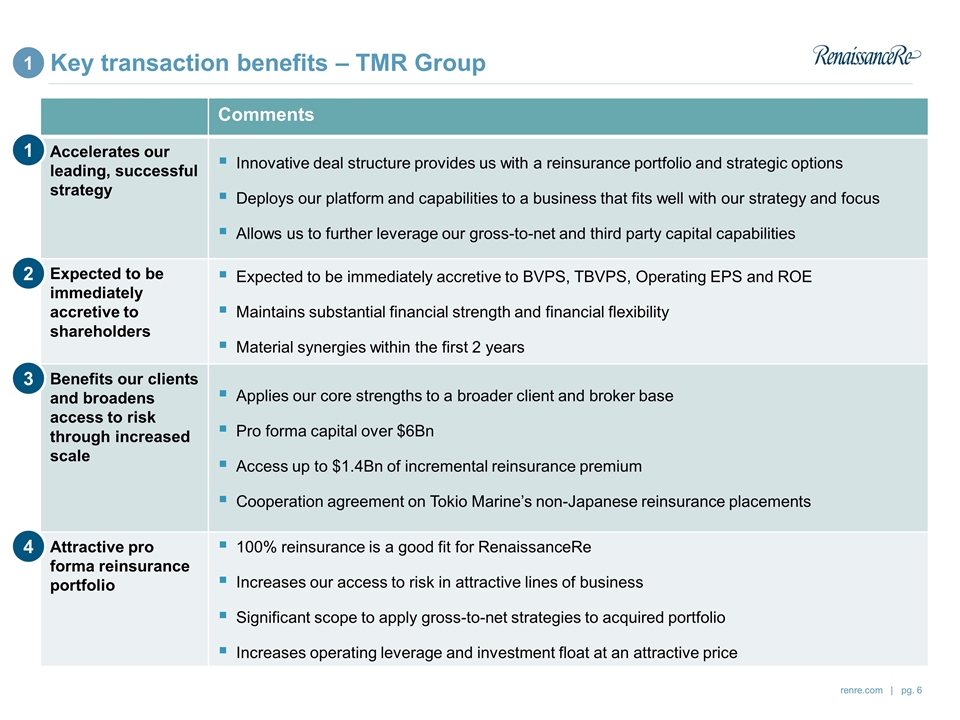

Key transaction benefits – TMR Group Comments Accelerates our leading, successful strategy Innovative deal structure provides us with a reinsurance portfolio and strategic options Deploys our platform and capabilities to a business that fits well with our strategy and focus Allows us to further leverage our gross-to-net and third party capital capabilities Expected to be immediately accretive to shareholders Expected to be immediately accretive to BVPS, TBVPS, Operating EPS and ROE Maintains substantial financial strength and financial flexibility Material synergies within the first 2 years Benefits our clients and broadens access to risk through increased scale Applies our core strengths to a broader client and broker base Pro forma capital over $6Bn Access up to $1.4Bn of incremental reinsurance premium Cooperation agreement on Tokio Marine’s non-Japanese reinsurance placements Attractive pro forma reinsurance portfolio 100% reinsurance is a good fit for RenaissanceRe Increases our access to risk in attractive lines of business Significant scope to apply gross-to-net strategies to acquired portfolio Increases operating leverage and investment float at an attractive price 1 2 3 4 1

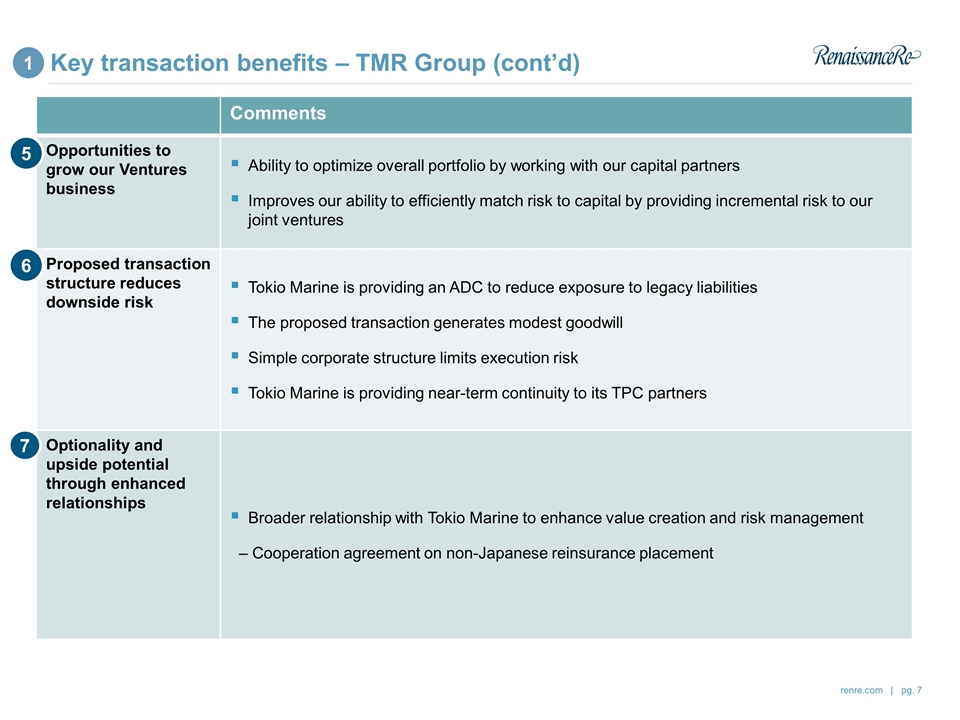

Key transaction benefits – TMR Group (cont’d) Comments Opportunities to grow our Ventures business Ability to optimize overall portfolio by working with our capital partners Improves our ability to efficiently match risk to capital by providing incremental risk to our joint ventures Proposed transaction structure reduces downside risk Tokio Marine is providing an ADC to reduce exposure to legacy liabilities The proposed transaction generates modest goodwill Simple corporate structure limits execution risk Tokio Marine is providing near-term continuity to its TPC partners Optionality and upside potential through enhanced relationships Broader relationship with Tokio Marine to enhance value creation and risk management – Cooperation agreement on non-Japanese reinsurance placement 5 6 7 1

