SLIDE PRESENTATION

Published on February 11, 2008

RenaissanceRe Holdings Ltd. Investor Presentation February 2008 Exhibit 99.2 |

Table of Contents Consistent Strategy Identifying Opportunities Leveraging Our Franchise Enterprise Risk Management Hurricane Risk Mitigation Well-Positioned for the Future |

3 Our focus and strategy remain the same We focus on four key business areas: Property Cat Reinsurance Specialty Reinsurance Individual Risk Joint Ventures and Strategic Investments Four core strategies are key to our success: Superior risk selection underwriting discipline, proprietary tools, risk management culture Superior marketing to get the business that we select Superior capital management to match capital with risk Superior joint ventures- to maximize capital efficiency for clients, capital providers and RNR shareholders |

4 Key Competitive Advantages Discipline - Disciplined underwriter with proven track record in hard and soft markets; history of identifying market inefficiencies Talent & Culture - Experienced management team; risk management culture; shared strategic vision Use Of Technology Proprietary models to analyze and aggregate risk; large databases to support decision making; recognize limits of modeling Relationships - Excellent customer and broker relationships; recognized market leader; focus on adding value Capital - Strong capitalization; strong loss reserves; multiple channels by which to access capital; disciplined capital management |

Table of Contents Consistent Strategy Identifying Opportunities Leveraging Our Franchise Enterprise Risk Management Hurricane Risk Mitigation Well-Positioned for the Future |

6 While our strategy will remain consistent, our business focus will evolve We operate today with the same culture and principles as when the company was formed By staying disciplined and focused we have been able to leverage our approach to build a more diversified business model We will continue to evaluate new opportunities and hope to add additional franchises, but are committed to maintaining our culture and our standards for growing book value per share We will only add businesses that we believe will earn attractive risk-adjusted returns and will exit businesses that no longer do the same

|

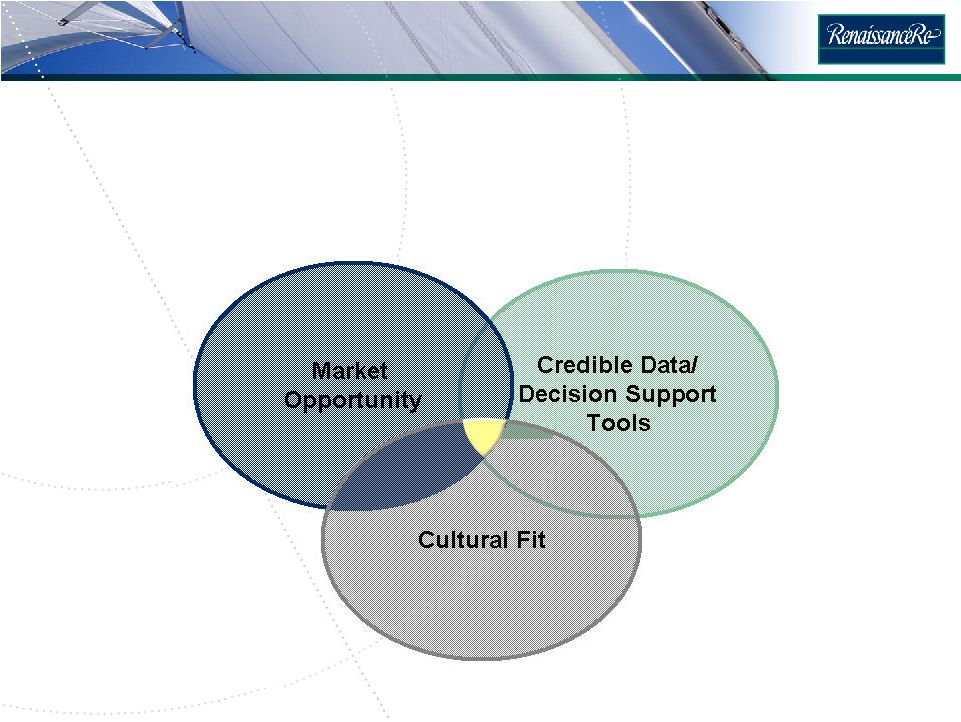

7 We screen new opportunities with a consistent framework We look for new business opportunities that meet our return hurdles and fit our

