EX-99.2

Published on May 22, 2023

May 22, 2023 RenaissanceRe to Acquire Validus Re Exhibit 99.2

Disclaimer This presentation is being delivered on behalf of RenaissanceRe Holdings Ltd. (“RenaissanceRe” or the “the Company”) and refers to the Company’s acquisition of certain businesses from AIG, which include (i) Validus Reinsurance Ltd. and its consolidated subsidiaries, (ii) AlphaCat and (iii) renewal rights for the Talbot Treaty business. Throughout this presentation we refer to these businesses that we are acquiring collectively as “Validus Re.” Any forward-looking statements made in this presentation, including statements about our expectations, forecasts, projections and estimates regarding the impact of the transactions described herein, reflect RenaissanceRe’s current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We may also make forward-looking statements with respect to our business and industry, such as those relating to our strategy and management objectives, plans and expectations regarding our response and ability to adapt to changing economic conditions, market standing and product volumes, and insured losses from loss events, among other things. These statements are subject to numerous factors that could cause actual results to differ materially from those addressed by such forward-looking statements, including those disclosed in RenaissanceRe’s filings with the SEC, including its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and the following: the risk that the Validus Re acquisition may not be completed within the expected timeframe or at all; the risk that regulatory agencies in certain jurisdictions may impose onerous conditions following the Validus Re acquisition; difficulties in integrating Validus Re; risk that the due diligence process that we undertook in connection with the Validus Re acquisition may not have revealed all facts that may be relevant in connection with the Validus Re acquisition; our ability to manage the growth of the Validus Re operations successfully following the acquisition of Validus Re; that historical financial statements of Validus Re are not representative of the future financial position, future results of operations or future cash flows of Validus Re following the acquisition of Validus Re; risks from our increased debt obligations as a result of the Validus Acquisition; the dilutive impact on our shareholders from the issuance of common shares to AIG in connection with the Validus Acquisition; our exposure to natural and non-natural catastrophic events and circumstances and the variance they may cause in our financial results; the effect of climate change on our business, including the trend towards increasingly frequent and severe climate events; the effectiveness of our claims and claim expense reserving process; the effect of emerging claims and coverage issues; the performance of our investment portfolio and financial market volatility; the effects of inflation; the ability of our ceding companies and delegated authority counterparties to accurately assess the risks they underwrite; our ability to maintain our financial strength ratings; the highly competitive nature of our industry; our reliance on a small number of brokers; collection on claimed retrocessional coverage, and new retrocessional reinsurance being available on acceptable terms or at all; the historically cyclical nature of the (re)insurance industries; our ability to attract and retain key executives and employees; our ability to successfully implement our business, strategies and initiatives; our exposure to credit loss from counterparties; our need to make many estimates and judgments in the preparation of our financial statements; our ability to effectively manage capital on behalf of investors in joint ventures or other entities we manage; changes to the accounting rules and regulatory systems applicable to our business, including changes in Bermuda and U.S. laws or regulations; other political, regulatory or industry initiatives adversely impacting us; our ability to comply with covenants in our debt agreements; the effect of adverse economic factors, including changes in the prevailing interest rates and recession or the perception that recession may occur; the effect of cybersecurity risks, including technology breaches or failure; a contention by the IRS that any of our Bermuda subsidiaries are subject to taxation in the U.S.; the effects of possible future tax reform legislation and regulations in the jurisdictions in which we operate; our ability to determine any impairments taken on our investments; our ability to raise capital on acceptable terms, including through debt instruments, the capital markets, and third party investments in our joint ventures and managed fund partners; our ability to comply with applicable sanctions and foreign corrupt practices laws; and our dependence on the ability of our operating subsidiaries to declare and pay dividends. The audited consolidated financial statements of Validus Reinsurance Ltd. for the years ended December 31, 2022 and December 31, 2021, were filed as Exhibit 99.2 to our Current Report on Form 8-K filed with the SEC on May 22, 2023. However, we have not filed (i) historical financial statements of Validus Reinsurance Ltd. for the quarter ended March 31, 2023, (ii) historical financial statements of the other entities that we expect to acquire in connection with the Validus Re acquisition, or (iii) pro forma financial information in accordance with Regulation S-X published by the SEC. We will file with the SEC historical financial statements with respect to the businesses we expect to acquire in connection with the Validus Re acquisition as well as unaudited pro forma financial information presented in accordance with the requirements of Regulation S-X no later than 71 days after the date that the initial report on Form 8-K disclosing the completion of the Validus Re acquisition must be filed.