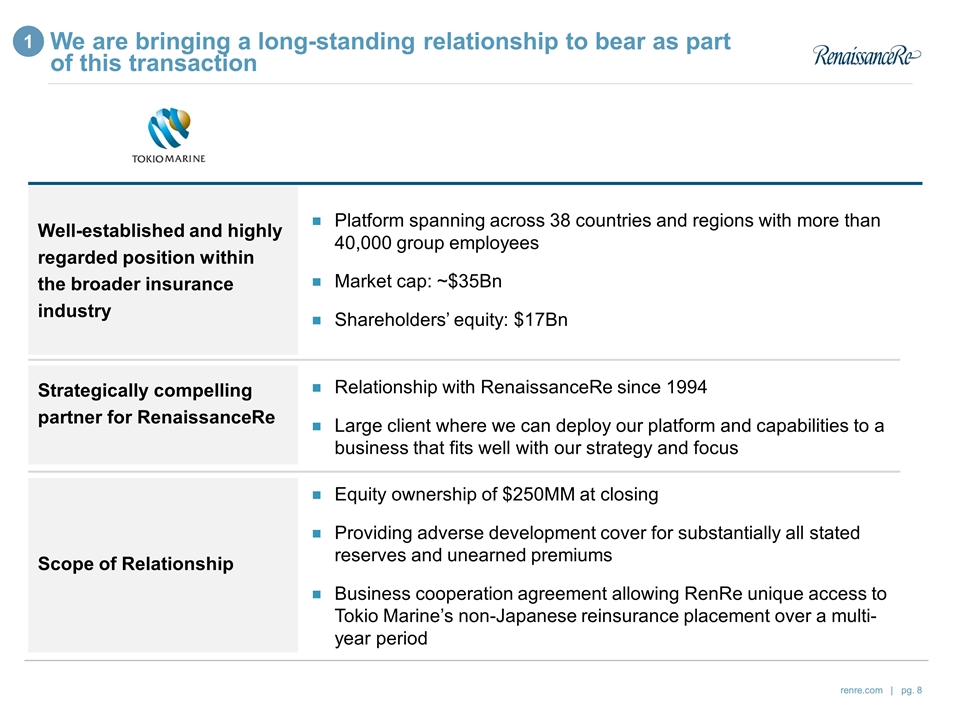

We are bringing a long-standing relationship to bear as part of this transaction Platform spanning across 38 countries and regions with more than 40,000 group employees Market cap: ~$35Bn Shareholders’ equity: $17Bn Well-established and highly regarded position within the broader insurance industry Strategically compelling partner for RenaissanceRe Relationship with RenaissanceRe since 1994 Large client where we can deploy our platform and capabilities to a business that fits well with our strategy and focus 1 Scope of Relationship Equity ownership of $250MM at closing Providing adverse development cover for substantially all stated reserves and unearned premiums Business cooperation agreement allowing RenRe unique access to Tokio Marine’s non-Japanese reinsurance placement over a multi-year period

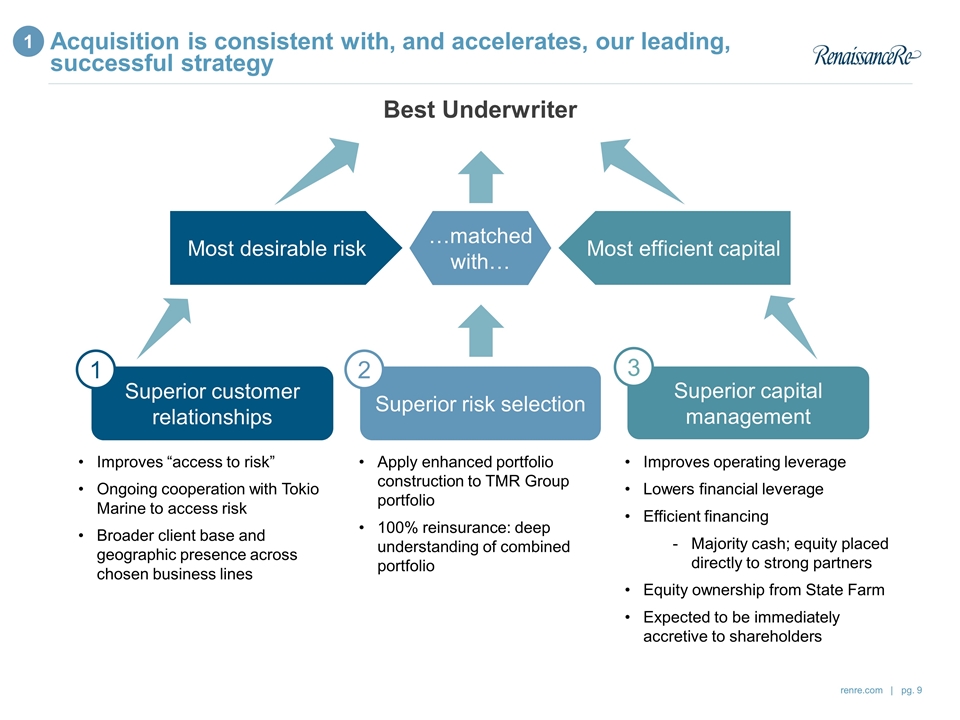

Acquisition is consistent with, and accelerates, our leading, successful strategy Superior customer relationships Superior capital management Superior risk selection Best Underwriter Most desirable risk Most efficient capital …matched with… 1 2 3 Improves “access to risk” Ongoing cooperation with Tokio Marine to access risk Broader client base and geographic presence across chosen business lines Apply enhanced portfolio construction to TMR Group portfolio 100% reinsurance: deep understanding of combined portfolio Improves operating leverage Lowers financial leverage Efficient financing Majority cash; equity placed directly to strong partners Equity ownership from State Farm Expected to be immediately accretive to shareholders 1