business model. |

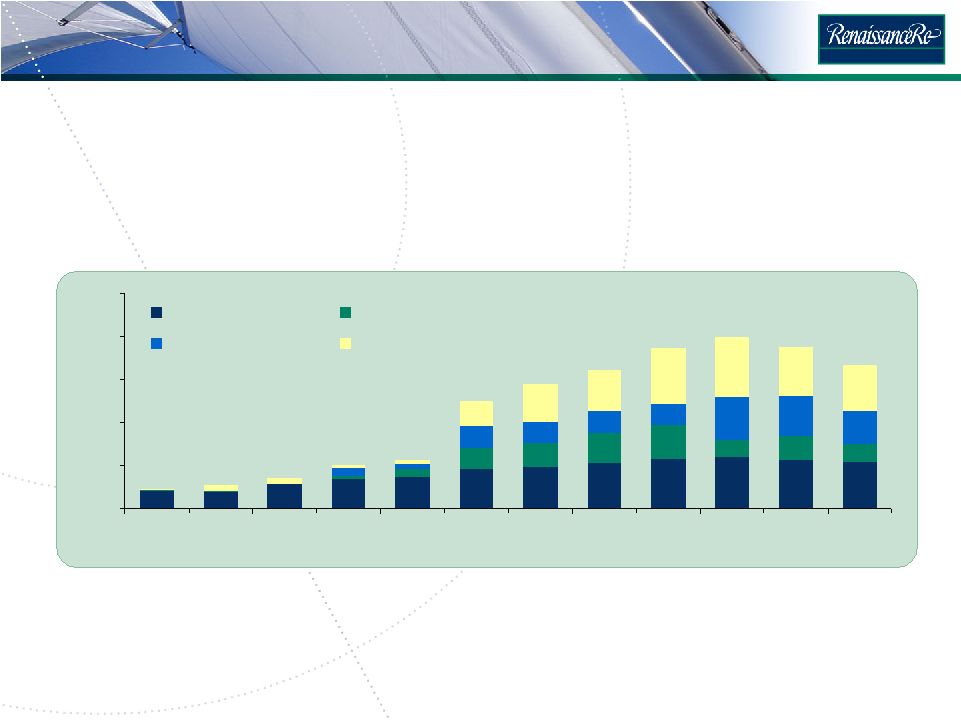

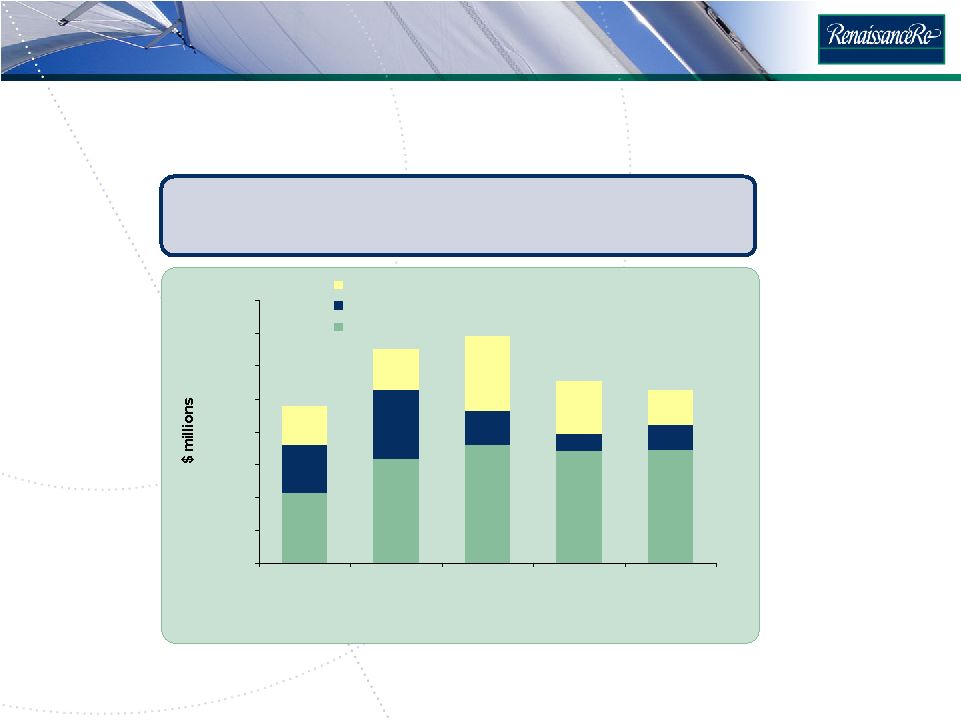

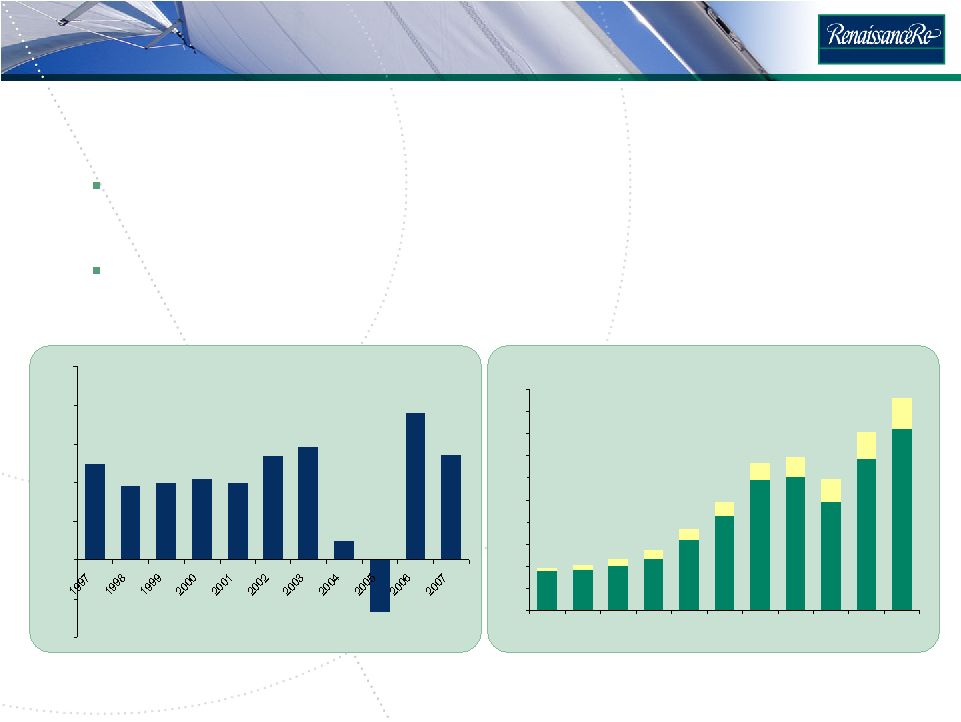

8 Weve used this approach to grow from a Cat company to four successful business units 0 500 1,000 1,500 2,000 2,500 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 *2008 proj. RenRe Cat RenRe Specialty Joint Venture Individual Risk Projected as of Q1 Information concerning the reconciliation of Non-GAAP measures can be found at the end

of this presentation. *2008 projected Managed Catastrophe and Specialty Premiums

are based on February 2008 premium estimates of managed catastrophe premiums down 10%, Individual Risk premiums down 5% and specialty reinsurance premiums written

down 25%. Gross written managed premium |

Table of Contents Consistent Strategy Identifying Opportunities Leveraging Our Franchise Enterprise Risk Management Hurricane Risk Mitigation Well-Positioned for the Future |

10 We are leveraging off of our market-leading franchise in Property Cat Consistent pricing Quick response Customized products Capacity for large lines Advice on Cat risk management Superior credit quality and willingness to pay Normal open market position Plus preferred signings on open market transactions Plus private market transactions Option to renew business written for fully collateralized vehicles RNR delivers value RNR gets preferred status |