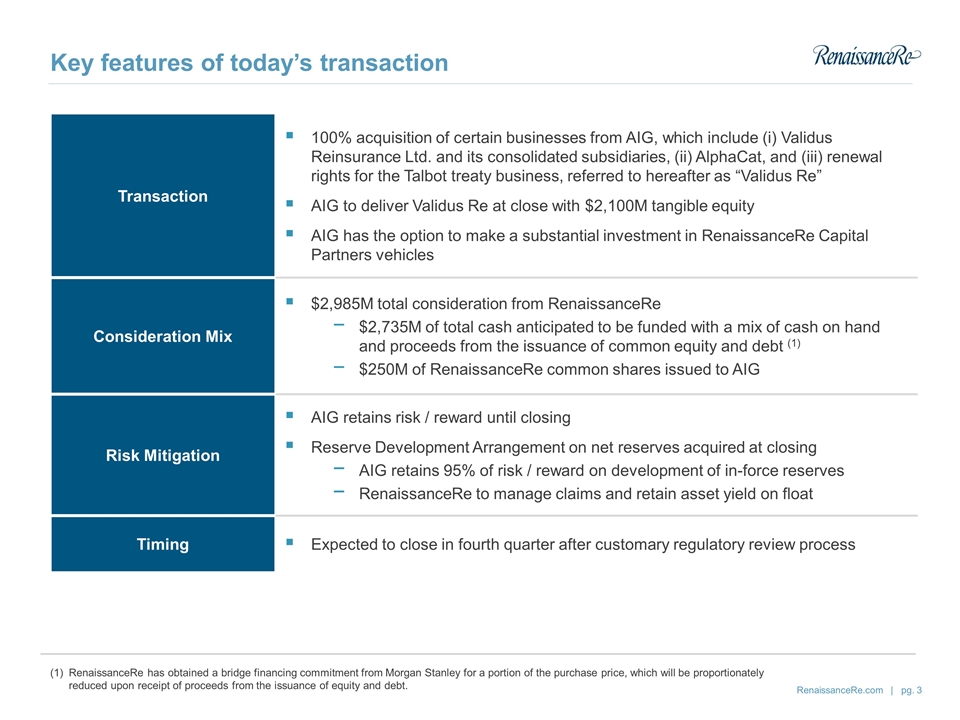

Key features of today’s transaction Transaction 100% acquisition of certain businesses from AIG, which include (i) Validus Reinsurance Ltd. and its consolidated subsidiaries, (ii) AlphaCat, and (iii) renewal rights for the Talbot treaty business, referred to hereafter as “Validus Re” AIG to deliver Validus Re at close with $2,100M tangible equity AIG has the option to make a substantial investment in RenaissanceRe Capital Partners vehicles Consideration Mix $2,985M total consideration from RenaissanceRe $2,735M of total cash anticipated to be funded with a mix of cash on hand and proceeds from the issuance of common equity and debt (1) $250M of RenaissanceRe common shares issued to AIG Risk Mitigation AIG retains risk / reward until closing Reserve Development Arrangement on net reserves acquired at closing AIG retains 95% of risk / reward on development of in-force reserves RenaissanceRe to manage claims and retain asset yield on float Timing Expected to close in fourth quarter after customary regulatory review process RenaissanceRe has obtained a bridge financing commitment from Morgan Stanley for a portion of the purchase price, which will be proportionately reduced upon receipt of proceeds from the issuance of equity and debt.

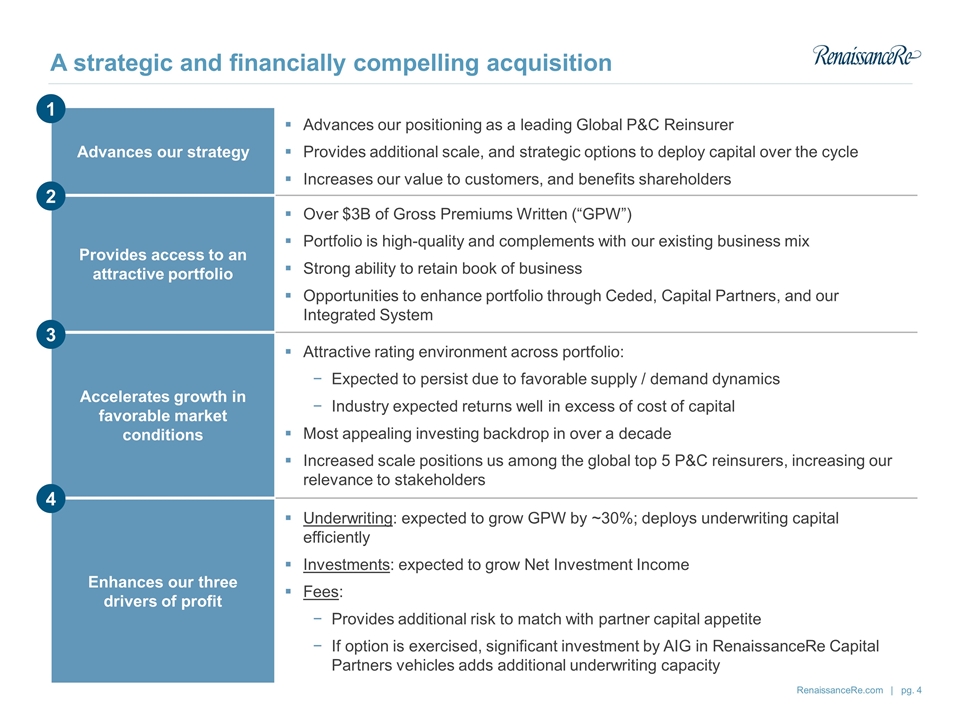

A strategic and financially compelling acquisition Advances our strategy Advances our positioning as a leading Global P&C Reinsurer Provides additional scale, and strategic options to deploy capital over the cycle Increases our value to customers, and benefits shareholders Provides access to an attractive portfolio Over $3B of Gross Premiums Written (“GPW”) Portfolio is high-quality and complements with our existing business mix Strong ability to retain book of business Opportunities to enhance portfolio through Ceded, Capital Partners, and our Integrated System Accelerates growth in favorable market conditions Attractive rating environment across portfolio: Expected to persist due to favorable supply / demand dynamics Industry expected returns well in excess of cost of capital Most appealing investing backdrop in over a decade Increased scale positions us among the global top 5 P&C reinsurers, increasing our relevance to stakeholders Enhances our three drivers of profit Underwriting: expected to grow GPW by ~30%; deploys underwriting capital efficiently Investments: expected to grow Net Investment Income Fees: Provides additional risk to match with partner capital appetite If option is exercised, significant investment by AIG in RenaissanceRe Capital Partners vehicles adds additional underwriting capacity 1 2 3 4