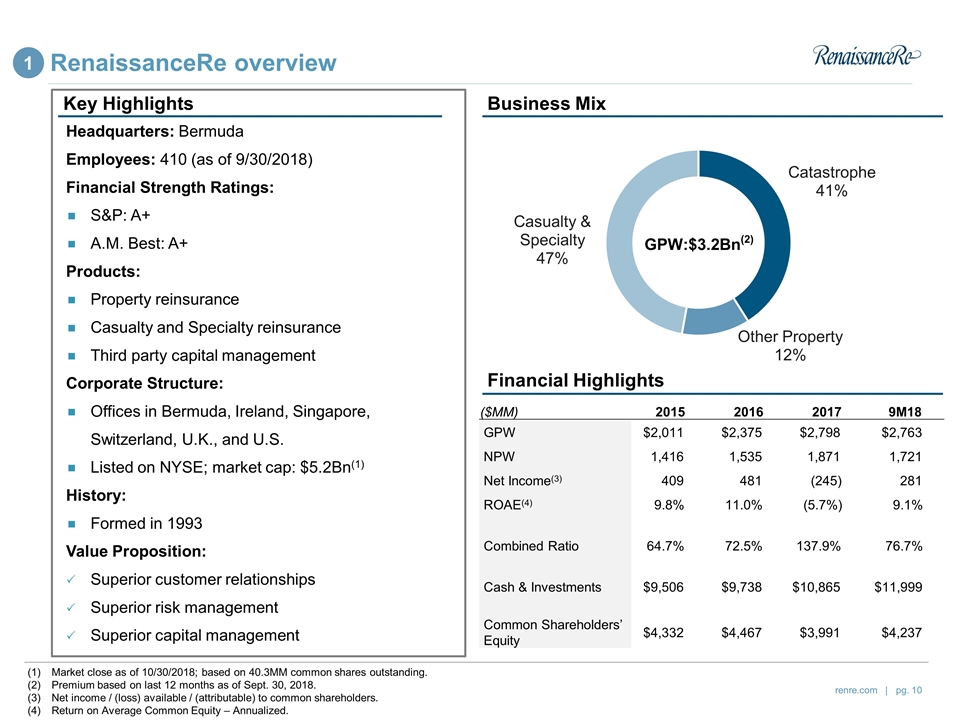

($MM) 2015 2016 2017 9M18 GPW $2,011 $2,375 $2,798 $2,763 NPW 1,416 1,535 1,871 1,721 Net Income(3) 409 481 (245) 281 ROAE(4) 9.8% 11.0% (5.7%) 9.1% Combined Ratio 64.7% 72.5% 137.9% 76.7% Cash & Investments $9,506 $9,738 $10,865 $11,999 Common Shareholders’ Equity $4,332 $4,467 $3,991 $4,237 RenaissanceRe overview Headquarters: Bermuda Employees: 410 (as of 9/30/2018) Financial Strength Ratings: S&P: A+ A.M. Best: A+ Products: Property reinsurance Casualty and Specialty reinsurance Third party capital management Corporate Structure: Offices in Bermuda, Ireland, Singapore, Switzerland, U.K., and U.S. Listed on NYSE; market cap: $5.2Bn(1) History: Formed in 1993 Value Proposition: Superior customer relationships Superior risk management Superior capital management D Business Mix Financial Highlights Market close as of 10/30/2018; based on 40.3MM common shares outstanding. Premium based on last 12 months as of Sept. 30, 2018. Net income / (loss) available / (attributable) to common shareholders. Return on Average Common Equity – Annualized. GPW:$3.2Bn(2) Key Highlights 1

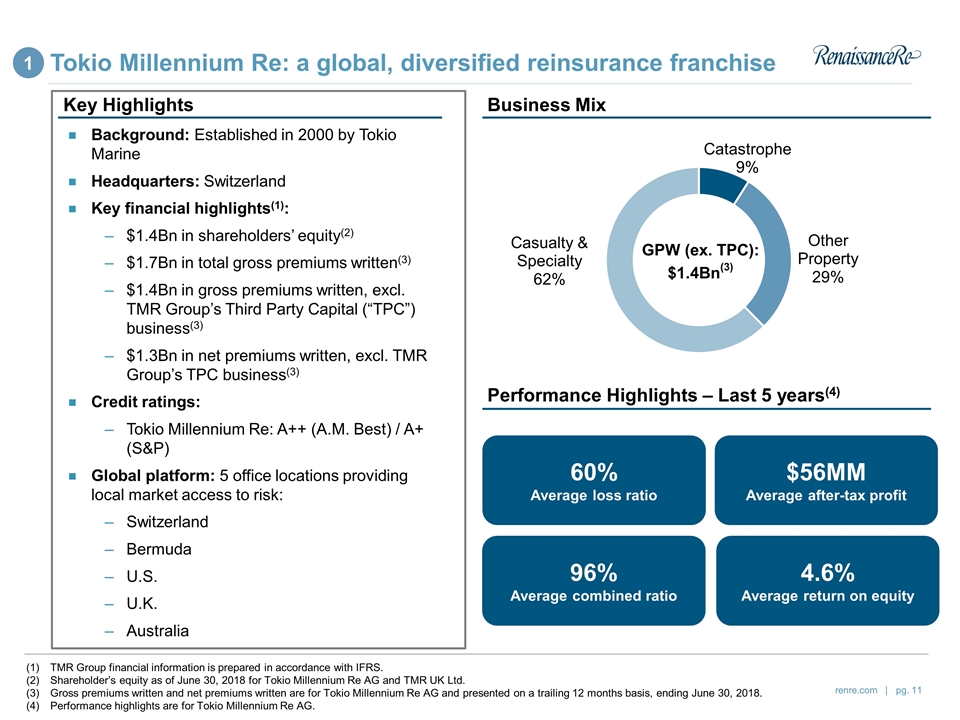

Tokio Millennium Re: a global, diversified reinsurance franchise Background: Established in 2000 by Tokio Marine Headquarters: Switzerland Key financial highlights(1): $1.4Bn in shareholders’ equity(2) $1.7Bn in total gross premiums written(3) $1.4Bn in gross premiums written, excl. TMR Group’s Third Party Capital (“TPC”) business(3) $1.3Bn in net premiums written, excl. TMR Group’s TPC business(3) Credit ratings: Tokio Millennium Re: A++ (A.M. Best) / A+ (S&P) Global platform: 5 office locations providing local market access to risk: Switzerland Bermuda U.S. U.K. Australia Key Highlights Business Mix TMR Group financial information is prepared in accordance with IFRS. Shareholder’s equity as of June 30, 2018 for Tokio Millennium Re AG and TMR UK Ltd. Gross premiums written and net premiums written are for Tokio Millennium Re AG and presented on a trailing 12 months basis, ending June 30, 2018. Performance highlights are for Tokio Millennium Re AG. GPW (ex. TPC): $1.4Bn(3) Performance Highlights – Last 5 years(4) 60% Average loss ratio 96% Average combined ratio $56MM Average after-tax profit 4.6% Average return on equity 1