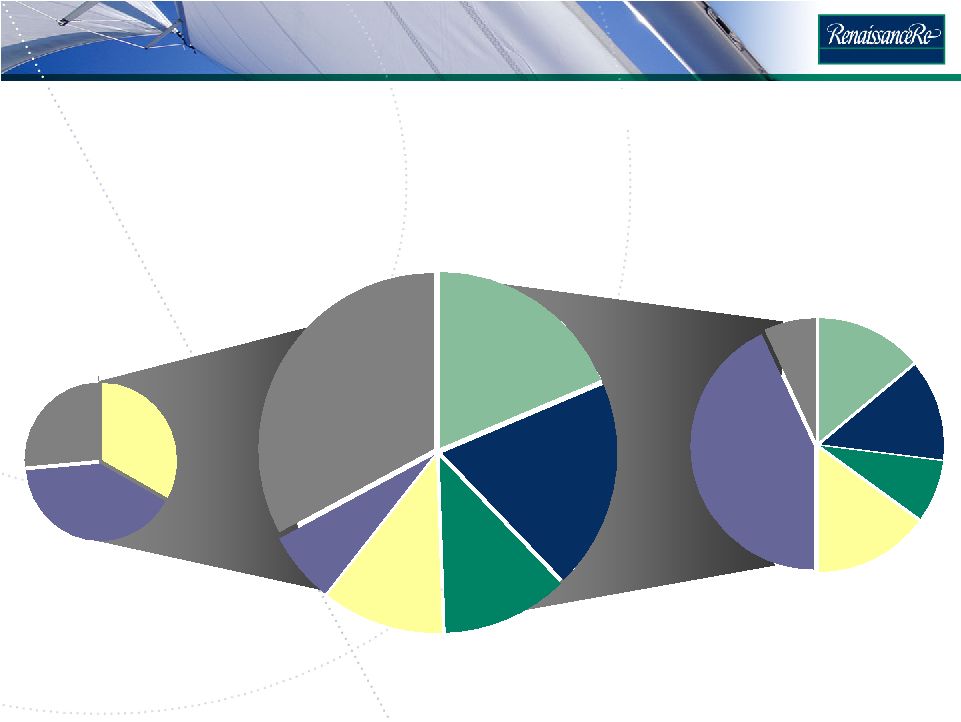

11 2001 Specialty Premium $77 million 2007 Specialty Premium $287 million 2005 Specialty Premium $427 million 33% 41% 26% 32% 19% 19% 7% 11% 12% 14% 7% 43% 15% 13% 8% Since 2001, weve built a more diversified Specialty portfolio while remaining disciplined in 2007s softening market

|

12 Individual Risk premium has grown significantly since 2004, yet we remained disciplined in 2007s softening market $0 $100 $200 $300 $400 $500 $600 $700 $800 2004 2005 2006 2007 2008 proj. Commercial Property Personal Lines Property Commercial Multi -Lines Individual Risk Gross Written Premium by Major Type of Business Information concerning the reconciliation of Non-GAAP measures can be found at the end

of this presentation. *2008 projected premiums are based on February 2008

premium estimates of Individual Risk premiums down 5%. |

13 Individual Risk is selectively focused with a small group of partners Our Individual Risk Unit is focused on high-margin primary insurance and quota

share reinsurance where we evaluate the Individual Risk

(i.e. underwriting policies as distinguished from portfolios) We partner with other insurance companies and program managers (intermediaries) who source the risk and provide back office support We target a small number of partners with the following characteristics: Leaders in their classes of risk Large premium volume Efficient back offices Focused on data, systems and rigorous risk analytics We are developing proprietary risk modeling tools to track and evaluate exposures

|

14 Ventures has developed three areas of competence Catastrophe Portfolio Participation CPPs - Participation in the results of our Property Cat book Starbound I & II (Florida) Timicuan Re (Florida) Cat Bonds Other Platinum (2002) IPO spin-off of St. Pauls reinsurance operations ChannelRe Holdings Ltd. (2004) Financial guarantee reinsurer in partnership with MBIA, Partner Re and Koch Financial Tower Hill (2005) - Recapitalization of Florida primary insurance companies Top Layer Re DaVinci Re OPCat Examples Custom packaging and selling of risk Strategic investments to capitalize upon market dislocations Attractive businesses that we prefer to invest in rather than operate Continue to selectively consider large deals or other classes of business Leveraging RenRes capabilities and reputation as the leading Property Cat reinsurer Very active role in the management, oversight and corporate governance of the entities Business 3) Customized Reinsurance 2) Strategic Investments 1) Property Cat Joint Ventures |

15 The period following the 2004 and 2005 storms highlighted the importance of Ventures role within RenaissanceRe In 2006 and 2007 we executed four significant capital raises to bring capacity to

our clients Our joint venture track record since 1999 demonstrates RenaissanceRes ability to

add value = generate alpha DaVinci and Top Layer Re remain strategic components of our core business Opportunistic joint ventures such as TimRe and Starbound I have produced >40% returns to investors, Starbound II

is projected to return >40% to investors We expanded on our inventory of relationships with investors and advisors We believe that our reputation with our clients, the option value of the renewal

business, the return we produced for our investors and the fee income will

continue to benefit us for years into the future We remain differentiated in our approach and the resources we dedicate which

leaves us well positioned |

Table of Contents Consistent Strategy Identifying Opportunities Leveraging Our Franchise Enterprise Risk Management Hurricane Risk Mitigation Well-Positioned for the Future |