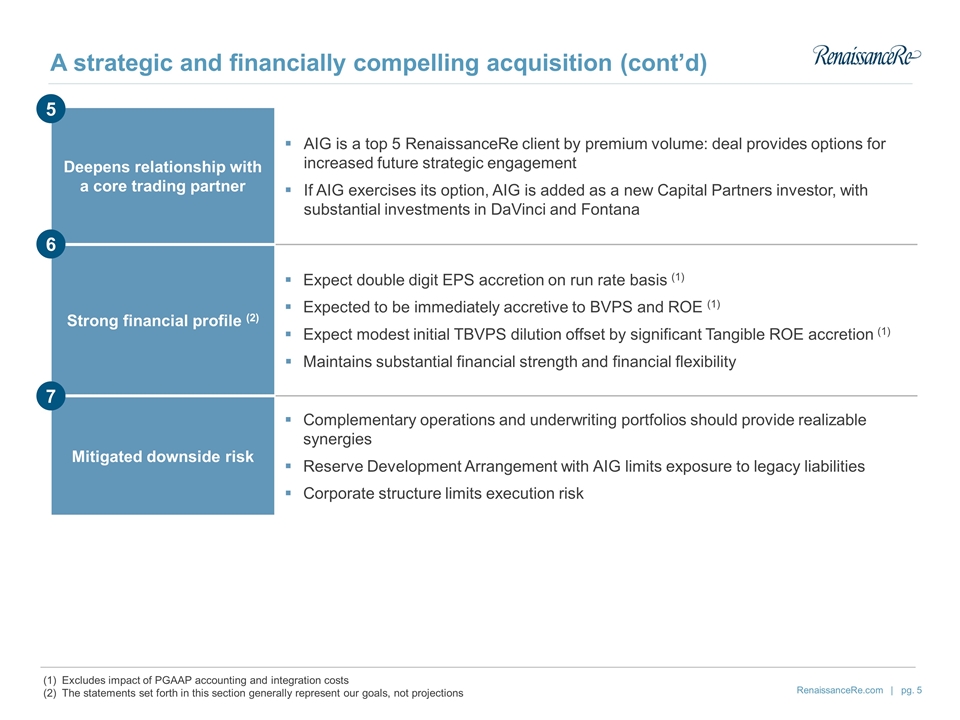

A strategic and financially compelling acquisition (cont’d) Deepens relationship with a core trading partner AIG is a top 5 RenaissanceRe client by premium volume: deal provides options for increased future strategic engagement If AIG exercises its option, AIG is added as a new Capital Partners investor, with substantial investments in DaVinci and Fontana Strong financial profile (2) Expect double digit EPS accretion on run rate basis (1) Expected to be immediately accretive to BVPS and ROE (1) Expect modest initial TBVPS dilution offset by significant Tangible ROE accretion (1) Maintains substantial financial strength and financial flexibility Mitigated downside risk Complementary operations and underwriting portfolios should provide realizable synergies Reserve Development Arrangement with AIG limits exposure to legacy liabilities Corporate structure limits execution risk 5 6 7 Excludes impact of PGAAP accounting and integration costs The statements set forth in this section generally represent our goals, not projections