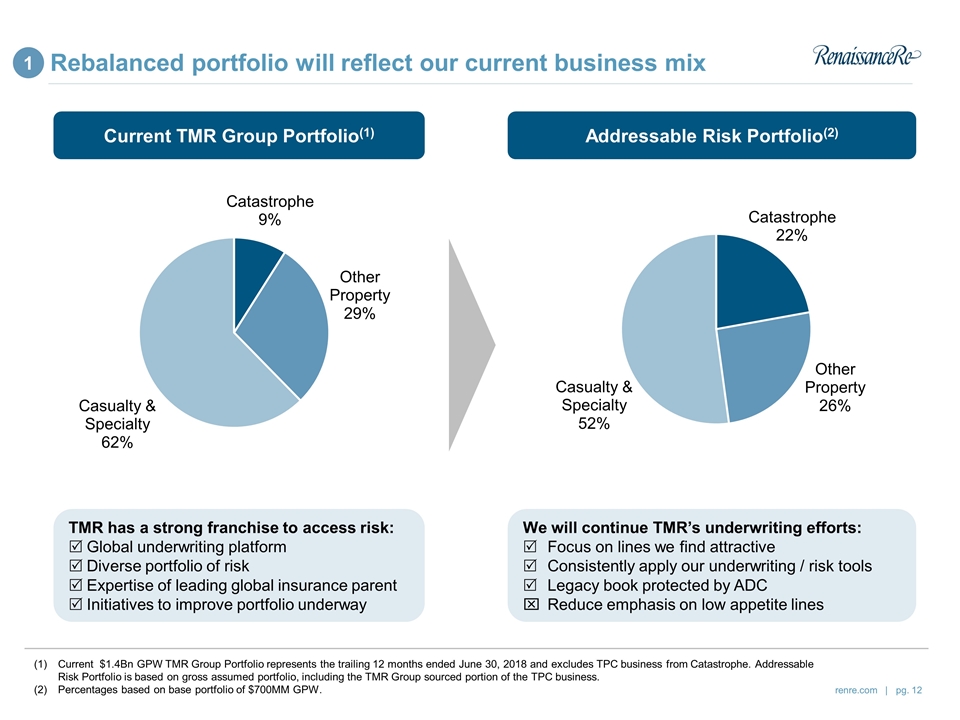

Rebalanced portfolio will reflect our current business mix TMR has a strong franchise to access risk: Global underwriting platform Diverse portfolio of risk Expertise of leading global insurance parent Initiatives to improve portfolio underway 1 Current TMR Group Portfolio(1) Addressable Risk Portfolio(2) We will continue TMR’s underwriting efforts: Focus on lines we find attractive Consistently apply our underwriting / risk tools Legacy book protected by ADC Reduce emphasis on low appetite lines Current $1.4Bn GPW TMR Group Portfolio represents the trailing 12 months ended June 30, 2018 and excludes TPC business from Catastrophe. Addressable Risk Portfolio is based on gross assumed portfolio, including the TMR Group sourced portion of the TPC business. Percentages based on base portfolio of $700MM GPW.

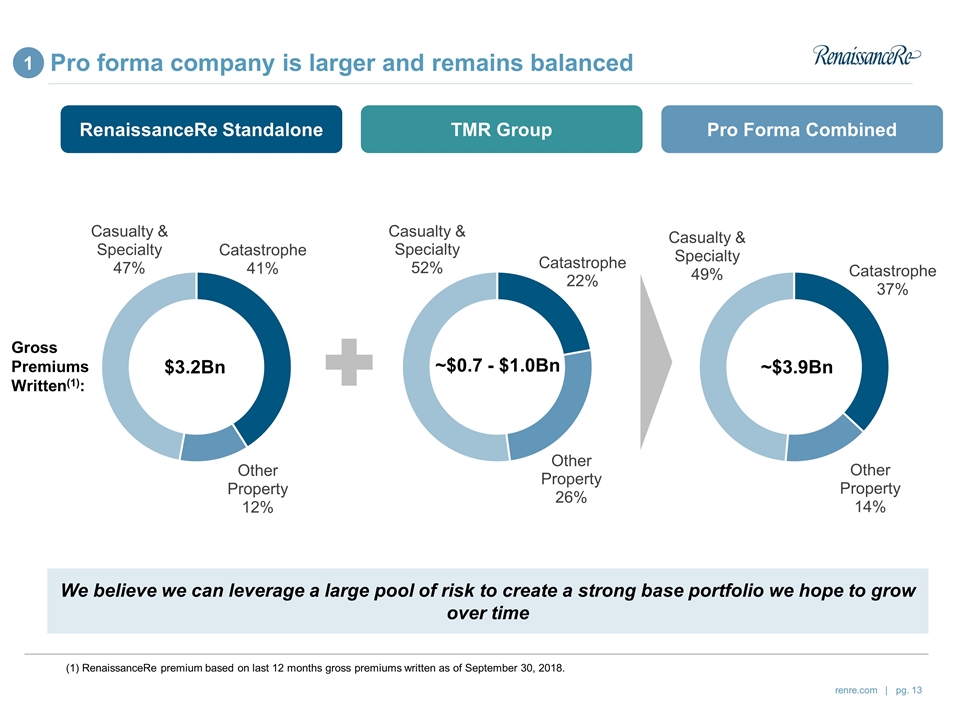

Pro forma company is larger and remains balanced RenaissanceRe Standalone TMR Group Pro Forma Combined $3.2Bn ~$0.7 - $1.0Bn ~$3.9Bn (1) RenaissanceRe premium based on last 12 months gross premiums written as of September 30, 2018. We believe we can leverage a large pool of risk to create a strong base portfolio we hope to grow over time Gross Premiums Written(1): 1