17 Why bother with ERM? Good risk management can provide a significant competitive advantage Avoiding surprises allows you to take better advantage of the opportunities created by

dislocated markets Communicating accurate expectations maintains your credibility with your key

stakeholders Disciplined measurement and aggregation of risk decreases the mortality rate for your franchise Good risk tools allow you to pursue the best opportunities in a very inefficient

business |

18 What does good ERM look like? Corporate culture that embraces the goals of risk management Expertise and tools to assess and evaluate risk-reward decisions Robust systems and frameworks to measure and monitor the aggregation of risk Defined tolerance for acceptable levels of risk; processes to avoid or eliminate

certain types of risks Focus on qualitative as well as quantitative aspects of risk; seek to manage

operational risk; recognize the limits of quantitative modeling Rough proxies for risk instead of ignoring risk Constant process to enhance and improve; journey not a destination Emphasis on performance vs. tolerances and modeled expectations rather than purely results Regular communication about risk with key internal and external stakeholders

(management, rating agencies, board of directors) |

19 Risk management is more than

modeling management expertise and corporate culture are critical Avoid Surprises Proactive Response to Market Opportunities Superior Risk Management Highly talented individuals Underwriters understand models Clear accountability Tight control of authority Peer review Ownership mentality REMS © Computer System Clean database User friendly system Multiple vendor models Many unique custom features Management Procedures and Culture |

Table of Contents Consistent Strategy Identifying Opportunities Leveraging Our Franchise Enterprise Risk Management Hurricane Risk Mitigation Well-Positioned for the Future |

21 Hurricane risk mitigation -

Quantifying, managing catastrophic risk RenaissanceRe has been investigating the damage patterns and economic impact

of catastrophic storms for many years. By contributing to hurricane risk mitigation efforts, we are seeking to: Increase the resiliency of storm-exposed communities by introducing them to

the most effective mitigation techniques and products Reduce the frequency of claims and the severity of the financial impact of storms to the (re)insurance industry Our current hurricane risk mitigation efforts include: RenaissanceRe Wall of Wind AeroEdge StormStruck Hurricane Risk Mitigation Leadership Forum If every home in Florida could be built to withstand winds of up to 130 mph with minimal damage, we believe that expected windstorm losses to the insurance industry would be reduced by at least 80%. |

22 RenaissanceRe Wall of Wind

A positive force for change |

Table of Contents Consistent Strategy Identifying Opportunities Leveraging Our Franchise Enterprise Risk Management Hurricane Risk Mitigation Well-Positioned for the Future |

24 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Our goal remains long-term growth in tangible book value per share plus accumulated dividends Tangible book value per share plus accumulated dividends has grown at an annualized rate of 17.5% from 1998 through 2007 driven by a track record of strong Operating ROE While the 2004 and 2005 results were disappointing, 2005s result is consistent

with our models that indicate we should expect to lose money every ten to

fifteen years -20% -10% 0% 10% 20% 30% 40% 50% Operating ROE* Tangible Book Value Per Share plus Accumulated Dividends* * Information concerning the reconciliation of Non-GAAP measures can be found at the end

of this presentation. |

25 RenaissanceRe is well-positioned As we approach our 15 th anniversary, our balance sheet and capital base are strong - our capital position is stronger than at any point in our history Our organization has been strengthened with new talent, bringing unprecedented breadth of expertise Our distinctive corporate culture remains a key competitive advantage We continue to strengthen our position as the market leader in property cat reinsurance; ahead of peers on risk analytics We view ourselves as a capital provider to our clients and provide capital principally in the form of reinsurance, alternative forms of capital are provided

to meet clients evolving needs We are well positioned for 2008 but we will remain disciplined and will not seek growth unless we find attractive opportunities |

26 Safe Harbour Statement Cautionary Statement under "Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995: Statements made in this presentation contain information about the Company's future

business prospects. These statements may be considered "forward-looking." These statements are subject to risks and uncertainties that could cause actual results to differ materially from

those set forth in or implied by such forward-looking statements. For further information regarding cautionary statements and factors affecting future results, please refer to RenaissanceRe Holdings Ltd.s filings with the Securities and Exchange Commission, including its Annual Report on Form

10-K for the year ended December 31, 2006 and its Form 10-Qs for the

quarters ended March 31, 2007, June 30, 2007 and September 30, 2007.

This presentation includes certain non-GAAP financial measures within the meaning of

Regulation G including "operating return on equity", "tangible book value per share plus accumulated dividends and gross written managed premium. A definition of such measures and a reconciliation of these measures to the most comparable GAAP figures in accordance with Regulation G is available in the Company's 2006, 2005, 2004 and 2003 Annual Reports and the February 6, 2007, May 1, 2007, July 31, 2007, October 30, 2007 and February 5, 2008

Press Releases which are located on the Company's website www.renre.com.

|

RenaissanceRe Holdings Ltd. Renaissance House 8 20 East Broadway Pembroke, HM 19 Bermuda Tel: (441) 295-4513 www.renre.com |