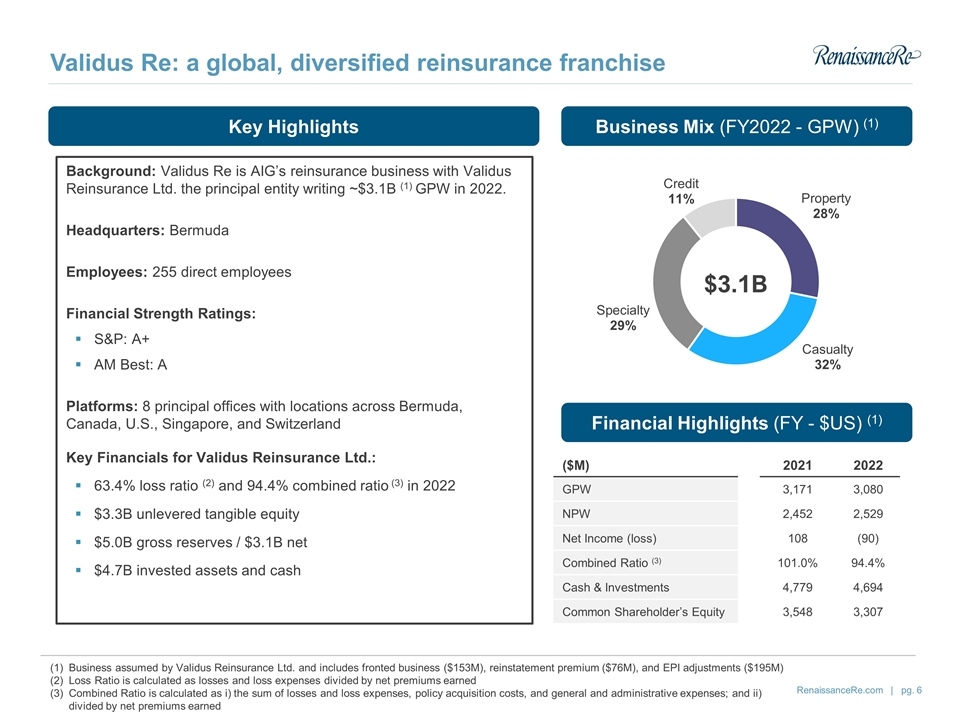

$3.1B Background: Validus Re is AIG’s reinsurance business with Validus Reinsurance Ltd. the principal entity writing ~$3.1B (1) GPW in 2022. Headquarters: Bermuda Employees: 255 direct employees Financial Strength Ratings: S&P: A+ AM Best: A Platforms: 8 principal offices with locations across Bermuda, Canada, U.S., Singapore, and Switzerland Key Financials for Validus Reinsurance Ltd.: 63.4% loss ratio (2) and 94.4% combined ratio (3) in 2022 $3.3B unlevered tangible equity $5.0B gross reserves / $3.1B net $4.7B invested assets and cash Validus Re: a global, diversified reinsurance franchise Key Highlights Business Mix (FY2022 - GPW) (1) Financial Highlights (FY - $US) (1) ($M) 2021 2022 GPW 3,171 3,080 NPW 2,452 2,529 Net Income (loss) 108 (90) Combined Ratio (3) 101.0% 94.4% Cash & Investments 4,779 4,694 Common Shareholder’s Equity 3,548 3,307 Business assumed by Validus Reinsurance Ltd. and includes fronted business ($153M), reinstatement premium ($76M), and EPI adjustments ($195M) Loss Ratio is calculated as losses and loss expenses divided by net premiums earned Combined Ratio is calculated as i) the sum of losses and loss expenses, policy acquisition costs, and general and administrative expenses; and ii) divided by net premiums earned

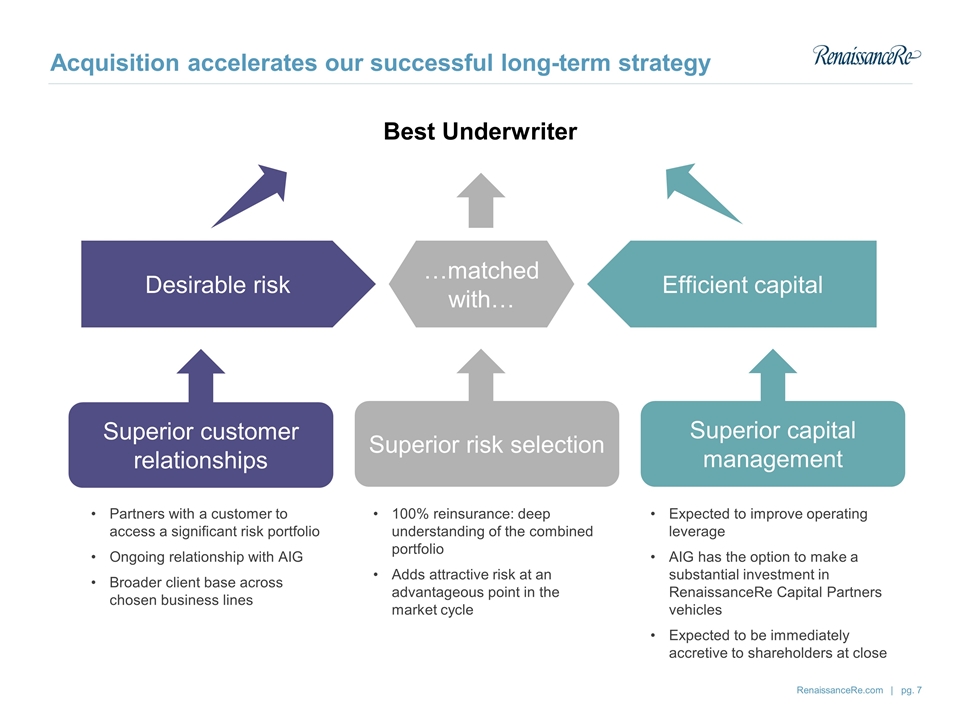

Acquisition accelerates our successful long-term strategy Superior risk selection Best Underwriter Superior capital management Superior customer relationships Desirable risk Efficient capital …matched with… Partners with a customer to access a significant risk portfolio Ongoing relationship with AIG Broader client base across chosen business lines 100% reinsurance: deep understanding of the combined portfolio Adds attractive risk at an advantageous point in the market cycle Expected to improve operating leverage AIG has the option to make a substantial investment in RenaissanceRe Capital Partners vehicles Expected to be immediately accretive to shareholders at close