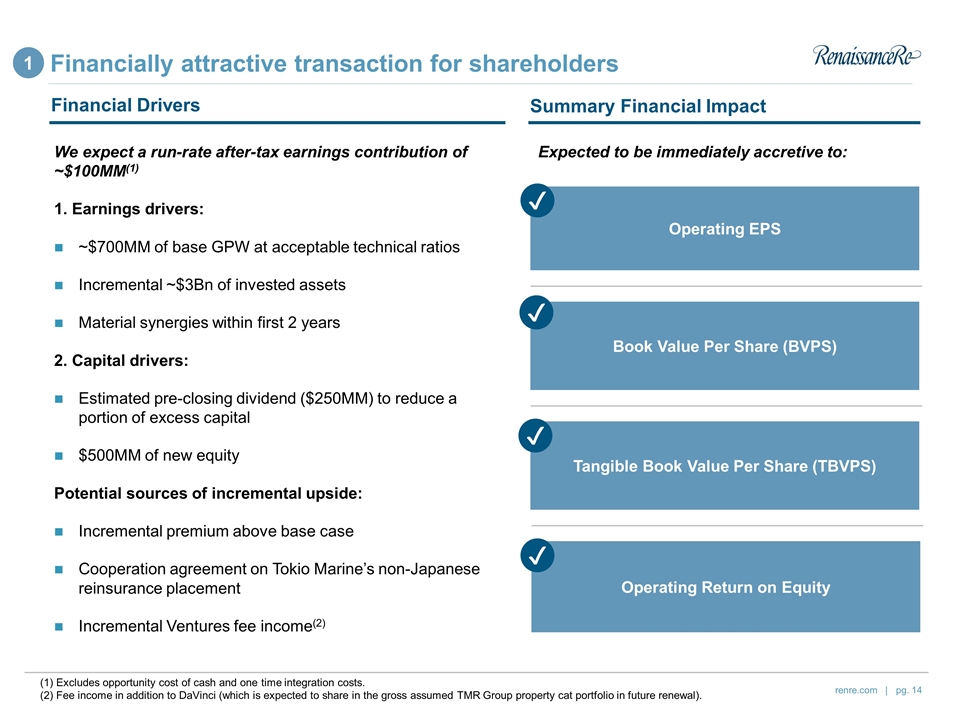

Operating EPS Book Value Per Share (BVPS) Operating Return on Equity Tangible Book Value Per Share (TBVPS) We expect a run-rate after-tax earnings contribution of ~$100MM(1) 1. Earnings drivers: ~$700MM of base GPW at acceptable technical ratios Incremental ~$3Bn of invested assets Material synergies within first 2 years 2. Capital drivers: Estimated pre-closing dividend ($250MM) to reduce a portion of excess capital $500MM of new equity Potential sources of incremental upside: Incremental premium above base case Cooperation agreement on Tokio Marine’s non-Japanese reinsurance placement Incremental Ventures fee income(2) Financial Drivers Summary Financial Impact ✔ ✔ ✔ ✔ Expected to be immediately accretive to: (1) Excludes opportunity cost of cash and one time integration costs. (2) Fee income in addition to DaVinci (which is expected to share in the gross assumed TMR Group property cat portfolio in future renewal). 1 Financially attractive transaction for shareholders

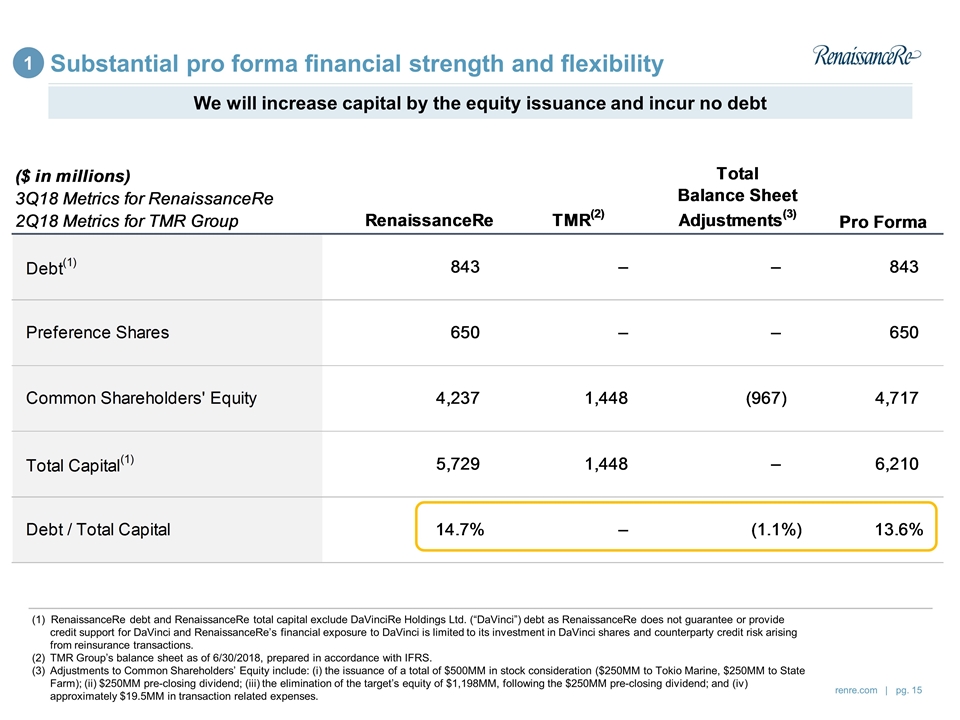

(1) RenaissanceRe debt and RenaissanceRe total capital exclude DaVinciRe Holdings Ltd. (“DaVinci”) debt as RenaissanceRe does not guarantee or provide credit support for DaVinci and RenaissanceRe’s financial exposure to DaVinci is limited to its investment in DaVinci shares and counterparty credit risk arising from reinsurance transactions. (2)TMR Group’s balance sheet as of 6/30/2018, prepared in accordance with IFRS. Adjustments to Common Shareholders’ Equity include: (i) the issuance of a total of $500MM in stock consideration ($250MM to Tokio Marine, $250MM to State Farm); (ii) $250MM pre-closing dividend; (iii) the elimination of the target’s equity of $1,198MM, following the $250MM pre-closing dividend; and (iv) approximately $19.5MM in transaction related expenses. We will increase capital by the equity issuance and incur no debt 1 Substantial pro forma financial strength and flexibility