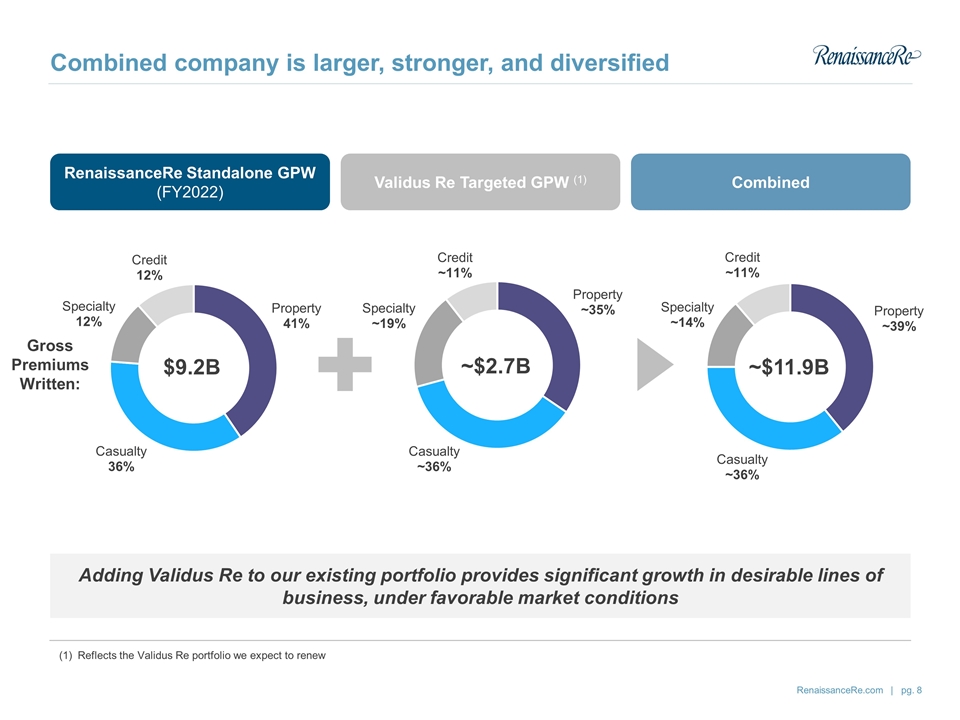

Combined company is larger, stronger, and diversified Validus Re Targeted GPW (1) Combined RenaissanceRe Standalone GPW (FY2022) $9.2B Gross Premiums Written: ~$11.9B ~$2.7B Adding Validus Re to our existing portfolio provides significant growth in desirable lines of business, under favorable market conditions Reflects the Validus Re portfolio we expect to renew

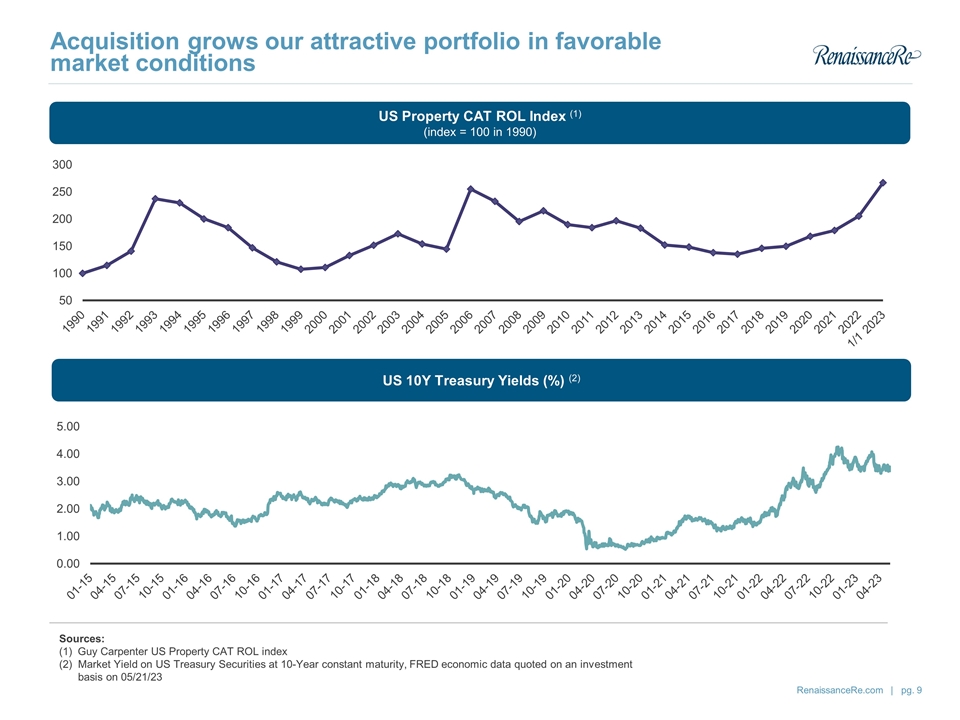

Acquisition grows our attractive portfolio in favorable market conditions US Property CAT ROL Index (1) (index = 100 in 1990) US 10Y Treasury Yields (%) (2) Sources: Guy Carpenter US Property CAT ROL index (2) Market Yield on US Treasury Securities at 10-Year constant maturity, FRED economic data quoted on an investment basis on 05/21/23 1/1