Acquisition of TMR Group – conclusion Accelerates our leading, successful strategy Expected to be immediately accretive to shareholders Benefits our clients and broadens access to risk through increased scale Attractive pro forma reinsurance portfolio Opportunities to enhance our third-party capital platform Proposed transaction structure reduces downside risk Optionality and upside potential through broader strategic relationships 1

Expanding our relationship with State Farm Overview State Farm is the largest P&C insurance provider in the U.S. Surplus of $99Bn as of June 30, 2018 Relationship with RenaissanceRe spanning over 19 years Co-founders of Top Layer Re (1999) and DaVinci (2001) Strategic Benefits Transaction provides opportunity to further expand our 19 year relationship with State Farm Supportive of RenaissanceRe’s broader strategy Transaction $250MM of RenaissanceRe stock priced at October 30th Agreement executed concurrently with transaction announcement of Tokio Millennium Re; expected closing in 4Q18 2

Acquisition of Tokio Millennium Re + investment from State Farm Continued execution of our strategy

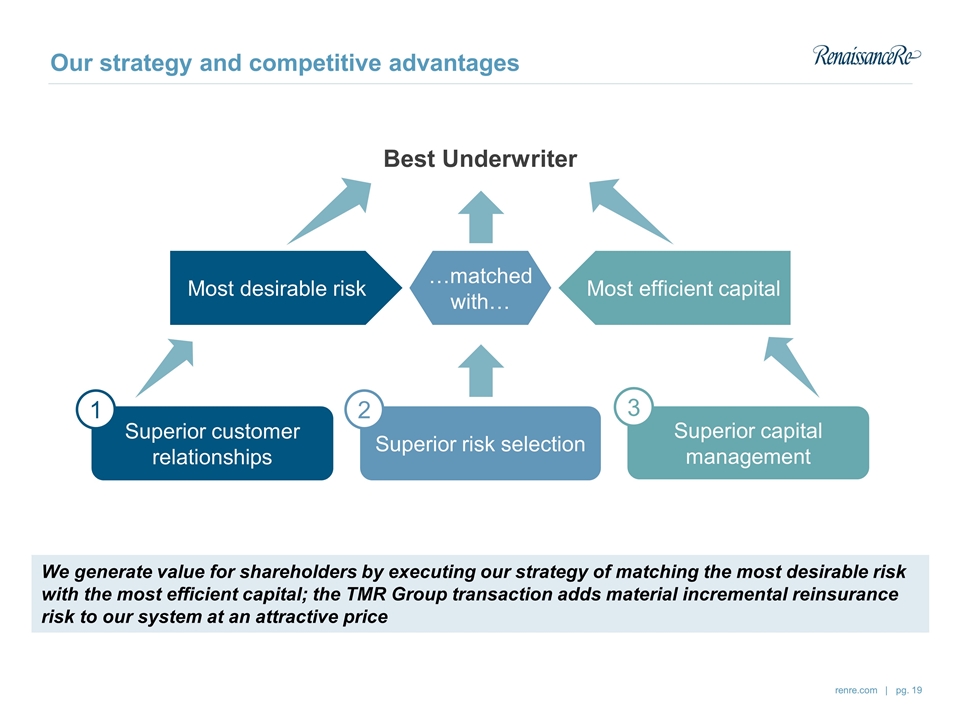

Our strategy and competitive advantages We generate value for shareholders by executing our strategy of matching the most desirable risk with the most efficient capital; the TMR Group transaction adds material incremental reinsurance risk to our system at an attractive price Superior customer relationships Superior capital management Superior risk selection Best Underwriter Most desirable risk Most efficient capital …matched with… 1 2 3

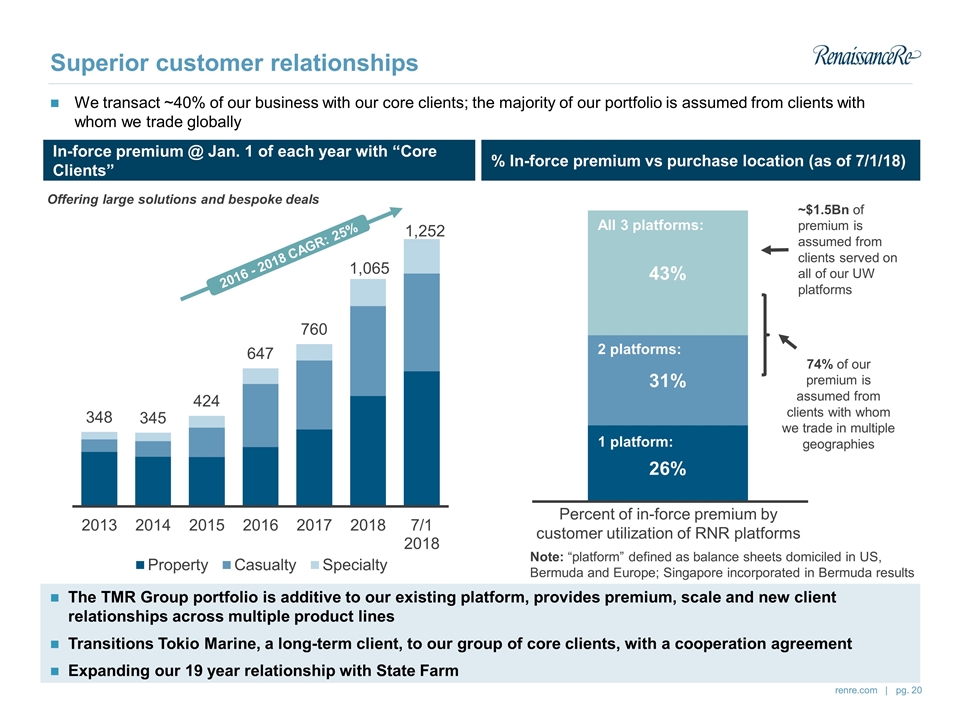

Note: “platform” defined as balance sheets domiciled in US, Bermuda and Europe; Singapore incorporated in Bermuda results Superior customer relationships ~$1.5Bn of premium is assumed from clients served on all of our UW platforms 74% of our premium is assumed from clients with whom we trade in multiple geographies Percent of in-force premium by customer utilization of RNR platforms 2 platforms: All 3 platforms: We transact ~40% of our business with our core clients; the majority of our portfolio is assumed from clients with whom we trade globally The TMR Group portfolio is additive to our existing platform, provides premium, scale and new client relationships across multiple product lines Transitions Tokio Marine, a long-term client, to our group of core clients, with a cooperation agreement Expanding our 19 year relationship with State Farm In-force premium @ Jan. 1 of each year with “Core Clients” % In-force premium vs purchase location (as of 7/1/18) 2016 - 2018 CAGR: 25% Offering large solutions and bespoke deals