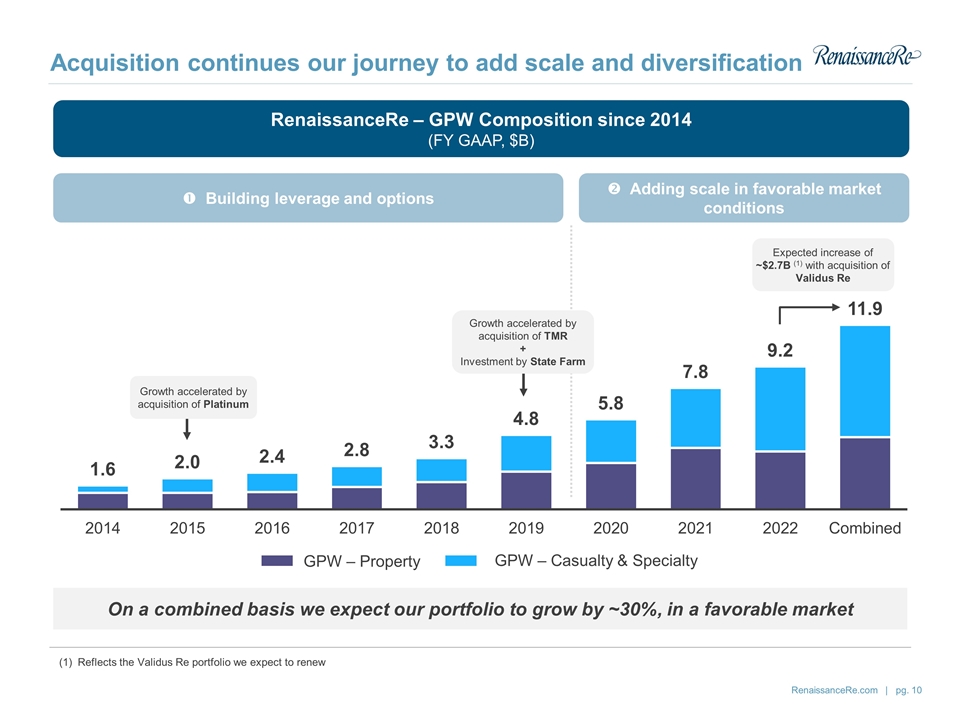

Acquisition continues our journey to add scale and diversification RenaissanceRe – GPW Composition since 2014 (FY GAAP, $B) Building leverage and options Adding scale in favorable market conditions Expected increase of ~$2.7B (1) with acquisition of Validus Re Growth accelerated by acquisition of Platinum Growth accelerated by acquisition of TMR + Investment by State Farm On a combined basis we expect our portfolio to grow by ~30%, in a favorable market GPW – Property GPW – Casualty & Specialty Reflects the Validus Re portfolio we expect to renew

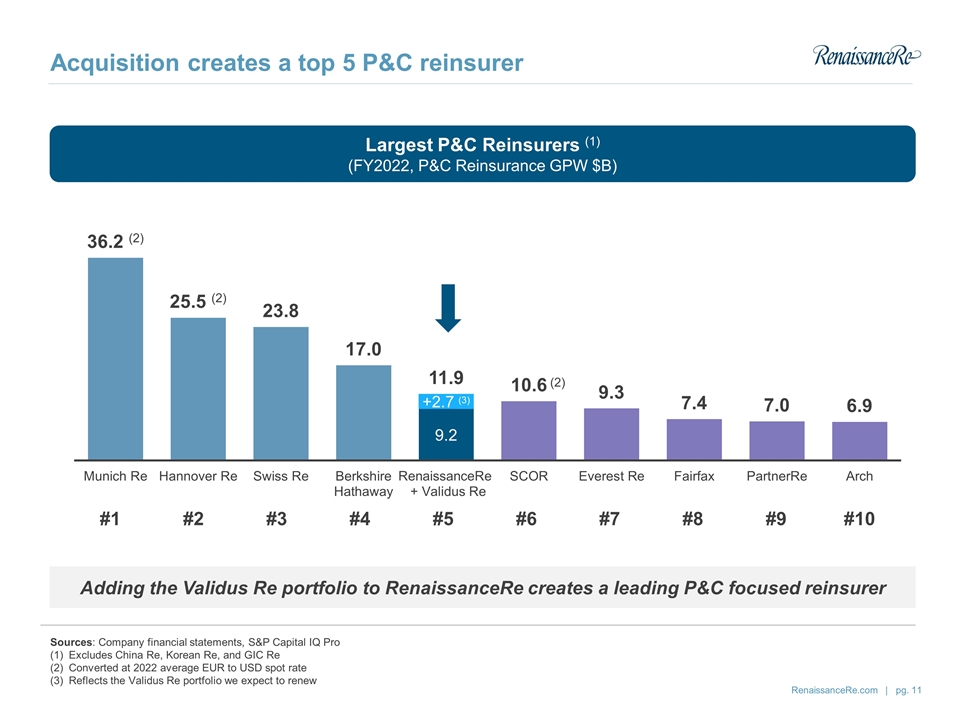

Acquisition creates a top 5 P&C reinsurer #1 #2 #3 #4 #5 #6 #7 #8 #9 #10 Largest P&C Reinsurers (1) (FY2022, P&C Reinsurance GPW $B) Sources: Company financial statements, S&P Capital IQ Pro Excludes China Re, Korean Re, and GIC Re Converted at 2022 average EUR to USD spot rate Reflects the Validus Re portfolio we expect to renew Adding the Validus Re portfolio to RenaissanceRe creates a leading P&C focused reinsurer (2)