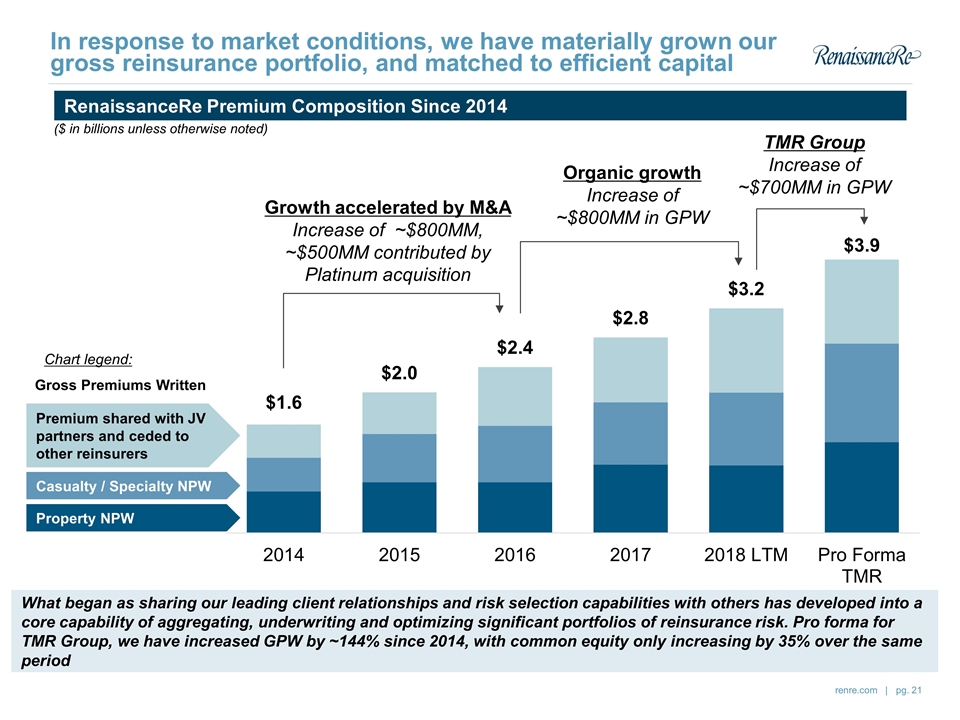

In response to market conditions, we have materially grown our gross reinsurance portfolio, and matched to efficient capital RenaissanceRe Premium Composition Since 2014 Organic growth Increase of ~$800MM in GPW Premium shared with JV partners and ceded to other reinsurers Casualty / Specialty NPW Property NPW ($ in billions unless otherwise noted) Gross Premiums Written Growth accelerated by M&A Increase of ~$800MM, ~$500MM contributed by Platinum acquisition TMR Group Increase of ~$700MM in GPW Chart legend: What began as sharing our leading client relationships and risk selection capabilities with others has developed into a core capability of aggregating, underwriting and optimizing significant portfolios of reinsurance risk. Pro forma for TMR Group, we have increased GPW by ~144% since 2014, with common equity only increasing by 35% over the same period

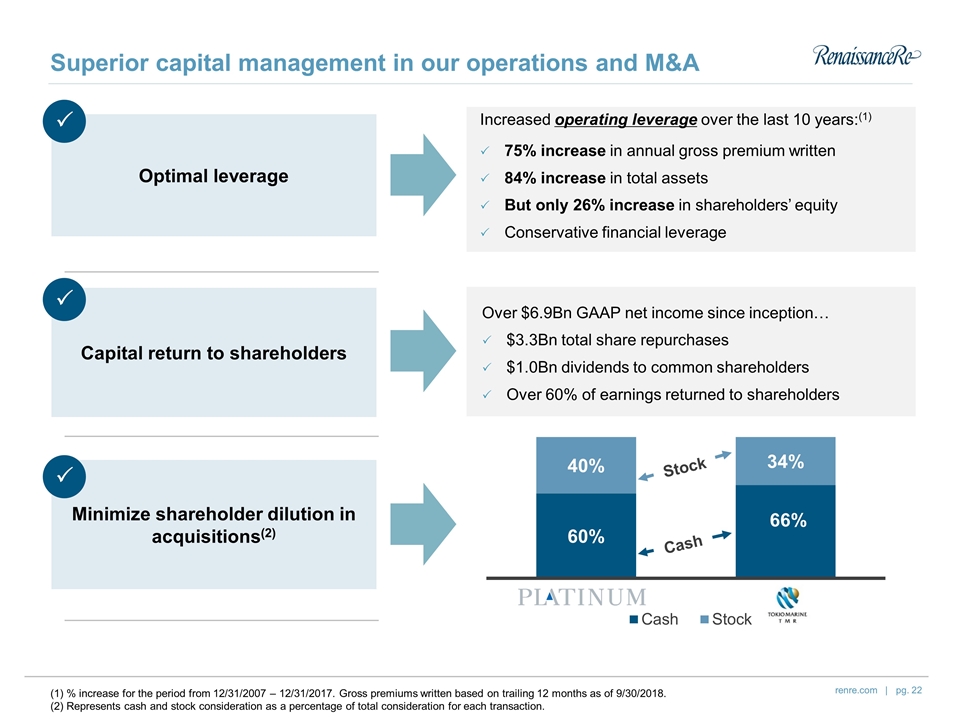

Superior capital management in our operations and M&A Optimal leverage Capital return to shareholders Minimize shareholder dilution in acquisitions(2) P P P Over $6.9Bn GAAP net income since inception… $3.3Bn total share repurchases $1.0Bn dividends to common shareholders Over 60% of earnings returned to shareholders Increased operating leverage over the last 10 years:(1) 75% increase in annual gross premium written 84% increase in total assets But only 26% increase in shareholders’ equity Conservative financial leverage (1) % increase for the period from 12/31/2007 – 12/31/2017. Gross premiums written based on trailing 12 months as of 9/30/2018. (2) Represents cash and stock consideration as a percentage of total consideration for each transaction. Cash Stock