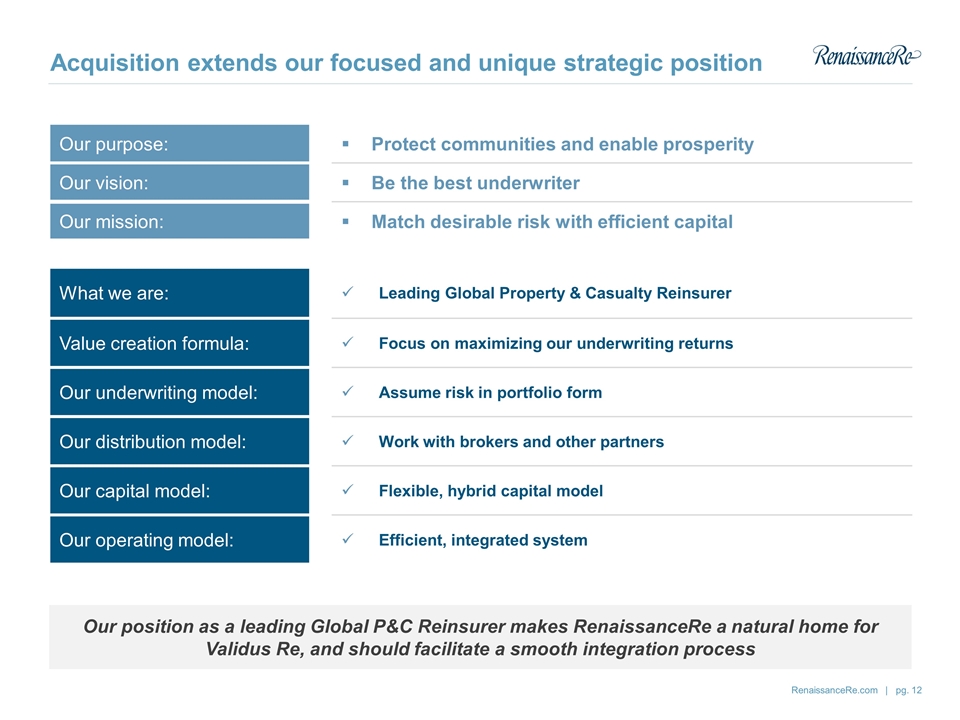

Acquisition extends our focused and unique strategic position Our purpose: Protect communities and enable prosperity Our vision: Be the best underwriter Our mission: Match desirable risk with efficient capital What we are: Leading Global Property & Casualty Reinsurer Value creation formula: Focus on maximizing our underwriting returns Our underwriting model: Assume risk in portfolio form Our distribution model: Work with brokers and other partners Our capital model: Flexible, hybrid capital model Our operating model: Efficient, integrated system Our position as a leading Global P&C Reinsurer makes RenaissanceRe a natural home for Validus Re, and should facilitate a smooth integration process

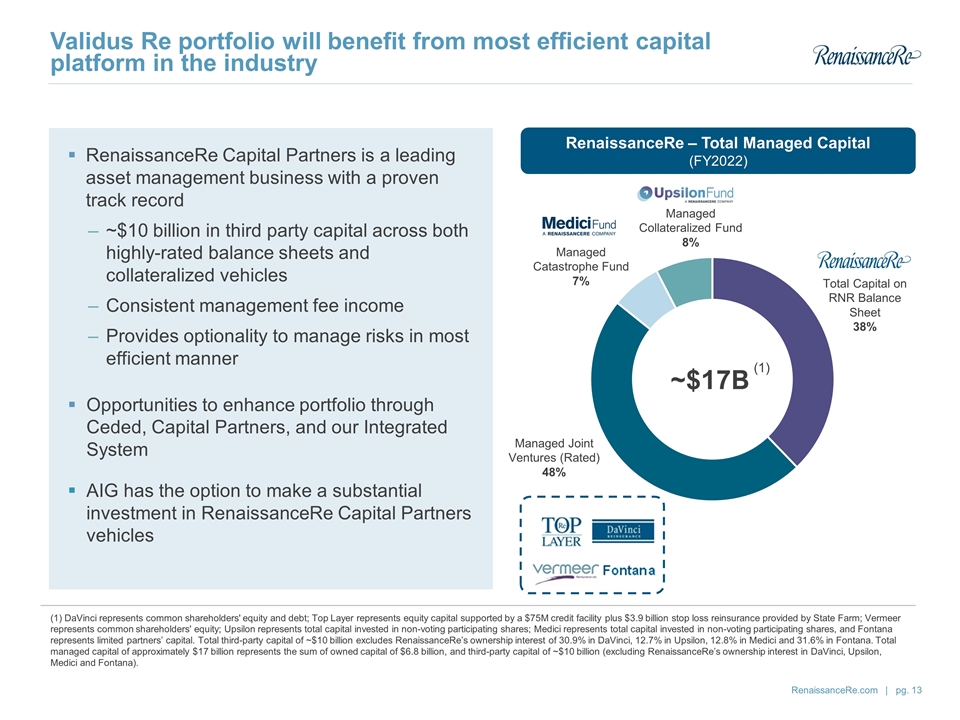

(1) DaVinci represents common shareholders' equity and debt; Top Layer represents equity capital supported by a $75M credit facility plus $3.9 billion stop loss reinsurance provided by State Farm; Vermeer represents common shareholders' equity; Upsilon represents total capital invested in non-voting participating shares; Medici represents total capital invested in non-voting participating shares, and Fontana represents limited partners’ capital. Total third-party capital of ~$10 billion excludes RenaissanceRe’s ownership interest of 30.9% in DaVinci, 12.7% in Upsilon, 12.8% in Medici and 31.6% in Fontana. Total managed capital of approximately $17 billion represents the sum of owned capital of $6.8 billion, and third-party capital of ~$10 billion (excluding RenaissanceRe’s ownership interest in DaVinci, Upsilon, Medici and Fontana). RenaissanceRe – Total Managed Capital (FY2022) Validus Re portfolio will benefit from most efficient capital platform in the industry (1) RenaissanceRe Capital Partners is a leading asset management business with a proven track record ~$10 billion in third party capital across both highly-rated balance sheets and collateralized vehicles Consistent management fee income Provides optionality to manage risks in most efficient manner Opportunities to enhance portfolio through Ceded, Capital Partners, and our Integrated System AIG has the option to make a substantial investment in RenaissanceRe Capital Partners vehicles Managed Joint Ventures (Rated) 48% Total Capital on RNR Balance Sheet 38% Managed Catastrophe Fund 7% Managed Collateralized Fund 8%