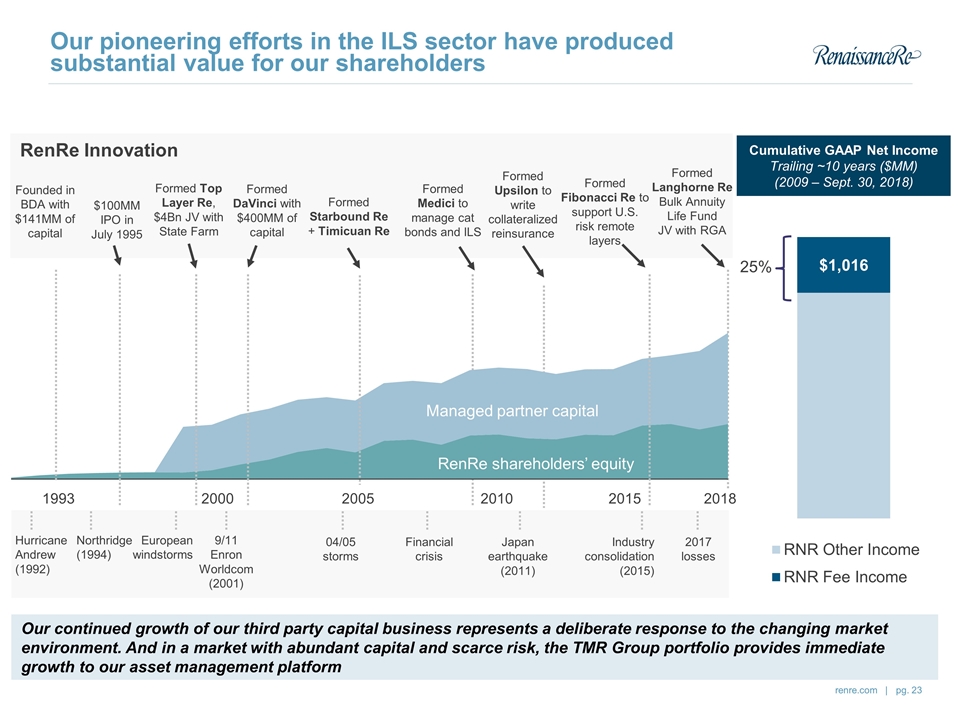

RenRe Innovation Our pioneering efforts in the ILS sector have produced substantial value for our shareholders Hurricane Andrew (1992) Northridge (1994) European windstorms 9/11 Enron Worldcom (2001) 04/05 storms Financial crisis Japan earthquake (2011) Industry consolidation (2015) 2017 losses RenRe shareholders’ equity Managed partner capital Founded in BDA with $141MM of capital $100MM IPO in July 1995 Formed DaVinci with $400MM of capital Formed Top Layer Re, $4Bn JV with State Farm Formed Starbound Re + Timicuan Re Formed Medici to manage cat bonds and ILS Formed Upsilon to write collateralized reinsurance Formed Fibonacci Re to support U.S. risk remote layers Formed Langhorne Re Bulk Annuity Life Fund JV with RGA Our continued growth of our third party capital business represents a deliberate response to the changing market environment. And in a market with abundant capital and scarce risk, the TMR Group portfolio provides immediate growth to our asset management platform 25% Cumulative GAAP Net Income Trailing ~10 years ($MM) (2009 – Sept. 30, 2018)

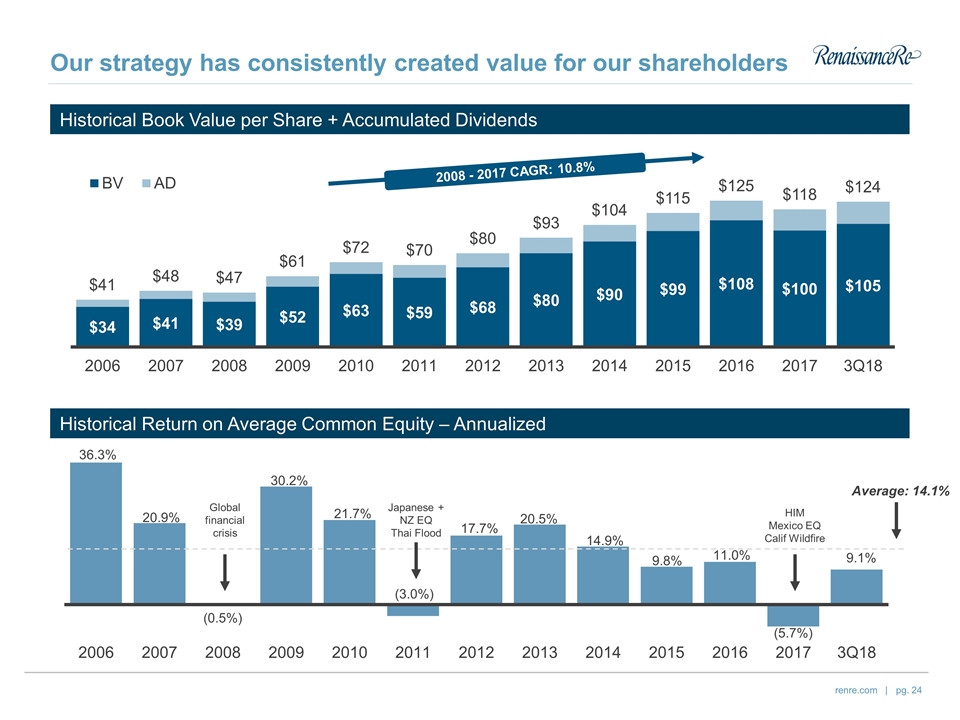

Our strategy has consistently created value for our shareholders Global financial crisis Japanese + NZ EQ Thai Flood HIM Mexico EQ Calif Wildfire Average: 14.1% Historical Return on Average Common Equity – Annualized Historical Book Value per Share + Accumulated Dividends 2008 - 2017 CAGR: 10.8%

Renaissance House 12 Crow Lane Pembroke HM19 Bermuda www.renre.com