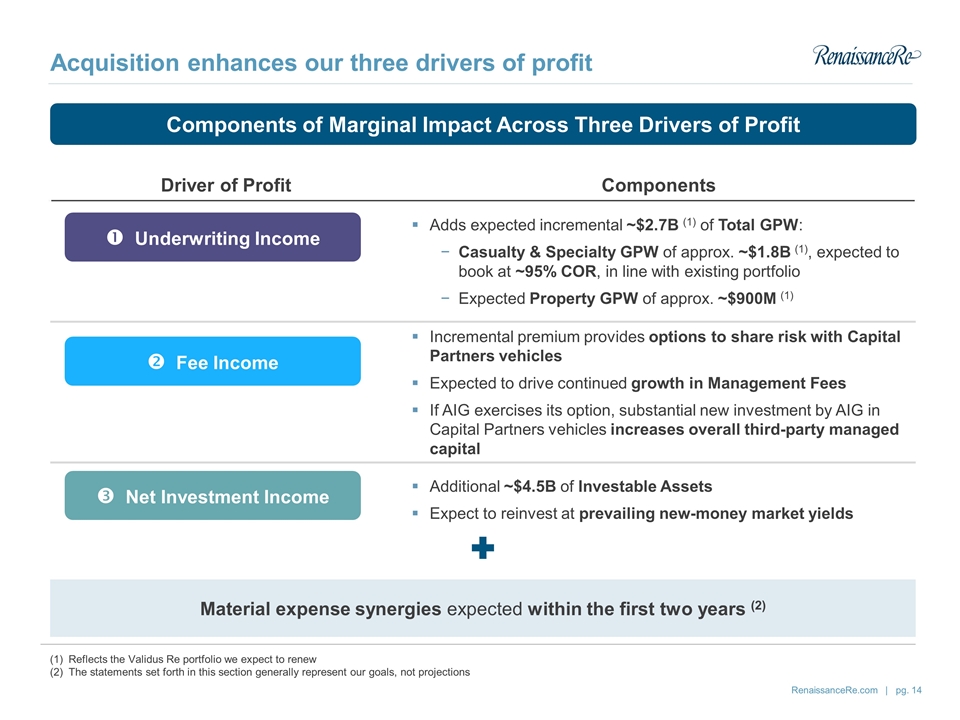

Driver of Profit Components Adds expected incremental ~$2.7B (1) of Total GPW: Casualty & Specialty GPW of approx. ~$1.8B (1), expected to book at ~95% COR, in line with existing portfolio Expected Property GPW of approx. ~$900M (1) Incremental premium provides options to share risk with Capital Partners vehicles Expected to drive continued growth in Management Fees If AIG exercises its option, substantial new investment by AIG in Capital Partners vehicles increases overall third-party managed capital Additional ~$4.5B of Investable Assets Expect to reinvest at prevailing new-money market yields Material expense synergies expected within the first two years (2) Over $80M of run-rate expense synergies expected Reflects the Validus Re portfolio we expect to renew The statements set forth in this section generally represent our goals, not projections Components of Marginal Impact Across Three Drivers of Profit Underwriting Income Fee Income Net Investment Income Acquisition enhances our three drivers of profit

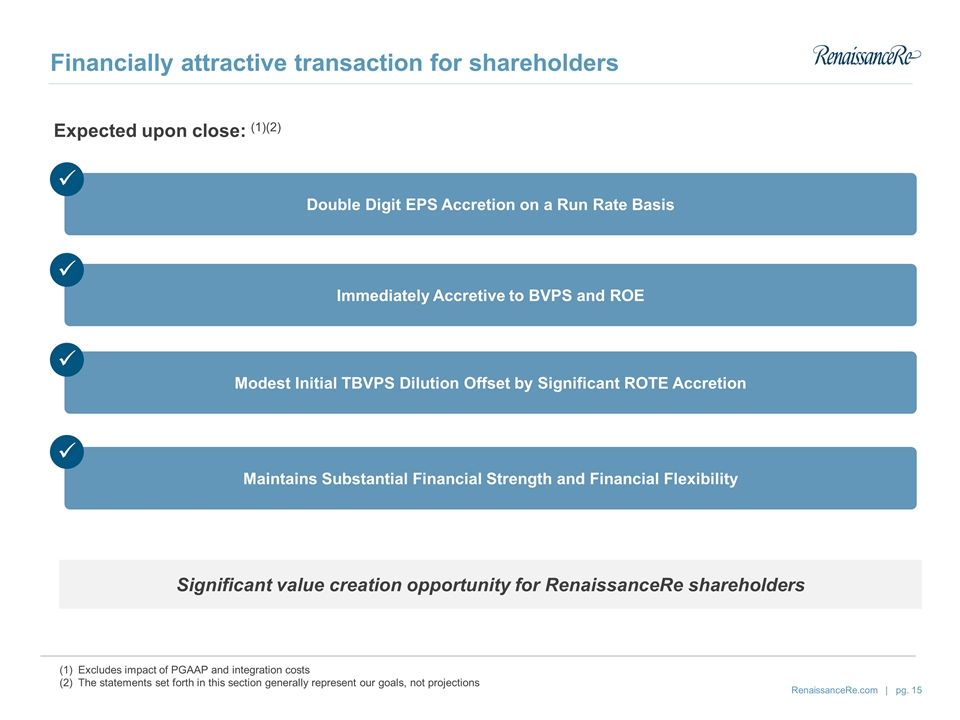

Financially attractive transaction for shareholders Expected upon close: (1)(2) Double Digit EPS Accretion on a Run Rate Basis Immediately Accretive to BVPS and ROE Modest Initial TBVPS Dilution Offset by Significant ROTE Accretion Maintains Substantial Financial Strength and Financial Flexibility ü ü ü ü Excludes impact of PGAAP and integration costs The statements set forth in this section generally represent our goals, not projections Significant value creation opportunity for RenaissanceRe shareholders

Transaction highlights Advances our strategy Provides access to an attractive portfolio Accelerates growth in favorable market conditions Enhances our three drivers of profit Deepens our relationship with a core trading partner Strong financial profile Mitigated downside risk